The Early Morning Pitch: Weekly Forum Pairs Start-Ups with Business Partners

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Linking Innovators and Investors

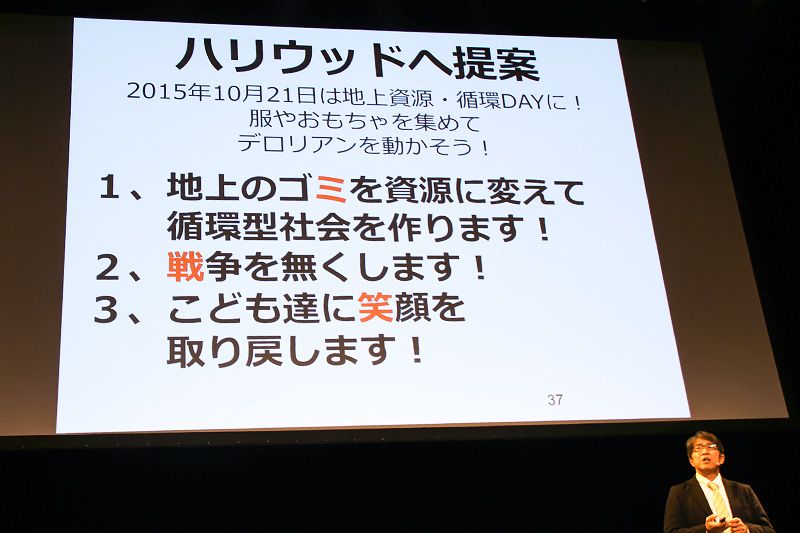

In the 1989 Hollywood film Back to the Future Part 2, Marty McFly, the character portrayed by Michael J. Fox, time travels to 4:29 pm on October 21, 2015. This date was celebrated in Tokyo by running a doppelganger of the time-traveling DeLorean through the Odaiba district. The man behind the feat was not Doc Brown, though, but Iwamoto Michihiko, CEO of Japan Environment Planning (Jeplan). Iwamoto not only worked with Universal Studios to reproduce the look of the sports car but also got it to run on recycled fuel—Doc Brown used banana peels and other waste—to showcase his start-up’s technology that turns used clothing into bioethanol.

Media coverage of this event naturally focused on the souped-up DeLorean, but the real story may have been Jeplan’s technology of the future, which is already helping a leading supermarket chain and many other companies develop new sources of energy.

This recycling technology has led to Jeplan’s inclusion in Yui 2101, a socially responsible, eco-friendly investment fund that links asset formation with efforts to promote social and emotional well-being. Jeplan itself is broadening its social impact with plans to increase the number of recyclable waste collection stations at shopping malls and consumer electronics retailers from 900 to 3,000 over the next three years.

One of CEO Iwamoto’s aims in hosting a Back to the Future event in Tokyo was to promote the idea of a recycling society.

One of CEO Iwamoto’s aims in hosting a Back to the Future event in Tokyo was to promote the idea of a recycling society.

Jeplan’s big break came at the Morning Pitch, a weekly forum sponsored by Tohmatsu Venture Support and Nomura Securities that gives innovative start-ups an opportunity to pitch their ideas to bigger companies that are potential investors.

Launched in 2013, the Morning Pitch is held from 7 to 9 every Thursday morning on the forty-eighth floor of an office building in Shinjuku. Each session is organized around a theme, and young companies with new ideas make presentations in front of 100 to 150 big business representatives looking for investment opportunities. When the pitch strikes a chord, business cards are exchanged, and talk of a potential tie-up begins.

Jeplan made its pitch subsequently chosen as the best presentation of the year in 2014; the fame gained enabled the company to substantially expand its business.

The Dream of Becoming Global Standard Setters

For its part, the government is promoting small, innovative businesses through the Japan Venture Awards, sponsored by the government-affiliated Organization for Small and Medium Enterprises and Regional Innovation (SME Support, Japan). Since 2000, the JVA has honored more than 200 ambitious entrepreneurs, including software developer Cybozu, which has now gained a listing on the First Section of the Tokyo Stock Exchange. Among the panelists at the 2016 awards ceremony was Cybozu CEO and President Aono Yoshihisa, who created a stir in Japan for taking childcare leave three times while serving as president. His comments were a source of inspiration for up-and-coming entrepreneurs.

Many of the presenters at the Morning Pitch have represented university-based ventures. The government, too, is encouraging universities to play an incubator role by preparing legislation to allow all public universities, not just national institutes of higher learning, to invest in new ventures. The bill envisions regional universities spearheading innovation and promoting industrial and economic activity in outlying areas of Japan.

The entrepreneurs making their morning pitch in the hopes of attracting financial support are seen as helping lift Japan from its “three lost decades” of economic stagnation. Among them are leaders of social businesses that seek to achieve profits while also addressing pressing social issues.

One notable example is Terra Motors, makers of the Bizmo all-electric scooters. The company, headed by founder and CEO Tokushige Tōru, captured the best presentation of the year prize at a Morning Pitch session in December 2015. With sales channels in Vietnam and six other developing Asian nations, Terra is helping these countries achieve a clean and sustainable society and tackle air pollution with its electric vehicles.

The Morning Pitch “champion” for 2015 was Tokushige Tōru of Terra Motors, who seeks to expand sales of his company’s all-electric motorcycles to markets around Asia.

The Morning Pitch “champion” for 2015 was Tokushige Tōru of Terra Motors, who seeks to expand sales of his company’s all-electric motorcycles to markets around Asia.

While China has a lead in this market, having sold 500,000 vehicles worldwide, Terra has been making inroads with its advanced technology, achieving a 30% improvement in battery life. Annual sales have jumped from ¥300 million to ¥3 billion in just one year, and the company aims for another 10-fold increase in 2016.

“I was appalled by the lack of dynamic businesses in Japan,” Tokushige says, recounting his reasons for starting the firm. “While the number of start-ups has been rising, Japan only has a single ‘unicorn’ [a start-up valued at $1 billion or more], meaning there’s a near vacuum of successful mega-ventures. I saw this as a crisis that demanded an immediate response.”

The special, yearend Morning Pitch in December 2015 was held on the themes of “technology” and “global.” Among the other top start-ups with unique products and services were Seven Dreamers Laboratories, which developed the Laundroid laundry-folding robot, and Axelspace, which promotes the private-sector use of space with its commercial microsatellites.

The Laundroid is just one of the many unique products developed by Seven Dreamers Laboratories.

The Laundroid is just one of the many unique products developed by Seven Dreamers Laboratories.

“The emergence of Japan-to-global businesses is the cherished dream of the Japanese VC industry,” commented Kariyazono Sōichi, chairman of the Japan Venture Capital Association, at the yearend event. “There have been a number of successful start-ups over the past two decades, but none has become so big as to establish a new global standard.”

Tohmatsu Venture Support, which sponsors the Morning Pitch, has launched similar forums in a number of other cities in Asia and North America, paving the way for Japanese start-ups to find global investors as well as for innovators around the world to find marketing opportunities in Japan.

An Expanding VC Market

Investments in Japanese start-ups have been rising over the past several years. According to Japan Venture Research, 52 venture funds invested ¥195.0 billion in 2015, a significant rise from the ¥135.5 billion spent by 41 funds the previous year.

While the amount invested did not reach the ¥204.5 billion (by 31 funds) of 2013—when the venture capital market experienced a huge expansion—it has easily cleared the ¥100 billion mark for three years running, and there has been a consistent rise in the number of investments made.

(Originally written in Japanese by Miki Takajirō of the Nippon.com editorial department and published on March 29, 2016. Banner photo: Tokyo at sunrise, from the room where start-ups make their “Morning Pitch.”)