Can Japanese Electronics Firms Find the Spark They Need?

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

One look at the consolidated financial results for the first half of fiscal 2011 (April to September) is enough to bring the tough situation facing Japan’s leading electronics firms into stark relief.

The top eight electronics manufacturers (Hitachi, Panasonic, Sony, Toshiba, Fujitsu, Mitsubishi Electric, NEC, and Sharp) saw their combined sales slip to ¥21.154 trillion, a 4.6% year-on-year decrease. Operating profits among the companies plummeted by 41.7%, to ¥484.9 billion, resulting in a cumulative net loss of ¥80.5 billion. The industry as a whole has thus has fallen into the red.

The overall outlook for fiscal 2011 (April 2011 to March 2012) is also grim, with six of the eight companies having revised their forecasts downward in the three months since their first quarter results. And the cumulative sales, operating profits, and net profits of the eight companies are expected to dip below the cumulative figures for the previous fiscal year.

Panasonic was particularly badly hit, posting a cumulative loss of ¥136.1 billion for the first half of fiscal 2011. For the fiscal year as a whole it expects to report a ¥420 billion loss, a disappointing setback given that it started the fiscal year expecting to be in the black.

This is the first time Panasonic’s annual losses have surpassed the ¥400-billion mark since fiscal 2001. The bad news comes at a time when memories are still fresh of the company’s “destruction and creation” restructuring, which included getting rid of the organizational structure built up by the company’s founder Matsushita Kōnosuke and redesigning its sales system.

Sony, meanwhile, posted a ¥42.4 billion loss for the first half of fiscal 2011. The company, which had initially expected to make a profit for the year, is now bracing itself for a ¥90 billion loss.

Financial Results of Japan’s Top 8 Electronics Firms

First half of fiscal 2011 (April–September 2011)

| Sales | Operating profit | Net profit/loss | |

|---|---|---|---|

| Hitachi | ¥4.573 trillion | ¥170.6 billion | ¥50.9 billion |

| Panasonic | ¥4.005 trillion | ¥47.5 billion | –¥136.1 billion |

| Sony | ¥3.070 trillion | ¥25.8 billion | –¥42.4 billion |

| Toshiba | ¥2.912 trillion | ¥80.2 billion | ¥22.6 billion |

| Fujitsu | ¥2.092 trillion | ¥7 billion | ¥5.7 billion |

| Mitsubishi Electric | ¥1.744 trillion | ¥113.6 billion | ¥69.5 billion |

| NEC | ¥1.443 trillion | ¥6.7 billion | –¥10.9 billion |

| Sharp | ¥1.315 trillion | ¥33.5 billion | –¥39.8 billion |

| Total | ¥21.154 trillion | ¥484.9 billion | –¥80.5 billion |

(Figures in yen rounded off to nearest billion)

Forecast results for fiscal 2011 (April 2011–March 2012), as of December 2011

| Sales | Operating profit | Net profit/loss | |

|---|---|---|---|

| Hitachi | ¥9.5 trillion | ¥400 billion | ¥200 billion |

| Panasonic | ¥8.3 trillion | ¥130 billion | –¥420 billion |

| Sony | ¥6.5 trillion | ¥20 billion | –¥90 billion |

| Toshiba | ¥7.0 trillion | ¥300 billion | ¥140 billion |

| Fujitsu | ¥4.54 trillion | ¥135 billion | ¥60 billion |

| Mitsubishi Electric | ¥3.73 trillion | ¥240 billion | ¥135 billion |

| NEC* | ¥3.25 trillion | ¥90 billion | ¥15 billion |

| Sharp | ¥2.8 trillion | ¥85 billion | ¥6 billion |

| Total | ¥45.62 trillion | ¥1.4 trillion | ¥46 billion |

* On January 26, 2012 NEC revised its estimated results for fiscal 2011 downwards, as follows: Sales ¥3.1 trillion, operating profit ¥70 billion, net loss ¥100 billion (ed.)

The Problems Facing Electronics Firms

The dismal performance of Japan’s electronics manufacturers can be attributed to a number of factors.

First among these is the strong yen, which has had a major negative impact. At the beginning of fiscal 2011, the yen was expected to hold steady at around 85 to the US dollar. Instead, it plummeted down into the 70s. The yen has strengthened against all the major currencies, placing a heavy burden on all of Japan’s electronics companies.

The second factor is a slowdown in global demand, due to the economic instability in Europe triggered by the fiscal crisis and the murky outlook for recovery in the United States. The earthquake and tsunami that struck northeastern Japan on March 11, 2011 also had an impact, along with the sudden drop in demand for flat-screen televisions following the switchover from analog to digital broadcasting on July 24, 2011 (with the exception of Iwate, Miyagi, and Fukushima Prefectures). Even during the peak New Year holiday period, retailers were expecting flat-screen TV sales to be down by 60% to 70% from the previous year.

The market for flat-screen televisions was around 26 million units in fiscal 2010. But this boom came at the expense of future sales. Industry insiders expect the market to slip to somewhere in the region of 10 million units in fiscal 2012.

Panasonic revised its flat-screen TV shipment plans from 25 million units down to 19 million units, in line with the sluggish global demand, particularly in Japan, Europe, and North America. Sharp likewise adjusted its shipment plan from 15 million units to 13.5 million units. Sony initially hoped to ship 40 million units, but has now slashed this to just 20 million units in an effort to prioritize profits.

Hirai Kazuo, vice president of Sony, at a November 2, 2011 press conference to announce the company’s first half results for fiscal 2011. Hirai announced that flat-screen TV shipments for fiscal 2012 would be revised downward from 40 million units to 20 million units. (Photo: Jiji Press)

Hirai Kazuo, vice president of Sony, at a November 2, 2011 press conference to announce the company’s first half results for fiscal 2011. Hirai announced that flat-screen TV shipments for fiscal 2012 would be revised downward from 40 million units to 20 million units. (Photo: Jiji Press)

A third factor is ever-cheaper retail prices. Prices of flat-screen televisions have continued to fall against the backdrop of a worldwide glut in the supply of display panels. And South Korea has been taking the lead in offering cheaper products in the US market, helped by a relatively weak South Korean won. This has placed Japan in a difficult position, given the soaring value of its own currency. In the PC sector as well, foreign manufacturers have released notebook computers retailing at just ¥30,000, further driving down prices. Japanese PC makers are struggling to compete.

Another key factor impacting the bottom line of electronics firms is the money they are spending to carry out the structural reforms needed to deal with worsening financial results.

For some time now, Japanese electronics firms have been losing money on their TV businesses. This has led Panasonic, for instance, to consolidate its four sites producing plasma display panels into a single site, and to reduce production of liquid crystal displays from two sites down to one. Sharp has converted its Kameyama plant, which previously produced LCDs for televisions, into a production site for the small and medium-size LCDs used in smartphones and other products.

Electronics firms are also carrying out systematic restructuring. This includes cutting jobs, streamlining operational bases, and shifting production overseas, including hiring other companies to handle product design and production on commission, a practice known as “original design manufacturing.” These efforts, which include the revaluation of fixed assets, require serious amounts of money.

There is no doubt that Japan’s major electronics companies find themselves in an extremely difficult position today.

Panasonic’s PDP plant in Amagasaki, Hyōgo Prefecture. Production has been stopped at the company’s two other PDP plants in the city as part of efforts to restructure its television business. Production has also been halted at a Panasonic plant in Shanghai. (Photo: Sankei Shimbun)

Panasonic’s PDP plant in Amagasaki, Hyōgo Prefecture. Production has been stopped at the company’s two other PDP plants in the city as part of efforts to restructure its television business. Production has also been halted at a Panasonic plant in Shanghai. (Photo: Sankei Shimbun)

Can Smart TVs Lift Profits?

There are some hopeful signs for Japan’s leading electronics firms, however. Even for the television business, which has been dragging down profitability, there may be light at the end of the tunnel.

For example, apart from the three prefectures hit hardest by the March 11 disaster, households throughout Japan have fully switched over to digital broadcasting. This should provide an opportunity for electronics firms to supply new services that will lead to new markets.

More than 80% of Sony’s “Bravia” range of LCD televisions come equipped with Internet-connection terminals as standard. Currently, only around 15% of users connect to the Internet via their televisions, but Sony expects this figure to increase to around 30% by the end of March 2012—and the company is hopeful that it might be as high as 75% by fiscal 2015.

Televisions hooked up to the Internet allow viewers to watch online videos and access a variety of other online services. Already TV owners can make free phone calls using Skype or operate an Internet-linked television remotely via a smart phone or tablet computer. In the future, televisions are likely to serve as the core terminal for home energy management systems that control things everything from domestic electricity use to solar-power generation, as well as home security terminals to oversee security cameras and lock and unlock doors.

These televisions geared to the Internet age are generally called “smart TVs.” Blessed with the world’s best broadband infrastructure, Japan is in a good position to lead this market. The characteristics of the Japanese TV market also make it difficult for overseas firms to compete. This means that if Japanese manufacturers can get their business models up and running quickly and accumulate the necessary know-how, they should be well placed when it comes to expanding the market internationally in the future.

Offering the “Full Package”

Another area where Japanese electronics giants have a competitive edge is their ability to over an all-inclusive, interconnected lineup of products.

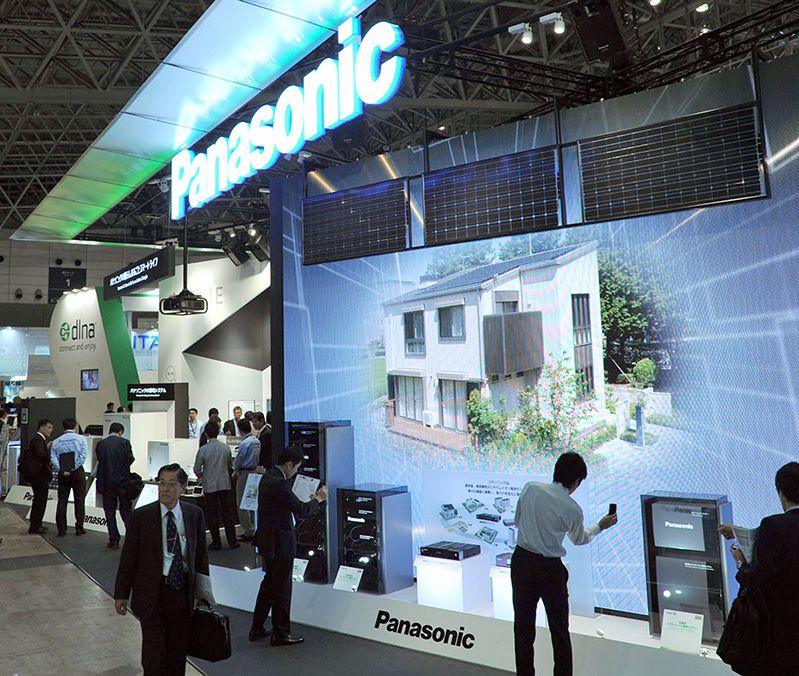

Many of Japan’s electronics firms, including Panasonic, Hitachi, and Toshiba, are able to offer a comprehensive range of products, from digital household devices to domestic appliances like washing machines and refrigerators. They can also link them to all sorts of technologies, including energy, control, IT, and network technologies.

One of Panasonic’s concepts for the future involves an “integrated” system bringing together all of the electronic devices within a household, building, or retail store. In the longer term, the company has its sights set even higher, and dreams of extending this integration to the community level, creating fully integrated “smart cities.”

This is another area where major Japanese electronics firms should be able to leverage their unique skill sets in the future. And this is a major reason why Japanese firms have led the world in the developing and producing so many cutting-edge technologies.

The CEATEC 2011 exhibition of household electronics and IT products, held in October 2011 at Makuhari Messe in Chiba City, at which participating electronics firms displayed their concepts of the “smart homes” and “smart cities” of the future. (Photo: Sankei Shimbun)

The CEATEC 2011 exhibition of household electronics and IT products, held in October 2011 at Makuhari Messe in Chiba City, at which participating electronics firms displayed their concepts of the “smart homes” and “smart cities” of the future. (Photo: Sankei Shimbun)

In many cases, it has been expertise in parts and materials, rather than finished products, that has sustained the profitability of Japanese electronics firms. The power of manufacturing craftsmanship in Japan stems not so much from production itself as from the state-of-the-art technologies created through research and development that allow firms to set themselves apart from their rivals. Even those companies who have revised their forecasts downwards have not taken the step of cutting back on research and development. This is further proof that the strengths of Japanese manufacturing craftsmanship are alive and well.

Hunkering Down Is the Key

Nippon Keidanren, a federation of Japanese companies, points to six factors behind the challenging environment for Japanese corporations: the continuing strength of the yen, high corporate taxes, delays in trade liberalization, labor regulations, excessively ambitious greenhouse gas policies, and the limited power supply since the March 11 earthquake.

Clearly Japanese corporations face a severe situation. Japan’s major electronics manufacturers are no exception. This is clear from the financial results for the first half of fiscal 2011 and the downward revisions for the fiscal year as a whole.

And yet I am confident that Japan’s electronics companies will ultimately emerge from this challenging period stronger than ever.

The key will be how well these firms can hunker down during the current period of hardship. This will lay the groundwork for the next step forward once better times return.

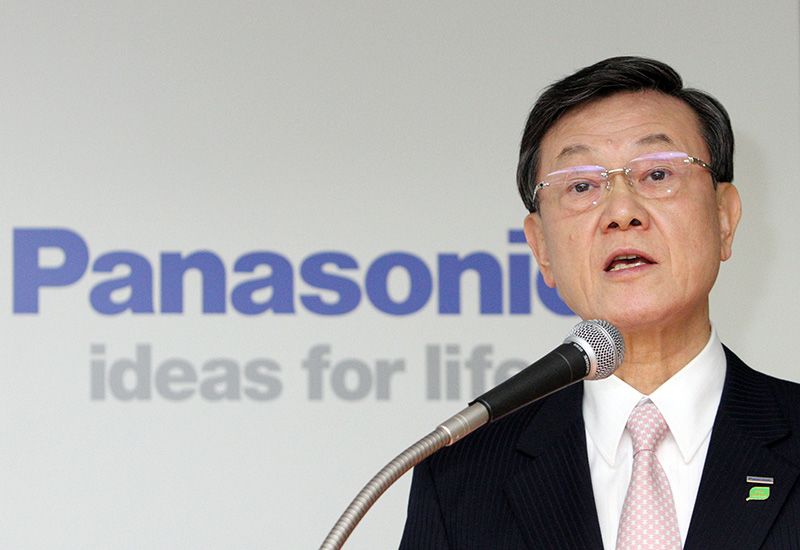

Panasonic’s president, Ōtsubo Fumio, borrowed an aphorism from the Ming Dynasty Chinese classic Caigentan (Vegetable Roots Discourse) to describe the situation facing his company today: “‘The longer one lays low, the higher he will fly.’ Today, we are preparing for the next leap forward. The question for Panasonic is how far we will be able to progress by 2018, when we celebrate our 100-year anniversary. The environment and energy are the areas that will carry us forward.”

Ōtsubo’s comments apply equally well to all of Japan’s electronics firms.

Panasonic’s president Ōtsubo Fumio announcing the restructuring of the company’s television business at an October 31, 2011 press conference. Panasonic is expected to post a ¥420 billion loss for fiscal 2011, but President Ōtsubo describes the present stage as preparation for “the next leap forward.” (Photo: Sankei Shimbun)

Panasonic’s president Ōtsubo Fumio announcing the restructuring of the company’s television business at an October 31, 2011 press conference. Panasonic is expected to post a ¥420 billion loss for fiscal 2011, but President Ōtsubo describes the present stage as preparation for “the next leap forward.” (Photo: Sankei Shimbun)

(Originally written in Japanese on December 2011.)

Sony Electronics makers Panasonic televisions strong yen Ōkawara Katsuyuki Hitachi Toshiba Fujitsu Mitsubishi Electric NEC Sharp smart TV Ohkawara Katsuyuki