Elpida and the Failure of Japan Inc.

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

In late February of this year, Elpida Memory Inc.—Japan’s sole maker of dynamic random-access memory chips and the number three DRAM manufacturer worldwide—filed for bankruptcy protection, facing ¥448 billion in liabilities. It was the biggest bankruptcy by a Japanese manufacturer in the post–World War II era.

Elpida’s decision to seek bankruptcy protection came less than three years after a massive rescue operation approved by the Ministry of Economy, Trade, and Industry in June 2009. Under the Act on Special Measures for Industrial Revitalization, Elpida had received ¥30 billion in new investment (essentially public funds) from the Development Bank of Japan and loans totaling some ¥100 billion from the DBJ and commercial banks.

What does the semiconductor giant’s failure to rebound despite the 2009 bailout say about Japanese industrial policy? Some critics view it as an object lesson in the perils of government intervention. As I see it, however, the problem is not excessive government involvement but the lack of a strong, smart, tough industrial policy. In the following, I discuss this failure and call for a fundamental course correction. First, however, we need to understand the factors behind Elpida’s collapse.

Bad Management Decisions

Elpida Memory Inc. President and CEO Sakamoto Yukio (left) bows his head at a February 27 press conference announcing the company’s decision to petition for the initiation of bankruptcy proceedings under the Corporate Reorganization Law. (Photo: Sankei Shimbun)

Elpida Memory Inc. President and CEO Sakamoto Yukio (left) bows his head at a February 27 press conference announcing the company’s decision to petition for the initiation of bankruptcy proceedings under the Corporate Reorganization Law. (Photo: Sankei Shimbun)

Something largely neglected by the media in their coverage of Elpida’s bankruptcy is the business restructuring plan under which METI approved the 2009 bailout. The plan called for Elpida to rebuild its business around its high-value-added Premier DRAM products for advanced mobile devices. But while Elpida’s sales of this advanced, high-end DRAM rose substantially in fiscal 2010, they still constituted only 30% of net sales for that year.

Under the original plan, Elpida was to begin shifting production of commodity DRAM (for desktop computers and other non-mobile devices) to Taiwan immediately so as to focus operations at its Hiroshima Plant on Premier DRAM products. Yet Elpida’s September 2011 business report indicated only that it was preparing to transfer about 40% of the Hiroshima Plant’s production capacity—or about 50,000 chips a month—to its Taiwan plant. What delayed the shift was not the physical process of relocating the production line. Rather, it seems that the Hiroshima Plant was obliged to keep producing commodity DRAM because orders for Premium DRAM products failed to grow as anticipated. The basic problem, contrary to the explanations put out by Elpida’s public relations department and company president Sakamoto Yukio, was that Elpida was outdone by its competitors when it came to offering customers the combined benefits of high-quality DRAM and flash memory. While Elpida possessed formidable technological assets in such areas as three-dimensional integrated circuits, it made a series of bad management decisions when it came to flash memory.

Sakamoto has repeatedly cited the strong yen and other external circumstances to explain his company’s sagging fortunes, but Elpida’s missteps in the area of flash memory were a key contributing factor. In this sense, Sakamoto must accept the largest share of the blame for the Elpida fiasco.

METI’s Detachment

The other major culprit in the Elpida debacle, however, is the Japanese government’s passive, hidebound, and ineffective industrial policy.

Over the past few weeks a good number of Japanese critics have condemned METI for failing to provide further assistance to Elpida once it became clear the company was in trouble. The notion that the government should have continued throwing good money after bad with additional loans and investments is misguided. On the other hand, those who point to the 2009 bailout as an indictment of over-protective industrial policy are also wide of the mark.

Sakamoto’s version of events may gloss over his own responsibility, but he has a point when he argues that Japanese manufacturers today face numerous disadvantages when competing in the global marketplace, even over and above the strength of the yen. One of the biggest problems is Japan’s taxation system. Compared to most economies that depend on manufacturing, Japan offers its industries too little leeway when it comes to depreciation allowances and write-offs for capital asset losses. At present, use of the production output method for calculating depreciation is effectively limited to mining and a few other industries; semiconductors and other high-tech businesses are rarely permitted to take advantage of it.

METI should have begun pressuring the Ministry of Finance and the National Tax Agency years ago to allow high-tech industries to apply the same method. Now is not too late to start making up for this neglect. As things stand now, Japan’s amortization and taxation systems are making the capital investment vital to high-tech manufacturing so costly that the country is in danger of losing its domestic production facilities—including the “mother factories,” or manufacturing bases—of major domestic manufacturers. The lesson we should take away from the collapse of Elpida is not that Japan’s industrial policy has been too protective but that it has been too passive. After Sakamoto’s own incompetence, METI’s detachment since the bailout of 2009 is most to blame for Elpida’s collapse.

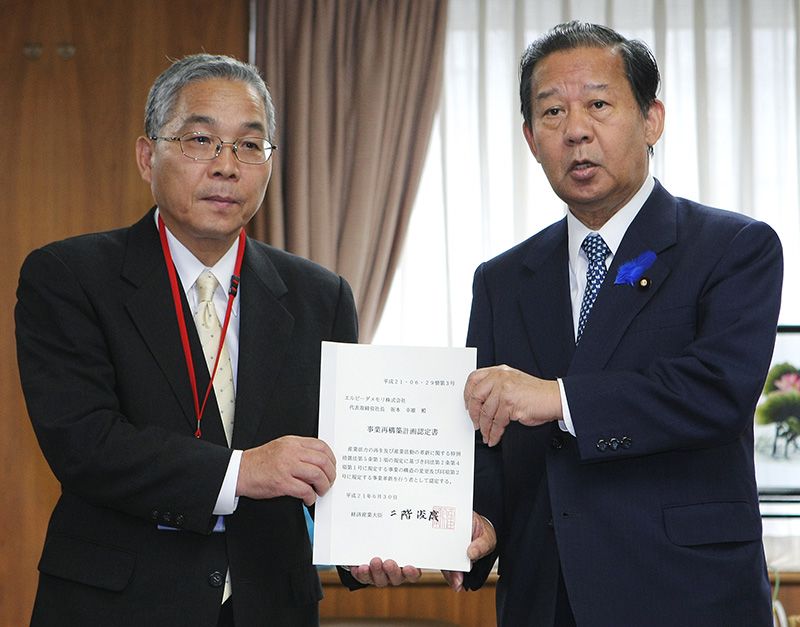

Elpida CEO Sakamoto receives METI’s authorization on June 30, 2009, for a bailout under legislation passed to help Japanese industry weather the recession. (Photo: Jiji Press)

Elpida CEO Sakamoto receives METI’s authorization on June 30, 2009, for a bailout under legislation passed to help Japanese industry weather the recession. (Photo: Jiji Press)

When METI has seen fit to take action in recent years, it has shown itself to be neither smart nor tough when it comes to industrial policy. At the time of the 2009 Elpida bailout, there was a proposal for Taiwan to invest in Elpida as the technological partner for a planned chip maker to be called Taiwan Memory Co., which was meant to consolidate that nation’s struggling DRAM industry with Taiwanese government backing. That plan fell apart. It is easy enough to blame this outcome on Taipei’s failure to bring Taiwanese businesses on board, but it was METI that embraced the plan on the basis of inadequate information instead of hammering out a sound strategy predicated on a thorough understanding of the situation on the ground—including the political and business environment in Taiwan. It was also METI that threw up its hands the moment the plan failed to materialize as initially envisioned, instead of hanging tough and working to salvage something positive from it.

The detached, easily defeated METI of today is a far cry from the legendary Ministry of International Trade and Industry that forged and enforced bold industrial policies in the 1950s and 1960s. The key difference is that METI no longer values first-hand information and bottom-up ideas from the people directly involved in production. Instead, it puts all its faith in the business “establishment”—that is, the top management of Japan’s big-name firms. This orientation in turn reflects a deep aversion to risk. In essence, METI and Japanese big business both think inside the same narrow box.

Rebuilding Japan’s Semiconductor Industry

Japanese industrial policy regarding the semiconductor business can be traced all the way back to the late 1940s, when the work of William Shockley and others paved the way for commercialization of the transistor. The history of that policy is too extensive to be evaluated in detail here, but certainly one of the turning points was the semiconductor trade agreement with the United States signed in 1986 in an effort to resolve a major bilateral trade conflict of the 1980s. The pact in essence handed US chip makers a minimum share of the market for semiconductors used in Japanese-made consumer electronics. In so doing, it staved off the collapse of US chip makers like Micron Technology, which were being driven out of business in every segment but DRAM. Ironically, Micron is now one of the companies bidding to take over Elpida. Which side has shown itself strategically smarter and tougher—“Japan Inc.” or the United States, the country said to have no industrial policy? In fact, Washington’s industrial strategy has proven the more savvy by far.

The crisis facing Japan’s semiconductor industry is much bigger than Elpida’s. The system LSI (large-scale integration) business is hemorrhaging from multiple wounds. Semiconductor giant Renesas Electronics is scrambling to cut costs by consolidating its domestic production sites (many of them inherited when the company was formed from a merger with NEC Electronics in 2010), including the former Yamagata Factory of NEC Electronics. Now the Yamagata fab has the opportunity to spin off and achieve profitability as a foundry, a facility that fabricates chips designed by other companies. With the backing of Japanese manufacturers and American businesses like IBM—which had a manufacturing agreement with the Yamagata plant when it was part of NEC Electronics—such a facility could compete with Taiwan Semiconductor Manufacturing Co., currently the world’s largest chip foundry. If METI were smart, it would actively encourage a shift to this new, more profitable model. Yet according to recent reports, the plan favored by Innovation Network Corporation of Japan—a major private-public investment fund—would dismantle the Yamagata facility rather than put its assets to work.

Japan’s semiconductor design and manufacturing operations can be made profitable again, but only if METI abandons the tired old approach of merging the big appliance companies’ chip units, in favor of the kind of smart, aggressive strategies that can restore morale on the ground —similar to the robust policies of the 1950s and 1960s, based on first-hand information and insights. History’s judgment of METI’s effectiveness in the twenty-first century will hinge on whether it moves quickly to embark on such a policy.

(Originally written in Japanese on April 7, 2012.)

manufacturing United States Taiwan strong yen Elpida Semiconductors METI Industrial Policy Inoue Koki DRAM chips