The Political History of Japan’s Consumption Tax

Politics Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

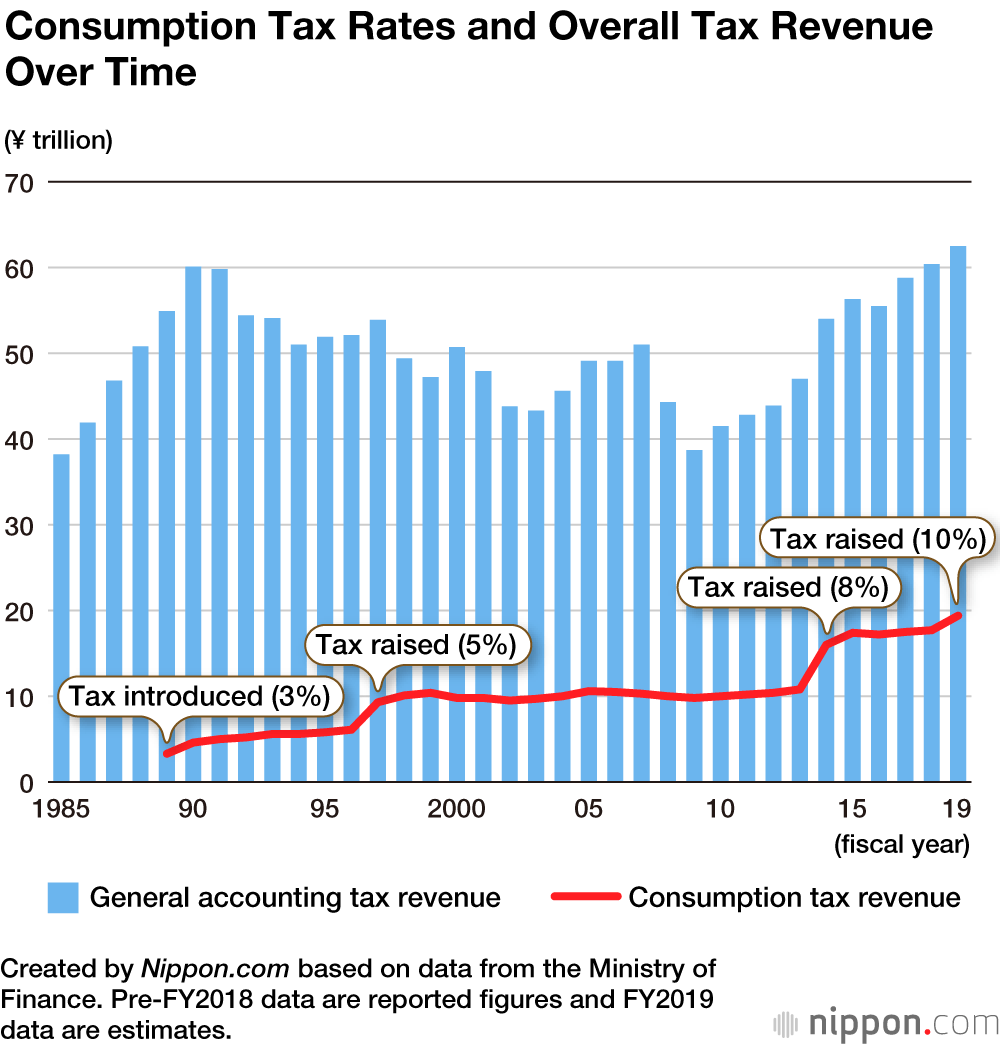

On October 1, 2019, the consumption tax in Japan rose from 8% to 10%. Prime Minister Abe Shinzō had twice postponed the hike, but amid rising social welfare costs due to the aging of the population, the government enacted it at the third time of asking. The 2-point hike is being positioned as a means of securing funds for free preschool education for all and free higher education for disadvantaged students.

There will be a split rate for the first time in the history of the tax, which was first introduced in 1989. The current rate of 8% will still apply to food products (excluding meals and other products consumed on the premises at restaurants or shops, along with alcohol) and subscriptions to newspapers published at least twice a week. There is also a reward point system to run until June 2020 whereby cashless payments at smaller retailers and restaurants come with a rebate of up to 5% of the total cost, awarded in points that can be used for other purchases.

The Political History of the Consumption Tax

| January 1979 | Prime Minister Ōhira Masayoshi's administration decides to implement a general consumption tax to improve public finances, but abandons the plan in the face of a severe public backlash in the October general election. |

| February 1987 | The administration of Prime Minister Nakasone Yasuhiro submits a draft sales tax bill to the Diet, but abandons the bid in May due to widespread public opposition. |

| December 1988 | A consumption tax bill is passed under the administration of Prime Minister Takeshita Noboru. |

| April 1989 | A 3% consumption tax is introduced. Soon after, in June, Prime Minister Takeshita is forced to resign in the wake of an insider-trading and corruption scandal involving the human-resource company Recruit. |

| February 1994 | A plan to abolish the consumption tax and introduce a 7% national welfare tax is announced; however, the plan is withdrawn the day after its announcement due to a lack of coordination within the coalition government led by Prime Minister Hosokawa Morihiro. |

| November 1994 | During Prime Minister Murayama Tomiichi's administration, the Diet passes a bill to hike the consumption tax rate from 3% to 4% and add a regional consumption tax of 1%, bringing the total to 5% in 1997. |

| April 1997 | The consumption tax rate is raised to 5% under Prime Minister Hashimoto Ryūtarō. |

| September 2009 | The Democratic Party of Japan, led by Hatoyama Yukio, is elected to power on an election manifesto pledging no consumption tax hikes for four years. |

| June 2010 | After Kan Naoto takes over leadership of the DPJ, just prior to the upper house election, the party announces the consumption tax will be increased to 10%; the DPJ suffers a crushing defeat in the election. |

| June 2012 | The government of Prime Minister Noda Yoshihiko introduces a bill to raise the consumption tax rate to 8% in 2014 and to 10% in 2015. On August 10, the upper house plenary session approves the bill. |

| April 2014 | The tax rate rises to 8% during the administration of Prime Minister Abe Shinzō. |

| November 2014 | Prime Minister Abe announces that the scheduled hike to 10% will be postponed by 18 months, from October 2015 to April 2017. |

| June 2016 | Following deliberations within his Liberal Democratic Party and the ruling coalition, Prime Minister Abe announces another postponement of the tax hike; the rate will rise to 10% two and a half years later, in October 2019. |

| October 2018 | Prime Minister Abe announces that the tax rate will rise to 10% in October 2019. |

| October 2019 | The tax rate rises to 10%, although some items like food products (excluding dining out and alcohol) and newspaper subscriptions remain at the 8% rate. |

(Originally published on September 28, 2012; most recent update on October 8, 2019.)

Abe Shinzō tax consumption tax social security VAT sales tax