Abenomics: A Midterm Evaluation

Bolder Reforms Needed to Drive Abenomics Forward

Politics Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

A Recovery Fueled by Rising Asset Prices

Abenomics, the economic policy package set forth by Abe Shinzō after he became prime minister for the second time in December 2012, aimed to change people’s expectations and end the persistent deflationary spiral through the declaration of a fundamental shift—a “regime change,” so to speak—in policy direction and content. The financial markets were the first to respond positively. The stock market turned bullish, and the Nikkei average on the Tokyo Stock Exchange, which had fallen below 9,000 points, topped 15,000 in May, about six months after Abe took office. Meanwhile, the yen fell sharply, losing about 20% of its value against the dollar.

Higher stock prices improved consumer sentiment, bringing about a consumption-led recovery, and the weaker yen gave a major boost to corporate earnings in export industries. As a result, the Japanese economy is finally showing signs of shaking off deflation.

We should note, however, that the solid improvement in the real economy is not the cause but a result of the rise in asset prices. Indicators like the consumer confidence index, the economy watchers survey, and the Bank of Japan’s Tankan survey of business sentiment have improved in response to Abenomics, but their gains have clearly trailed the asset price advances. Without the sharp rise in the stock market and the weakening of the yen, we would presumably not have seen the economy pick up as well as it has.

The Essential Role of the Third Arrow

Up to now, Abenomics seems to have been led by expectations. Partly because of the hike in the consumption tax from 5% to 8% that the government went ahead with in April this year, the upturn has been losing steam, and we are now at a critical stage in the process of attempting to get the real economy growing on a sustained basis.

In order to make the recovery self-sustaining, it will be essential to get the performance of the real economy to match the heightened expectations. And to achieve this, the government must present a growth strategy that will tap the energy of the private sector to the maximum and open the way to new frontiers of growth backed by human resources and technology. Reviewing the contents of the growth strategy that have been revealed so far, we can clearly see many problems. The Abe administration needs to adopt a bolder stance in shooting off the “third arrow” of Abenomics, the reform and growth strategy that is supposed to complement the other two arrows, monetary relaxation and fiscal stimulus.

The Demographic and Fiscal Drags on Growth

On June 14 last year Abe’s cabinet adopted the Japan Revitalization Strategy, with the slogan “Japan Is Back” as its subtitle. The strategy called for the promotion of private-sector investment based on improvements in productivity, aiming for an average nominal growth rate of around 3% and real growth of around 2% over the coming 10 years. But Japan’s potential growth rate is in bad shape by comparison with other countries’, and it is considerably lower than the government’s target. The general assessment is that Japan’s expansion will trail that of other major economies.

For one thing, the process of population aging is expected to progress much faster in Japan than in other advanced countries. According to current projections, those aged 65 or over will account for almost 40% of the total population as of 2050, and there will be only one working person to support each senior. If the working-age population continues to shrink and the rise in social security spending is not curbed, it is impossible to imagine that the Japanese economy will be able to achieve sustained growth. Fewer workers and more seniors will put a supply-side crimp on expansion, and a shrinking domestic market is liable to hold down aggregate demand.

The huge and growing national debt, which is now equivalent to around two years’ worth of gross domestic product, will also act as a major drag on economic expansion. As we can see from the impact of this year’s consumption tax hike (from 5% to 8%), it is better to avoid raising taxes if we consider only the short-term economic picture. With the signs of a slowdown in the recovery becoming apparent, we are hearing increasing calls for postponement of the additional hike of the consumption tax from 8% to 10%, which is scheduled for October 2015. But putting off the hike merely shifts the burden to future generations. If the government continues to expand its debt even though it is on the brink of fiscal collapse, the negative effects will be considerable. In the final analysis, this sort of profligacy could well be a major hindrance to growth.

Economy Picks Up, But Wages Lag

For the economy as a whole, households are the biggest sources of consumption demand, and if their purchasing power (meaning income) does not rise, it is difficult to achieve a robust recovery. Prior to the launch of Abenomics, wages had been declining ever since the late 1990s as the economy experienced deflation. After Abenomics got underway, the BOJ’s unprecedented relaxation of monetary policy and the rise in import prices due to the weakening of the yen caused consumer prices to start creeping up, but wages have not been rising in tandem.

The Abe administration, judging that higher wages are essential in order to end deflation, has pushed corporate Japan to implement pay hikes. But while Abe’s current term as prime minister has seen stock prices pick up smartly and consumer prices start rising gradually, it has not brought a solid advance in wages at the macroeconomic level.

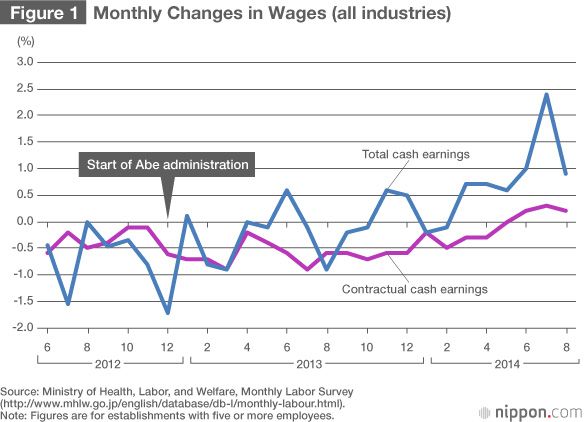

Companies whose performance has improved have been giving their employees bigger bonuses and more overtime pay. But as figure 1 indicates, the increase in regular wages has been anemic, reflecting the fact that many business executives, particularly at smaller enterprises, are still feeling cautious about the prospects for the economy and are thus reluctant to implement pay hikes.

A more serious problem is that even under Abenomics many companies continued to cut down on their numbers of relatively high-paid regular employees and increased their use of relatively low-paid non-regular staff. Until last year, this tendency held down wages at the macro level, even if some individual workers were getting pay raises.

This year the rise in total cash earnings has accelerated, and contractual cash earnings have finally started to move up. This development may be attributed to the fact that when labor and management conducted their annual round of wage talks this past spring, both sides shared the understanding that higher wages were the key to getting the economy on a self-sustaining growth cycle, in line with the common view adopted by the three sides in the Government-Labor-Management Meeting for Realizing a Positive Cycle of the Economy (an Abe administration initiative). But there is still a pronounced tendency for the rise in wages to lag behind that in prices; this means that real wages are continuing to fall despite the government’s efforts.

Japan’s Low Labor Productivity

In a market economy, it is normal for real wages to increase when the productivity of labor increases. And in Japan’s case up to now, real wages have in fact tended to move generally in line with productivity. If pay hikes are not accompanied by improvement in productivity, it will eventually become difficult to raise them further. So quite a few people are looking to improved productivity as the way to increase the potential growth rate in the face of a declining population.

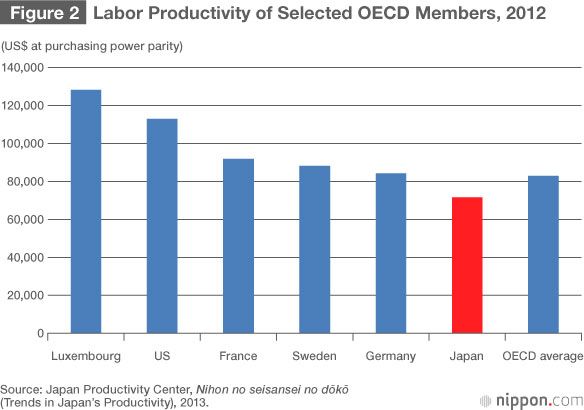

Japan’s labor productivity has been improving somewhat in recent years, but as figure 2 shows, it is still low by comparison with other advanced nations—and is below the average for the members of the Organization for Economic Cooperation and Development. In the Japan Revitalization Strategy unveiled in June 2013, the government stressed the importance of promoting renewal of industry, accelerating the entry of start-ups, regulatory reform, activating human resources, and promoting science and technology. Achieving solid results through the implementation of these growth strategy planks will be crucial for the enhancement of Japan’s productivity.

In the face of the ongoing process of population aging, a major contribution to sustained growth can come from expansion of jobs and training of human resources in new growth fields. The government needs to renew its efforts to promote the restructuring of the labor market with moves like correcting the skewed distribution of information so as to improve the matching of workers and employees and expanding tuition subsidies and public facilities to strengthen vocational training in common skills.

When it comes to the specifics of reforms like the relaxation of employment regulations and expansion of the discretionary labor system, however, any proposal sets off a storm of counterarguments. First of all the government needs to overcome the many clashes of interests and steadily implement its growth strategy. Even with a shrinking labor force, it should not be impossible to put the Japanese economy on a growth track if the quality of labor improves and employment increases in growth fields.

Overcoming Vested Interests to Implement Deregulation and Structural Reform

On June 24 this year the Abe administration approved a revised version of the Japan Revitalization Strategy originally adopted in June 2013. The new version addressed a number of topics that had not been taken up in the original strategy, notably labor market reform, improvement of agricultural productivity, and development of healthcare and nursing care as new growth fields, and it also set forth directions for resolving outstanding issues in these areas.

Previously the Japanese economy was seen as being supported by its manufacturing sector, and it was widely believed that productivity gains in nonmanufacturing industries were much lower than in manufacturing. In recent years, however, manufacturers have seen their international competitive strength decline in relative terms, while high-value-added activities have tended to shift toward areas closer to the service sector. Also, even in traditional nonmanufacturing industries, we are seeing a broadening of the base for attractive business opportunities in fields with good growth prospects. This can be seen in agriculture, healthcare, and also tourism.

These fields, however, are bound by numerous regulations and receive various subsidies. We cannot hope for efficient management or productivity gains in fields that are hemmed in by rigid regulations or that continue to be heavily subsidized. In order to turn them into engines of growth for the Japanese economy, it will be necessary to take bolder steps than before to deregulate and implement structural reform.

Policies that enhance productivity mean a larger pie to be divided up among all—something to which nobody can object. But even those who agree with the growth strategy in general are liable to voice opposition to specific measures. Up to now, this sort of opposition has stood in the way of policy implementation. Measures that will cause major changes in existing economic setups tend to be strongly opposed by those whose livelihoods depend on the status quo. And since the prospective benefits of such measures are generally spread broadly and thinly, few people actively speak up in favor of them. Overcoming the vested interests and implementing reforms requires strong political leadership. The Abe administration’s mettle will be tested by its ability to follow through with its growth strategy.

Current Efforts Are Not Enough

The policy “regime change” of Abenomics made financial markets—foreign investors in particular—bullish about Japan, producing major gains in stock prices. The new policies also stimulated consumption, and exporters led an advance in corporate profits. But to a large extent these positive developments were powered by market optimism, and we have yet to see a solid recovery in the real economy accompanied by higher productivity.

This year the government has started tackling some medium- to long-term issues, such as a review of the investment posture of the Government Pension Investment Fund, reduction of the corporate tax rate, advancement of women’s positions in the workplace, and the use of foreign human resources in the construction sector. But current efforts are clearly quite inadequate to solve the fundamental problems of the Japanese economy. The remaining policy options for preventing long-term economic stagnation are limited. Structural reforms that squarely address the demographic shift and the fiscal deficit are an urgent priority. Warding off prolonged stagnation will require a firm posture of implementing deregulation and structural reform even in areas where the changes will cause great pain.

Abenomics is an unprecedented social experiment, and everybody hopes it will succeed. But managing the Japanese economy, which faces major medium- to long-term issues, will continue to be a challenging task even if an end to the deflationary trend comes into sight. Will it be possible to find an exit from the current policy of massive monetary expansion without causing major side effects and to achieve sustained economic growth? And will it be possible to cope with the graying of Japanese society and at the same time maintain confidence in the government bond market while facing the difficult task of restoring long-term health to public finances? The true test of Abenomics lies ahead.

(Originally published in Japanese on October 28, 2014. Title photo: A display in Tokyo’s financial district on the morning of October 20, 2014, shows the benchmark Nikkei average up by more than 400 points. The market was responding to the Bank of Japan’s decision to further increase its asset purchases. © Jiji)

consumption tax fiscal deficit Japanese economy Abenomics deregulation Japan Revitalization Strategy declining birthrate and aging population labor productivity structural reform