Young Japanese Firms Quick to Adopt International Accounting Standards

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

A succession of recent announcements by major Japanese companies—notably relatively young firms like Softbank and Rakuten—that they were adopting the International Financial Reporting Standards has generated great interest. The IFRS accounting rules were originally developed to harmonize standards in the European Union and have since been adopted by countries outside the region; they are now governed by the International Accounting Standards Board.

How will their adoption by Japanese companies affect management practices here? In the following I will briefly describe IFRS’s evolution and features and explore future prospects in the light of Japan’s past experiences with international standards.

The “Language” of Accounting Rules

Accounting rules are often likened to a language; they not only prescribe how numbers indicating corporate performance are to be reported but also have the power to change the very nature of business activity.

Each country hitherto had its own accounting “language,” a set of rules for domestic businesses to follow. But over the past several years, a movement to integrate national standards and establish a universal language called IFRS has been gaining momentum—one of the biggest reasons being the globalization of investment activity. Investors want to be able to compare businesses on a global basis, but this would be impossible if their financial statements are compiled according to different sets of rules. Efforts have been made, therefore, to facilitate comparison by harmonizing the national accounting rules as much as possible.

The attempt, though, has created competition between US and European standards. The US Securities and Exchange Commission has its own rules, called the US Generally Accepted Accounting Principles, which all companies on US securities exchanges are required to adopt. The SEC initially sought amendments that would bring about a convergence of US-GAAP and IFRS standards, but when more than a hundred countries quickly announced their intentions to adopt IFRS, the SEC changed course and embraced the new rules, announcing in 2008 a roadmap to make IFRS a requirement.

Japan’s Transnational Firms Embrace IFRS

The trend spread to Japan as well, where the gradual transition to IFRS was led by IT giants seeking to expand their global operations. So IFRS rules have benefits for not only global investors but also transnational corporations.

Perhaps another reason that the trend has been led by young Internet companies is because they have not invested heavily in older standards and could afford to change course with relative ease. Not a few managers at older companies that have long been using existing Japanese accounting rules believe that an abrupt overhaul of accounting practices entails serious risks.

One such risk is the possibility that the value of a company’s assets would appear much lower when calculated using IFRS rules than under existing standards or that business results would appear far less robust. This, in turn, could adversely affect that company’s share prices or actual business performance. Older companies, therefore, are hesitant to make the jump in the face of such risks.

New Yardstick for Corporate Performance

What are the drawbacks of adopting IFRS? For companies, transitioning to a new accounting standard entails much more than just revising the way they report their results; it could fundamentally alter their notions of cost and profit.

Needless to say, corporate activities do not come to a complete halt at the end of a business year and start from scratch at the start of the next year; they continue from year to year. Costs and profits are calculated for a cross-section of that continuum known as a financial year using certain standards. When those yardsticks change, then, naturally, business performance will appear in a new light.

Under one set of accounting rules, the value of assets like land, buildings, and stocks may be calculated using the price at which they were purchased. But another set of rules may require that they be reported based on their current market values. Depending on market fluctuations, such assets—even if not traded—could make a company very rich or, in extreme cases, broke.

Market-price accounting has the advantage of enabling an accurate assessment of a company’s real worth, but its downside is the difficulty of determining what price from which date to use. The assessed worth may also be marked by volatility as market values fluctuate. Some argue that such volatility is a drawback of this accounting approach.

Fluctuating asset values can also affect a company’s reputation, brand strength, and other intangible assets, which could ultimately impact on business performance.

A change in accounting rules can thus have significant impact on the picture presented by a company’s financial statement, turning what had been a profitable enterprise into a money loser—even when there is no change in its assets or income. This could dampen its attractiveness to investors, hindering its efforts to raise capital on the market and setting back its plans to boost productivity.

EU Strategy to Harmonize Standards

IFRS took on the nature of a global standard when the rules were adopted by the European Union, eliminating the potential for discrepancies in accounting standards among the member states. In a highly strategic move, the EU then sought to turn this product of thoroughgoing negotiations—incorporating the insights of many different countries—into a set of standards that countries outside the region could also adopt.

Table 1. Chronology of IFRS Adoption by Various Countries

| October 2002 | Norwalk Agreement is reached outlining plans for the Financial Accounting Standards Board to converge IFRS and US GAAP into one set of compatible standards |

| January 2005 | EU adopts IFRS for all listed companies (boosting IFRS’s global influence) |

| April 2005 | US announces a policy of converging US GAAP and IFRS |

| August 2007 | Tokyo Agreement is reached between the Accounting Standards Board of Japan and the International Accounting Standards Board, containing a roadmap for the convergence of Japanese and IFRS standards |

| June 2009 | The Business Accounting Council of Japan’s Financial Services Agency issues an interim report containing a roadmap with a view to the mandatory adoption of IFRS |

| July 2012 | The SEC publishes a Final Staff Report examining the potential impact of transitioning to IFRS and weighing the costs and benefits for issuers |

| December 2014 | The number of Japanese companies that have adopted or plan to adopt IFRS reaches 67 (as of February 2015, based on Tokyo Stock Exchange data) |

Table created by Nippon.com.

Had individual EU member states sought to globalize their own accounting standards, they would no doubt have met resistance from the United States and China. But as a set of practices representing the EU as a whole, IFRS can no longer be ignored by the international community. This unified approached facilitated its acceptance in Asia and among emerging economies.

The trend toward the global integration of accounting standards will no doubt continue. Stubborn adherence to national standards would discourage the flow of cross-border investment funds. National standards may co-exist alongside IFRS for a period of time, but the trend toward the adoption of a universal accounting “language” should accelerate in the years to come.

Japan’s Modified Standards

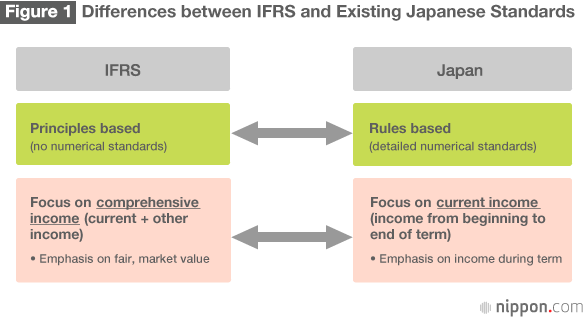

In Japan, a draft Japanese version of IFRS is being developed. This is an attempt to smooth over the discrepancies between existing Japanese standards and “pure” IFRS by updating certain provisions to retain some Japanese accounting practices (Figure 1).

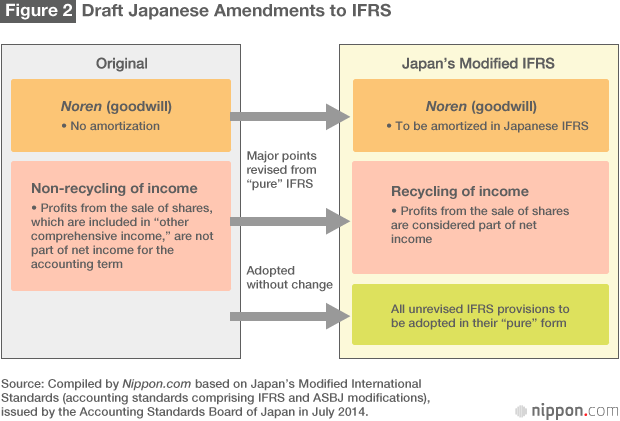

The IFRS side originally rejected any exceptions to its principles-based standards, but there are cases in which this would lead to the overturning of widely accepted practices. In Japan, one such practice is that covering the amortization of intangible assets called noren (goodwill).(*1) The Japanese draft that is currently being prepared retains this accounting practice, although it is not found in the original IFRS rules (Figure 2).

Enhancing Negotiating Skills

In 2009 the Business Accounting Council of Japan’s Financial Services Agency issued a roadmap with a view to the mandatory adoption of IFRS, and the momentum will likely accelerate henceforth. Whether Japanese companies will be called upon to adopt IFRS in their pure form or whether they will have the option of choosing a modified version, though, remains to be seen.

This will hinge, to a large extent, on how skillfully Japanese negotiators can present their case to the International Accounting Standards Board. Negotiation skills affect not only accounting standards, of course, but rules of all kinds; unless Japan can argue its case more persuasively, it will find itself having to work with rules that put it and its businesses at a disadvantage—regardless of the outstanding features of their products and technologies. Unless they receive the recognition they deserve, Japanese companies will find it difficult to compete globally.

There is rule-making competition in a broad range of areas, not just accounting standards. One pertinent example concerns food safety. In an age of borderless investment, the kind of rules countries play by will have an impact not only on the performance of individual businesses but on the growth of entire economies. Japan has had little success in international rule-making to date, but negotiating prowess is perhaps the most important and required skill today in ensuring its continued growth. Thought should be given to more actively tapping human resources with rich international business experience to present Japan’s arguments in international forums.

(Originally written in Japanese and published on February 27, 2015. Banner photo: Fast Retailing, which operates the Uniqlo chain of clothing stores (© Picture Alliance/AFLO), and Takeda Pharmaceutical (©Jiji) are two Japanese companies that have adopted IFRS.)

(*1) ^ Noren (literally, “shop curtain”) is the difference between the price paid for purchasing a company and the market value of the acquired company’s net assets. When the price paid is higher, the premium must be reported as a noren fee and routinely amortized each accounting term within a period of 20 years.

business Softbank noren Rakuten Yahoo IFRS international accounting standards