A Financial Crisis Quietly Approaches

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

In the years since the financial crisis of 2008, the Japanese banking industry has become more and more structurally depressed. With the Bank of Japan maintaining a low interest rate policy over the long term, the average lending spread is close to zero if not negative, and banks cannot anticipate higher earnings from lending activities. The only remaining path to higher earnings is reduction of costs. Banks have rapidly curtailed their branches and employees, however, and traveling further down this road risks shrinking the customer base. Unless banks move away from a business model centered on accepting deposits to make loans, they will jeopardize their survival. To ready itself against a situation where banks cannot withstand the risk of rising interest rates, the Financial Services Agency is beginning to reestablish a safety net in case banks go under.

Cost Reductions Reach Their Limit

In autumn 2017, Japan’s Big Three banks announced major plans to consolidate branches and downsize staff. Mizuho Financial Group reported it would trim its workforce by 19,000, Mitsubishi UFJ Financial Group by 9,500, and Sumitomo Mitsui Financial Group by 4,000. As a result, a total of 32,500 bank employees will be let go over a few years. While this seems like a large number, major restructuring moves are already under way throughout the banking industry.

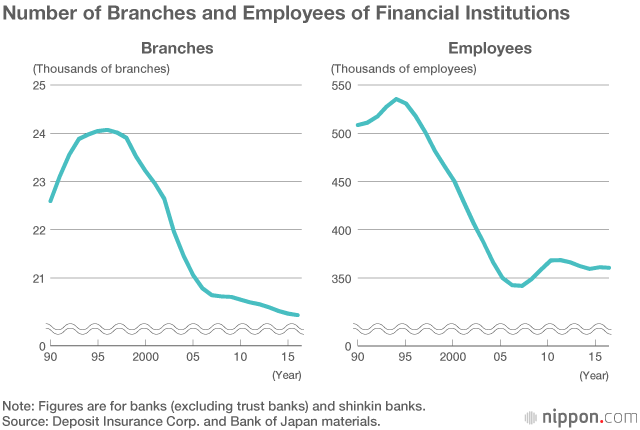

The chart below shows that, compared to before the financial crisis of 2008, the number of branches has fallen by more than 20% and the number of employees by nearly 40%. While the number of employees has remained steady over the past decade, this is the outcome of banks replacing regular employees with nonregular and specialist staff with lower wages.

Despite such efforts to cut costs, the management of the Big Three and regional banks all state that recovery of earnings will be difficult to achieve going forward. Moreover, the FSA reports that profitability has become an issue for many regional banks as earnings on customer services continue to decline. FSA Commissioner Mori Nobuchika stated at a meeting with the heads of regional banks in 2007 that conventional efforts to cut costs have reached a limit and risk eroding the customer base. He also noted that downsizing can be one approach to restructuring business models.

Banks pay close to zero interest for deposits, the source of their funds. Lending such funds without a lending spread means that the return on assets is nearly zero. Banks have become repositories of nonperforming assets. There is very little that separates nonperforming assets from bad loans. The slightest change in the business environment has the potential of turning these assets into bad loans.

Of the potential changes in the business environment for banks, the biggest would be an increase in interest rates. Should interest rates rise, the price of assets with low yields would decline. The market value of Japanese government bonds held by banks would fall sharply, and such valuation losses would cause banks to record huge losses. The lending spread would grow more negative as the divergence with the funding interest rate widens. As a result, loan assets would turn into assets that yield only losses. Regional banks’ exposure to yen interest rate risk is three times that of the Big Three banks, and the damage that would result from a turn to higher interest rates would be vast.

Reducing Bank Branches

Given the interest rate risk that the financial industry harbors, what kind of monitoring are financial authorities considering? In the Financial System Report of October 2017, the BOJ noted, “if there is an increase in the number of financial institutions with declining loss-absorbing capacity due to the continued weakening of their profitability, the financial intermediation function could weaken, adversely affecting the real economy,” indicating the possibility that financial system uncertainties might return.

In the words of one senior BOJ official, the central bank has done everything it can with monetary policy, and its focus has now shifted to financial system policies. Given that excessive monetary easing contributed to financial system uncertainties, hearing that the BOJ’s next theme is responding to such uncertainties is somewhat difficult to accept. It may be true, however, that the BOJ feels there is nothing it should be doing, with the exception of market operations to control the long-term interest rate.

What is noteworthy about the Financial System Report is its detailed analysis concluding that there are too many bank branches in Japan. While the number of branches is declining, the report argues that, once post offices are included, the level of bank branches in Japan is nearly the same as Germany, a level considered to be overbanked. The report also notes that the concentration of bank branches in a small country will tend to increase competition between branches. In short, the report calls for the further reduction of branches. The report also notes that, with the decline of Japan’s population and the decrease of the number of companies, overcapacity continues despite the cutback of bank employees. The BOJ has never before been so specific about reducing the number of branches in order to lower costs.

Higher Interest Rates Will Bring Nonperforming Loans

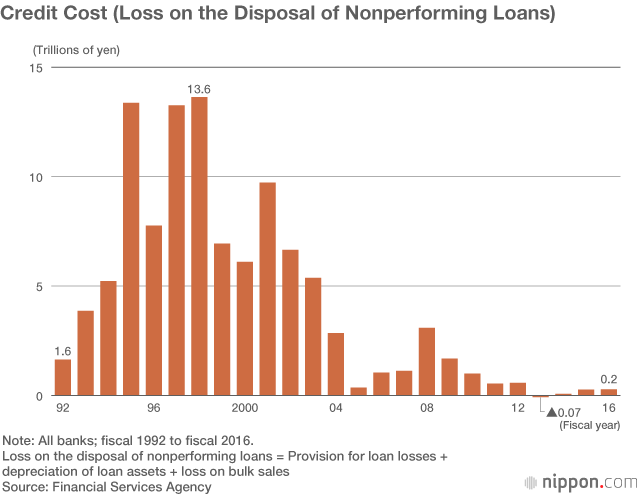

Banks’ nonperforming loan ratios are extremely low, and loan loss reserves are also at a low level. The loan loss reserve ratio, which is determined by the amount of loan losses, is also low since there are currently few nonperforming loans. Once loan losses occur, however, the loan loss reserve ratio will rise, and loan assets against which provisions must be made will increase. Hence, there is risk that credit cost will rise in a procyclical manner. The following chart depicts credit cost, or the loss on the disposal of nonperforming loans. At first glance, the chart seems to depict a tranquil situation.

The nonperforming loan problem should be viewed as having acquired explosive energy through a long period of low interest rates. The FSA is considering how to evaluate and monitor banks whose balance sheets may be sound but still have profit and loss issues. How to determine the profitability of assets and their present value are recurring and difficult questions for auditors.

If the discount rate is set low, book value and market value will not deviate greatly (with a zero discount rate, book value and market value are equal). However, if interest rates rise, the discount rate will need to be set higher, and the market value of assets will fall sharply. As a result, some banks may discover that they are actually insolvent.

Moreover, loan assets with the potential of deteriorating are becoming evident. Previously, loans in partial need of monitoring were viewed as restructured loans (rescheduled loans with reduced or waived interest or extended maturity) that should be self-assessed as nonperforming loans. Under the Small and Medium-Sized Enterprise Finance Facilitation Act, often called the Financial Moratorium Act, whose aims became incorporated into the supervisory policies of the FSA, loans in partial need of monitoring are assessed as performing loans when management restructuring plans are in place.

As a result, loan assets requiring a loan loss provision of around 30% as nonperforming loans are being assessed as performing loans and receiving a provision of only several percent. Such hidden nonperforming loans are estimated to total between ¥7 and 8 trillion (all bank basis). Banks are also carrying ¥1.2 trillion in restructured loans on their loan books. Such rescheduled loans will fall short of management restructuring plans when interest rates rise and are highly likely to require further rescheduling. Rather than being performing loans, they are certain to turn into nonperforming loans.

Targeting Financial Restructuring and a Stronger Safety Net

A requisite level of recapitalization will be necessary to deal with nonperforming loans. Prompt corrective action and an early warning system are monitoring mechanisms available to financial authorities with regard to capital adequacy standards. In autumn 2017, the FSA began to examine the more flexible application of these mechanisms (early application to require the increase of equity capital). At the same time, it began to examine the flexible application of the Act on Special Measures for Strengthening Financial Functions in the injection of public funds (flexible application of existing standards to enable the early injection of public funds). Also, in relation to financial restructuring, which is effective in stabilizing the financial system, exploration has begun to enact a Diet-legislated special act that does not conflict with the Antimonopoly Act in view of the Fair Trade Commission rejecting the merger of the Eighteenth Bank and Shinwa Bank in Nagasaki Prefecture.

During the last four years, the FSA has respected the judgment of financial institutions and has suspended the assessment of individual loans with the exception of large borrowers. This stance, however, is now being threatened by a development in 2017, the bankruptcy of the bargain travel agency Tellmeclub with total liabilities of ¥15 billion. What was problematic for the FSA was not the size of liabilities but banks’ assessment of Tellmeclub as a performing borrower. The FSA was angered that banks’ understanding of basic business details and the confirmation of the use of funds were inadequate and that credit assessments did not function as they should.

While the FSA maintains it is not planning to revive the assessment of individual loan assets, if the self-assessment of performing borrowers is inadequate, this risks shaking the very foundations of current financial administration. To repeat, nonperforming loan ratios are extremely low. Should interest rates rise, however, potential nonperforming loans will turn bad. The breakdown of credit assessments has become a reality. With the threat of approaching financial crisis, the FSA is redoubling its vigilance.

(Originally published in Japanese on January 15, 2018. Banner photo: President Satō Yasuhiro of the Mizuho Financial Group holding a press conference on interim consolidated financial results for September 2017 in Tokyo on November 13, 2017. On the same day he announced plans to slash the number of employees by 19,000. © Jiji.)