Five Years at the Bank of Japan: Governor Kuroda’s Policy Achievements and Pending Issues

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Objectives and Achievements During Governor Kuroda’s Term

When Kuroda Haruhiko was appointed governor of the Bank of Japan in the spring of 2013, he set a goal of achieving 2% inflation within two years. Kuroda had two reasons for establishing this objective: the economic view that the ongoing recession in Japan was mainly due to lack of inflation and the view that “inflation is always and everywhere a monetary phenomenon,” as Milton Friedman put it.

What then has Kuroda achieved during his time in office? Through monetary easing of a “different dimension,” he has provided a clear answer to the question of whether these two views are appropriate.

First, the economic view that the ongoing recession in Japan is due to lack of inflation has been refuted.

To confirm this point, let us examine the current state of Japan’s economy. Supported by the strong recovery of the world economy, the unemployment rate fell to 2.7% in November 2017. Meanwhile, consumer prices excluding fresh food and energy (core CPI), an index closely watched and attached importance by the BOJ, rose only 0.3% year on year in the same month. We can therefore conclude that domestic inflation is not a necessary condition for an expanding economy.

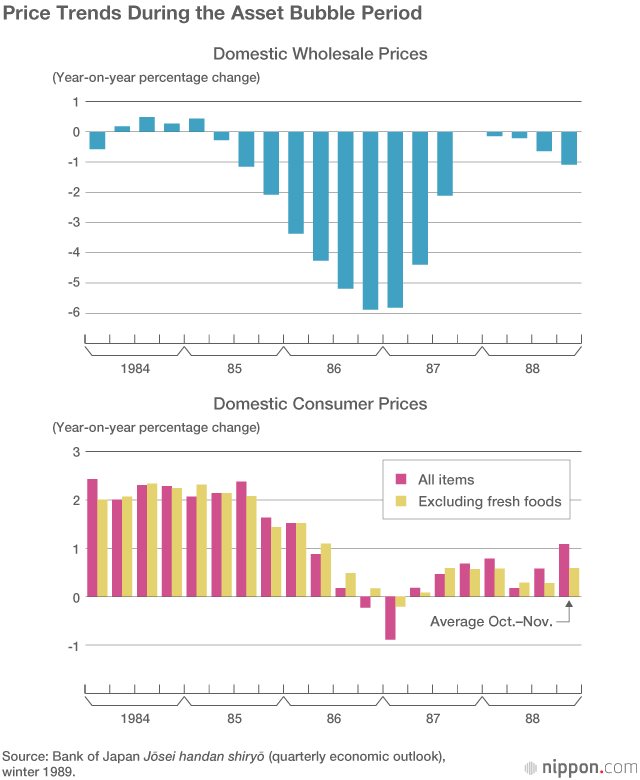

This, however, was not a matter that needed confirming. That strong expansions can occur under deflationary conditions was a key lesson of the Japanese asset price bubble in the 1980s. In the second half of the 1980s, with Japan’s economy experiencing deflation (see the graph below), the BOJ had great difficulty in correcting its loose money policy despite the pronounced growth of an asset price bubble.

By going through this period, the BOJ became painfully aware that it must carefully monitor not only prices but the economy as a whole, particularly financial imbalances. This experience of the BOJ, that price stability is neither a necessary nor sufficient condition for the stability of the overall economy, is finally being understood by the central banks of Europe and the United States subsequent to the financial crisis of 2008.

Second, the view that inflation could be created by easing monetary policy was also refuted. Kuroda declared that he would achieve 2% inflation within two years and that he would adjust monetary policy as needed without any hesitation to achieve this target. It is highly probable, however, that the consumer price index will remain largely flat over his time in office, and there is still no prospect of achieving a 2% inflation target. Since Kuroda clearly sought to realize the inflation target whatever it takes, it should be painfully evident that deflation cannot be overcome by monetary policy alone.

These two points will be useful in considering the objectives for managing monetary policy going forward.

An Accord Between the Government and the BOJ

What then are the issues that remain? Maintaining stability of the economy is the most important issue for central banks in any period. However, the BOJ’s unwavering dedication to the achievement of a 2% inflation target has made monetary policy inflexible and risks destabilizing the economy. Stated another way, the issue for the BOJ should be to restore flexibility to monetary policy and thereby avoid destabilizing the economy.

For this reason, some domestic economists argue that the inflation target should be lowered to 1%. However, the BOJ explicitly abandoning its 2% target will reduce confidence in the central bank and is unlikely to yield positive results.

Given the above, what specifically is necessary? If the new leadership to take office in March 2018 is to repair the policy framework, the most realistic approach is to return to a joint statement announced by the government and the BOJ on January 22, 2013, when the BOJ was led by Shirakawa Masaaki, to overcome deflation and achieve sustainable economic growth announced.

In the accord, the BOJ established as its price stability target consumer prices increasing 2% over the previous year, and it would aim to achieve this target as early as possible. Meanwhile, to strengthen policy coordination with the BOJ, the government would steadily promote measures aimed at establishing a sustainable fiscal structure with the view to ensuring the credibility of fiscal management.

Of the efforts outlined in the joint statement, Kuroda has thus far emphasized the early achievement of the 2% target alone. The joint statement, however, also calls for the BOJ to ascertain whether there is any significant risk to the sustainability of economic growth, including from the accumulation of financial imbalances. The statement therefore rules out an approach that places the achievement of the price stability target above all else.

In a speech explaining the joint statement three days after its release, Shirakawa stated that overseas central banks do not specify dates for achieving price stability irrespective of the adoption of inflation targeting, that the BOJ’s view on aiming for sustainable price stability is based on a similar understanding, that it will bear in mind the risk of financial imbalances, and that it will not confine itself to a specific date for achieving the inflation target.

Currently, the BOJ’s yield curve control has led to the considerable accumulation of financial imbalances. These imbalances include the loss of fiscal discipline by the government, the profit of banks being squeezed by a vanishing lending spread, the significant decline of the functioning of the long-term government bond market, and the distortion of price formation in the stock market through the BOJ’s massive purchases of exchange traded funds. The BOJ should pay more attention to such distortions. Returning to the principles of the joint statement will increase vigilance regarding these developments and will pave the way to a more balanced management of monetary policy.

Debate of an Exit Strategy Should Begin

At his regular press conference of September 2017, Kuroda stated that the joint statement is still in effect and that the possibility of the price stability target influencing financial markets would not be a reason for compromising the BOJ’s most important target. Then, in his regular December press conference, Kuroda remarked that the achievement of the 2% price stability target is the most important target of monetary policy and that specific interest rates would be monitored in relation to the price stability target. Subsequently, there has been no change in his stance of placing the achievement of the price stability target above all else.

Such a stance is incompatible with the basic position of the joint statement. Moreover, Kuroda’s rigid stance toward exit strategies ignores the famous discussion of the relationship between the government and the central bank presented in a piece in the autumn 1981 Quarterly Review of the Federal Reserve Bank of Minneapolis titled “Some Unpleasant Monetarist Arithmetic.” Even if the central bank is independent, it cannot allow the government to default on its debts when the national interest is considered. This inconvenient truth requires central banks to manage monetary policy by considering its effect on fiscal discipline.

The United States is currently unwinding its unprecedented monetary easing, and Europe is also heading toward an exit. To secure leeway for monetary easing before the next downturn, it would be desirable for the BOJ to move toward an exit while the economy is at full employment without being overly committed to the price stability target. In this process, the BOJ should avoid raising concerns about fiscal bankruptcy, avert the destabilization of the financial system, and restore flexibility to monetary policy to be able to head off excessive inflation should it arise.

Specific measures will be needed to minimize the shock to the financial market. These measures should include avoiding the deadlock of government fund raising in the process of revising monetary easing, ensuring that interest rate policies are not restricted by the impairment of the BOJ’s balance sheet from the raising of interest rates, and preventing losses from being forced on financial institutions through government and BOJ policies. A number of proposals have already been made regarding these measures. Many of them are worth examining and the government and the BOJ should exchange the views with private financial institutions.

The BOJ, however, continues to reject any discussion of exit strategies requiring such systemic measures, arguing that the prospect for achieving the inflation target remains out of view. The first issue for the new BOJ leadership is to quietly begin the discussion of exit strategies as part of steps to restore flexibility to monetary policy without going so far as to unsettle markets.

(Originally published in Japanese on February 5, 2018. Banner photo: Bank of Japan Governor Kuroda Haruhiko holding a press conference after the meeting of the BOJ Policy Board in Tokyo on January 23, 2018. © Jiji.)