First Year of Abenomics Boosts All Economic Indicators

Politics- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

First Signs of Positive Cycle

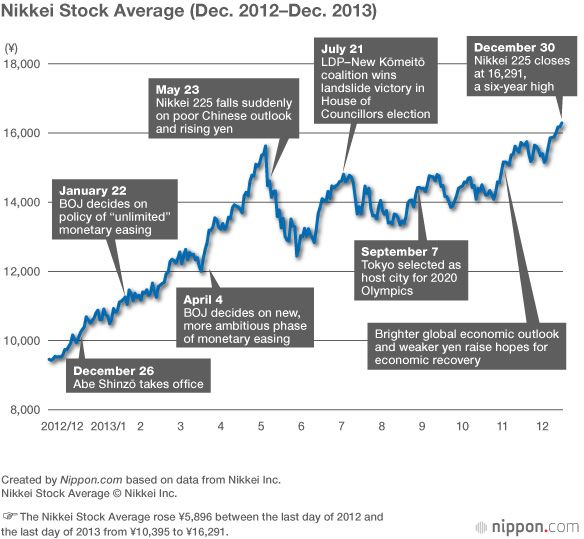

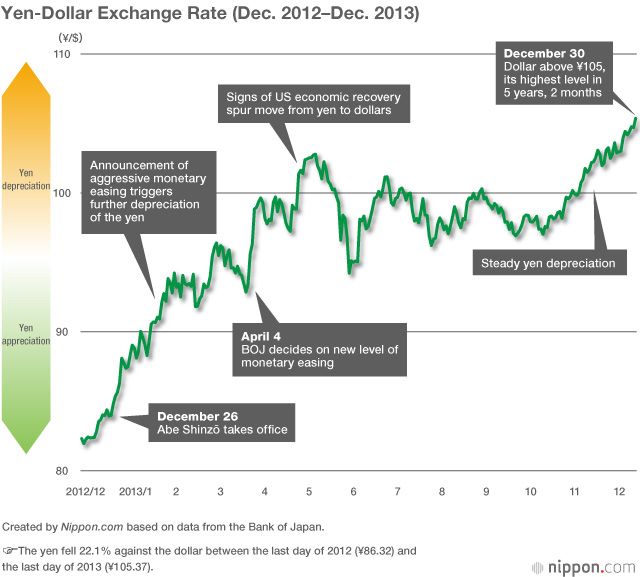

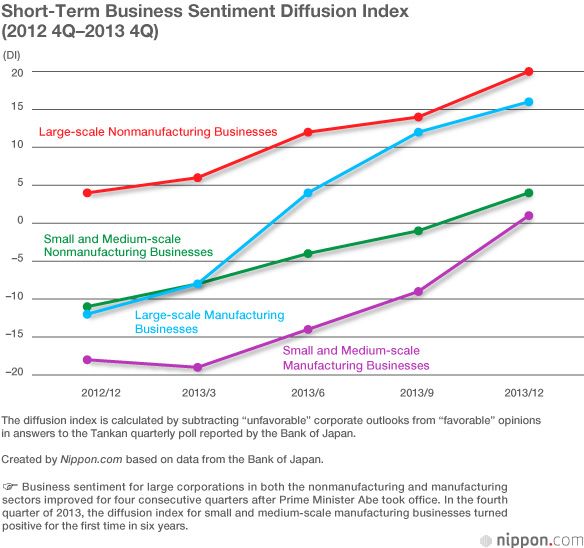

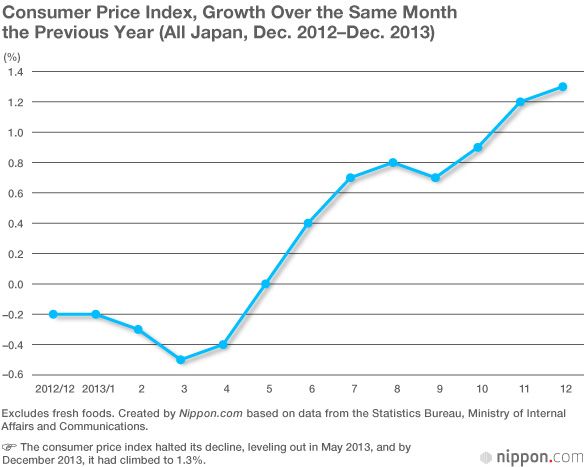

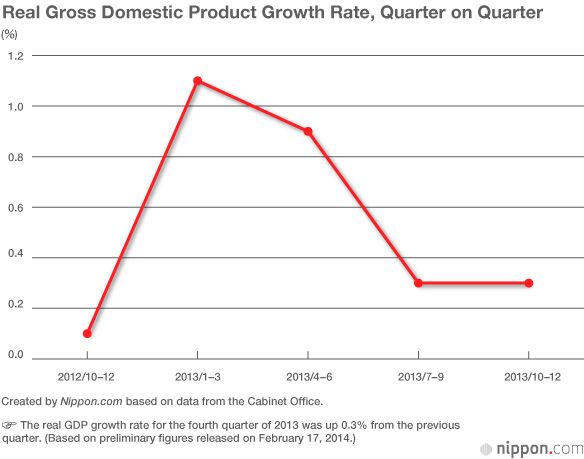

The key economic figures for December 2013 revealed that business and consumer sentiment picked up during the previous year, showing improvements in all areas, including production, individual consumption, employment and wages, and stock prices. The Bank of Japan’s quarterly Tankan report also showed a recovery in short-term business confidence among large-scale manufacturers. And some companies, particularly major corporations, are starting to increase pay.

These indicators hint at the first signs of the positive economic cycle promised by Abenomics—one in which recovering corporate earnings bring higher wages and greater employment, which in turn lead to boosted consumer spending and an economic upswing. In his policy speech at the beginning of the 186th ordinary Diet session on January 24, Prime Minister Abe stated that without a virtuous economic cycle, it would be impossible to break free from deflation. He further emphasized that the government would take all possible measures to address issues related to the April 1 rise in the consumption tax from 5% to 8% and continue to make economic recovery its top priority.

Reasons for Concern

However, there are reasons for concern. Since the beginning of 2014, in Argentina the peso has plummeted, spreading uncertainty in emerging markets and triggering a rise in the yen and a fall in Japanese stock prices. Exports may sag further if emerging economies remain troubled and the gains in the export sector thanks to 2013’s depreciation slip away. The effects of April’s tax hike on consumer spending will also need to be monitored.

For the Japanese economy to escape deflation and a positive cycle to take hold, the government’s growth strategy, the “third arrow” of Abenomics, must be properly implemented. Maintaining improvements in exchange and stock price trends and corporate performance will also be key. The future state of emerging economies and US financial policies will play important roles.

Comparison of Major Economic Indicators at End of 2012, End of 2013

| Indicator | December 2012 | December 2013 | |

|---|---|---|---|

| Market trends | Nikkei stock average | Closed at 10,395 on December 28 | Closed at 16,291 on December 30, a six-year high |

| Yen-dollar exchange rate | Year closed with dollar in ¥85 range | Depreciation brings dollar to ¥105 range on December 30 | |

| Employment | Unemployment ratio | 4.3% | 3.7% (Major improvement from 4.0% in November) |

| Ratio of active job openings to applicants | 0.83 | 1.03 (Increase of 0.03 point from the previous month) | |

| Production | Industrial production index (base 2010 = 100) | 94.7 | 100.3 (Increase of 1.1% from the previous month) |

| Consumer spending | Retail sales value | ¥14.0 trillion | ¥13.5 trillion (Increase of 2.6% compared with the same month the previous year) |

| Consumer price index (Composite index for all Japan. Excludes fresh food.) | 99.4 | 100.6 (Increase of 1.3% compared with the same month the previous year) | |

| Business Survey Index | Government’s monthly economic report | December report states that Japanese economy is weak recently due to slowing global economy | The word “deflation” is dropped from the December report. The January 2014 report changes December’s wording that the “Japanese economy is on the way to recovery at a moderate pace” to state that the “Japanese economy is recovering at a moderate pace” in the first upward revision for four months. |

(Title photo: Prime Minister Abe Shinzō attends a ceremony at the Tokyo Stock Exchange at the final trading session of the year on December 30, 2013. Photo by Tōyō Keizai/Aflo.)

Bank of Japan Abe Shinzō foreign exchange unemployment consumer prices Abenomics economics stock