Moves Toward Lowering Japan’s Corporate Taxes

Politics Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

The Japanese government and ruling Liberal Democratic Party have put forward a plan to lower the country’s effective corporate tax rate starting in 2015. (The corporate tax rate in Tokyo is currently 35.64%). The plan was included in an outline of key economic and fiscal management policies issued in June 2014. A comprehensive version of the tax plan, which should go before the Diet at the year’s end, is expected to be part of tax revision legislation to take effect in the coming fiscal year. As the administration of Prime Minister Abe Shinzō continues to push its Abenomics growth strategy of structural and monetary reforms, it hopes to boost Japanese firms’ competitiveness and lure foreign corporations to Japan with a lower tax rate.

A Pillar of Long-Term Growth

Japan’s corporate tax rate is one of the highest in any leading economy. Prime Minister Abe, in a speech given at the World Economic Forum in Davos, Switzerland, in January 2014, pledged to lower this rate, saying: “Lowering the corporate income tax will allow companies to increase spending on research and capital investments as well as raise wages.”

Noda Takeshi, chair of the ruling Liberal Democratic Party’s tax panel, submitted a plan to reduce corporate taxes to Prime Minister Abe on June 3. While the panel backed lowering the corporate tax rate, it accepted this on condition that alternative revenue sources must first be secured to offset the resulting decline in income.

Lowering a World-Leading Rate

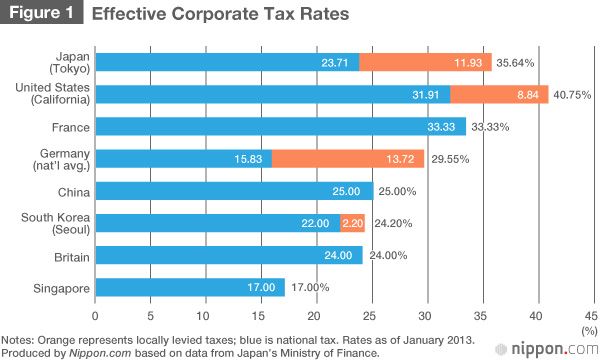

According to figures from Japan’s Ministry of Finance comparing corporate tax rates around the globe, the rate for a Tokyo-based company stands at 35.64% (the national rate of 23.71% plus the local rate of 11.93%). The United States also has high rates, with the corporate tax burden for a US company in California being 40.75%. The 33.33% national rate in France and 29.55% for Germany (15.83% national and 13.72% regional combined) are also comparatively high. The 17.00% rate for Singapore is one of the lowest among economically advanced nations.

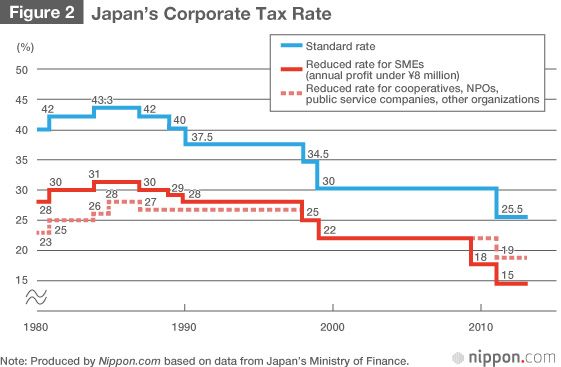

An international trend over the last few years has been to lower corporate tax rates. In Japan, the country’s rate has been gradually lowered starting in the middle of the 1980s, when the nation’s corporate tax burden was at its peak. Globalization has made it easy for companies to lower costs by relocating to countries with lower rates, and many countries have pursued “tax haven” policies to lure corporations to their shores. Measures by developed nations to keep domestic companies at home, such as tax reductions, have initiated a global tax war.

Sakakibara Sadayuki, the newly appointed chairman of Japan’s business federation Nippon Keidanren, stated at his inaugural press conference on June 3 that he would like to see the effective corporate tax rate begin falling in fiscal 2015 to reach the 20%–30% range over the next three years. The rate is expected to eventually be brought in line with other OECD nations, to 25%.

Ensuring Revenue Sources

The most significant issue related to lowering the corporate tax rate is ensuring replacement sources of revenue. Ensuring other income flows for the government is essential to getting Japan back on a viable fiscal track. Finance Minister Asō Tarō has shown reservations about lowering the corporate tax rate, but said he can accept his party’s plan as long as the government takes other steps to secure additional revenue sources to offset the drop from lowering the corporate rate.

The LDP’s tax panel is considering such measures as widening the revenue base through tax increases and decreased tax breaks, such as those that allow unprofitable companies to apply losses to offset profits in the next fiscal year.

(Banner image: Office buildings in Tokyo’s Marunouchi district. Photo © Jiji Press Photo.)

Abe Shinzō economy taxes policy Abenomics Corporate tax tax reduction reflation