Japanese Firms Accelerate Outbound Mergers and Acquisitions

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

All-Time Highs in 2015

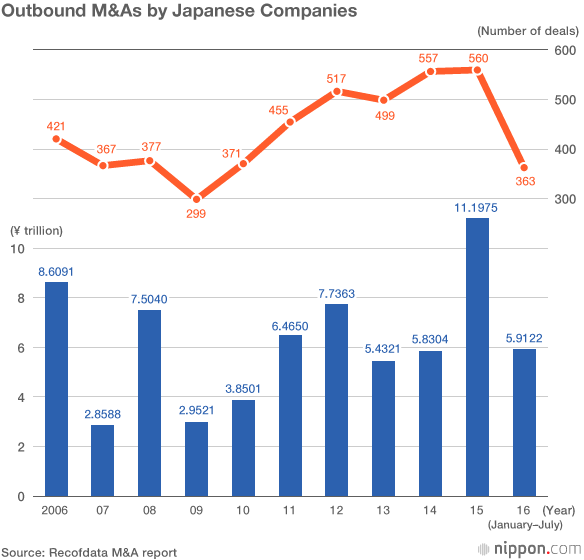

Recof, a Tokyo-based company that proposes and executes M&As for clients, reports that Japanese companies completed 560 outbound M&As in 2015—an increase of 0.5% over the previous year—worth a total of ¥11.2 trillion, an increase of 92%. Both these figures are all-time highs. Previous highs were the 557 deals in 2014 and ¥8.6 trillion in 2006. By region, the number of deals with European firms climbed 16.2% to 136 in 2015, while Asian deals declined 16.4% from 232 to 194.

This strong interest in M&As is partly the result of record high corporate earnings and a large pool of retained earnings. The Financial Statements Statistics of Corporations by Industry published by the Ministry of Finance indicates that the retained earnings of Japanese companies (excluding the financial and insurance sectors) totaled ¥355.7 trillion as of the end of 2015, the highest on record and ¥23 trillion higher than in 2015. Retained earnings also increased by more than ¥10 trillion in the first quarter of 2016. With a shrinking population precluding the substantial growth of domestic demand, Japanese companies are turning to outbound M&As to tap the growth of overseas markets.

The largest offshore deal in 2015 was made by Itochu and Thai partner Charoen Pokphand Group to purchase the stock of a subsidiary of CITIC—China’s largest state-owned enterprise—for about ¥1.2 trillion. This was also the largest investment ever made by a Japanese company in China. Insurance companies loomed large in the other major deals of 2015, such as the acquisition of HCC Insurance Holdings, a major US health and casualty insurer, by Tokio Marine Holdings for about ¥940 billion; the acquisition of a British nonlife insurance company by the Mitsui Sumitomo Insurance Company, and the acquisition of mid-tier US life insurance companies by the Meiji Yasuda Life Insurance Company and the Sumitomo Life Insurance Company.

SoftBank’s Mega-Purchase

Interest in outbound M&As did not diminish in 2016. While the number of deals between April and July fell below the year-ago level, the total since January (through July) was 363, an increase of 14.9%. Should the pace continue, the number of deals in 2016 could surpass last year’s record high. The value of the deals through July stands at ¥5.9 trillion, already more than the value of deals for the entire year of 2014 (¥5.8 trillion).

It was SoftBank Group’s £24 billion (about ¥3.3 trillion) purchase of ARM that significantly boosted the value of M&As in 2016. This is the largest foreign acquisition ever made by a Japanese company, surpassing the ¥1.7 trillion that Japan Tobacco paid for Gallaher, a major British tobacco company, in 2006.

ARM was founded in 1990 and specializes in the design of semiconductors. Its technology is widely used in smartphone CPUs and in the circuit designs of communication semiconductors. ARM has a 90% share of the global market for smartphone chips. With the purchase of ARM, Softbank is positioning itself for the age of the Internet of things, where vehicles and all manner of physical objects are connected to the web.

Recent Major Outbound Acquisitions by Japanese Companies

| Buyer company | Target | Amount (as announced) | Date of announcement | |

|---|---|---|---|---|

| 1 | SoftBank | ARM Holdings (Britain) | ¥3.3 trillion | July 18, 2016 |

| 2 | Japan Tobacco | Gallaher (Britain) | ¥1.7 trillion | Dec. 15, 2006 |

| 3 | Suntory | Beam (US) | ¥1.7 trillion | Jan. 14, 2014 |

| 4 | SoftBank | Sprint Nextel (US) | ¥1.6 trillion | Oct. 15, 2012 |

| 5 | Itochu and CP Group (Thailand) | CITIC subsidiary (China) | ¥1.2 trillion | Jan. 20, 2015 |

| 6 | Tokio Marine | HCC Insurance (US) | ¥940 billion | June 11, 2015 |

| 7 | Mitsui Sumitomo Insurance | Amlin (Britain) | ¥640 billion | Sept. 8, 2015 |

| 8 | Meiji Yasuda Life | StanCorp (US) | ¥620 billion | July 24, 2015 |

| 8 | Japan Post | Toll Holdings (Australia) | ¥620 billion | Feb. 18, 2015 |

| 10 | Japan Tobacco | International assets of Reynolds American (US) | ¥600 billion | Sept. 29, 2015 |

| 11 | Dai-ichi Life | Protective (US) | ¥580 billion | June 4, 2014 |

| 12 | Sumitomo Mitsui Financial | GE Japan (US) | ¥575 billion | Dec. 15, 2015 |

| 13 | Sumitomo Life | Symetra Financial (US) | ¥460 billion | Aug. 11, 2015 |

| 14 | NTT Data | IT services unit of Dell (US) | ¥350 billion | March 28, 2015 |

| 15 | SoftBank | Japan Telecom assets of Ripplewood Holdings (US) | ¥340 billion | May 27, 2004 |

Looking for Growth in Asia

Japanese companies regard the acquisition of foreign companies as a major component of their growth strategies. They hope to benefit from growth in the US and emerging economies and to expand their business through the purchase of companies in those countries. Prominent in recent years have been M&As targeting Southeast Asian companies, led by financial institutions. Sumitomo Mitsui Banking acquired an equity interest in Eximbank (Vietnam) in 2007, which was followed by investments by Mizuho Corporate Bank (currently Mizuho Bank) in Vietcombank and by the Bank of Tokyo–Mitsubishi UFJ in Vietinbank, while Sumitomo Mitsui Banking has invested in banks in Indonesia, Cambodia, and Hong Kong. The Bank of Tokyo–Mitsubishi UFJ acquired the Bank of Ayudhya (Thailand) and bought about 20% of the stock (about ¥100 billion) of Security Bank, a major Philippine bank, in January 2016 to make it an equity-method subsidiary.

Recent Acquisitions of Asian Companies by Japanese Firms

| Buyer company | Target | Amount (as announced) | Date of announcement | |

|---|---|---|---|---|

| 1 | Itochu and CP Group | CITIC subsidiary | ¥1.2 trillion | Jan. 20, 2015 |

| 2 | Bank of Tokyo–Mitsubishi UFJ | Bank of Ayudhya (Thailand) | ¥560 billion | July 2, 2013 |

| 3 | Sumitomo Mitsui Banking | 40% equity interest in Bank BTPN (Indonesia) | ¥150 billion | May 8, 2013 |

| 4 | Kintetsu World Express | APL Logistics (Singapore) | ¥140 billion | Feb. 17, 2015 |

| 5 | Sumitomo Mitsui Banking | Bank of East Asia (Hong Kong) | ¥100 billion | Sept. 9, 2014 |

| 6 | Bank of Tokyo–Mitsubishi UFJ | Security Bank (Philippines) | ¥90 billion | Jan. 14, 2016 |

| 7 | Bank of Tokyo–Mitsubishi UFJ | Vietinbank (Vietnam) | ¥60 billion | Dec. 27, 2012 |

| 8 | Sumitomo Corp. | 17.5% equity interest in Bank BTPN (Indonesia) | ¥56 billion | Feb. 18, 2015 |

| 9 | Mizuho Corporate Bank | Vietcombank (Vietnam) | ¥43 billion | Sept. 30, 2011 |

| 10 | Sumitomo Mitsui Banking | Eximbank (Vietnam) | ¥25 billion | Nov. 27, 2007 |

Mid-tier companies and legal services are also taking part in M&As in 2016. Air Water, a major industrial gas company based in Osaka, acquired a 100% stake in Taylor-Wharton Malaysia, a subsidiary of Taylor-Wharton—a US manufacturer of cryogenic storage systems—for an undisclosed sum. In addition, Mori Hamada & Matsumoto, a law firm with the third-largest number of lawyers in Japan, is planning to buy Chandler & Thong-ek Law Offices (Thailand) in January 2017 with the aim of strengthening its presence in Thailand and to respond to the growing demand for legal services in Southeast Asia. Other Japanese firms are expected to follow.

Among major enterprises, Kawasaki Heavy Industries announced its policy for Asian M&As when it released its financial statements for the fiscal year ending March 2016. In its medium-term management plan (fiscal 2016 to 2018), it intends to procure investment funds of more than ¥100 billion to acquire engineering companies in Asia capable of designing, sourcing, and building power generation plants. Ajinomoto’s current medium-term management plan (fiscal 2014 to 2016) calls for investments of about ¥200 billion in the food industry in Thailand, Vietnam, and other high-growth nations.

Foxconn Takes Over Sharp

Japanese companies are increasingly also becoming targets for inbound M&As. According to Recof, there were 120 acquisitions of Japanese companies by foreign firms between January and July 2016, an increase of 10.1% over the 109 deals from the same period in 2015. The purchases were valued at ¥1.8 trillion, 3.5 times the value of the year-ago period (¥506 billion).

These inbound acquisitions include the sale of Supercell, a Finnish mobile game developer owned by a subsidiary of the SoftBank Group, to Tencent Holdings, a major Chinese Internet company, for about ¥770 billion, as well as the transfer by TDK of certain mobile device component assets to Qualcomm, a major US semiconductor company, for about ¥360 billion. Sharp being taken over by Foxconn of Taiwan for ¥389 billion is a prominent example of an entire Japanese company being sold off.

M&As are also occurring between Japanese companies. More than 2,000 deals were made between 2005 and 2007, after which the number retreated to 1,086 deals in 2011. A subsequent upswing resulted 1,662 M&As with a total value of ¥3.6 trillion in 2015. Between January and July 2016, there were 1,035 deals valued at ¥2.2 trillion, exceeding the corresponding figures of the year-ago period. Toshiba, whose business remains slack, sold Toshiba Medical Systems, its stellar medical equipment subsidiary, to Canon for ¥666 billion. Mitsubishi Motors, which was revealed to have overstated the fuel efficiency of its vehicles, was acquired by Nissan Motor for ¥237 billion. And Nippon Steel & Sumitomo Metal Corp, Japan’s largest steel company, acquired fourth-ranked Nisshin Steel to strengthen its competitiveness against Chinese rivals.

(Originally written in Japanese by Nagasawa Takaaki and published on September 5, Banner photo: SoftBank Group CEO Son Masayoshi speaking to the press on the acquisition of ARM Holdings on July 18, 2016, in London. © Jiji)Sharp Softbank corporate acquisitions corporate mergers foreign investment