The Challenge of Restoring Japan's Fiscal Integrity

Toward More Sustainable Social Security for Japan

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Japan’s public finances are facing an unprecedented situation in both historical and international terms. The debt to GDP ratio of general government (central and local) has exceeded 200%, an all-time high surpassing the level recorded in fiscal 1944 toward the end of World War II. In 1944, however, the debt situation could be expected to improve once the war ended. The current situation may be worse since the growth of social security expenses from the aging of society is placing pressure on public finances in the form of mounting fiscal deficits.

Weak Tax Revenue Base and Limited Investment in Next Generation

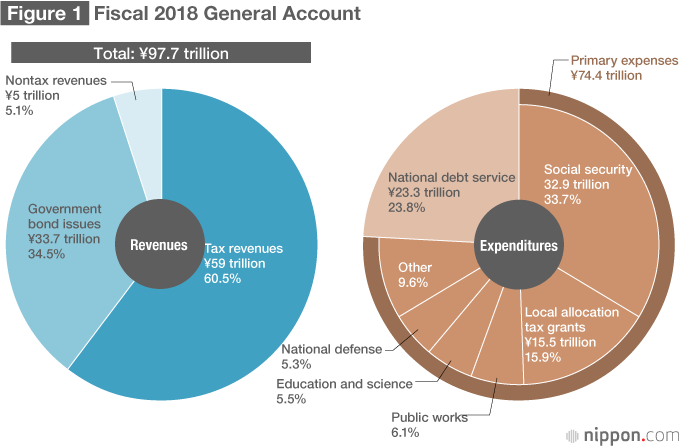

In structural terms, Japan’s public finances are underpinned by a weak tax revenue base, where tax revenues fund only 60% of general account expenditures. In the initial government budget for fiscal 2018, general account expenditures total ¥97.7 trillion, of which ¥33.7 trillion are funded through the issue of government bonds. Tax revenues (including revenue stamp revenues) are estimated at ¥59 trillion, a figure that rises to ¥64 trillion when other investment revenues are included.

Public finances in Japan are fraught with major structural problems in the form of higher social security expenses from the aging of society and the rising cost of government bonds from the accumulation of public debt. In the fiscal 2018 central government budget, social-security-related expenditures take the largest share at 33.7% (¥32.9 trillion). When combined with the cost of servicing government bonds (23.8%; ¥23.3 trillion) and with local allocation tax grants (15.9%; ¥15.5 trillion), these three components account for more than 70% of government expenditures. Investments in the next generation, such as for education, science, and public works, account for less than 30% of the government budget.

While reporting in newspapers and other mass media tends to focus on the growth of social security related expenditures in the general account, of far more importance is the growth of social security benefit expenditures financed by central and local governments. Although social security related expenditures in the fiscal 2018 budget reaching an all-time high of ¥33 trillion became a topic of discussion, social security benefit expenditures paid by central and local governments and through insurance premiums will soon surpass ¥120 trillion. Social security benefit expenditures have been financed in recent years by insurance premium revenues (about ¥60 trillion), by the national treasury (about ¥33 trillion), and by local governments (about ¥10 trillion). Social security related expenditures in the general account of the central government basically corresponds to the social security benefit expenditures paid by the national treasury and represent only a part of social security benefit expenditures.

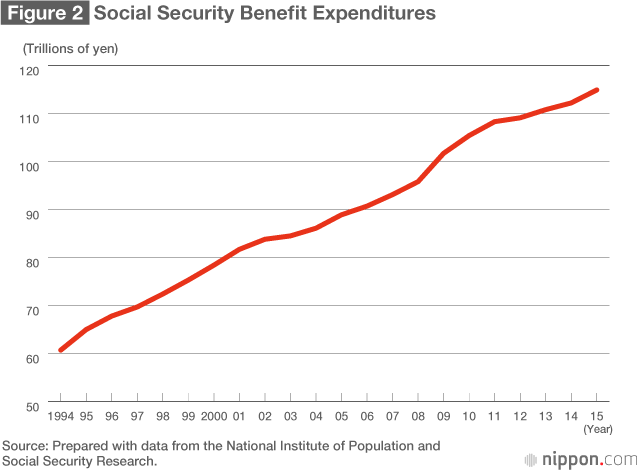

Social Security Benefit Expenditures Increasing at Annual Rate of ¥2.5 Trillion

As portrayed in Figure 2, social security benefit expenditures financed by central and local governments (settlement basis) have grown from ¥90 trillion in fiscal 2006 to ¥115 trillion in fiscal 2015. In other words, such expenditures are growing by an annual average of ¥2.5 trillion, which is as much as tax revenues will rise when the consumption tax rate is increased by 1 percentage point.

In a long-term projection of Japan’s public finances submitted in October 2015 as a drafting committee report to a subcommittee of the Fiscal System Council of the Ministry of Finance, the ratio of medical and long-term care expenditures to GDP is projected to rise from about 10% in fiscal 2020 (8% for medical expenditures and 2% for long-term care expenditures) to about 16% in fiscal 2060 (10% for medical expenditures and 6% for long-term care expenditures). This suggests that the reform of public finances must center on the reform of social security. Public finances have deteriorated so far that more than ¥30 trillion in government bonds must be issued each year. This situation is greatly influenced by the failure to allocate financial resources for social security expenditures, which have inevitably grown with the aging of society. The proper approach should be to use tax revenues to cover the shortage of financial resources for social security expenditures.

Government Budget Projections Assume Higher Economic Growth Rate

What will Japan’s public finances look like in the medium to long term? One point of reference is provided by the government’s fiscal projections, the most recent being the “Economic and Fiscal Projections for Medium- to Long-Term Analysis” published by the Cabinet Office in January 2018.

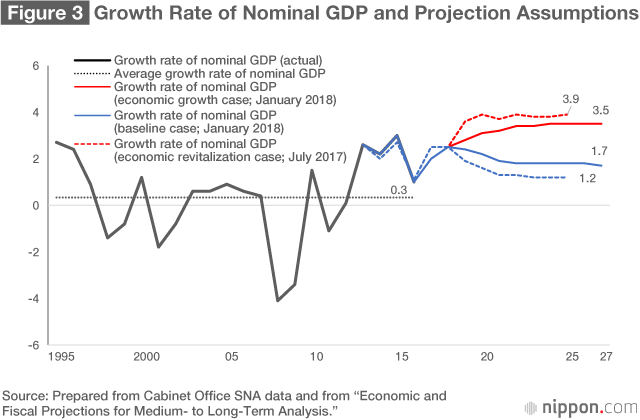

The economic and fiscal projections provide two scenarios: a high economic growth case (economic revitalization case) and a low-growth baseline case. In both these cases, the general government debt to GDP ratio is projected to decrease between fiscal 2018 and fiscal 2027. Since the public debt to GDP ratio is expected to decrease even in the low-growth scenario, this may give the impression that worries about public finances can be set aside. However, growth rates being assumed for the economy remains major concerns. In the latest economic and fiscal projections, the growth rate of nominal GDP was increased in the low-growth baseline case compared to the previous projection. As seen in Figure 3, the nominal growth rate of the baseline case was revised upward from 1.2% to 1.7% for the second half of the 2020s. This is the main reason for the decline of the debt to GDP ratio even in the low-growth baseline case.

The argument might be made that the nominal growth rate assumed in the previous economic and fiscal projections was too high since nominal GDP grew at an average of only 0.3% between fiscal 1995 and fiscal 2016. Despite this record, nominal GDP was projected to increase at a rate of 1.2% in the previous baseline case.

Efforts to Restore Integrity of Public Finances Must Continue

If the average growth rate of nominal GDP is assumed to be 0.3%, to what level will the public debt to GDP ratio converge? Setting specifics aside, where the ratio will converge can be calculated using Domar’s proposition. When the average budget deficit to GDP ratio is q and the average growth rate of nominal GDP is n, the public debt to GDP ratio will converge to q÷n.

For example, when the budget deficit to GDP ratio is q=3% and the growth rate of nominal GDP is n=2%, q÷n will equal 1.5, meaning that the public debt to GDP ratio will converge to 150%. In the low-growth case in the latest economic and fiscal projections, the budget deficit of general government is projected to be 3.3% of GDP around fiscal 2027. If the growth rate of nominal GDP is projected to average 0.3%, the public debt to GDP ratio will converge to 1,100%. This indicates that, to ensure the sustainability of public finances, the budget deficit to GDP ratio must be reduced to an appropriate level.

For this reason, efforts to restore the integrity of public finances must continue. While the government and ruling parties have abandoned the goal of achieving a positive primary balance for general government finances by fiscal 2020, with regard to the framework for restoring the integrity of public finances, the cabinet approved a new economic policy package on December 8, 2017, aiming to revolutionize human resources development and productivity. The government’s summary of the package contains the following text (underlining by the author).

Since the revision of the purposes of use of the tax revenue generated from the consumption tax rate hike affects the periods for achieving a fiscal surplus in the national and local primary balance, it is difficult to achieve the goal of fiscal surplus in the primary balance for FY2020. However, the government will never give up on the fiscal consolidation and stick to its target for thoroughly and continuously making efforts to reform both revenues and expenditures and aim for achieving a fiscal surplus in the primary balance. To achieve this target, the government will announce the period of achieving a fiscal surplus in the primary balance and develop a concrete and highly-effective plan to support this in the “Basic Policies on Economic and Fiscal Management and Reform” for the next year upon closely examining the efforts for the integrated reform of finance and economy in the past.

The Normalization of Interest Rates will Increase Interest Expense of Government Bonds

Public finances in Japan are burdened with persistent deficits and massive debt. Despite this extremely difficult situation, Japanese citizens seem little concerned about their sustainability. This indifference is likely strongly influenced by the Bank of Japan’s current policy of monetary easing where it buys large quantities of government bonds to maintain the long-term interest rate at an extremely low level. As a result, the yield on government bonds is around 1% (weighted average interest for outstanding government bonds), and the interest expense for government bonds of about ¥1.0 quadrillion is only about ¥10 trillion. Should the interest rate rise to 5% or 6%, however, the interest expense will increase five to six times to ¥50 trillion to ¥60 trillion.

It is worth bearing in mind that, when the government and the BOJ are viewed as a single entity, the cost of their combined debt will not change regardless of whether the BOJ holds government bonds or not. The cost of debt is presently not materializing since interest rates are close to zero. But once deflation ends and interest rates return to normal, the cost-free financing of budget deficits will no longer be possible, and huge debt service costs will reemerge. In the years following the Tokyo Olympic Games in 2020, the landscape for Japan’s economy and public finances can be expected to change greatly. Given this prospect, what is needed is the resolute reform of public finances and the social security system, a process that should also consider the decision to raise the consumption tax rate in October 2019 and should specify the medium- to long-term shape of social security policies.

(Originally written in Japanese and published on April 2, 2018.Banner photo: The office buildings of the Ministry of Finance and the National Tax Agency in Kasumigaseki, Tokyo © Jiji.)