Japan’s Employment System on Trial

The Spring Wage Offensive and Wage Trends in Japan

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Wage Hikes Seen at Smaller Firms Too

The final results of the shuntō, or spring wage offensive, of 2023 are reported in a survey published by the Japanese Trade Union Confederation (Rengō). The data shows that the labor unions of large companies with 1,000 or more employees that negotiated on an average wage basis achieved an increase of 3.69% for the component corresponding to an annual wage increase and an increase of 2.16% for the base pay component. Unions of small companies, with 99 or fewer employees, that negotiated on an average wage basis achieved an annual wage increase of 2.94% and a base pay increase of 1.87%. While the increase rate was somewhat restrained for the unions of these smaller firms, the Rengō survey does suggest that the trend for higher wages has spread to them as well.

The base pay component involves increases achieved through the revision of existing wage schedules. The annual wage increase, meanwhile, concerns the component of hikes to bring newer hires’ wages in line with those of longer-serving employees, in accordance with these schedules and based on labor agreements or rules of employment.

Regarding the annual bonuses received by full-time union members, labor unions negotiating monetary amounts achieved an increase of ¥28,351 over the previous year, up 1.82%. The many labor unions negotiating bonuses by the number of months achieved a bonus increase of 0.01 months from the previous year. Wage increases in Japan have tended to be made through bonuses to avoid their becoming a part of fixed labor costs. Taking into consideration the fact that there was no major change in bonuses and that the benefit of the higher base pay component noted above will accrue every month, the Rengō survey suggests the possibility that momentum is shifting to base pay hikes. Bonuses in the Rengō survey, however, include those negotiated by the number of months. Since this component cannot be converted into an increase rate, it will be necessary to consider statistics indicating the wage trend for Japan as a whole on a monetary basis, as will follow below.

The Gap Between Shuntō and MHLW Survey Outcomes

According to the Monthly Labor Survey of the Ministry of Health, Labor, and Welfare (MHLW), total real wages were down 5.3% in July 2023 from the February 2019 level. The analysis of contributing factors reveals that the total nominal cash earnings of full-time workers grew 2.0% and the corresponding cash earnings of part-time workers grew 0.3%. Meanwhile, consumer prices made a negative contribution of –7.0%. In addition, the growing share of the workforce represented by part-time workers, whose wages tend to be less than the average, contributed –0.8%. In other words, while nominal wages have increased for both full-time and part-time workers, the real value of their wages has fallen due to the upsurge of consumer prices.

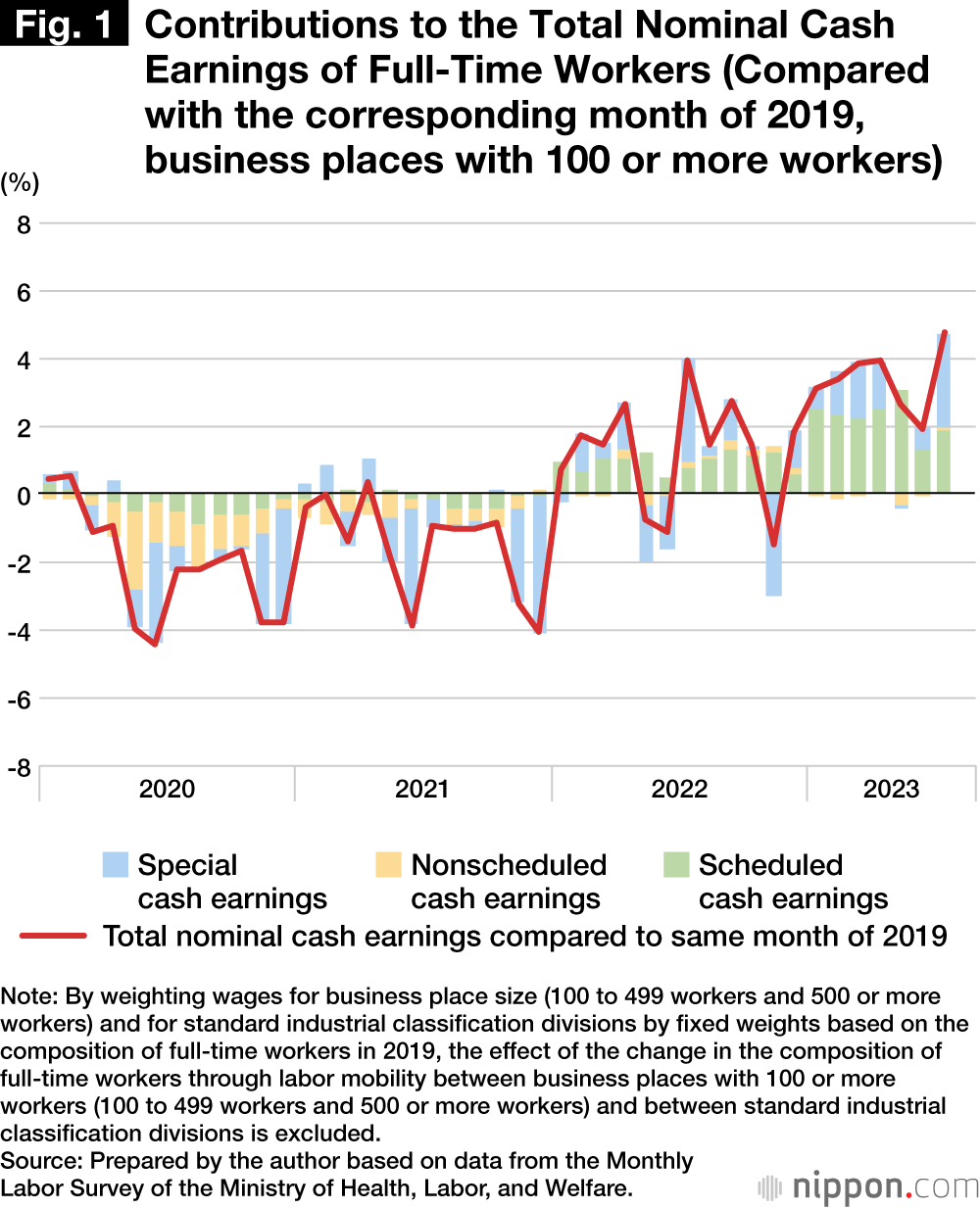

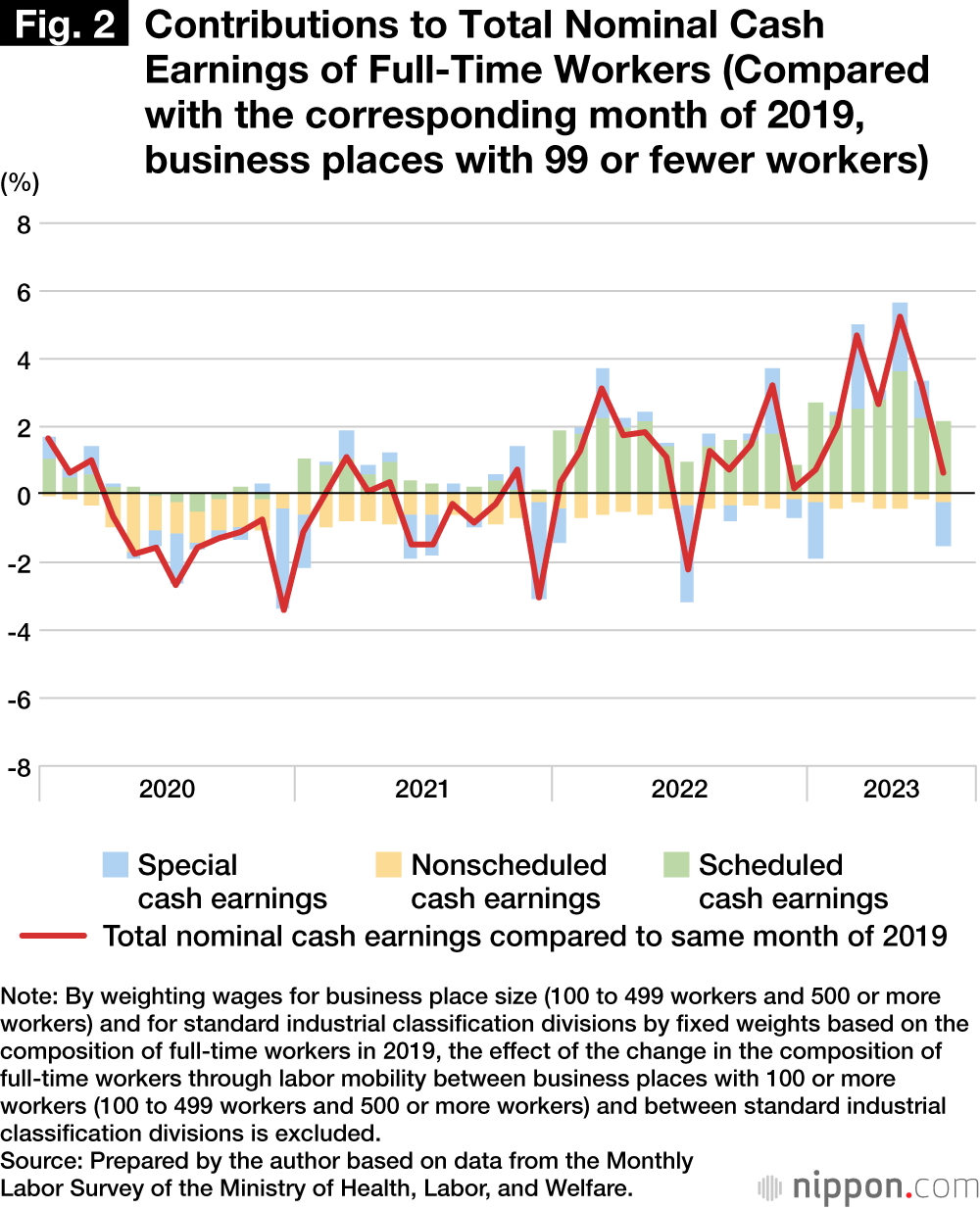

A more detailed analysis can be made by considering the trend for the total nominal cash earnings of full-time workers for business places above and below 100 workers.

In the case of companies with 100 or more workers, the increase of total nominal cash earnings is positive for June and July 2023 compared to the same months in 2019, although the increase is somewhat low compared to that seen for May. The difference in the rate of increase between March and May 2023, on either side of the shuntō negotiations at the change in the fiscal year, is 0.83 percentage points (see figure 1). In the spring wage offensive of 2023, the labor unions of companies with 100 or more workers that negotiated on an average wage basis achieved an increase of 2.13% for the base pay component (weighted average). Thus, the growth of scheduled cash earnings for Japan as a whole is somewhat restrained compared to the shuntō results. The positive contribution of special cash earnings was a substantial 2.78% in July 2023, though, which together with the growth of bonuses points to companies responding to the desire for wage increases.

Annual income will need to be interpreted with considerable latitude due to monthly fluctuations influenced by such factors as labor mobility. Should an increase of 0.83 percentage points, the difference in the increase between March and May 2023, continue for a period of 12 months, and should the increase of winter bonuses correspond to 2.78%, the degree of contribution of special cash earnings noted above, the cumulative monthly contribution of the wage increase component will be about 10 percentage points and the cumulative contribution of the biannual bonus component will be about 5% for the year, compared to prepandemic levels. In other words, a comparison of cumulative contributions reveals that wages are moving toward sustainable increases due to a shift from bonuses to base pay.

In the case of business places with 99 or fewer workers, the difference in the increase of wages between March and May 2023 is 1.09 percentage points (figure 2). Labor unions of companies with 99 or fewer workers that negotiated on an average wage basis in the spring wage offensive achieved an increase of 1.87% for the base pay component, which is less than the increase achieved by their counterparts in larger firms. Thus, the growth of scheduled cash earnings for Japan as a whole is more restrained than the results of the spring wage offensive. Since special cash earnings appear to have made a negative contribution in July 2023, this suggests the possibility that companies are responding to the desire for wage increases by using lower bonuses to increase scheduled earnings.

The relationship between the spring wage offensive of 2023 and the trend for wages for Japan as a whole can be summarized as follows.

The data suggests that wage increases are spreading even to smaller companies. However, compared to the increase of the base pay component achieved in the spring wage offensive, the growth of scheduled cash earnings for Japan as a whole is restrained.

For both larger and smaller business places, the data suggests the possibility that the method for increasing wages is shifting from bonuses to base pay. It appears that those with 99 or fewer workers are using the decrease of bonuses to increase base pay, while business places with 100 or more workers are increasing both bonuses and base pay.

Profits On the Rise

In the following paragraphs I will examine the background to the spread of wage increases to small companies.

The upsurge of energy prices and raw material costs have a major impact on company management. In a survey of cost pass-throughs published by Teikoku Databank in July 2023, 74.5% of companies reported they were more or less able to pass through higher costs and 4.5% reported they were passing through 100% of costs. On the other hand, 12.9% of companies were in difficult circumstances and unable to pass through any costs.

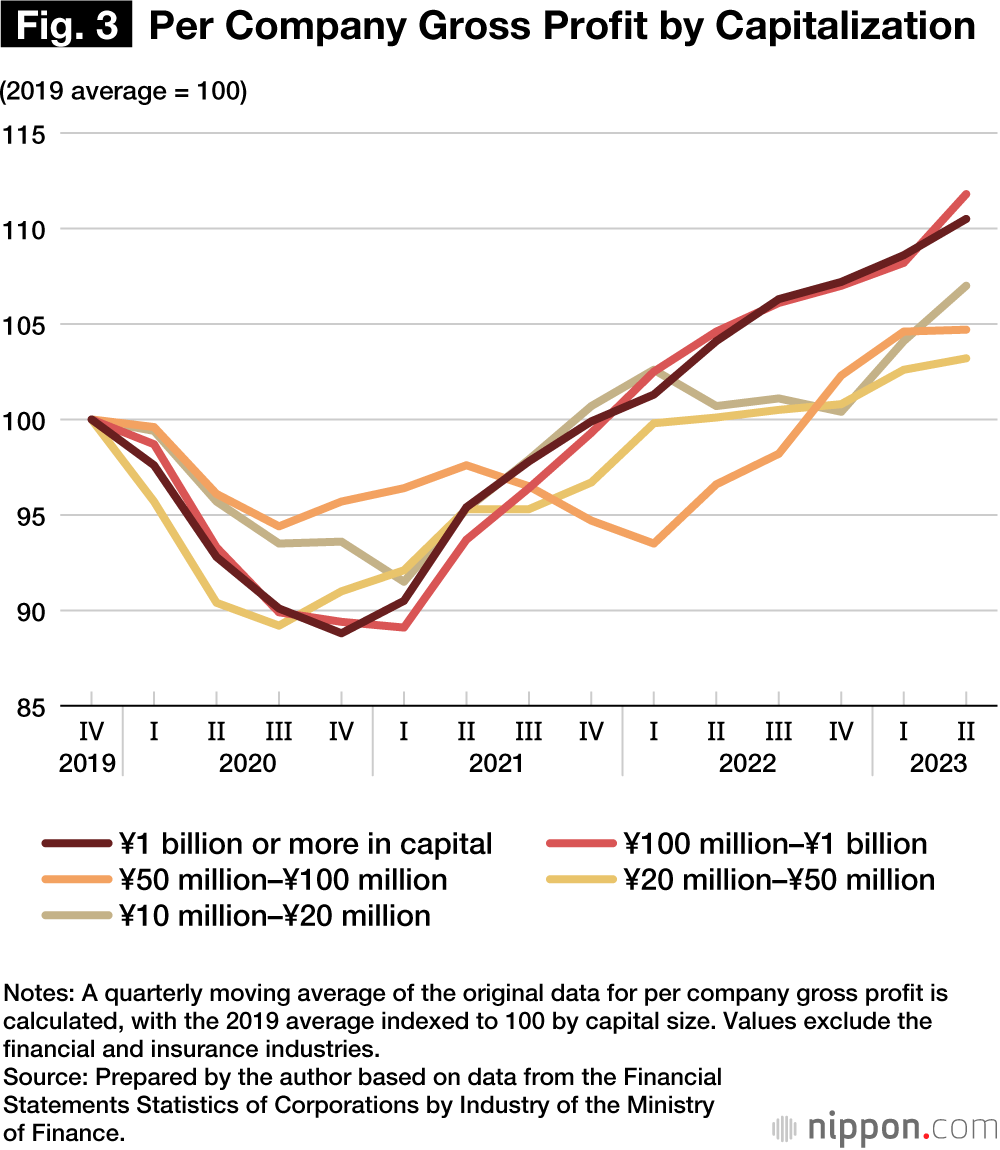

Meanwhile, in the Financial Statements Statistics of Corporations by Industry published by the Ministry of Finance, gross profit—measured as (total sales minus total cost of goods sold) divided by the number of companies in the statistical population—which indicates a company’s capacity to fund the labor costs of sales and general administration, has increased since the fourth quarter of 2022 even for small and medium-sized enterprises capitalized at less than ¥100 million (figure 3). Even as the cost of goods sold rises from the upsurge of energy prices and raw material costs, companies including small and medium-sized enterprises are recording higher sales through the pass-through of costs and the adjustment of product volume. While there are companies that are unable to pass through costs and whose gross profit is being squeezed, taking Japan as a whole, a growing number of smaller players have the capacity to fund the labor costs of sales and general administration with the increase of gross profit. This is thought to be one of the factors enabling the spread of wage increases even to small companies.

Are SMEs feeling the need to increase wages? In the Bank of Japan’s Tankan (Short-Term Economic Survey of Enterprises), the employment conditions DI (the percentage of firms seeing an excessive labor supply minus the percentage of those seeing insufficient labor) of small enterprises is –36 percentage points in the latest September survey. This exceeds the –34 percentage points of the September 2019 survey before the COVID-19 pandemic hit. Sentiment of insufficient employment conditions is foreseen to reach –40 percentage points going forward (the December 2023 survey), suggesting that there is a growing need to secure workers through higher wages.

The 2024 Shuntō Will Further Accelerate the Trend for Wage Increases

Finally, I will evaluate wages after the spring wage offensive of 2023 by comparing Japan with other nations.

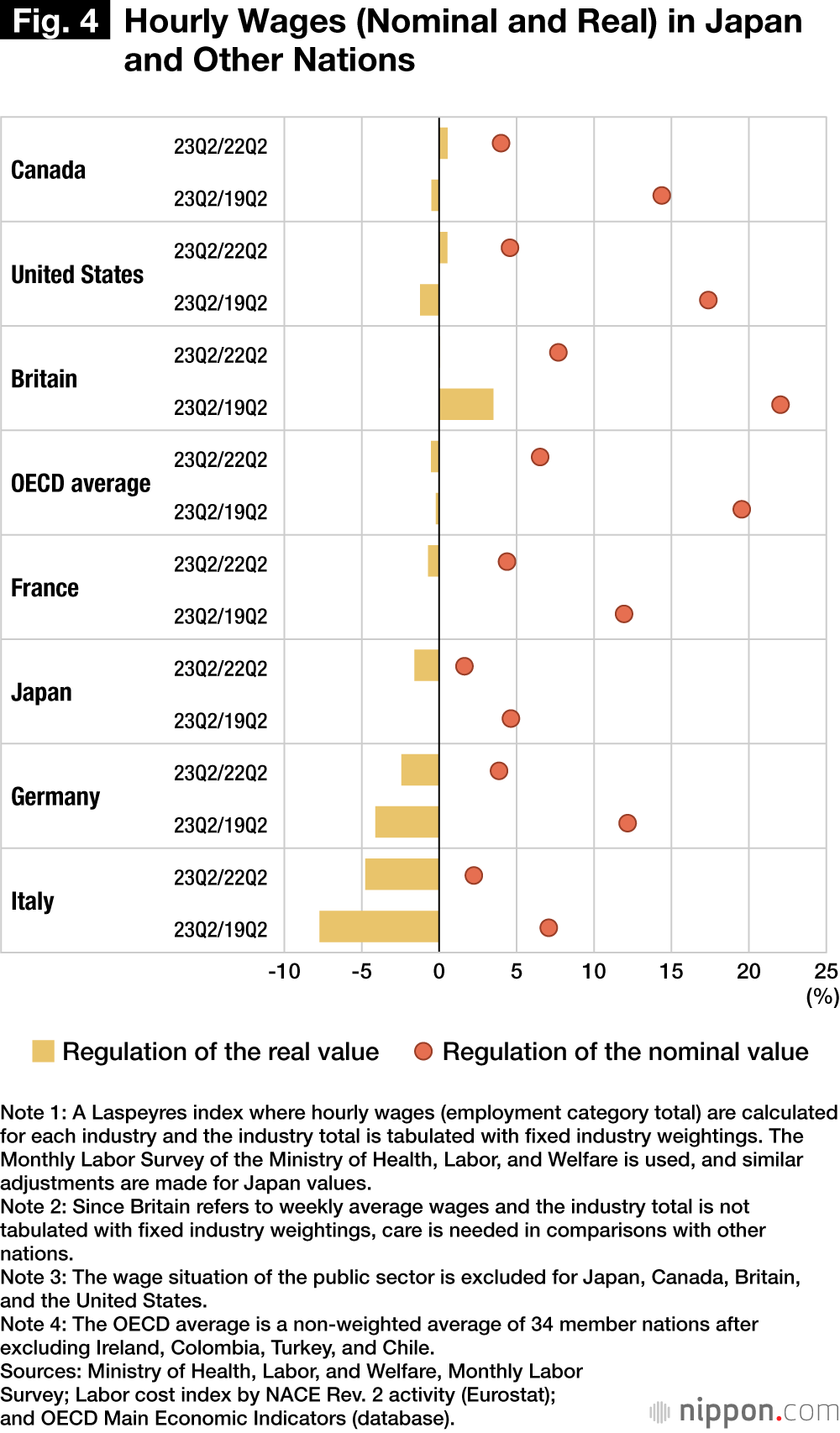

Figure 4 shows G7 and OECD averages for hourly wages (nominal and real values). The markers indicate the rate of change of nominal values and the bar graphs the rate of change of real values. At left for each country, the chart portrays the year-on-year rate of change between the second quarter of 2023 and the second quarter of 2022;on the right is the change between the second quarter of 2023 and the second quarter of 2019, before the pandemic hit.

In the year-on-year comparison, the rate of change of real wages is positive for Canada, the United States, and Britain, but negative for the OECD average (34 nations), France, Japan, Germany, and Italy. The real value of wages is continuing to decline in many nations. While the increase of nominal wages is small in Japan compared to other nations, the impact of surging consumer prices is also relatively small. As a result, the rate of decrease of real wages in Japan is smaller than that of Germany and Italy.

When the comparison is with the period before the COVID-19 pandemic, the distinctive features of wages in Japan noted above are even more pronounced. While the increase of nominal wages is small, since the influence of surging consumer prices is also relatively small, the rate of change of real wages is slightly positive in Japan. This rate of change is positive for only Britain and Japan; it is nearly zero for the OECD average and France, and it is negative for the United States, Germany, and Italy.

To summarize, while real hourly wages are decreasing in many nations, since the increase of nominal wages is small in Japan and since the price-hike impact is also relatively small, the reality of wage increases and surging prices are not readily perceived compared to other nations.

Compared to the prepandemic period, real hourly wages are slightly positive in Japan. Further efforts to increase wages will be important to make such increases a felt reality and to generate a virtuous economic circle through the stimulation of consumption expenditures. In the OECD’s Employment Outlook 2023, the growth rate of unit profits (operating surplus divided by real GDP) is greater than the growth rate of unit labor costs (employee compensation divided by real GDP) for Japan and many other nations. This indicates that companies have the capacity to absorb future wage increases with the growth of corporate profits. This article has noted that gross profit, which indicates the capacity to fund labor costs, has increased. The current profits of companies (seasonally adjusted) have reached a record high in the second quarter of 2023. While there are companies that are struggling to pass through costs, what will be important is to generate a virtuous economic circle by having the firms capable of doing so allocate their growing profits to workers. It is hoped that the shuntō of 2024 will further accelerate the trend for wage increases.

This article represents the views of the author and should not be taken as the official view of affiliated organizations. This translation omits part of the original article in Japanese.

(Originally published in Japanese. Banner photo: Prime Minister Kishida Fumio explaining the pillars of new economic policies on September 25, 2023, at the Prime Minister’s Office. The second pillar is the sustainable increase of wages. © Jiji.)