Buying US Steel: Nippon Steel’s Purchase Becomes Tariff Bargaining Chip

Economy Politics- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

No Choice but to Swallow the “Golden Share”

Nippon Steel’s acquisition of US Steel followed a long, rocky road due to resistance from the US government under President Joe Biden and the United Steelworkers union. The end of the Biden administration, however, did give negotiators in Japan a glimmer of hope due to incoming President Donald Trump’s desire to be seen as a deal maker and his willingness to change tack to achieve such deals. Therefore, the eventual consummation of the agreement under the Trump administration should not be too surprising.

Despite acquiring full ownership of US Steel, Nippon Steel’s control of the company will differ from other cases of “wholly owned” subsidiaries. This is due to the signing of a “national security agreement” with the Trump administration that granted the White House a noneconomic “golden share” and effective veto power over decisions at shareholders’ meetings affecting America’s national and strategic interests. The United States itself has traditionally been opposed to the use of golden shares as they undermine shareholders’ rights, but in this case accepting these provisions, among others, was essential for Nippon Steel to secure US government approval.

In response to concerns about the NSA’s provisions, Nippon Steel Chairman Hashimoto Eiji emphasized that the company would retain “sufficient managerial freedom” and that management would not “be constrained in pursuing anything we aim to.” Given the possibility that the presence of the golden share provision could affect share prices, Hashimoto had little choice but to make this assertion to ensure the deal made its way through his company’s general shareholders meeting.

Hashimoto Eiji, chairman and CEO of Nippon Steel, at a press conference on June 19, 2025, following the completion of the acquisition of US Steel. (© Jiji)

Nevertheless, without knowing the full details of the agreement and its provisions, it is difficult to evaluate the full extent that the US government can intervene in the management of US Steel and the risks associated with such intervention.

Certainly, Nippon Steel management’s freedom of action is restricted insofar as it must invest $11 billion of capital in the United States by 2028. We also know that Nippon Steel cannot downsize US Steel, close American factories, or scale down their operations without permission. As US Secretary of Commerce Howard Lutnick noted on social media, there is much more to the deal than the general details currently available to the public.

Between purchase costs and promised capital investments, Nippon Steel will dedicate approximately ¥3.5 trillion (around $25 billion) to the acquisition of US Steel, raising questions over whether it can fully recover this investment through business operations. As a top-tier management team, Nippon Steel’s executives must have carefully calculated the return on investment and conducted detailed analysis of growth potential based on conditions in the American market, US Steel’s customer base, and its competition. It must have judged that the long-term opportunities in both the automotive and shipbuilding industries justified the outlays.

Key Points of the Deal

- US Steel to become a wholly owned subsidiary of Nippon Steel

- Purchase price of ¥2 trillion ($14.1 billion)

- Completion of national security agreement with US government

- Noneconomic “golden share” with veto rights granted to US government

- Promised future capital investment of ¥1.5 trillion ($11 billion)

Compiled by Nippon.com based on various media reports.

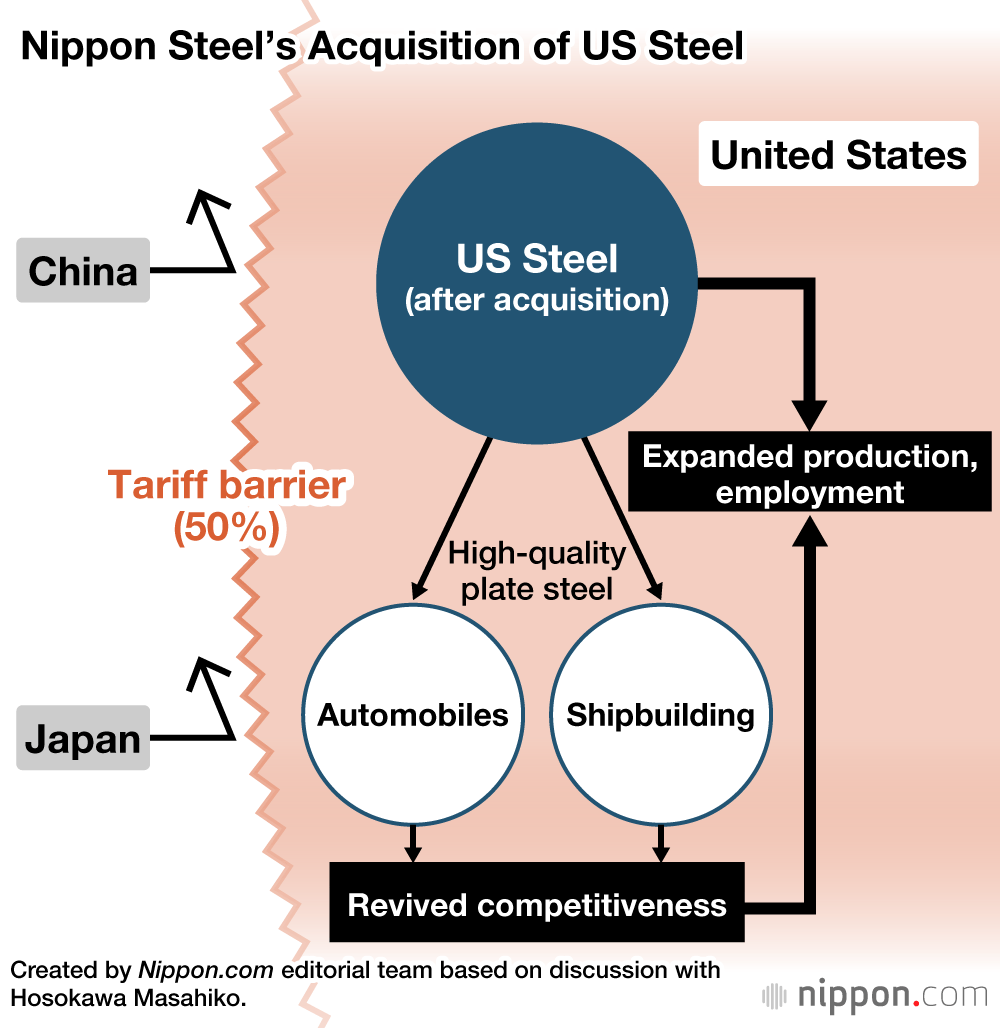

Nippon Steel persisted in its acquisition of US Steel despite the barriers placed in its way as it saw few other opportunities for growth on this side of the Pacific. Japan’s own domestic market has peaked, and the company has been completely excluded from the Chinese market. On the other hand, production in the United States is relatively protected from cheap foreign steel by high tariffs (50%), making it an attractive market for corporate investment.

From a management perspective, pursuing this deal was entirely rational. Even if US Steel fails to grow as anticipated, evaluating the outcome requires us to consider Nippon Steel’s prospects should the deal not have been made. The nature of high-level business decision-making is the evaluation of the relative risks and opportunity costs of any given action.

Addressing a US Lack of Access to Quality Steel

Nippon Steel’s acquisition of US Steel is likely to contribute to the revival of US production of steel and to downstream industries like automobiles and shipbuilding. The decreased competitiveness and quality of American steel is one factor in the long-term decline of both industries. The lack of high-quality premium steel sheets for automobiles and thick steel plates for shipbuilding at reasonable prices created a critical bottleneck that undermined domestic American industries dependent on steel.

Therefore, Nippon Steel’s promise of capital investment and the introduction of technology and engineering expertise into American industry could both improve product quality and enable production expansion in the United States. No matter how loudly President Trump insists on the revival of American manufacturing in automobile and shipbuilding industries, without sufficient quality and volume of domestically sourced steel, his ambitions would have remained ultimately unrealizable. Nippon Steel’s acquisition is therefore also a significant development for the United States and President Trump’s policies.

The acquisition and likely contribution to the revival of American manufacturing are an essential part of the big picture surrounding ongoing US-Japan trade negotiations. From Nippon Steel’s perspective, it must have been irritating to have the acquisition negotiations linked to US-Japan tariff negotiations. Indeed, the Ministry of Economy, Trade, and Industry actively sought to avoid this linkage. Nevertheless, the completion of the deal should give the Japanese side more confidence and a clear message.

However, even if the Japanese side presents a grand vision of how Nippon Steel will revitalize the American steel industry and downstream manufacturing, it would be naive to expect the recent agreement to immediately lead to success in tariff negotiations. Commerce Secretary Lutnick is known as a hardliner, and talks are taking place in an environment where the US administrative apparatus has lost considerable numbers of staff and operational capacity. Both of these are factors making it more difficult for the Japanese government to communicate its point of view. We should for the time being expect no sudden changes in the tariff negotiations being led by Minister of Economic Revitalization Akazawa Ryōsei. Tokyo will need to keep working to gain the understanding of the Trump administration and its political appointees.

An Evaporating Possibility of a General Agreement

While Akazawa’s American counterpart is nominally Secretary of the Treasury Scott Bessent, it appears that Lutnick is the point man for the United States in tariff negotiations with Japan. During the fifth round of negotiations in early June, Akazawa met with Lutnick for two hours on the first day, and then the next day he met Bessent for 45 minutes, followed by Lutnick again for a further two hours. This indicates that the issue of automobile tariffs was the focus of intense discussion.

Both Lutnick and Bessent look only to President Trump and are constantly mindful about his reaction. In mid-June, Akazawa appeared to have hopes for a general US-Japan agreement on tariffs ahead of the G7 summit in Canada. His comments at the time indicated that he had received a positive response from Lutnick about this possibility.

However, Trump’s response seems to have been quite different. In fact, Lutnick eventually did not accompany Trump to the G7 summit. High-stakes negotiations like this are never straightforward.

Negotiations at the ministerial level are likely to accelerate in the future. Japan must stay on message and emphasize its contribution to American manufacturing, employment, and productivity through its investments in the domestic steel industry and, in turn, the American automotive industry. Ideally, Japan’s contribution will be reflected in the reduction of tariffs on automobiles on Japanese makers, which appears to currently be the main battleground. The key message will be that Japan is partnering with the United States to help revive America’s own manufacturing industry.

(Originally published in Japanese on June 26, 2025, based on an interview by Mochida Jōji of Nippon.com. Banner photo: Nippon Steel Corporation headquarters. © AFP/Jiji.)