Sony’s Strategy for Taking On the GAFA Giants

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

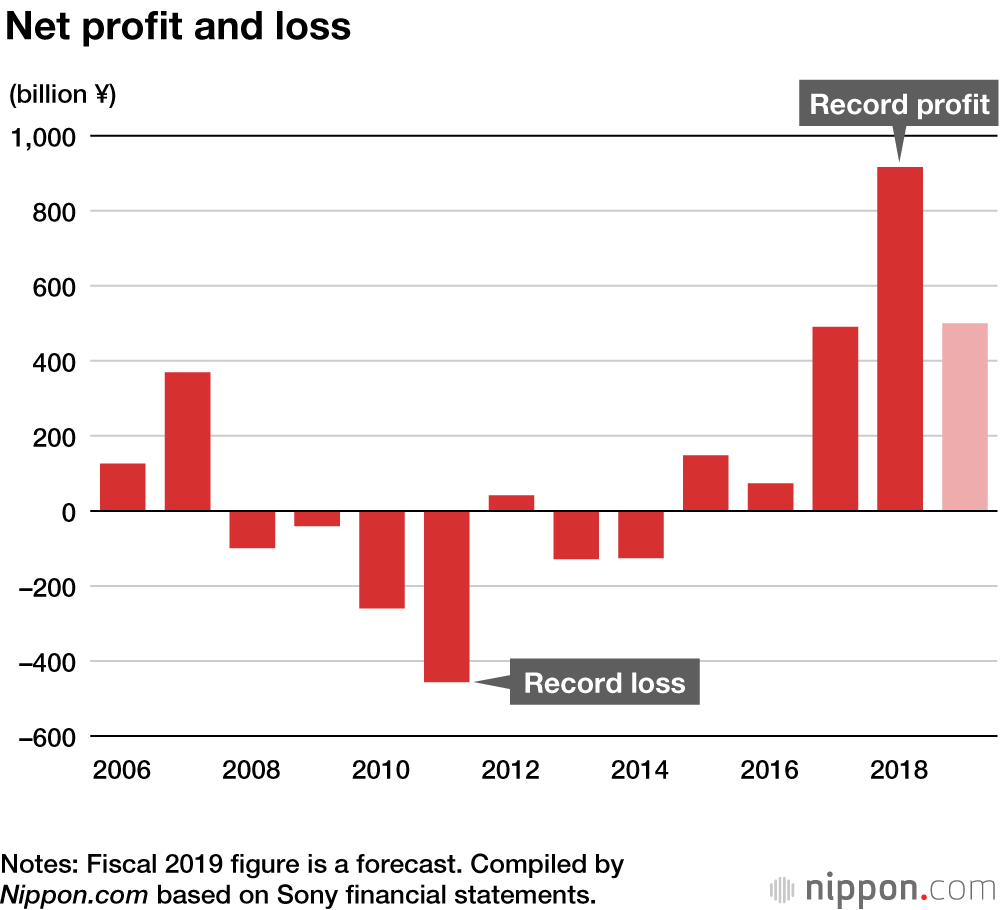

According to Sony’s consolidated financial statement released on April 26 for fiscal 2018, the year ended March 31, 2019, its pretax profit exceeded ¥1 trillion for the first time, and it posted a record high net income for the second consecutive year. This gave the impression that the company has fully recovered from the brutal slump it suffered at the beginning of the decade, despite the negative effects of the slowing Chinese economy. However, a fall in profit is forecast for fiscal 2019. The sustained growth of its game business, which has led the recovery, will soon be put to the test, with the announcements by Google and Apple of full-scale entry into this market, putting these giants hot on Sony’s tail.

Confidence in Profit from a Circular Business Model

At Sony’s financial results meeting, Senior Executive Vice President and CFO Totoki Hiroki proudly announced that the company had posted record high profit for the second consecutive year and is maintaining high profit levels. “I think that our ability to generate stable profit is the result of our efforts to increase the proportion of recurring revenue and strengthen our profit foundation,” he noted.

Starting in fiscal 2008, Sony suffered consolidated net losses for four consecutive years, including its worst on record in fiscal 2011, a loss of ¥456.6 billion. Hirai Kazuo, who was appointed company president that year, embarked upon corporate restructuring that included retrenchment of 15,000 staff in Japan and overseas. While Sony sold off its poorly performing PC business, in its television business, facing the onslaught of cheaper Asian rivals, it adopted a high added-value strategy, pursuing uniqueness over scale. Its emphasis on high resolution was well-accepted in Western markets, helping the business return to profit.

The company rebounded to profitability in fiscal 2017, posting its first positive figures in 20 years in operating income, which indicates the profit on the main business. Sony’s recovery has been led by its game and network services business, which has grown to produce over a quarter of the company’s consolidated profit.

The business has seen its sales almost triple from the fiscal 2011 level of ¥800 billion, becoming the largest business segment for the company in sales terms. This is not based just on the sale of products, but includes distribution of online content, with the successful construction of a business model that earns profits from monthly subscriptions. Its PlayStation Now streaming game service, launched in 2014, has seen subscribers increase by some 40% annually; they currently number around 700,000.

While PlayStation 4 console sales decreased in fiscal 2018, the company achieved income and profit increases from growth in game software and network services. Sales from these game and network service areas, together with the music and movies businesses, which also support recurring income, are heading toward a total of 50% of Sony’s total sales.

The GAFA Powers Strike Back

According to research company IHS Markit, worldwide consumer expenditure on video games, such as PlayStation 4, Nintendo Switch, and Microsoft’s Xbox One, totaled $47 billion (approximately ¥5 trillion) in 2018, up 12% from the previous year. Steve Bailey, principal senior games analyst for IHS Markit, believes that further growth, centered on games and network services, can be expected in 2019.

While this would appear to provide ideal business conditions for Sony, it is unclear how long they will last. GAFA—the American giants of tech, Google, Apple, Facebook, and Amazon—have started making their own moves in the sector. In late March, Google announced a new service called Stadia, to launch in 2019, that will stream high definition games for tablets and smartphones. Less than a week later, Apple announced the fall launch of Apple Arcade, a subscription-based game streaming service. The selling point for both is the move away from hardware, with no requirement to buy a pricey dedicated device.

CFO Totoki explains that he is not surprised at this development. “As the opportunities of the segment become more widely known, it’s natural that various other players will enter the market. We need to transform threat into opportunity.” His confidence springs from the strong position that Sony enjoys as a pioneer in the market for fixed-fee game streaming services, and one that now offers unmatched content in 19 markets around the world.

However, he is not complacent about the market changes. The operating profit for the company’s game and network services business in fiscal 2019 is forecast to fall by around ¥30 billion compared with the previous year. At the company’s results briefing, Totoki explained that the majority of this is the costs for development of the next generation model, revealing that Sony is accelerating development of the rumored PlayStation 5. In addition, the company is developing the cloud technology that forms the base for its game streaming service, adopting the bold strategy of partnering with its long-standing console rival Microsoft.

It is essential for Sony to have both ample content and appealing hardware in order to grow the recurring sales it aims for. Can the next-generation model of a product already on the market for 20 years really offer value that outstrips rival units like the Switch and Xbox, along with the new services from Google and Apple? Now that game and network services have grown to become a key business for Sony, this will be an important test.

Emphasis on Cash Generation

Attending the company’s management policy briefing in May 2018 for the first time as CEO, Yoshida Ken’ichirō revealed his intention to promote a management policy focused on cash generation through business activities. “We will focus on improving profit quality above profit growth. Our most important management indicator must be operating cash flow.” In its medium-term management plan, the company aims to generate an operating cash flow of over ¥2.2 trillion cumulatively by the end of March 2021, excluding the financial segment.

However, image sensors, which along with games played a key role in the company’s revival, may become a drag on further growth. Applications of this tech have expanded with growing demand for smartphone cameras, but the smartphone market has reached maturity and is starting to decline. Thanks to its development of larger sensors to provide multilens, higher-quality cameras for smartphones, Sony was able to avoid an abrupt fall in demand for its high-performance offerings, but the company must speed up efforts to capture new demand in future growth fields, such as automated driving.

It will need to invest substantial funds to achieve this. Yoshida announced that, of the ¥2 trillion of operating cash flow, fully half would be directed toward capital investment, focused on image sensors. He explained that the second half would provide resources for strategic investment, including mergers and acquisitions to gain the technology required to bolster Sony’s content, which underpins its recurring income, and to boost the competitiveness of its image sensors. The question is how to generate this cash.

Electronics Play a Supporting Role

Sony’s medium-term management plan positions electronics, once the company’s star player, as the “cash cow” that will generate the most stable operating cash flow during its three years. This is a business that can produce profit without requiring large-scale investment, even in a mature market with little room for growth. Key to this are televisions, which can provide profit without requiring the company to pursue scale, and digital cameras, which enjoy profitability despite the overall shrinking market, thanks to Sony’s pioneering of top-grade mirrorless technology.

In fact, of the net value of cash flow for fiscal 2018, excluding cash outflow due to investment, electronic products and solutions, incorporating televisions, digital cameras and smartphones, is second after games and network services. At a time when image sensors require massive capital investment in R&D and upgrades to facilities, and with games and music requiring ongoing investment to secure content, electronics are playing an increasingly vital role to secure income for Sony.

Even if the company can turn a profit in the still-loss-making smartphone business, though, it is unclear whether electronics can produce stable earnings after the current medium-term business plan ends in March 2021.

Televisions, digital cameras, and smartphones are all considered mature markets, and profit growth will rely on development of ground-breaking products, such as Apple’s iPhone. In other words, the company’s continues to pay serious attention to the smartphone business due to its potential to produce just such breakthroughs. In the past, the electronics division has defined Sony, which launched era-defining products like the Trinitron television in 1968 and the Walkman in 1979. Revival of the division holds the key to achieving sustained growth.

A Warning from the Founder

In his opening remarks as CEO at the management strategy briefing, Yoshida shared an anecdote about Sony’s founder Morita Akio. “In September 1993, two months before he suffered cerebral apoplexy, I had the opportunity to talk with Morita in person. He told me that Sony had learned many things from the United States in the past, but that the time had come to humbly do so once more.” The next year, Amazon was founded. In 1997, Sony posted a record-high profit, but its failure to respond to the advent of online companies would have a devastating impact on the business.

One year has passed since this speech emphasizing the need for a management approach featuring both alertness to danger and humility, along with a long-term perspective. Having achieved two consecutive years of record profits, Yoshida must certainly be paying all the more heed to Morita’s words of warning.

(Originally published in Japanese. Banner photo: Sony CEO Yoshida Ken’ichirō at the management policy briefing in Tokyo on May 21, 2019. © Jiji.)