Addressing the Policy Issues Raised by GAFA and Other Large Tech Firms

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Innovation and Competition

In recent years, many government institutions and think tanks have actively examined ways to regulate large IT companies. Based on the Japanese government’s Future Investment Strategy 2018, a working group of the Ministry of Economy, Trade, and Industry, the Japan Fair Trade Commission, and the Ministry of Internal Affairs and Communications published in December 2018 basic principles for establishing rules responding to the appearance of platform businesses. Moreover, at the G20 Osaka Summit in June 2019, international rules for the free flow of digital data became the subject of discussion.

I will begin by summarizing the technological and industrial characteristics of large IT companies. The first characteristic of platform businesses as represented by GAFA is the successive appearance and rapid advancement of complementary technologies like semiconductors, communications networks, and artificial intelligence. A second characteristic is the way patents and other intellectual property are less certain to provide market advantages as compound linkages strengthen between complementary technologies. Third is a “two-sided market”—a market structure where the platform connects customer groups and suppliers affiliated with different markets.

In two-sided markets, user utility increases with the size of the network. This is known as a network effect. Two-sided markets also exhibit powerful economies of scale, where the additional cost of providing a service becomes extremely small. For this reason, many services are provided for free. With economies of scale operating on both the demand and supply sides, two-sided markets encourage platforms to accumulate large quantities of data, human resources, and technology. In this manner, the market dominance of GAFA and other large IT companies operating platforms increases further.

With digital platforms, the research and development of complementary technologies and the development of associated products and services proceed in parallel. Thus, the key to success is engaging continuously in the development of new functions and services. The competition that occurs between platform businesses is not competition in the market, like price competition, but competition for the market, where being the first to offer new products and services takes priority.

Furthermore, platforms can be viewed as engaging in competition for attention, seeking to attract users through free services and large-scale advertising, as well as frame competition, meaning effort to influence the frame of consumer preferences and decision making using the insights of psychology and behavioral economics.

In this manner, platforms are competing fiercely around the axis of innovation. This aspect should be viewed in a positive light. On the other hand, network effects and economies of scale promote the concentration of data in platforms, and their influence is extending to the behavior and thinking of individuals. Attention needs to be paid not just to the economic dominance of platform businesses but to their growing political and social clout.

A Growing Income Divide and Tax Avoidance

Depending on how these reciprocal functions and mechanisms are viewed, the approaches taken toward appropriate competition and regulatory policies will differ. Thus, bearing in mind the perspective of pluralistic dominance, I will lay out the policy issues raised by platform businesses. They can be expressed in the form of the following three trade-offs.

The first trade-off is between higher productivity enabled by the technological advances of platforms and greater discontent over income distribution. For example, automation allowed by robots and AI will decrease the number of tasks where human labor has the advantage, and the substitution of capital for such labor will reduce the wages of workers. Thus, with the spread of AI-based automation technology, labor’s share of national income will decline as long as there is no increase in high-wage employment opportunities.

The first trade-off raises serious issues with a social dimension. For example, an increase in nonregular employees, such as gig workers like Uber drivers, can be anticipated. Legal protections are far from adequate for gig workers, who are regarded as independent contractors under the law. In Japan, they are not considered to be workers in the Labor Standards Act, and they are not adequately vested with the right to organize or the right to collective bargaining conferred to workers by the Labor Union Act. To maintain competitiveness, many large IT companies require employees to sign agreements with restrictive terms, such as no-poaching clauses and noncompete clauses that prohibit working in side jobs or leaving to work for competitor companies. There is a strong need for policy adjustments to eliminate the void between labor law and competition law.

The second trade-off is between the promotion of innovation through the concentration of data, technology, and human resources and the increased risk that R&D and services will become less diverse. Large IT companies invest massively in R&D, and they actively acquire start-ups and other companies with the potential to become future rivals. Such measures further extend the concentration of data, technology, and human resources.

Whether the concentration of innovation is desirable for society as a whole will need to be decided on a case-by-case basis. For example, is it reasonable to expect that the concentration of data, technology, and human resources will expand high-wage employment opportunities and will promote technological changes that boost labor productivity? This is a question that deserves careful examination. The issue we need to address is how to use competition and innovation policies to maintain an environment where diverse R&D projects are executed.

The second trade-off is also associated with the issue of the international taxation of large IT companies. When data, human resources, and technology concentrate in Internet-based platforms, it becomes easy to transfer profits to countries with low tax rates. Large tech firms providing services without a physical presence can legally avoid taxes by establishing a legal presence in economies with low tax rates (tax havens). Such tax avoidance is generating concerns about whether it distorts a fair and impartial market environment and whether it fosters discontent over income distribution.

The Organization for Economic Cooperation and Development and the G20 labeled such tax avoidance BEPS, or base erosion and profit shifting, in 2013 and have established a project to revise tax rules to restrain BEPS by 2020. The OECD published a roadmap in March 2019 and a progress report in June 2019. However, given the complex ways the interests of large IT companies and national governments are entangled, we are still at the stage where further discussion is required.

Privacy Protection

The third trade-off is between the improvement of the quality of services presented by platforms through the concentration of data and heightened risks for privacy protection and security protection. The accumulation of personal data by platforms can be expected to enhance the speed and precision of searches and improve recommendation and matching features for users.

It should also be noted that the concentration of personal data becomes an attractive target for cyber attacks and that it raises the risk of data breaches. Innovation that promotes the management and use of distributed data will be needed. Data portability, enabling the free transfer of the information concentrated in platforms and interoperability between platform interfaces, will also be required. Moreover, measures to secure transparent and impartial procedures should be steadily implemented. What is desired is competition in services and technology that protects privacy and provides security so users can choose among a broad range of services.

Depending on circumstances, a monopolistic market can still become a contestable market. What is needed for this to happen is a market that smoothly distributes essential, bottleneck resources (such as data and technology) to make entering the market as easy as possible. Doing so will reduce the huge investments in fixed capital that can impede new entrants and will lower barriers to entry.

The issue for platform business policies concerns how to control the strength of large IT companies, with their growing social and economic monopoly power, without sacrificing the driving force for innovation. The range of laws providing the basis for control should begin with competition and extend widely to include labor issues, personal data protection, and international taxation rules. GAFA, who were once challengers making pivotal innovations, are now becoming immensely powerful monopolists.

In this process, we must avoid forestalling the appearance of outstanding future challengers through collective egoism. The market and social dominance being acquired by GAFA should not become vested interests. As large IT companies begin to broadly influence social values, what needs protecting are a fair and transparent society, a forum for speech that guards personal information and guarantees liberal values, and a market economy that maintains free and fair competition.

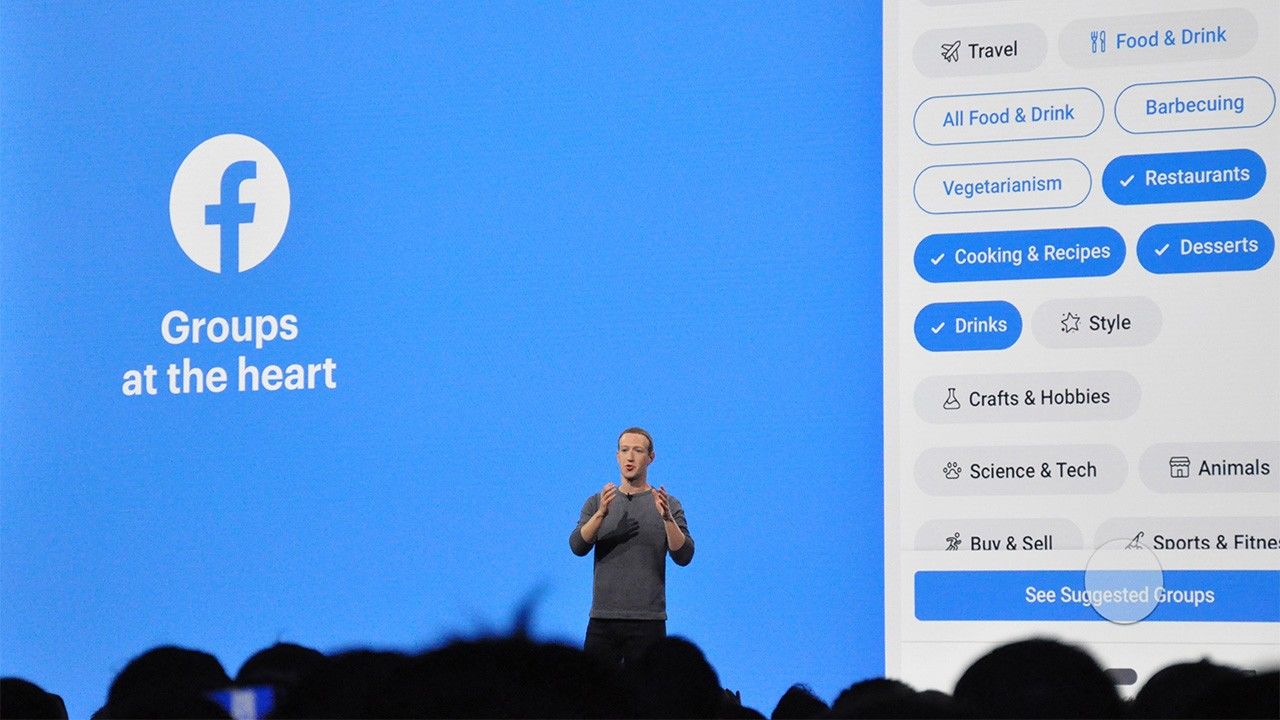

(Originally published in Japanese on July 22, 2019. Banner photo: Facebook CEO Mark Zuckerberg explains the company’s management policies. © Jiji.)