Japan’s Supply Chains at Risk: Preparing for a Taiwan Contingency

Economy Politics- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

The risk of an attack on Taiwan by China is mounting. Such a conflict, were it to occur, would severely disrupt trade with both countries. Given Japanese manufacturers’ heavy dependence on materials and parts from China and semiconductors from Taiwan, the economic impact on this country could be immense.

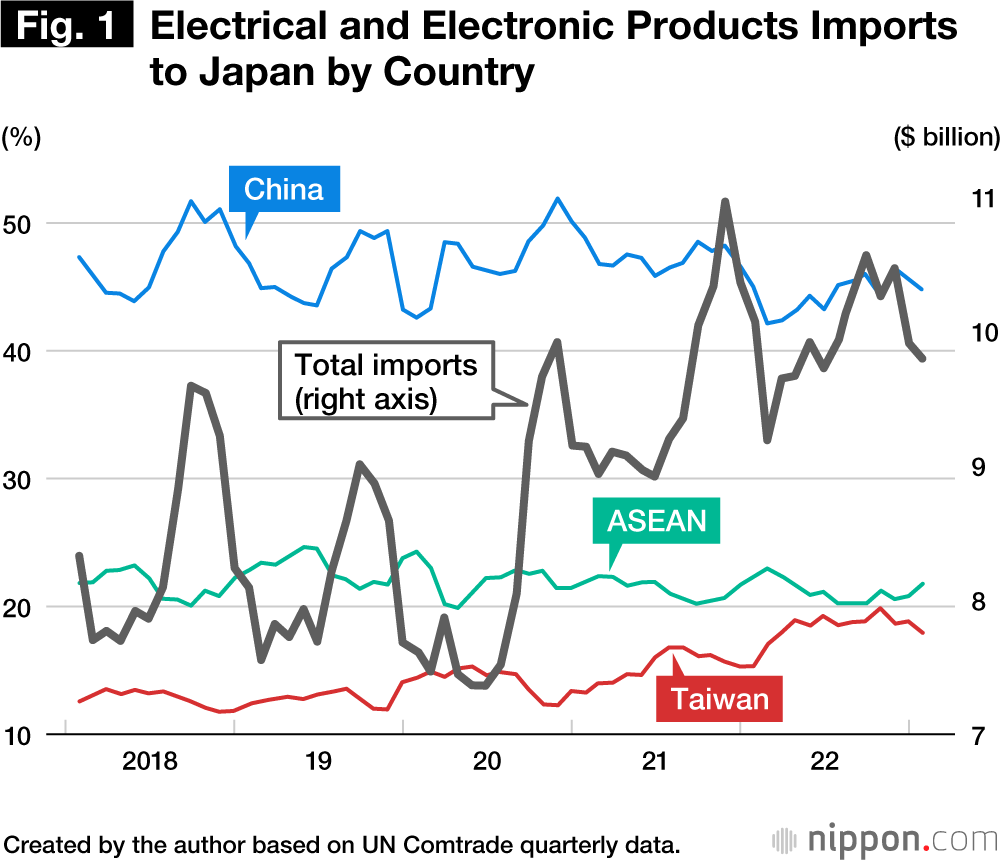

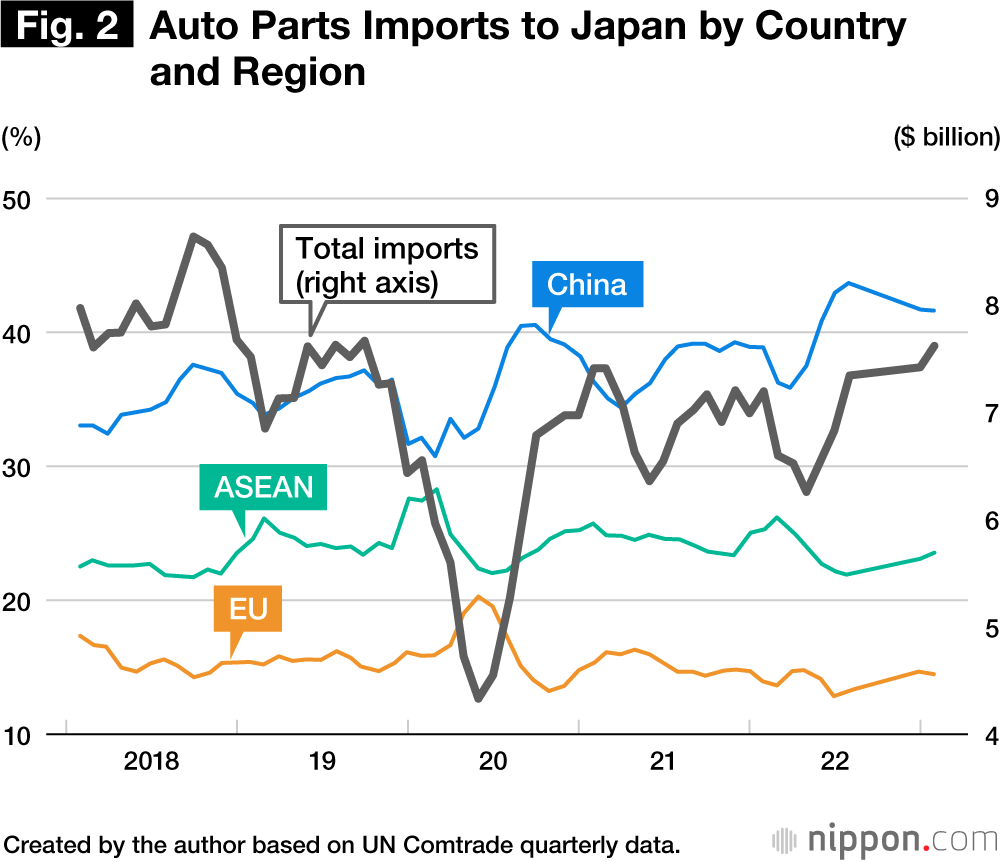

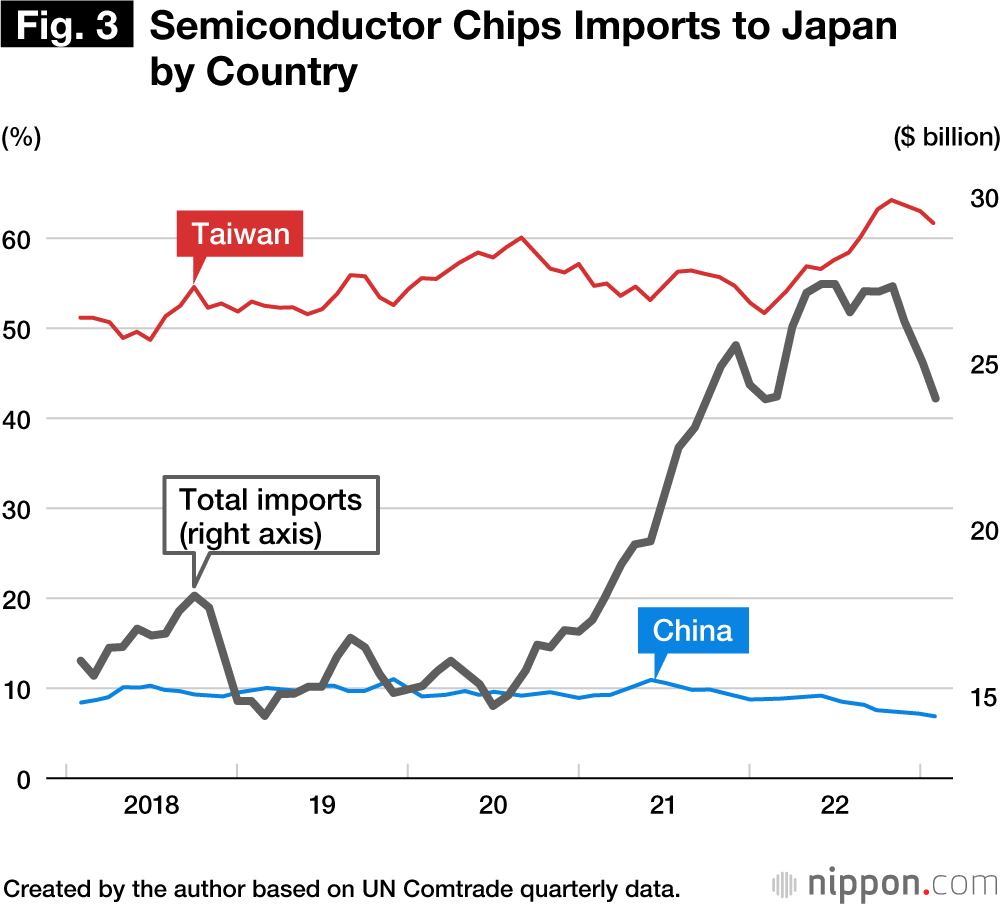

China currently supplies about 45% of Japan’s total imports of electrical and electronic products by value (Figure 1). Although this is down a bit from the peak of more than 50%, it is still a very high rate of dependence. China’s share of our auto parts imports has risen over the past five years, surpassing 40% at present (Figure 2). Taiwan accounts for more than 60% of Japan’s imports of semiconductor chips, and that share, too, has been climbing (Figure 3).

A Ten-Fold Impact on Production

With China and Taiwan occupying such a critical place in the supply chains of key Japanese industries, the economic impact of a disruption in imports from those countries would go far beyond the value of the imports themselves. The shortage of materials and parts would hinder production downstream, and the shock would be amplified as it propagated through Japan’s supply chains.

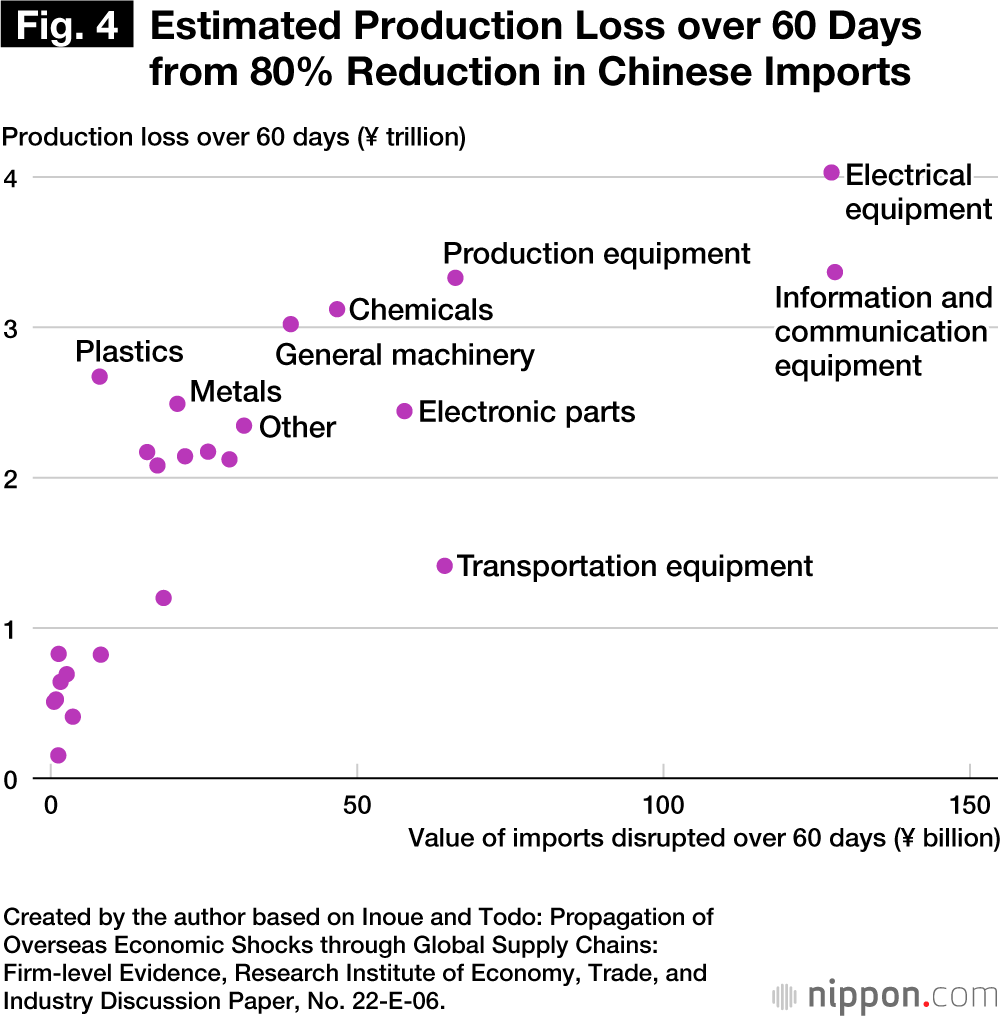

Using data on more than 4 million transactions by over 1 million companies, Professor Inoue Hiroyasu of the University of Hyōgo and the author simulated the economic effect of a disruption of imports from China under certain assumptions. The results suggest that an 80% drop in Chinese imports over a two-month period, amounting to a ¥1.4 trillion reduction, would cause Japan’s two-month value-added production to plunge by approximately ¥13 trillion, or about 15%. In other words, such a cut in imports would have roughly a 10-fold impact on domestic value-added production.

We also calculated the effect of that disruption on specific manufacturing industries. Our results, charted in Figure 4, indicate particularly severe losses for makers of electrical machinery and equipment (such as household appliances, consumer electronics, and industrial equipment) and producers of information and communications equipment (such as computers and cellphones).

In the categories of business-oriented machinery, plastic products, and fabricated metal products, the value of the imports cut off is much smaller, but the overall drop in production is quite large nonetheless. The reason is that, in these industries, the imported materials and parts tend to be used farther upstream in Japan’s domestic supply chains, and the effect is magnified as the shock propagates downstream.

We were unable to perform a similar analysis for imports from Taiwan owing to data constraints, but given the upstream position of Taiwan’s semiconductors in Japan’s domestic supply chains, there can be no doubt that a disruption in supply would be a huge blow to the economy.

Benefits and Limits of Onshoring

To mitigate the economic risks of a Taiwan contingency, Japan needs to reduce its dependence on Chinese and Taiwanese imports.

One way to go about this is “onshoring” (or “reshoring”)—that is, relocating offshore production bases to Japan. To this end, the government has embarked on a number of policies aimed at expanding domestic production of semiconductor chips. By offering generous subsidies and other incentives, it has persuaded global chip maker Taiwan Semiconductor Manufacturing Co. (TSMC) to build a new plant in Kumamoto Prefecture in Kyūshū. It has also provided funding to support development and production of next-generation chips by a new Japanese joint venture, Rapidus. In addition, many Japanese corporations are taking their own steps to boost domestic production with the aim of reducing their “China risk.”

There is something to be said for such onshoring initiatives from the standpoint of injecting resilience and vitality into the domestic economy. The Kumamoto TSMC plant has already begun drawing other semiconductor-related businesses to Kyūshū. Government subsidies and other measures to attract foreign manufacturers can be well worth the cost if domestic firms cluster around it and gain access to advanced technologies as a result.

That said, policy makers and business managers alike need to understand the limits of onshoring. Japanese corporations’ shift toward offshore production was driven by the need to maximize production efficiency. Reshoring must be approached judiciously, or it will compromise efficiency and undermine our manufacturers’ international competitiveness.

Let us remember as well that industrial policy—the use of government subsidies and other supports to foster targeted industries—is not always successful. Research has shown that even in China, which has a relatively good track record on industrial policy, a positive effect on productivity has been seen primarily in cases where intra-industry competition was maintained. The Japanese government’s efforts to nurture the domestic semiconductor industry can only bear fruit if it avoids the trap of protectionism and remains attuned to competition in the international marketplace.

Another point to bear in mind is that domestic supply chains are by no means immune to disruption. Japan is prone to natural disasters, and scientists say there is a high probability of a Nankai megathrust earthquake, a large-scale Tokyo earthquake, a violent eruption of Mount Fuji, or some other cataclysm in the not-too-distant future. Any of these could deal a massive blow to some of Japan’s major manufacturing centers. Excessive concentration of production bases within Japan poses a major risk in itself.

Risk Management Through Friendshoring

Given these considerations, our strategy for limiting the risk of supply-chain disruptions should focus not just on reshoring and onshoring but also—and perhaps more importantly—on “friendshoring.” This involves reducing our dependence on China by diversifying our supply chains with an emphasis on friendly countries with a low security risk. A greater diversity of production bases and suppliers would mitigate the shock of a Taiwan contingency by making it relatively easy to find replacements for the imports affected by the disruption.

Of course, for businesses, developing new production facilities and sourcing supplies from multiple countries can be a costly proposition. However, in view of the growing risks of overdependence on China, it seems to me that most companies would be well advised—even from their own cost-benefit standpoint—to adopt a “China plus one” strategy, securing at least one other supply source in addition to China.

As a matter of policy, the Japanese government needs to beef up support for friendshoring as well as onshoring. It already offers subsidies aimed at expanding production in Southeast Asia. In addition, the Japan External Trade Organization, the Organization for Small and Medium Enterprises and Regional Innovation, and local governments provide information for domestic companies seeking to produce or source merchandise abroad, including assistance matching them to overseas business partners. Evidence for the efficacy of business matchmaking is particularly strong, and one looks forward to the expansion of such programs.

But such support would be far more efficient if carried out as part of an international partnership. One approach might be to build global business matchmaking platforms in collaboration with the relevant agencies in other countries, making use of such frameworks as the Group of Seven, the Indo-Pacific Economic Framework for Prosperity, and the Japan-India-Australia Supply Chain Resilience Initiative.

Intellectual Friendshoring

Another important way of enhancing supply-chain resilience is by stepping up collaboration on research and development with like-minded countries—what one might call “intellectual friendshoring.”

In such high-tech industries as information and communications, the United States and its allies are attempting to stem the flow not only of goods but also of technology to China. A process of technological decoupling is underway.

On its own, Japan has little chance of countering China’s drive for technological dominance. It is essential that we step up joint research with such like-minded international partners as the United States, Europe, and Australia. There is ample evidence from empirical studies—my own included—that international joint research spurs innovation. Unfortunately, Japan has not done all it could over the years to promote such projects.

By boosting its technological capacity through innovation, Japan can enhance its international position as a country others rely on and build more robust supply chains. With sufficient technological know-how and resources, we can even develop our own replacements in the event that supplies of imported materials or parts are cut off.

Recently the Japanese government has taken significant steps in this direction. It has begun actively promoting joint research with Taiwan, South Korea, and the United States by persuading TSMC and Samsung Electronics to build new R&D centers in Japan and by establishing the Leading-edge Semiconductor Technology Center as a research platform for the development of next-generation semiconductors.

But policy support for international joint research will only have the desired effect if it avoids the pitfalls of protectionism. This means promoting participation by diverse businesses and incorporating mechanisms to ensure open competition. At the same time, the government should extend such support to a greater variety of industries instead of limiting it to semiconductors.

Balancing Economic and Security Needs

In the foregoing, I have called for reducing Japan’s supply-chain dependence on China in light of the economic risks of an attack on Taiwan. As part of that strategy, I have stressed the need for friendshoring and increased R&D cooperation with like-minded countries (intellectual friendshoring).

That said, there is no doubt that Japan benefits immeasurably from its economic relations with China. Furthermore, research supports the idea that armed conflict is less likely among countries that maintain some level of economic interdependence. For these reasons, it would be unwise to radically curtail Japan’s trade and investment ties with China. As a final caveat, I would stress the need for judicious policies that balance the economic and security interests of our nation.

(Originally published in Japanese. Banner photo: Kumamoto Mayor Ōnishi Kazufumi, second from right, and Kumamoto Prefecture Governor Kabashima Ikuo, third from right, pose with executives of Taiwan Semiconductor Manufacturing Co. at the global chip giant’s headquarters in Hsinchu, Taiwan, January 12, 2023. © Jiji.)