When Asset Bubbles Deflate: Will China Repeat the Japanese Experience?

World Economy Politics- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Keeping Bubbles Afloat: Not Necessarily the Best Idea

In the early 1990s, Japan tightened monetary policy forcefully to eliminate a real estate bubble. This tightening, however, went too far and triggered the bubble’s collapse.

China’s unprecedented property recession has been sparked by the Chinese government beginning to tighten monetary policy vigorously for the real estate sector in the summer of 2020. While China’s hasty tightening inviting a serious policy recession has similarities with Japan, though, differences also exist.

In Japan, the decline of asset prices became fully apparent, as they tumbled to one-fourth of their former value over a period of 10 years. A succession of companies went bankrupt as they defaulted on their debts or became insolvent.

In contrast, the decline of asset prices is still not widely recognized in China. Official statistics disclose that real estate prices fell about 10% in 2021 and have since recovered. There is no evidence of asset prices decreasing significantly.

At the same time, however, the demand for housing and the supply of new housing have fallen substantially. Housing sales have slumped 46% and the floor space of housing starts has plunged 60% over the two years ending in July 2023.

While companies experiencing cash flow shortfalls might seem at risk of failure, China has an economic practice of implicit government guarantees. In other words, companies deemed important are offered government help in the form of loans so they can meet interest payments or refinance principal amounts. As a result, companies in financial difficulties seldom fail.

Thanks to the government’s forceful interventions, the decrease of asset prices has not materialized in China, and companies are not going bankrupt. This may seem to be a positive development since it appears to be preventing the collapse of an asset bubble. This situation, however, can be likened to a person who has mistakenly eaten some spoiled food (deteriorated assets). By retaining this poison in the body without expelling it, health can be compromised in other ways.

Excess Investments Take a Toll

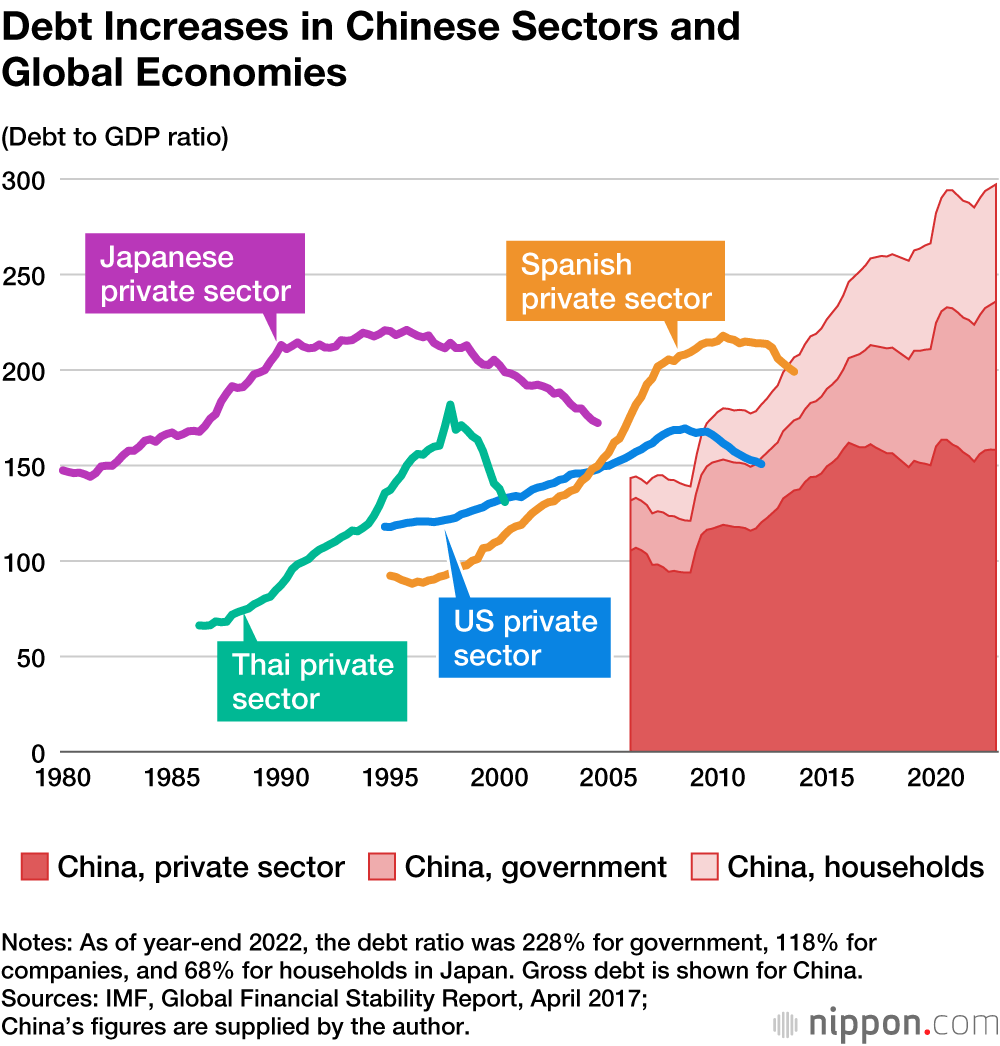

Over the last 10 years or so, the debt to GDP ratio has increased for Chinese companies, government, and households.

The figure presents the trends for corporate, household, and public debt in China. The chart also shows the trends for several other nations that experienced asset bubbles.

When second-rate investments accumulate, such as seen in real estate bubbles or in infrastructure with few users and limited economic effects, repaying debt will take time. Since the speed by which debt increases will exceed the rate of economic growth, the debt to GDP ratio will naturally rise. The graph of this ratio will turn downward once the asset bubble collapses, or when debt is redeemed in advance and debt claims are written down.

Companies in China have made excessive investments in real estate and in many other industrial sectors. The government sector, led by local administrations, has made excessive infrastructure investments to boost the economic growth rate year after year. The debt of households has also increased in the form of real estate loans.

The whole of China has invested in excess, which is evidenced by investments contributing more than 40% to annual economic growth. Despite the accumulation of debt, China has been able to avoid the collapse of an asset bubble through the government’s forceful economic interventions. Implicit government guarantees are stopping companies from going under.

Big Payouts for Poor Performance

I have stated above that even if an asset bubble does not collapse, the economy will be harmed in other ways. What are these ways?

The poison of a real estate bubble is easy to understand. By taking on unreasonable and expensive housing loans, households will see their finances squeezed by interest and principal payments, and consumption will decrease. The real estate sector’s debt burden and interest costs arising from its borrowings will naturally also rise.

The poison of the excess investments of companies stems from the condition where debt-financed investments yield no returns, generating only interest costs. This can be likened to paying an underperforming employee a large salary. Should the number of such employees grow, a company’s business foundations will deteriorate. Should China as a whole invest heavily in unproductive projects, thereby expanding its debt level and its debt service cost, a lower economic growth rate will be unavoidable.

Using public statistics I have estimated the unnecessary cost placed on China’s economy though the inefficient investments made year after year by companies, the government, and households at an annual 3.8 trillion yuan, about 3% of GDP. This estimate concerns only interest payments and sets aside the repayment of principal. China’s value-added tax (similar to Japan’s consumption tax), which is China’s largest tax category, raises 6 trillion yuan annually, and China’s public pension payments total 5 trillion yuan annually. Clearly, the unnecessary cost of inefficient investments is no small figure.

For nations where the market mechanism functions properly, any asset bubble would burst before such a level of irrationality arises, and major surgery would be performed through company bankruptcies and the write-down of debt claims. This purification process, however, cannot take place in China when the government prevents the decrease of real estate prices and when implicit government guarantees prevent companies from going under.

While the remark is often heard that China’s economy is becoming more like Japan’s, the discussion above should make clear that there are also major differences. The deterioration of China’s balance sheet is proceeding in a manner that would not occur in other nations.

The Poison Harming China

China is harmed in two ways when returns for inefficient investments (interest cost of credit received) amounts to fully 3% of GDP and does not contribute to economic growth.

The first is the unreasonable transfer of wealth; the second is the decrease of economic efficiency due to the massive funding of wasteful investments, resulting in lower economic growth.

Interest corresponding to 3% of GDP first accumulates at financial institutions controlled by state capital and is finally paid as interest to the wealthy class who have deposited huge sums of money at these financial institutions. The Xi administration’s common prosperity policy is actually fattening the government sector and is widening the wealth gap.

As a result, the greatest concern for China is the possibility that it will fall into the middle income trap.

If economic growth is to be maintained, impaired sectors with low productivity will need to be restructured and downsized. Since private enterprises are the entities with high productivity in China, the key issue will be how to further their growth. What is occurring, however, is the opposite, the unfair transfer of wealth.

All of China’s ills derive from the economic interventions of the Chinese government. These interventions may stave off the decrease of asset prices and the bankruptcy of companies, which may seem to be a positive development, but they are actually harming the economy through the unfair transfer of wealth and reduced efficiency.

What Should China Do?

The short-term issue for China is how to address lower economic growth ensuing from the sharp falloff of demand.

According to Richard Koo’s balance sheet recession theory, which has attracted considerable interest in China, the government should cover the demand shortfall without being concerned about the resulting budget deficit. The central government should take the place of regional governments—now in crisis from excess debt and the slump of land revenue, which is their main source of revenue—and issue large quantities of government bonds to create demand.

China is now a major creditor nation like Japan. It could issue large quantities of government bonds and sell them to state-owned financial institutions without depending on foreign investors. Even if the budget deficit increases, this should not be concerning (for the time being). Japan has demonstrated this possibility over the past 30 years.

There are, however, two problems. The first is how to use the funds raised by issuing government bonds to create demand.

If the central government merely assumes the infrastructure investments of local governments, this will only increase the level of inefficient investments and expand the unfair transfer of wealth. Therefore, demand should be created through the expansion of social security or through such new measures as the issue of consumption coupons in order to ease the future uncertainties of Chinese citizens and to direct demand toward consumption.

Another problem is the conservative wing of the Chinese Communist Party. Many of its members favor balanced budgets and would oppose a large increase in the budget deficit. They are likely to be firmly against a scattershot distribution of funds to citizens, such as the expansion of social security or the issue of coupons, preferring the lasting assets of infrastructure.

If China wants to avoid higher budget deficits and the deterioration of its balance sheets, it will need to work at cleaning up those sheets while tolerating a lower rate of economic growth. Or if lower growth cannot be accepted, it will need to tolerate budget deficits. Saying no to both low growth and rising deficits is not an option.

A long-term issue for China is cleaning up the huge amount of trash, or bad assets and bad debt, that has accumulated on both the asset and liability sides of the nation’s balance sheet.

What the country needs to do is revalue its unproductive garbage assets, record the resulting valuation losses, and write down related debt to a level corresponding to these assets’ actual effectiveness. Unless China performs such major surgery, its economy will not return to true health. Should China begin such a process, however, the cases of other nations shown in the figure above suggest that China will undergo years of zero or negative growth.

When Xi Jinping was elected to a third presidential term at the National Congress of the Chinese Communist Party in October 2022, he pledged to grow China’s per capita GDP to the level of a medium-developed nation by 2035. This will require China maintaining an average growth rate of around 4.5% for the next decade or so.

Having just made such a pledge, President Xi is hardly in a position to choose a policy of maintaining zero growth for many years. This being the case, the only option for China is to prevent growth from slowing for the time being by covering the shortfall of demand with central government finances and to clean up balance sheets gradually over time.

However, the likelihood that these measures will be successful is not high. Overcoming over time the problem of excess investment and debt is something the Xi administration has already tried in vain during two five-year terms starting in 2012, under such slogans as “new normal” and “debt reduction.”

(Originally published in Japanese. Banner photo: A woman walking by a playground for an unfinished housing project in a new city district of Zhengzhou, Henan Province on June 20, 2023. The developer is struggling to raise sufficient funds to complete presold homes, and the boycotting of housing loans is spreading throughout China. © AFP/Jiji.)