Behind Taiwanese Chip Makers’ Japan Investment Spree

Economy Technology- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Japan is becoming a mecca for Taiwanese semiconductor manufacturers. Last February, with the startup of its Kumamoto plant still months away, chip behemoth Taiwan Semiconductor Manufacturing Company announced its intent to build a second fab next door. Meanwhile, another Taiwanese chip maker has unveiled plans for a factory in Miyagi Prefecture.

In publicizing these moves, the companies have focused on how their expansion benefits Japan, which is hoping to stage a semiconductor comeback. But Taiwanese chip makers are not here to boost the Japanese economy. If Japanese stakeholders want to make the most of these new plants (heavily subsidized by the Japanese government), they need to understand what is motivating the investment.

TSMC founder Morris Chang speaks at the opening ceremony for his company’s new semiconductor plant in Kikuyō, Kumamoto Prefecture, on February 24, 2024. (© Yamada Shūhei)

Coming Full Circle

Speaking at the February 24 opening of TSMC’s first Japanese production facility (Kikuyō, Kumamoto Prefecture), company founder Morris Chang recalled a conversation he had with Sony Corp. co-founder Morita Akio 56 years earlier, when Chang visited Japan for the first time as a vice-president at Texas Instruments.

Born in Zhejiang Province in China, Chang had emigrated to the United States and built a distinguished career at TI, a pioneer in the development and application of integrated circuits. In 1968, he came to Japan as head of TI’s global semiconductor business to launch a Japanese subsidiary in partnership with Sony. On that occasion, Morita had touted the high productivity of Japanese factories and predicted that TI would be pleasantly surprised by its yields in Japan. Chang, who later supervised the opening of TI plants in Hatogaya (Saitama Prefecture) and elsewhere, was duly impressed.

By the mid-1980s, Japan dominated the global chip market. Around that time, the government of the Republic of China recruited Chang to help develop Taiwan’s own semiconductor industry. Contributing to Chang’s decision to launch TSMC in 1987 was his conviction that Taiwan’s culture and human resources had much in common with Japan’s.

Pioneering the Foundry Model

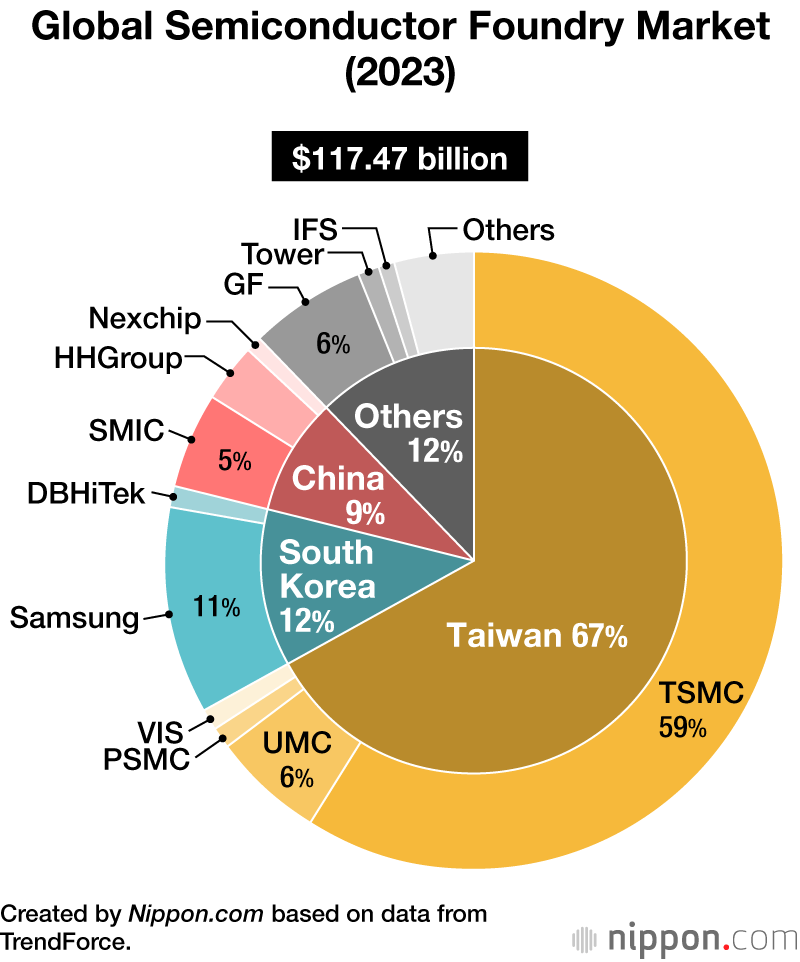

The Taiwanese semiconductor industry took a different path, however. TSMC was established as a pure-play foundry, manufacturing chips under contract to the companies that designed them. As such, it pioneered the dedicated-foundry model, which has taken hold in recent years. Today, foundries account for about 25% of global chip production, and in 2023 TSMC held a 59% share of the global semiconductor foundry market (value basis), according to Taiwanese market research firm TrendForce. What this means is that TSMC supplies about 15% of the world’s microchips.

Taiwan’s total share of the global foundry market comes to 67% (2023) when one adds in the output of firms like Lianhua Electronics Co. (UMC) and Power Crystal Semiconductor Manufacturing Co. (PSMC), which followed TSMC’s lead. In October 2023, PSMC announced plans to team up with Japan’s SBI Holdings to build a fab in Ōhira, Miyagi Prefecture. It hopes to start production sometime in 2027.

For dedicated foundries, competitiveness comes down to fab productivity. This has played to Taiwan’s strengths, just as Chang anticipated. Although TSMC manufactures some of its less advanced chips at fabs in Nanjing and elsewhere, more than 90% of its production capacity is still concentrated in Taiwan.

But TSMC has ramped up its overseas expansion in the past three or four years. In May 2020, the company announced its selection of Arizona as the site of an advanced-process fab. Plans for Kumamoto and Dresden were unveiled in 2021 and 2023, respectively. What has spurred this shift toward offshore production?

Adapting to Deglobalization

The two biggest factors are the global surge in protectionism fueled by US-China trade tensions and concern over Taiwan’s “five shortages.”

The high-tech trade dispute that boiled over between the United States and China in the spring of 2018 triggered a surge in semiconductor protectionism. After benefitting from the removal of tariffs worldwide, the semiconductor industry faced a raft of new import barriers and export restrictions, leading Chang to pronounce globalization and free trade “almost dead” in the microchip sector. Citing economic security, the governments of the leading industrial economies began offering generous subsidies and tax breaks to encourage domestic chip production, vying with one another to attract semiconductor companies like TSMC.

TSMC built its business model on low-cost domestic production. Small and light, semiconductors could be shipped almost anywhere from Taiwan, even by air freight, without compromising profits. But the US-China dispute has undermined the foundations of this business model. Moreover, with the cost of construction rising to about ¥1 trillion per fab in recent years, it makes economic sense to take advantage of the massive subsidies being offered by the United States, Japan, and Europe.

Taiwan’s Five Shortages

The other key factor driving TSMC’s shift in strategy is concern over the “five shortages” threatening Taiwan’s semiconductor industry. Chip plants need plentiful and reliable supplies of electric power and water, as well as land, labor, and high-level talent. And though the government of Taiwan may deny it, the industry has real concerns about all five of these resources.

Taiwan experienced two widespread power outages in 2021 and one in 2022, at a time when the country’s semiconductor plants were operating at full capacity amid a global chip shortage. President Tsai Ing-wen’s Democratic Progressive Party has long advocated the phase-out of nuclear power, and in January 2017, shortly after Tsai took office, a law was passed stipulating that all three of the country’s nuclear power plants—including the one currently operating—be decommissioned by 2025. The plan is to make up the deficit with renewable energy, especially solar and wind power, but industry leaders worry that dependence on such variable power sources will make the electricity grid less reliable.

Semiconductor plants use large amounts of water, and Taiwan experienced its worst drought in 57 years in 2020. (Environmental sentiment makes the building of new dams politically unpopular.) The industry is also grappling with the dwindling availability and rising cost of suitable land in the mountainous island country. Moreover, with Taiwan’s fertility rate hovering around 1.0% (one of the lowest rates in the world), labor shortages are looming as well.

Some observers have linked this expansion to Taiwan’s national security policy, positing that Taipei is using the country’s semiconductor industry as a “silicon shield” against Chinese aggression. While it is true that the ROC government is TSMC’s single largest shareholder, it controls only 6% of the total and is in no position to overrule the institutional investors that make up the overwhelming majority. TSMC is a listed corporation with a market capitalization of $700 billion, and its shareholders would never stand for a management strategy keyed to national security rather than corporate value.

The TSMC-Sony-Apple Triangle

In addition to the general considerations outlined above, TSMC had specific reasons for building the Kumamoto plant.

Speaking at an event in Taipei in December 2022, Chief Executive Officer C. C. Wei told industry leaders that TSMC was building the plant in Kikuyō to “help one of its customers,” which happened to be a supplier for TSMC’s “most important customer.” Though he avoided naming names, his meaning was clear: The basic purpose of the Kumamoto plant was to assist the Sony Group in supplying Apple Inc. with advanced image sensors.

Sony Semiconductor Solutions has its own plant in Kumamoto Prefecture, which produces advanced image sensors used in iPhone cameras. These image sensors incorporate logic chips supplied by TSMC, and it seems that Apple wanted the company to produce the chips in Kumamoto as a means of strengthening supply-chain resilience. Apple is TSMC’s biggest customer, accounting for about 20% of its annual sales.

This helps explain why TSMC launched Japan Advanced Semiconductor Manufacturing (JASM), with Sony as a minority shareholder, and why its initial production plan targeted the 22-nanometer and 28-nm node logic chips best suited to stacking in Sony’s image sensors. These process nodes have been around for at least a decade, and some in Japan were displeased to hear that TSMC’s first Japanese fab would not be producing more cutting-edge chips. However, in February 2022, auto parts maker Densō joined the partnership, and JASM announced that the plant would also use 12-nm and 16-nm technology to produce semiconductors geared to the automotive market.

Kumamoto mascot Kumamon makes an appearance at the opening ceremony for JASM’s first Kumamoto plant in February 2024. (© Yamada Shūhei)

A Vote of Confidence

Be that as it may, why would TSMC announce plans for a second Japanese plant even before the first one had begun operating? A clue can be gleaned from remarks delivered by TSMC Chairman Mark Liu at the February 24 opening ceremony. After thanking the Japanese government, Kumamoto Prefecture, Sony, and other investors, Liu conveyed his deep gratitude to Kajima Corp., the general contractor in charge of the plant’s construction. Under Kajima’s supervision, construction of the complex proceeded smoothly and was completed before the end of 2023, giving TSMC ample time to launch production by the end of 2024, as scheduled.

Contrast this with the problems plaguing TSMC’s Arizona plans. In July 2023, after months of negotiations with local labor unions, TSMC announced that the operations at the first fab, originally scheduled to begin sometime in 2024, would not commence until the following year. The company was also forced to push the second fab’s planned startup from 2026 back to 2027 or even 2028. Such delays are very costly. Building a new semiconductor plant is an extremely expensive undertaking, and makers are always anxious to begin recovering their investment as quickly as possible. Reports from Taiwan suggest that the Arizona debacle may be behind last December’s announcement that Chairman Liu would be stepping down in June. Given the strength of Germany’s labor unions, the Dresden plant could face similar problems.

TSMC was offered generous incentives by the United States, Europe, and Japan, and it has taken advantage of them. But the company must have realized by now that Japan is the best place to manufacture semiconductors. JASM’s second Kumamoto plant, officially announced on February 6, will use 6-nm process technology to produce cutting-edge semiconductors for the latest telecommunications and artificial intelligence applications. The market for such highly advanced chips is relatively small in Japan, suggesting that the second Kumamoto plant will play a bigger role in the global market.

At the February opening ceremony, Morris Chang stressed his belief that the Kumamoto plant would jump-start a “renaissance of semiconductor manufacturing in Japan.” Doubtless Chang is telling Japan what it wants to hear after dishing out some ¥1.2 trillion in subsidies. TSMC is a business, and its first priority is maximizing its own profits, not fueling a Japanese chip-making renaissance. But with a clear understanding of the sequence of events that brought Taiwanese chip makers to these shores, Japanese stakeholders have a good chance of building a win-win relationship.

(Originally published in Japanese. Banner photo: The Kumamoto plant of TSMC’s Japanese manufacturing subsidiary, JASM, in Kikuyō, Kumamoto Prefecture, scheduled to begin mass-production by the end of 2024. © Yamada Shūhei)