Tariff Negotiations: Investment a Way for Japan to Win US Over?

Economy Politics World- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Sign of Weakness

When Japan’s Minister for Economic Revitalization Akazawa Ryōsei attended the first round of tariff negotiations in the United States in April, the appearance of President Donald Trump at the talks could be seen as a sign of US desire to make haste. The United States is conducting discussions with more than 60 countries, and wants quick results to show. It seems to have viewed negotiations with Japan as being relatively simple, with the possibility of cooperation leading to a breakthrough.

However, the US demands that have emerged so far have been vague, and the target-setting process appears to have missed the point. The United States Trade Representative report on foreign trade barriers mentions nontariff barriers in Japan including problems related to standards on EV charging and automotive safety, as well as aspects connected with rice. However, even if such nontariff barriers were removed, it is questionable whether US automakers are serious about targeting the Japanese market.

The United States remains the world’s economic superpower, but its policy of imposing steep tariffs on other countries is also a sign of weakness. While Trump’s stated goal is to eliminate the trade deficit, US society has reached the state where its top priority should be to revive US manufacturing and secure employment for its workers. Tech giants like Google and Apple are in the forefront of their industry, but the country’s blue-collar workers have been left behind, suffering from a lack of jobs.

Japan must think about what the United States wants during negotiations, rather than considering it as a superpower. The two countries’ economies are tightly intertwined and there is a direct connection between their prosperity, so cooperation is likely to be in the national interest.

Clarity Needed for Investment

I think Japanese investment in the United States is an effective factor in reviving US manufacturing. While this is not something that the Japanese government can promise, as decisions are made by the private sector, Japan is currently the largest investor in the United States, a practice that generates revenue to be reinvested. Japan’s labor shortage puts a limit on its companies’ domestic growth, but it is easy to expand into the United States. Since this will happen without any particular intervention, it should be possible to give expected values at least, rather than specific numerical targets.

One proposal that has been floated is for an LNG project in Alaska with Japanese involvement. It is unlikely that this could see completion during Trump’s presidential term, but nonetheless it would ultimately result in a win-win outcome by contributing to Japan’s decarbonization and increasing US exports.

The auto industry is a prime example of how investment boosts manufacturing and employment. Japanese automakers have understood since the 1980s that exporting to the point that it leads to the decline of the US industry is unacceptable to Americans and invites a powerful backlash, so they have increased local production efforts.

However, if there are frequent tariffs like the ones currently imposed, it becomes impossible to calculate costs. It must be conveyed to the US side that companies cannot invest without a clearer knowledge of future conditions.

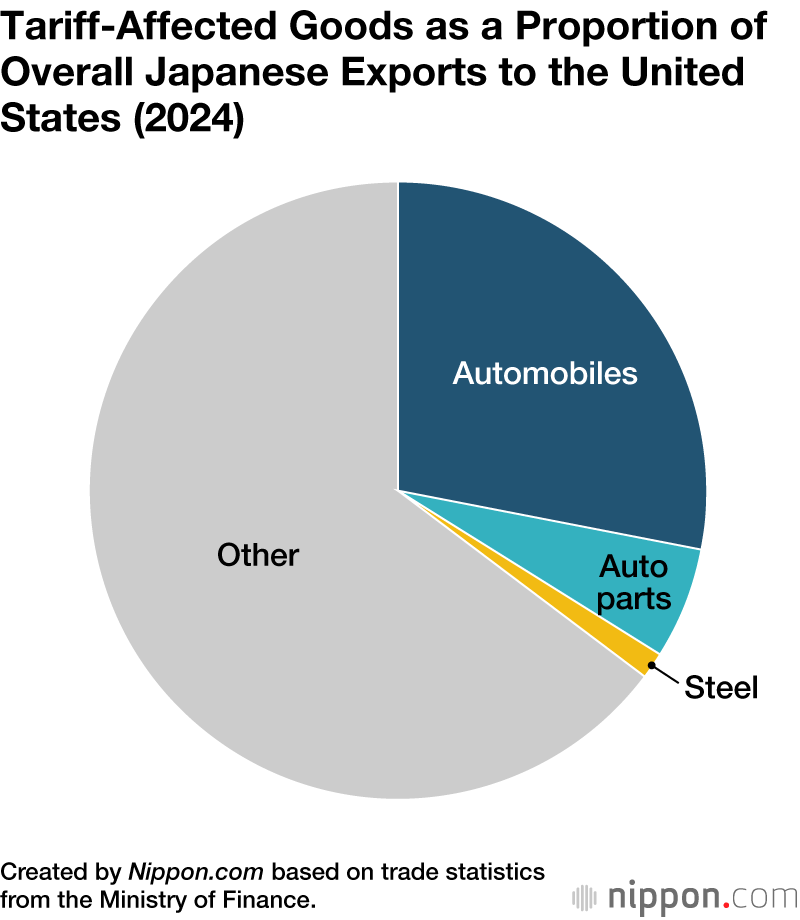

If we imagine the negotiations ending without agreement, the additional tariff will certainly hit the Japanese economy. Japan’s exports to the United States have been growing as a proportion of its overall exports. Its auto exports are particularly high, and the 25% tariff is a painful blow. This year’s profits for the auto industry may well vanish. Even if the tariffs on Japan are lifted, if the United States does not remove them worldwide, Japan will feel the effects of a global slowdown.

From a purely domestic perspective, things may not be so bleak. The manufacturing industry now represents a much-decreased proportion of the Japanese economy, meaning that the negative effects of high tariffs on manufactured goods may be limited. If punitive tariffs kick in Japan’s auto industry will indeed become unable to raise wages the way it has before, but due to the domestic labor shortage, it is unlikely that wages will plummet across the board in all industries. Rather, if the exchange rate remains at around ¥140 to the dollar, it should check the impact of inflation on the cost of imported goods, meaning that real wages could well rise.

Dollar Decline

Trump has sometimes identified the strong dollar and weak yen as the cause of the US trade deficit with Japan, but at the meeting between the countries’ finance representatives, US Secretary of the Treasury Scott Bessent made no demand for exchange-rate targets.

At the current rate of ¥140 to the dollar, the yen is actually stronger and the dollar weaker compared with when Trump won the presidential election in November last year. This is due to a slide in trust in the dollar. Asking for adjustments to bring down the dollar now would further weaken trust, leading to an outflow of capital. I think that Bessent well understands this point.

After World War II, the United States supported the global economy by buying goods from other countries as the center of free trade, but high tariffs aim to lighten that burden. This withdrawal of the world’s leading power decreases trust in the United States and the dollar as a base currency. If the United States talks only about how it is losing out, the world will not trust it. With the plunging of the dollar and the outflow of funds from US Treasuries, generally considered safe-haven assets, the United States was forced to hurriedly put its additional tariffs on ice and begin negotiations with other countries.

It is technically complicated to adjust the high value of the dollar against multiple foreign currencies. In the talks that led to the 1985 Plaza Accord where this was the goal, the main players were the United States, Japan, and the former West Germany. Today, it is not enough to tinker with the yen alone, and the biggest target is the Chinese yuan. But it is impossible to negotiate over currency with China.

Softening Stance

Shifts from Trump’s initial hardline stance have become apparent. Apart from the pause in additional tariffs, he backtracked on a stated desire to fire Federal Reserve Chair Jerome Powell and mentioned preparations for lowering extremely high tariffs on China.

The United States levied 145% tariffs on China, which responded by imposing 125% tariffs in return. Bessent described this as “the equivalent of an embargo” and the situation is unsustainable for the US economy. The Trump administration includes both Peter Navarro, the hawkish senior trade adviser who is pushing steep tariffs as a way to bring new life to manufacturing, and Bessent, who takes a more moderate line, with an eye on financial markets.

Trump’s statements are influenced by these two men, with changes in emphasis depending on the situation. Lacking awareness of how the United States is supported by the world, his one-sided demands have led to signs of distrust. Now that global investors are doubtful about both the dollar and the United States, it seems likely that Navarro will withdraw from the scene for the moment.

While negotiating with the United States for the elimination of tariffs, Japan should maintain and expand free trade systems, such as by bringing the European Union into the Trans-Pacific Partnership. Many countries have been too dependent on the United States, and they should work to expand domestic demand. In Japan’s case, however, population decline means that there are limits to how much it can achieve this way, and it can also contribute by investing in countries and regions with growth potential like India and Southeast Asia.

(Originally published in Japanese on May 1, 2025, based on an interview by Mochida Jōji of Nippon.com. Banner photo: US President Donald Trump with Japanese Minister for Economic Revitalization Akazawa Ryōsei. Courtesy the Cabinet Secretariat; © Jiji.)