From Reciprocal Tariffs to Economic Security: The Strategic Significance of Japan’s Pledge of $550 Billion Investment in the United States

Politics Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

US-Led Selection of Investment Targets

In negotiations over the Japan-US strategic trade and investment agreement, Tokyo and Washington agreed on a framework that caps tariffs on Japanese imports at 15%, with Japan signaling its intention to invest $550 billion in the United States. Concluded in July 2025, the deal reduced the originally announced 25% tariff rate in exchange for Japan’s commitment to invest.

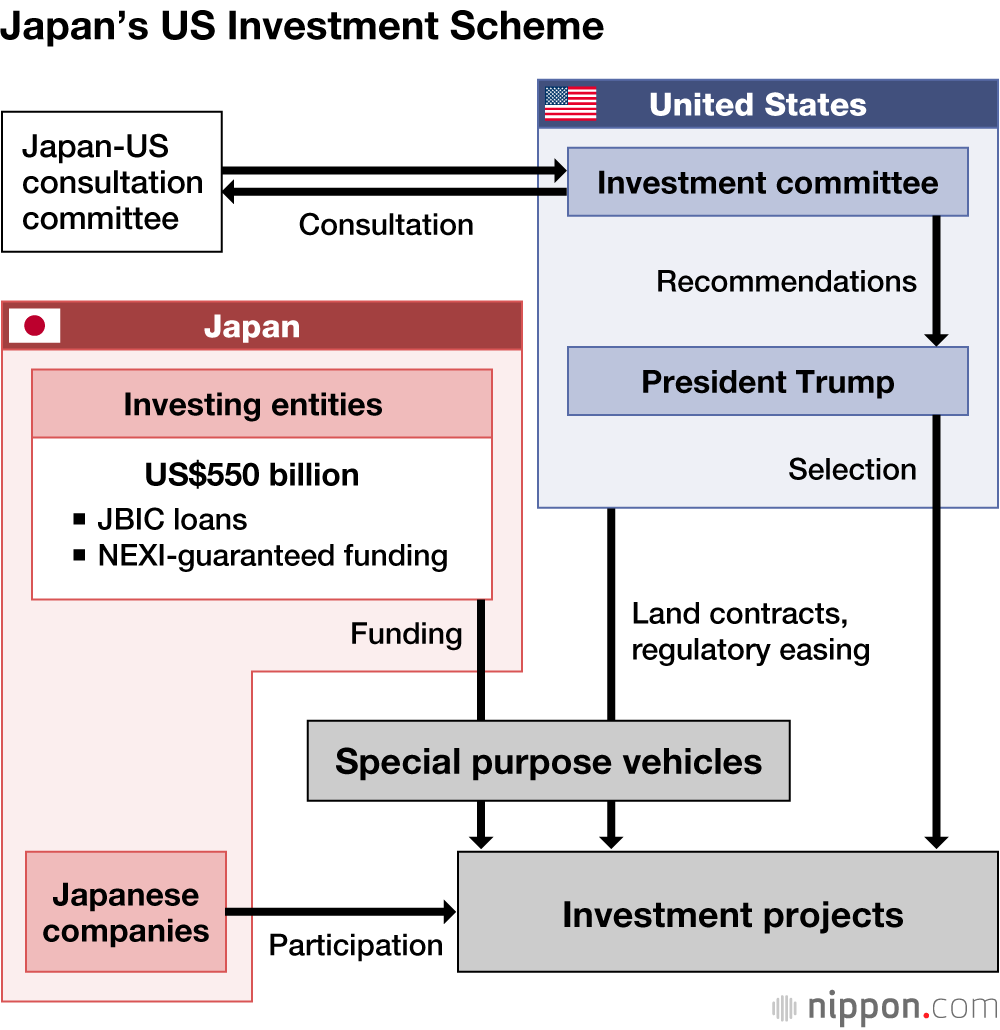

The agreement calls for the United States to lead the selection of investment targets and establishes two bodies to manage the process—an investment committee chaired by the US secretary of commerce and a Japan-US consultation committee—with final authority resting with the US president. The framework also includes measures to accelerate the process and increase its transparency. The memorandum of understanding contains a built‑in enforcement mechanism that allows Washington to raise the tariff ceiling if it judges that Japan is not fulfilling its commitments.

The agreement with Japan, alongside similar arrangements with Britain and the European Union, forms a pillar of the Trump administration’s tariff strategy: offering allies a 15% ceiling while tying their investments directly to rebuilding America’s manufacturing and defense industrial base.

Japan’s Cooperation in Power and Energy Sectors

The tariff-for-investment framework aims to leverage the respective strengths of allies and partners to bolster US economic security. Participating countries commit funding, technology, and support through government-affiliated financial institutions.

Japan will cooperate in the power and energy sectors—supporting stable electricity supply in the United States through renewable energy, hydrogen and ammonia supply chains, safe use of nuclear power, and modernization of transmission networks. South Korea will contribute to maritime transport security through shipbuilding, while Taiwan will supply semiconductors. The EU will stabilize markets through investment and purchases of strategic materials, Britain will provide pharmaceuticals and AI technologies, and Australia will work with the United States to secure stable supplies of lithium, rare earths, and other resources.

Emphasis on Reciprocity and Implementation

This strategic, sector-specific approach rewards countries that fulfill their commitments with preferential tariffs and expedited investment screening while maintaining higher tariffs on those that do not. It reframes trade relations around reciprocity and implementation performance, signaling a shift toward selective international cooperation and reduced dependence on China.

US President Joe Biden’s Indo-Pacific Economic Framework envisioned multilateral “friend-shoring” to stabilize supply chains. Trump rejects multilateralism, but his approach redefines friend-shoring as bilateral frameworks centered on tariffs and investment, positioning US allies as “selective friends.” The Japan-US agreement marks the beginning of this shift.

A High-Value Investment “Envelope”

Although the deal was widely reported in Japan as merely calling for $550 billion in investment, the figure actually represents an investment “envelope”—a pool of financing and guarantees committed through the Japan Bank for International Cooperation and other government-affiliated institutions. It bundles together projects that companies express interest in and is not a direct transfer of funds. Rather, it is a framework to support corporate investment decisions, a tool that Washington also views as beneficial for market development.

The actual investors are private companies, and details such as equity ratios, loan amounts, and loss-compensation mechanisms remain unclear. This uncertainty is a concern for the United States, but despite the ongoing US trade deficit with Japan, the administration accepted a 15% tariff cap without demanding reductions in Japanese tariffs or increases in Japan’s defense budget—likely because it needed to secure early, visible investment results.

High Demands and Expectations for Japanese Investment

The MOU stipulates that profits will be shared equally up to a certain threshold, with any excess distributed 90–10 in favor of the United States. However, this applies only to dividends on funds provided by private banks backed by JBIC or Nippon Export and Investment Insurance guarantees—not to the overall profits of the projects themselves.

Corporate profits are not being appropriated; rather, government-affiliated financial institutions are structurally assuming the risk. Some insiders see JBIC and NEXI as absorbing potential losses to secure the 15% tariff cap, enabling Japanese companies to benefit from expanded access to the US market and preferential treatment in government procurement. Still, JBIC is legally required to ensure repayment of its investments, incentivizing the creation of financially viable projects even as negotiations continue over profit-sharing mechanisms.

The key issue is how quickly Japan can act and how the Trump administration evaluates that performance. US Commerce Department officials have stated that if Tokyo’s coordination efforts fall short, Japan will be seen as having failed to meet its commitments.

According to US think tanks such as the Hudson Institute, the investment process—from recommendation to review, approval, and disbursement—can be completed in as little as a few weeks. Securing a few early presidential approvals will therefore be crucial to demonstrating Japan’s commitment.

Japanese companies are expected to not only benefit the US economy by creating jobs and establishing new production bases but also to ensure profitability. Some reacted uneasily to Trump’s claim that the United States would take 90% of the profits, prompting the Japanese government to clarify that profit distribution will reflect investment and risk levels. Actual implementation will be determined case by case under the MOU and presidential orders.

The administration is placing high demands on Japanese investment, but at the same time has high expectations. Commerce Secretary Howard Lutnick sought to ease Japanese concerns during his October 2025 visit to Tokyo, emphasizing that investments would be in areas “fundamental to national security” that have “virtually no risk,” meaning that companies would not be likely to incur losses.

One factor to watch is the possibility that the US Supreme Court may rule some of Trump’s executive orders unconstitutional in lawsuits challenging the scope of presidential tariff authority. Oral arguments were held on November 5, but no ruling has yet been issued. An adverse ruling could undermine the legal basis for tariff caps linked to investment performance.

An Economic Security Network to Counter China

The administration’s strategy of lowering tariffs to induce investment has drawn concern from member states of the Association of Southeast Asian Nations. ASEAN seeks good relations with the United States but prioritizes nonalignment; if negotiations with Washington stall, Beijing’s influence in the region could grow. Even as the United States concluded trade and critical minerals agreements with Malaysia and Cambodia and President Trump mediated a ceasefire in the Thailand-Cambodia border dispute during the October 2025 ASEAN summit in Kuala Lumpur, ASEAN maintained its distance, wary of becoming too entangled.

China, meanwhile, is expanding institutional linkages in the digital economy and green growth through the ASEAN-China Free Trade Area (FTA 3.0). In the first half of 2025, Belt and Road–related investment and construction contracts across ASEAN and other regions are estimated to reach $124 billion. Trade with ASEAN hit record highs, resulting in deepening mutual dependence.

The investment frameworks negotiated by the Trump administration with Japan, the EU, Australia, South Korea, and Britain could evolve into an economic security network designed to counter China’s regional initiatives. Rebuilding supply chains for strategic materials—such as rare earths and semiconductors—is central to this effort.

China is forming a rare earths coalition with a number of developing countries, including Cambodia and Myanmar, while the United States is spearheading the Minerals Security Partnership. Competition over mineral resources will intensify as Beijing and Washington increasingly vie for influence among resource-rich countries.

Crucially, China has recently tightened its export controls on certain rare earth materials amid worsening Sino-Japanese relations, raising concerns in Japan about potential supply disruptions. This development has once again highlighted the vulnerability of Japan’s critical mineral supply chains, which remain heavily dependent on China. In response, Japan should seek to diversify its supply sources by strengthening bilateral supply cooperation with Australia and Canada, and by promoting US-led multilateral frameworks such as the MSP.

Leveraging the CPTPP to Preserve an Open Trading Order

Japan, as a major US ally, cannot avoid engaging in Washington’s economic security initiatives. At the same time, it can seek to maintain an open trading order with like-minded countries while avoiding deep entanglement in US-China economic rivalry. A key tool in this strategy is the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), whose membership rose to 12 countries following Britain’s accession in December 2024. The EU is exploring avenues of deeper cooperation, and big Asian economies such as Indonesia and South Korea have expressed interest in joining. Japan is expected to support CPTPP expansion even as it participates in Trump’s tariff and investment frameworks.

As the arena of US-China competition shifts from trade rules to the broader redesign of the international order, Japan can help guide the CPTPP—an agreement that includes neither the United States nor China—into a third economic pole. This would enable it to function as an institutional buffer between the two superpowers and offer Japan a key platform to again play a leading role in shaping the global economic order, as it did when it salvaged the original TPP after the United States withdrew in 2017.

(Originally published in Japanese on December 17, 2025. Banner photo: US President Donald Trump and Japanese Prime Minister Takaichi Sanae hold signed documents in Tokyo on October 28, 2025. © Jiji; pool photo.)

United States trade investment Donald Trump economic security