Former BOJ Leader: Look for Patches of Sun in a Cloudy 2026 Economy

Economy Work- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Why Prices Remain High

INTERVIEWER Since the surge in oil and other resource prices in 2022, triggered by the war in Ukraine, the Japanese economy has endured rising prices for four straight years. Crude oil prices have largely stabilized now, so why does inflation persist?

MOMMA KAZUO The cause of the current bout of inflation lies in a shift in “the norm”—the standard shared by society regarding what is considered normal. You might call this the “prevailing market expectation.” For years, prices barely rose at all, but now the general expectation is that they will increase by around 2 percent annually. Labor unions are also basing their wage demands on the premise of 2 percent inflation. In other words, the socially accepted benchmark for price increases has moved from zero to about 2 percent.

Because a norm reflects a society’s shared sense of what is normal, it rarely changes once it takes root. The fact that it has changed suggests that people’s expectations were reshaped by a major shock. One such factor was the spike in resource prices around 2022 and 2023. The impact was so great that, even though prices have since eased, the underlying norm has been permanently altered. People now assume prices will continue rising for some time, setting off a chain reaction of wage hikes, price increases, and further wage hikes. Another factor was the sharp decline in the value of the yen. In 2022 alone, it fell by nearly 40 yen against the US dollar—from the 110 yen range to nearly 150 yen at one point. This was an extraordinary level of depreciation that delivered a profound shock to the economy.

Rate Hikes Despite a Weak Economy

INTERVIEWER In response to persistent inflation, the Bank of Japan raised interest rates again in December 2025, lifting the policy rate to 0.75 percent. Since the Japanese economy is far from robust, won’t this risk making monetary policy harder to steer?

MOMMA If you look at the real state of the economy, there’s no need to raise rates. The BOJ is adjusting interest rates solely because the norm—the socially accepted expectation for inflation—has shifted. Structurally, the Japanese economy remains weak, so there’s no clear correlation between economic growth and higher prices, which makes the situation rather tricky. Since the BOJ’s primary mandate is price stability, it has to raise rates when prices go up, even if the economy is sluggish. That said, both the government and the BOJ want to avoid moving too aggressively, so they’re proceeding with caution.

BOJ Governor Ueda Kazuo at a press conference following the December 2025 rate hike. (© Jiji)

As Governor Ueda Kazuo has explained, the BOJ is still pursuing monetary easing. But with inflation now settling at around 2 percent, it no longer needs to try as hard. The purpose of the rate hike is to moderate the previous pace of easing and fine-tune the level of stimulus.

Another reason is to stem the yen’s depreciation. To prevent further price increases, the BOJ needs to keep the currency from weakening any further. A renewed devaluation would also be unwelcome for the government, which has just introduced anti-inflation measures. Even though the BOJ raised rates around the same time as the US Federal Reserve moved to cut theirs, the interest‑rate gap remains large, so the underlying trend of a weak yen and strong dollar hasn’t changed.

INTERVIEWER What are the prospects for rate hikes in 2026?

MOMMA The BOJ is likely to raise its policy rate twice in 2026, by 0.25 percentage points each time, bringing it to 1.25 percent. By 2027, this rate could rise further to around 1.5 percent. The key variable is the United States. The US economy remains very strong thanks to the AI boom, and inflationary pressures from Trump‑era tariffs will also be at work. Even a new Federal Reserve chair appointed by Trump might find it difficult to cut rates.

On the other hand, the Japanese government would probably prefer that the BOJ hold off on additional rate hikes, so it’s hard to envision a scenario in which the Japan-US interest‑rate gap narrows. That means downward pressure on the yen will persist. To prevent further depreciation, the BOJ will have little choice but to keep raising rates—while securing the government’s understanding.

Will Wages Finally Outpace Prices?

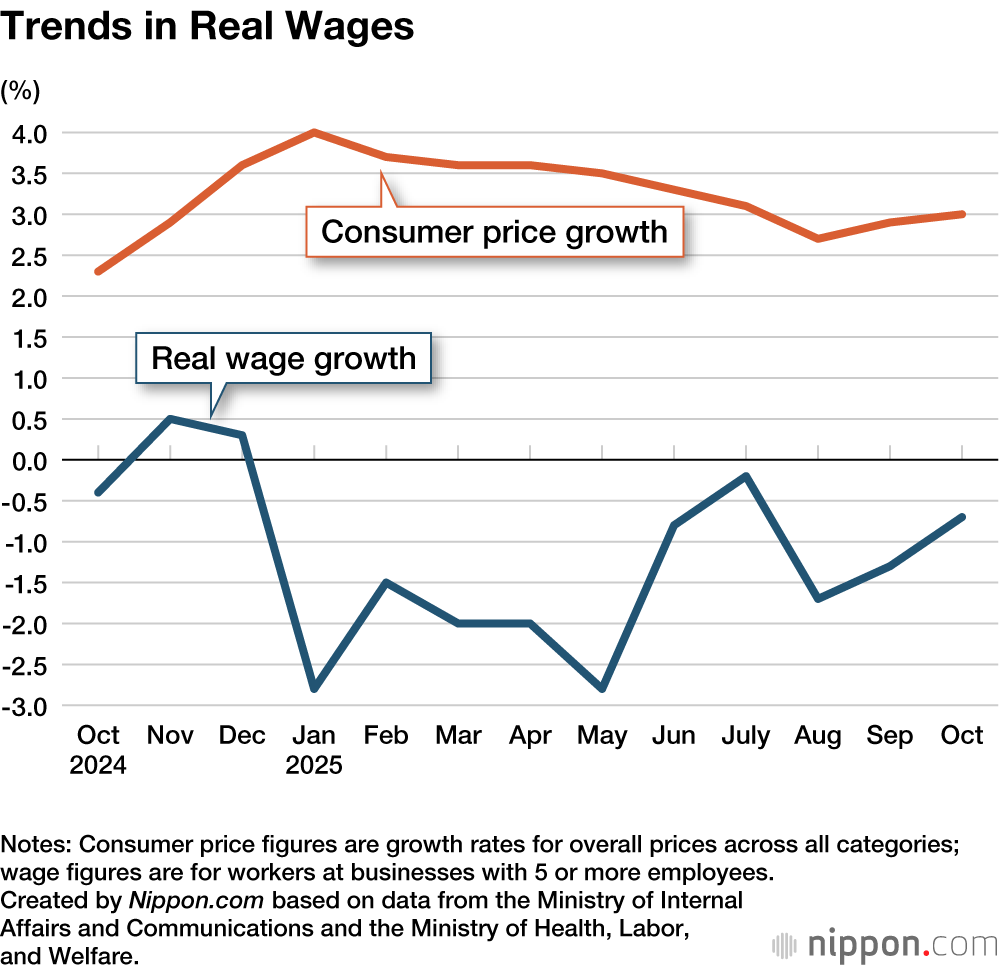

INTERVIEWER Will the BOJ’s rate hikes be enough to calm inflation? And can wages, which continued to erode in real terms in 2025, return to positive growth?

MOMMA There aren’t many domestic factors this year that would push prices sharply higher. Last year we saw abnormal increases in food prices—rice in particular—but things should settle down in 2026. Prices may remain high, of course, but at the very least the pace of increase should ease. Taking into account the abolition of the gasoline tax surcharge at the end of 2025, I expect consumer prices to stabilize at around 2 percent growth, down from last year’s average of roughly 3 percent inflation. The main risk is that the US economy proves stronger than expected, preventing the Federal Reserve from cutting rates and creating upward pressure on prices in Japan through a stronger dollar and weaker yen. And of course, we’ll also need to keep an eye on crude oil prices in the wake of the US attack on Venezuela at the beginning of this year.

Real wages—wages adjusted for inflation—kept falling year‑on‑year during 2025, but I expect they’ll turn positive this year. BOJ surveys project this year’s wage growth to be around 2.5 percent, roughly the same as last year. Last year’s inflation was around 3 percent, though, so wages failed to keep up with higher prices. But if inflation falls to around 2 percent, wages could come out slightly ahead. This suggests that real wages would rise by around 0.5 percent.

Impact of Takaichi’s Expansionary Fiscal Policy

INTERVIEWER Takaichi Sanae steered fiscal policy toward an expansionary footing upon becoming prime minister in 2025. But markets have reacted rather coolly to the administration’s large supplementary budget—financed with deficit-covering bonds—responding with higher long‑term interest rates and a weaker yen, developments that affect both growth and prices. How do you see these developments?

MOMMA Long‑term interest rates have risen, but they’re still hovering around 2 percent, which is not a level that raises real concerns about fiscal sustainability. Compared with last October—before Takaichi won the Liberal Democratic Party leadership election—long‑term rates have increased by only about 0.3 percentage points. Roughly half of that reflects BOJ Governor Ueda’s December 1 statement signaling openness to rate hikes, so the portion attributable to the administration’s policies is only around 0.15 percentage points.

Commentators have compared these developments to the “Truss shock” in Britain, where long‑term rates surged after a jump in government bond issuance under former Prime Minister Liz Truss. At the time, long-term rates spiked by 1.5 percentage points in just three weeks, though, so the scale was completely different. The Nikkei average has also been rising, so I don’t see Japan entering a phase of being “sold off.”

Turning to the question of the weakening yen, we see the impact of concerns about Japan’s worsening fiscal stance, along with anticipation that the Takaichi administration might try to restrain the BOJ from raising rates. But since the BOJ hiked its rates in December, and since Governor Ueda has hinted at further potential hikes, the prevailing view is that the yen is unlikely to weaken much further.

Outlook for 2026

INTERVIEWER Japan’s economy appears to have weathered many of the risks that emerged in 2025, from Trump’s tariffs to the slowdown in China. What will 2026 bring?

MOMMA There were certainly sectors that were hit hard by the Trump tariffs—notably manufacturers and subcontractors in the auto industry—but the impact was not large enough to show up in macro indicators, such as the overall growth rate. That’s because the tariff rates turned out to be lower than initially feared and because AI‑related investment in the United States was extremely strong, giving the economy there considerable momentum.

China, meanwhile, is beset by the collapse of its real‑estate bubble and weak household consumption, and its growth is likely to be subdued. Rising tensions in Japan-China relations could adversely affect certain industries, but again, the impact is unlikely to be large enough to impact the macroeconomy.

I believe the economy in 2026 will be better than in 2025, as real wages begin to grow. But I would still be cautious. Real wages have fallen by 3 percent compared with pre‑COVID levels, so even if they rise by 0.5 percent this year, it would take six years to return to where they stood before the pandemic. If I were to give a weather forecast, I’d say 2026 will be mostly cloudy but with lighter cloud cover, allowing sunlight to break through in places. I don’t expect clear skies just yet, although we may have a bit less cause for concern.

Table. Economic Indicator Forecasts for 2026

| 2025 | 2026 | |

|---|---|---|

| Average consumer price growth | Around 3% | Around 2% |

| Average real wage growth | -0.50% | 0.50% |

| BOJ policy lending rate | 0.75% | 1.25% |

| Long-term interest rate (maximum) | 2.10% | 2.50% |

| Nikkei average (maximum) | 52,636 | 55, 000 |

| Average yen-to-dollar rate | ¥149 | ¥155 |

(Originally published in Japanese on January 6, 2026, based on an interview by Mochida Jōji of Nippon.com. Banner photo: Grocery store staff in Urasoe, Okinawa, hand bags of surplus rice from government storehouses to customers. © Jiji.)