Japan’s Current Account Surplus Shrinks for First Time in Four Years

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

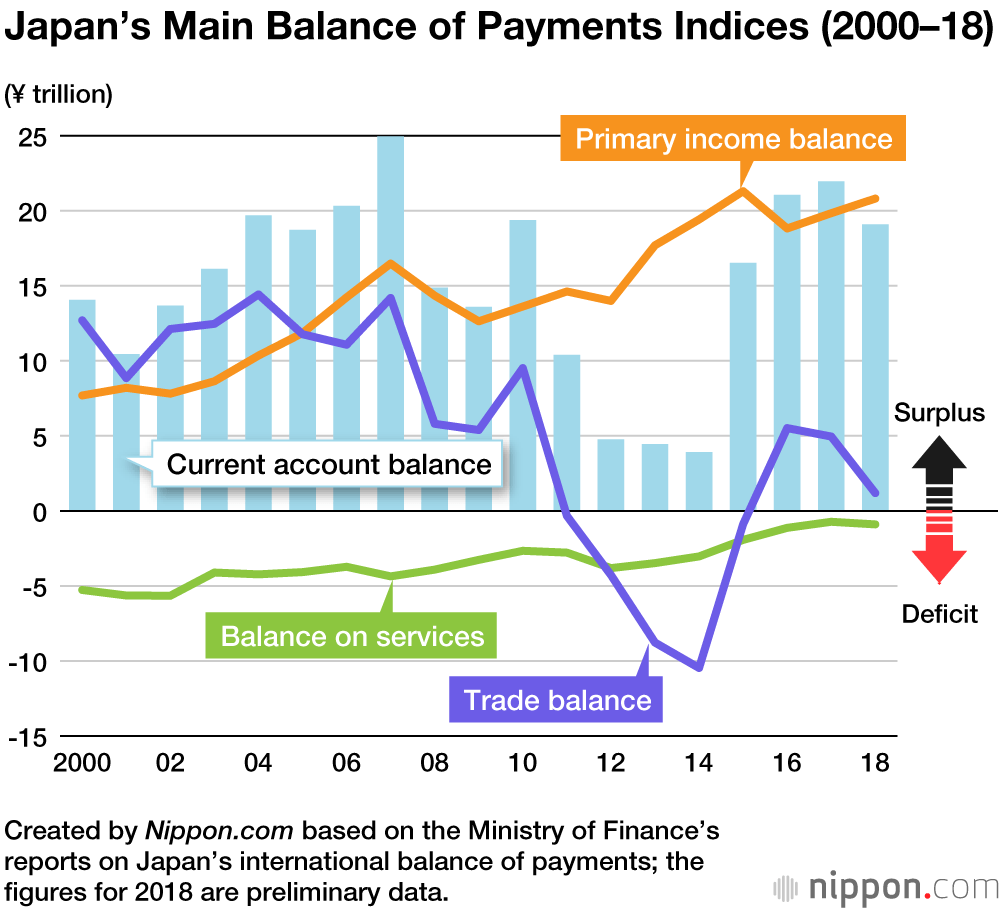

A preliminary report issued by the Ministry of Finance on Japan’s international balance of payments in 2018 shows that the current account balance, an economic indicator for international transactions for goods and services and investment earnings, ran a surplus of ¥19.1 trillion. This surplus is 13.0% lower than 2017, marking the first year-on-year decrease in four years. The high price of oil, which drove up the cost of imported goods, was a major factor behind the significant drop in the trade surplus.

Japan’s 2018 Balance of Payments

| (¥ billion) | (% compared to previous year) | |

|---|---|---|

| Current account balance | 19,093 | 87.0% |

| Trade balance | 1,188 | 24.0% |

| Exports | 81,207 | 105.1% |

| Imports | 80,019 | 110.6% |

| Primary income balance | 20,810 | 104.9% |

| Balance on services | -899 | 123.8% |

Created by Nippon.com based on the Ministry of Finance’s preliminary report on Japan’s 2018 international balance of payments.

Japan’s primary income balance, indicating the interest and dividends earned or paid on corporations’ foreign investments, increased 4.9% year-on-year, recording a surplus of ¥20,810 billion—the second-highest level on record. Dividends from overseas subsidiaries and the retained earnings of subsidiaries increased as a result of overseas mergers and acquisitions, particularly in the United States and Asia, as well as the expansion of overseas production sites.

The primary income balance has been expanding steadily ever since Japan restored its trade surplus in 2005, and a clear structure has emerged where the country’s current account surplus is bolstered by investment earnings rather than exports of such commodities as automobiles and electronic devices. The uncertain outlook for global trade, arising in part from US-China trade friction, makes it likely that investment will continue to sustain Japan’s current accounts.

Japan ran a trade surplus of ¥1,188 billion in 2018. This was the third consecutive year for the trade balance to be in the black, but the surplus was 76.0% smaller than that in the previous year. Although overall exports set a new record in 2018, rising 5.1% year-on-year to ¥81,207 billion, exports of semiconductor manufacturing equipment to Asia stalled in the latter half of the year. Meanwhile, the over 30% annual rise in oil prices drove up the value of imports to Japan by 10.6% year-on-year, far outpacing the rise of exports.

The balance on services was ¥899 billion in the red, the second straight year to be under ¥1 trillion. Within the balance on services, Japan’s travel balance set a new record surplus of ¥2,314 billion. Although torrential rain in western Japan and earthquakes negatively impacted tourism, the overall number of foreign visitors surpassed the 30-million mark for the first time. Earnings from tourism also exceeded earnings from trade.

(Translated from Japanese. Banner photo © Pixta.)