China Appeal Fading for Japanese Companies

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

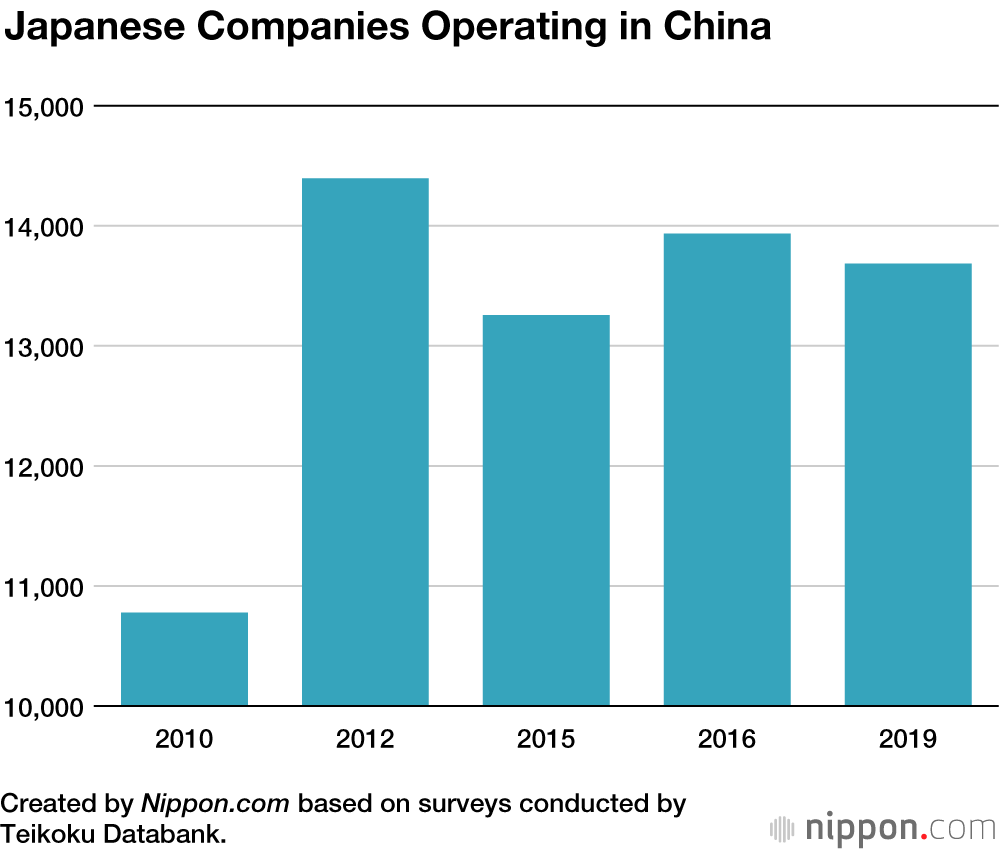

A Teikoku Databank survey found that there were 13,685 Japanese companies operating in China as of May 2019, a decrease of 249 compared to the previous survey conducted in 2016. Doing business in China has come to appear less attractive, with rising labor costs in the country over recent years among the declining benefits. Another factor is concern about the future impact of intensifying US-China trade friction.

The Teikoku Databank survey analyzed companies that were determined to have expanded their business to China, based on credit reports and its own database. The survey has been conducted every one to three years since 2010, with this year marking the fifth to date.

Manufacturing and Retail Decline

The number of Japanese companies doing business in China, according to past surveys, was 10,778 in 2010, 14,394 in 2012, 13,256 in 2015, and 13,934 in 2016. The total for 2019 of 13,685 shows a decline of 709 companies compared to the peak year of 2012.

By industry the number of companies in the manufacturing, wholesale, retail, and service industries fell from the 2016 survey, whereas the number of companies in the real-estate and financial sectors rose. The percentage decrease was steeper among companies up to medium size, whose cut-off point is annual sales of ¥1 billion.

Changes in the Number of Japanese Companies Operating in China by Annual Sales

| Annual sales | Number of companies (2019) | Number of companies (2016) | Change compared to 2016 | Proportion of total companies |

|---|---|---|---|---|

| Up to ¥100 million | 504 | 552 | -8.7% | 3.7% |

| ¥100 million–¥1 billion | 3,883 | 4,159 | -6.6% | 28.4% |

| ¥1–10 billion | 6,066 | 6,058 | 0.1% | 44.3% |

| ¥10–100 billion | 2,611 | 2,560 | 2.0% | 19.1% |

| ¥100 billion or more | 605 | 569 | 6.3% | 4.4% |

Created by Nippon.com based on surveys conducted by Teikoku Databank.

US-China Trade Friction May Lead to Further Decline

Japanese companies found to have set up new facilities in China include those that are establishing local production plants with an eye to demand in China as well as those that already have a presence and are now actively opening sales offices in response to the growth of the local market.

Meanwhile, prominent among companies withdrawing from China are those that are either moving production back to Japan or shifting production facilities to Southeast Asian countries amid slumping profits in China resulting from such factors as the rising labor costs that have accompanied economic growth, and the low exchange rate.

The survey shows that there is already a trend among major manufacturers and wholesalers to scale back their business with Chinese companies or shift production facilities to Southeast Asia, against the backdrop of intensifying US-China trade friction since last year. This suggests that the number of large Japanese companies withdrawing from China may further increase in the years ahead.

(Translated from Japanese. Banner photo © tomcat/Pixta.)