Future Japanese Pension Benefits to Drop to Half of Workers’ Take-Home Pay

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

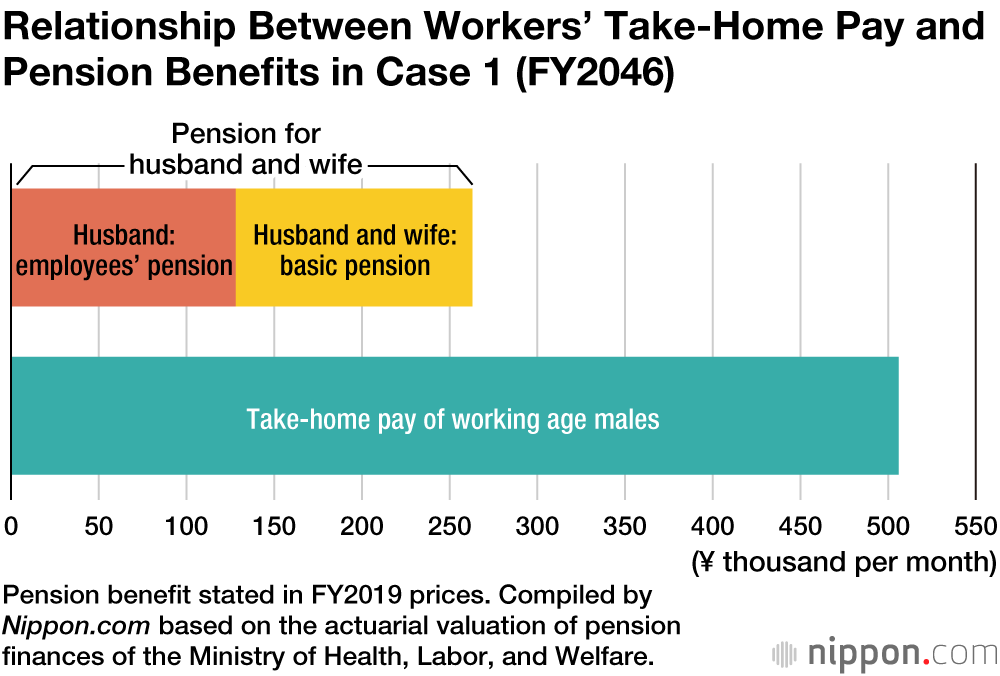

In the first revision of its public pension future outlook for five years, the Ministry of Health, Labor, and Welfare reported that the balance between beneficiaries and supporters paying insurance premiums is expected to worsen further, due to the aging of Japanese society. While pension benefits correspond to 61.7% of the average income of the working-age population in fiscal 2019, this replacement rate will unavoidably drop along with pensions in future years.

How far the replacement rate falls will depend on future economic conditions. Six estimates are provided in the MHLW actuarial valuation. In Case 1, the best-case scenario for economic growth and labor force participation (such as by women and the elderly), the replacement rate is predicted to decline to 51.9% in fiscal 2046. In Case 6, which is the worst-case scenario, it is foreseen to fall as far as 36–38% in fiscal 2043.

Outlook for the Income Replacement Rate

| Cases | Income replacement rate after benefit adjustment | Year benefit adjustment ends |

|---|---|---|

| 1 | 51.90% | FY2046 |

| 2 | 51.60% | FY2046 |

| 3 | 50.80% | FY2047 |

| 4 | 46.50% | FY2044 |

| 5 | 44.50% | FY2043 |

| 6 | 36–38% | FY2043 |

Cases 1 to 3 are cases where economic growth and labor force participation make advances, Cases 4 and 5 are cases where economic growth and labor force participation make some advances, and Case 6 is where economic growth and labor force participation do not advance. Compiled by Nippon.com based on the actuarial valuation of pension finances of the Ministry of Health, Labor, and Welfare.

Nakashima Kunio, a researcher at NLI Research Institute, states that productivity, which influences growth capacity, is the worst in 30 years. Considering only current economic conditions, the current situation corresponds to Case 6, the worst-case scenario. He argues that it will not be possible to rise above Case 6 unless efforts are made to promote the participation of women and the elderly in the labor force and to improve the flow of money throughout the economy.

In June, the Financial Services Agency released an advisory council report on pension issues stating that the pension will not be enough to live on after retirement and that savings of ¥20 million will be needed. However, Minister of Finance Asō Tarō refused to accept the report, fearing that it would become an issue in the upcoming House of Councillors election in July. The actuarial valuation of pension finances that was previously issued in June was released at the end of August after the election.

Pension System Participation Can Be Increased with Part-time Workers

Can anything at all be done to ease the worsening of pension finances? The actuarial valuation proposed delaying the start of receiving pension benefits and increasing the numbers of people who contribute to the pension system. One step that could be taken is to enable some part-time workers who currently cannot participate in the employees’ pension to do so. Participation in the employees’ pension is currently limited to people who work for companies with 501 or more employees. If this limit is removed, participants would increase by 1,250,000 persons, which would raise the overall income replacement rate, although only slightly.

The employees’ pension is a system where companies pay half of the pension insurance premium. Nakashima states that removing the limit on participation would likely be resisted by retailers and other small and medium-sized enterprises. Whether such a step can be taken will depend on small and medium-sized enterprises being willing to pay the insurance premium as a way to solve labor shortages.

(Translated from Japanese. Banner photo: Tamaki Yūichirō (left), leader of the Democratic Party for the People, attempting to hand the Financial Services Agency’s advisory council report to Minister of Finance Asō Tarō (second from right) during a party leader debate at the Diet. © Jiji.)