Japanese in Their Thirties and Forties Concerned About Savings Now and for Retirement

Economy Lifestyle Society Family- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

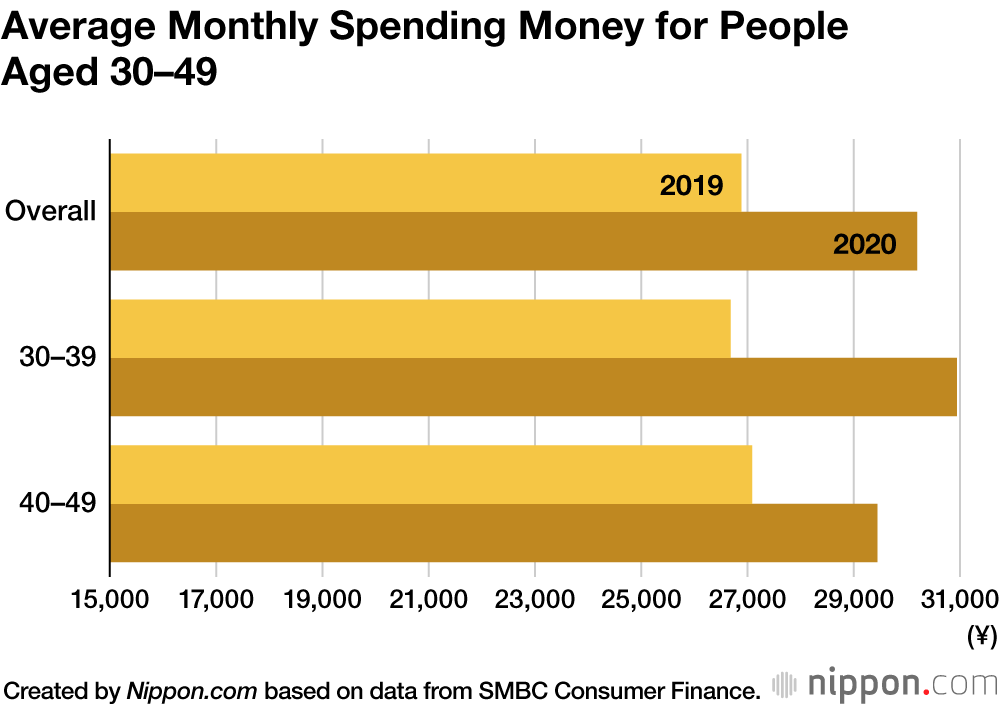

An SMBC Consumer Finance online survey conducted in early February, targeting a total of 1,000 people in their thirties and forties, revealed that, on average, respondents had ¥30,192 to spend freely every month. This was an increase of ¥3,307 compared to the results of a survey held in December 2019, prior to the COVID-19 pandemic. However, 30.4% answered that they had less than ¥10,000 and 6.4% that they had no money to spend freely at all.

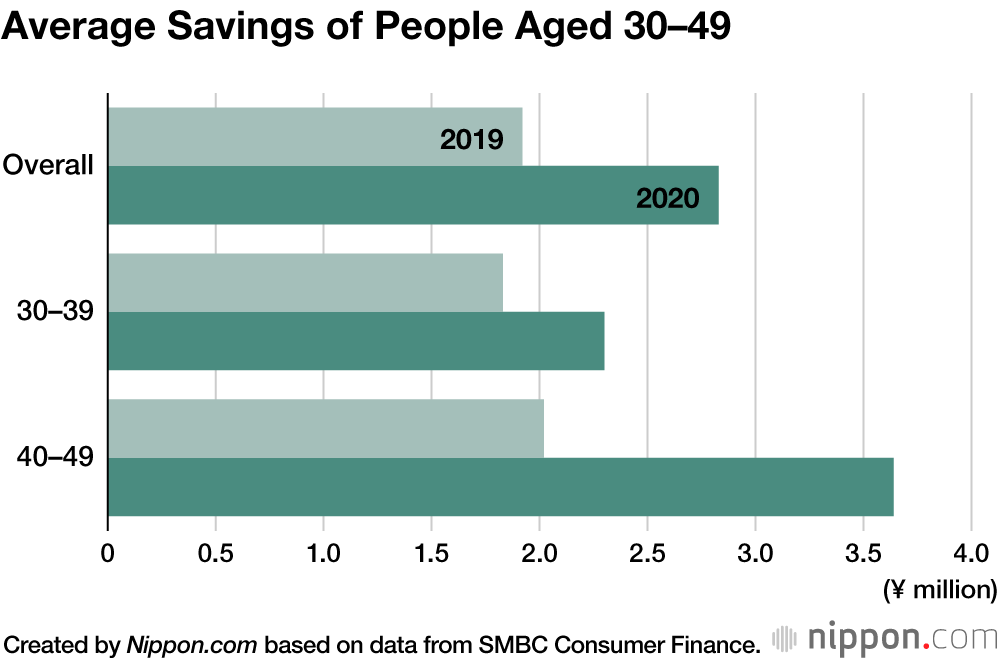

The average amount of savings was ¥2.83 million. This was an increase of ¥910,000 from ¥1.92 million at the time of the last survey in December 2019. Savings for people in their forties increased significantly by ¥1.62 million to ¥3.64 million.

SMBC Consumer Finance suggests that the change is due to reduced costs from the shift toward telework and refraining from going out, as well as households receiving ¥100,000 payouts and showing a growing preference to save because of worries over the future.

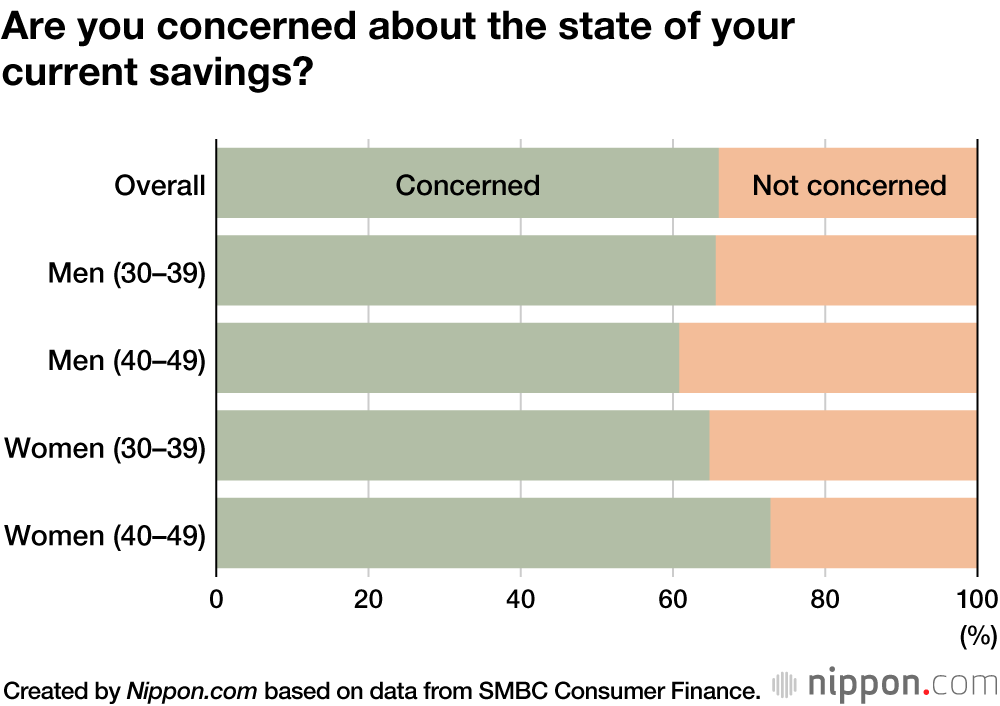

Even so, this does not mean that people are satisfied with their current amount of savings, and 66% of the total expressed concern. At 72.8%, women in their forties showed the highest percentage.

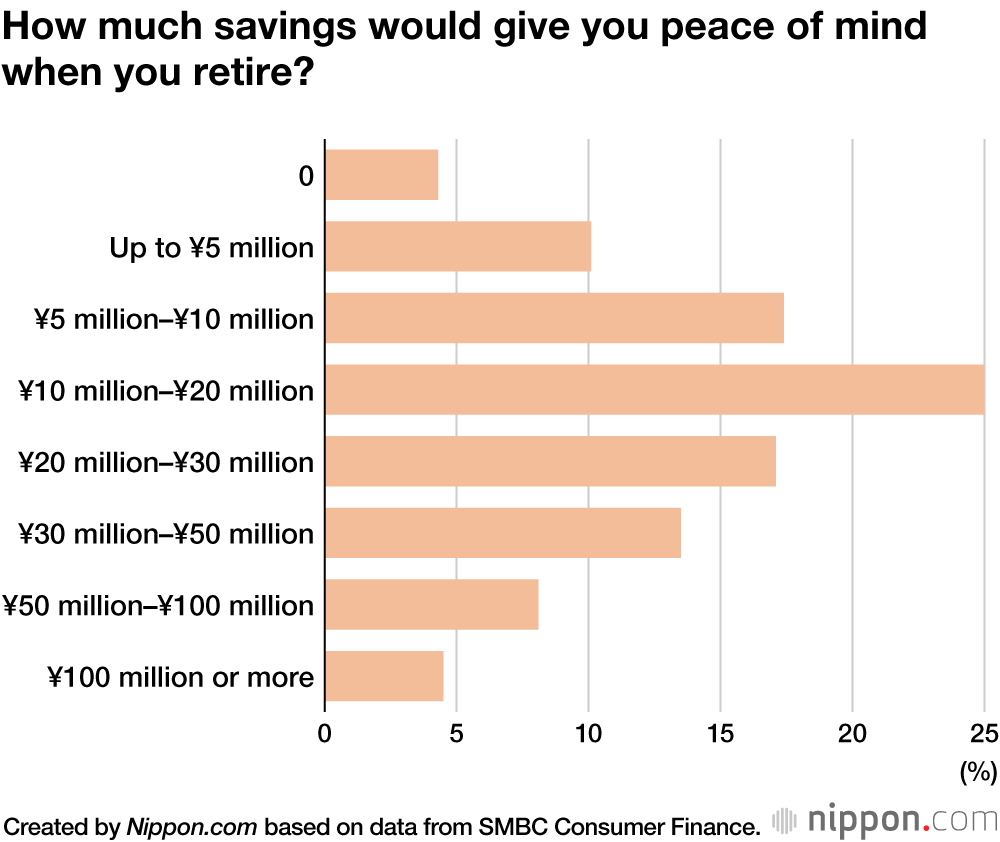

When asked how much savings would allow for peace of mind on retirement, the most common response with 25% was ¥10 million–¥20 million. The average showed a rise of ¥570,000 to ¥25.5 million since the December 2019 survey.

(Translated from Japanese. Banner photo © Pixta.)