Concern as Japanese Interest Rates on Business Loans Fall Below 1%

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

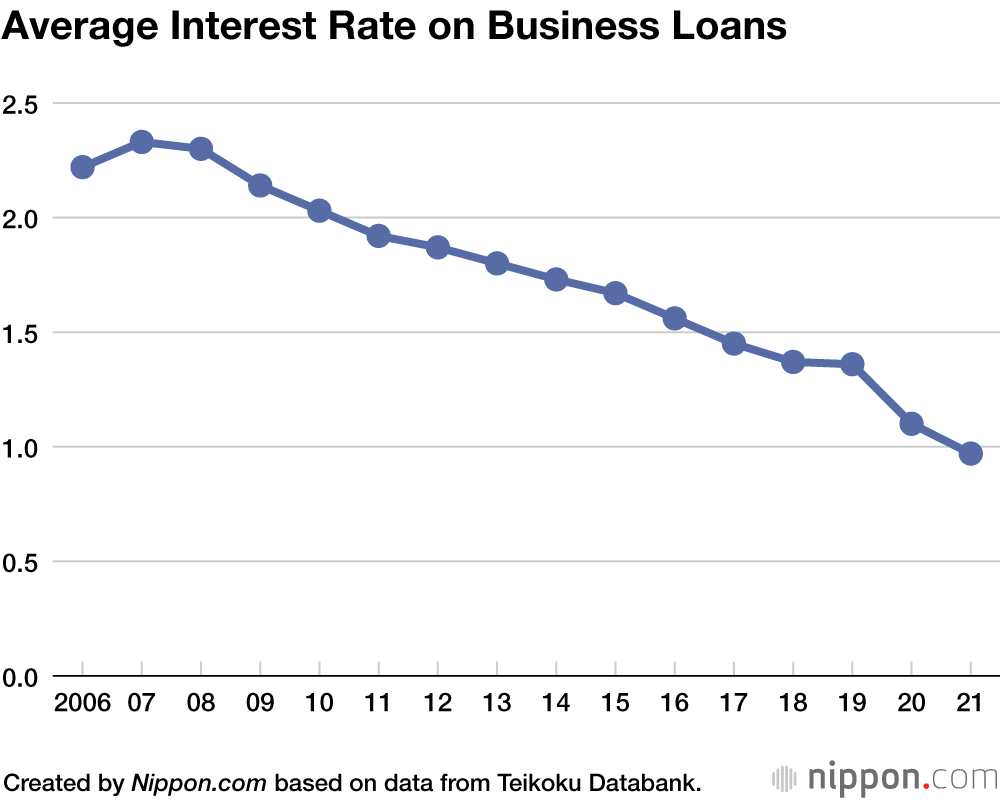

An analysis of business data performed by Teikoku Databank found that the average rate of interest paid by businesses to borrow money in fiscal 2021 fell by 0.13 points compared to the previous year to 0.97%, marking the first time that interest rates on business loans have dipped below 1%. After peaking at 2.33% in 2007, interest rates on such loans have continued to fall for 14 years straight. The average annual rate of decrease had been around 0.10 points, but in 2020 it swelled to 0.26 points due to a rapid increase in unsecured, effectively interest-free loans granted to help businesses weather the economic downturn brought on by the COVID-19 pandemic.

A breakdown by prefecture reveals that Nara had the lowest average interest rate at just 0.67%, followed by Kagawa and Toyama at 0.68% and 0.79% respectively. In all prefectures, average interest rates on business loans fell below 2019 levels, the last year not to be impacted by COVID-19.

While economic factors are putting downward pressure on Japan’s interest rates, expert project the situation will change starting from spring 2023 as repayments on COVID-debt ramp up, interest subsidies come to an end, and interest-free COVID loans begin accruing interest again. However, Teikoku Databank warns that the increased cost of servicing COVID debt could cause significant pain for poorly-performing businesses or those burdened with excessive debt.

(Originally written in Japanese. Banner photo © Pixta.)