Japanese Companies Give 65.8 Rating for Quantitative Easing Policy

Economy Politics- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

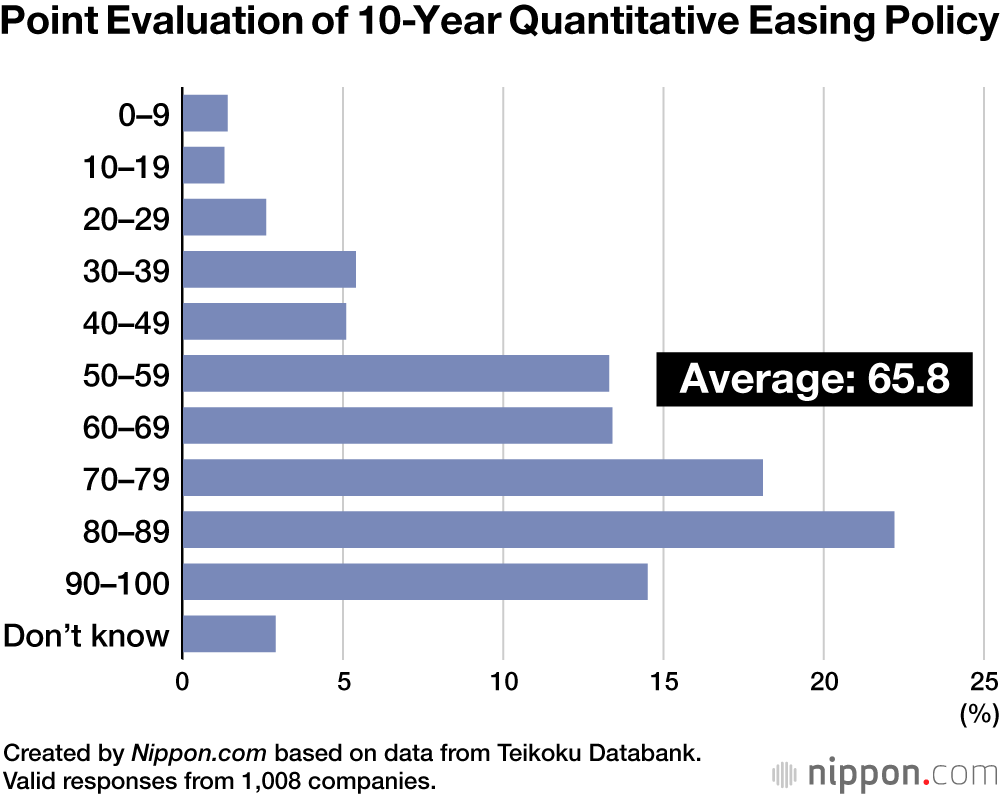

A survey of Japanese corporations found that that the policy of quantitative easing pursued by Kuroda Haruhiko during his 10-year reign as the governor of the Bank of Japan received an average approval rating of 65.8 points on a scale of 100 points. The breakdown of evaluations shows that 22.2% gave him a ranking of between 80 and 89, 18.1% between 70 and 79, 14.5% 90 or more, 13.4% between 60 and 69, and 13.3% between 50 and 59.

The online survey targeting companies nationwide was conducted by Teikoku Databank from February 10 to 14, with responses from 1,008 companies.

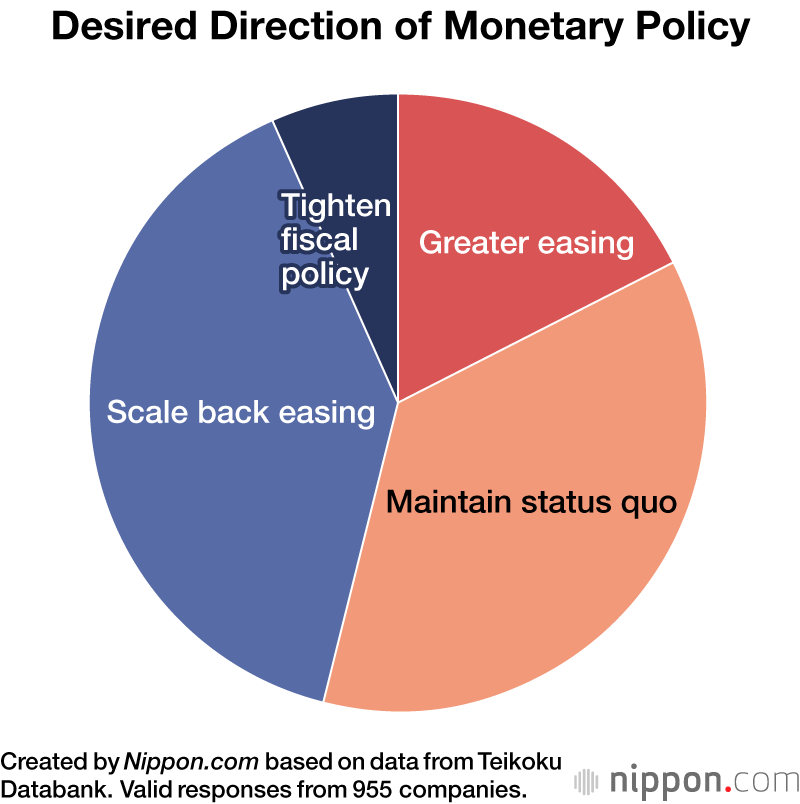

Kuroda’s tenure will come to an end in April 8, when he is set to be replaced by economist Ueda Kazuo. When asked about the desired direction of fiscal policy over the next year or so, the highest percentage of the surveyed companies, at 39.6%, mentioned “scaling down quantitative easing,” followed by 36.4% that preferred “maintaining the status quo.”

While some of the companies surveyed pointed to the need for a change in policy direction, noting that negative interest rates constrain economic growth, many of the respondents, especially small and medium-sized enterprises, called for a cautious modification of policy, expressing the hope that the new BOJ governor will be cautious so that the economy can make a soft landing.

(Translated from Japanese. Banner photo: Current BOJ Governor Kuroda Haruhiko [© Jiji], at left, and his successor Ueda Kazuo [© Kyōdō].)

Bank of Japan monetary policy finance Kuroda Haruhiko Ueda Kazuo