Most Japanese Companies Have Concerns Over New Invoice System

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Japan’s new system for submitting qualified invoices in order for companies to receive a consumption tax deduction started in October 2023. If an invoice does not include the applicable tax rate and registration number, the purchase tax credit, whereby businesses can deduct the amount of consumption tax at the time of purchase from the amount of tax due, will in principle no longer apply.

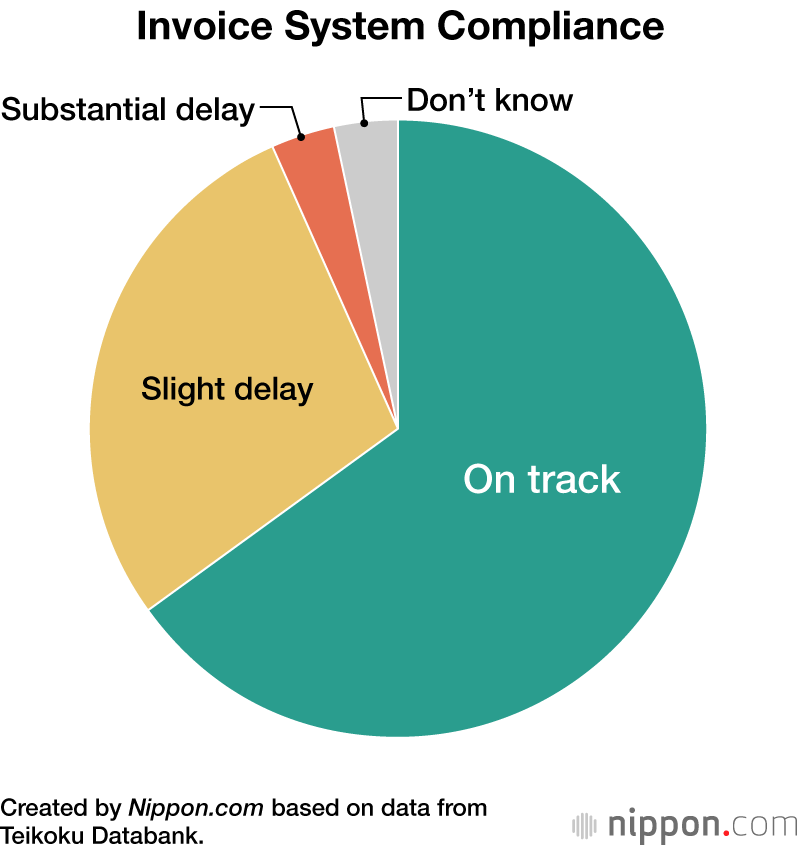

Teikoku Databank conducted a survey during the period October 6–11, immediately after the invoice system started, asking businesses about their status of compliance. They received valid responses from 1,494 companies, revealing that 65.1% were “on track with complying.” A further 28.5% said that there was a “slight delay” and 3.1% were experiencing a “substantial delay.”

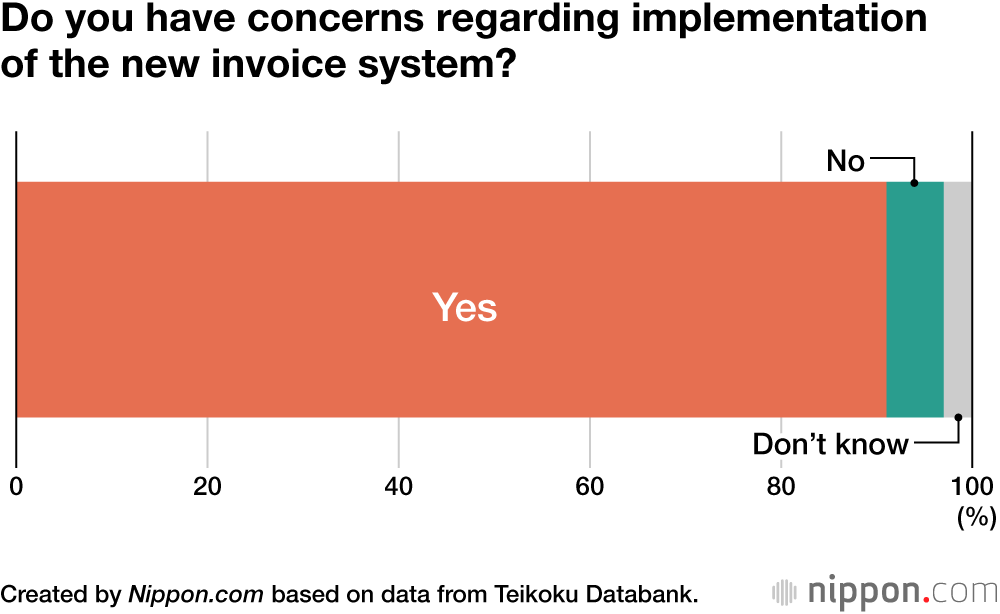

Asked if they had concerns over the introduction of the invoice system, 91% of respondents answered that they did. So, while two-thirds of companies maintained they were on track with complying, it was clear that the overwhelming majority had apprehensions.

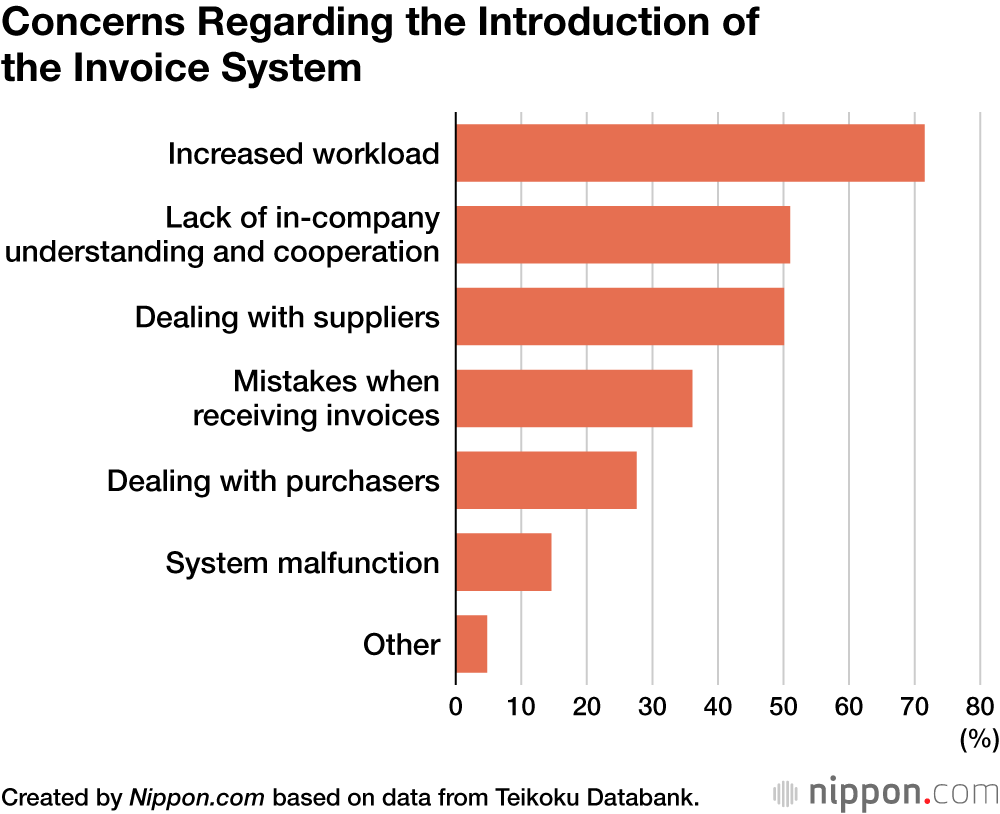

The most common concern that companies had was the “increased workload”, expressed by 71.5% of respondents, followed by “lack of in-company understanding and cooperation” at 51.0%, and “dealing with suppliers” at 50.1%.

Some of the specific issues that the companies experienced included “the method for recording the registration number differs depending on the client,” “if we need to confirm the registration number or ask for missing information, our regular work will be delayed and overtime will be required,” and “depending on the type of business, we might need to keep dealing with tax-exempt companies (that have no registration number).”

(Translated from Japanese. Banner photo © Pixta.)