Nikkei Index Sets First Record High Since 1989

Economy Politics- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Nvidia, a leading US chip maker, announced on February 21 all-time highs for sales and net profits for the November 2023 to January 2024 quarter. Responding favorably to the firm demand for semiconductors, investors snapped up IT-related shares on the stock markets of Japan, the United States, and Europe, and stock prices surged to mark record highs on February 22.

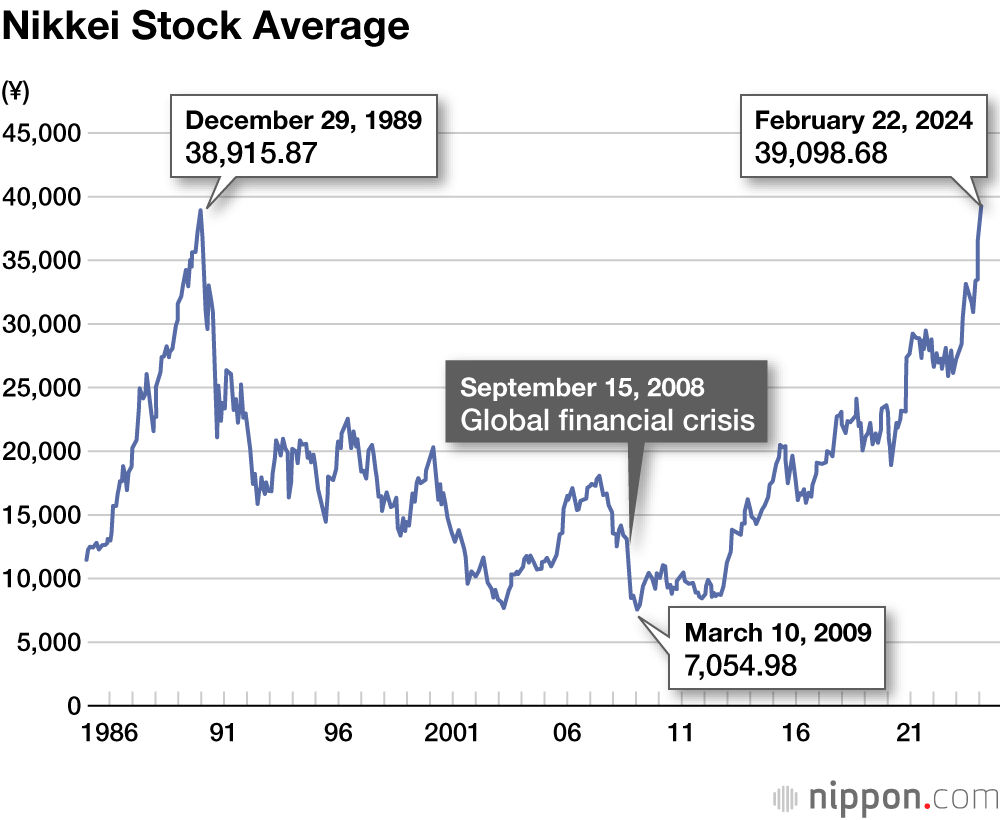

The Nikkei index (Nikkei 225) of the Tokyo Stock Exchange rose 836.52 points over the previous day and closed at 39,098.68 on February 22, clearing the 39,000 level for the first time. It took 34 years and 2 months to surpass its former all-time high of 38,915.87 recorded on December 29, 1989, the last trading day of that year.

Following the collapse of an asset bubble, Japan’s economy experienced a long period of stagnation widely known as “the lost decades.” In 1997 and 1998, financial institutions including Yamaichi Securities, the Long-Term Credit Bank of Japan, and the Nippon Credit Bank failed in succession. Deflation worsened in the years since 2000. A global financial crisis triggered by the collapse of Lehman Brothers then caused the Nikkei index to fall to 7,054.98 in March 2009, its low point in the post-bubble period.

In 2013, Bank of Japan Governor Kuroda Haruhiko announced monetary easing of “a different dimension,” and the BOJ began to purchase massive quantities of Japanese government bonds and exchange-traded funds. In April 2015, the Nikkei index returned to the 20,000 level after 15 years. In 2020, the global COVID-19 pandemic caused governments to implement large-scale stimulus measures, and the supply of large sums of funds to markets through monetary easing and fiscal outlays became a tailwind for shares. While Japanese stocks had lagged behind the global rise, the weakening of the yen boosted sentiment that they were undervalued, and the inflow of funds from foreign investors enabled the Nikkei index to mark a new all-time high after 34 years and 2 months.

During this period, global stock markets have grown enormously, leaving the Tokyo market with a diminished presence. The Dow Jones Industrial Average of the New York Stock Exchange has increased about 14-fold from the 2,700 level in 1989 to an all-time high of more than 39,000 in late February 2024. The SSE Composite Index of the Shanghai Stock Exchange has grown about 30 times over a December 1990 baseline. Japan’s nominal GDP, which ranked second after the United States in 1989, has been surpassed by China and Germany, falling to fourth place in 2023. Faced with an abundance of such issues as a declining birthrate, an aging and shrinking population, and massive government debt, what is the trajectory that Japan will follow beyond the dark tunnel of its lost 30 years?

(Translated from Japanese. Banner photo © Reuters.)