Expansionary Policy Reflected in Japan’s Record High Budget for Fiscal 2026

Economy Politics Lifestyle- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Expansionary Budget Exceeds ¥120 Trillion

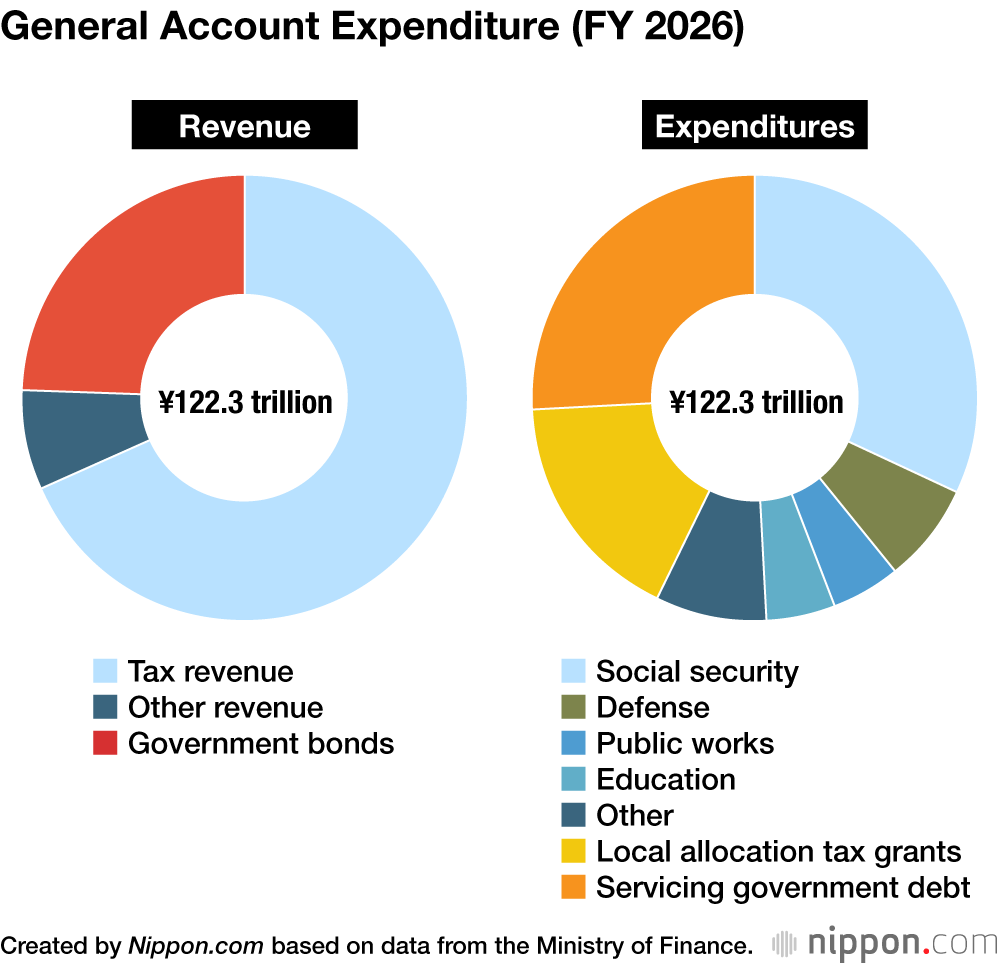

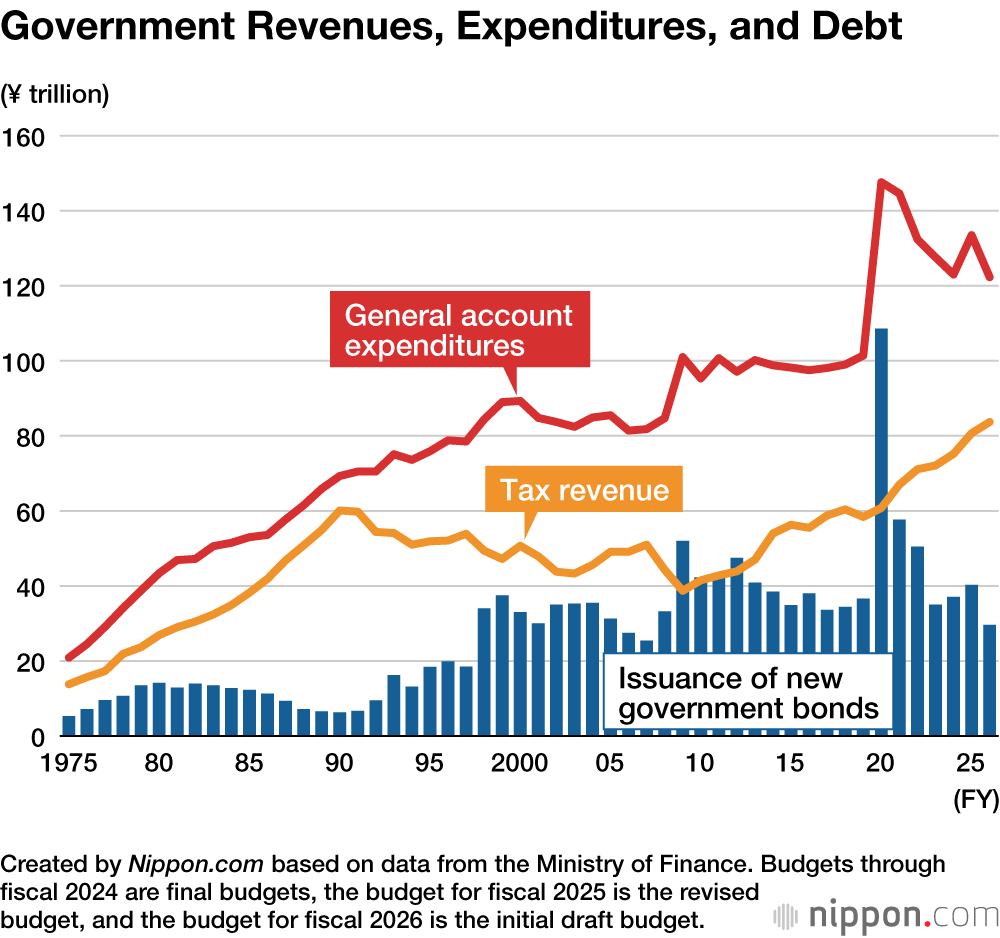

On December 26, 2025, the Japanese government approved a ¥122.3 trillion budget for fiscal 2026, which is a 6.2% year-on-year increase. The budget is the first to exceed ¥120 trillion and marks a record high for the second consecutive year.

Spending on social security, which accounts for one-third of all expenditures, rose 2.0% to a record ¥39.1 trillion, reflecting the graying of the population and measures to address the declining birthrate. In addition, with the end of the policy of zero interest rates, servicing the national debt by redeeming or paying interest on previously issued government bonds increased by 10.8% to ¥31.3 trillion. This is the first time for the figure to surpass ¥30 trillion and the sixth consecutive record high. Social security and debt servicing together account for nearly 60% of all government spending.

Defense spending totals ¥9.0 trillion in fiscal 2026, reaching the target of 2% of GDP two years ahead of schedule, while regional allocation tax grants distributed to local governments rise to ¥20.9 trillion. Both of these figures are new record highs.

Revenue is forecast to set a new record high for the seventh consecutive year, at ¥83.7 trillion, backed by strong corporate performance. New government bond issuance to cover the revenue shortfall will increase 3.3%, to ¥29.6 trillion. Japan’s bond dependency ratio, which indicates the ratio of debt to revenue, now stands at 24.2%.

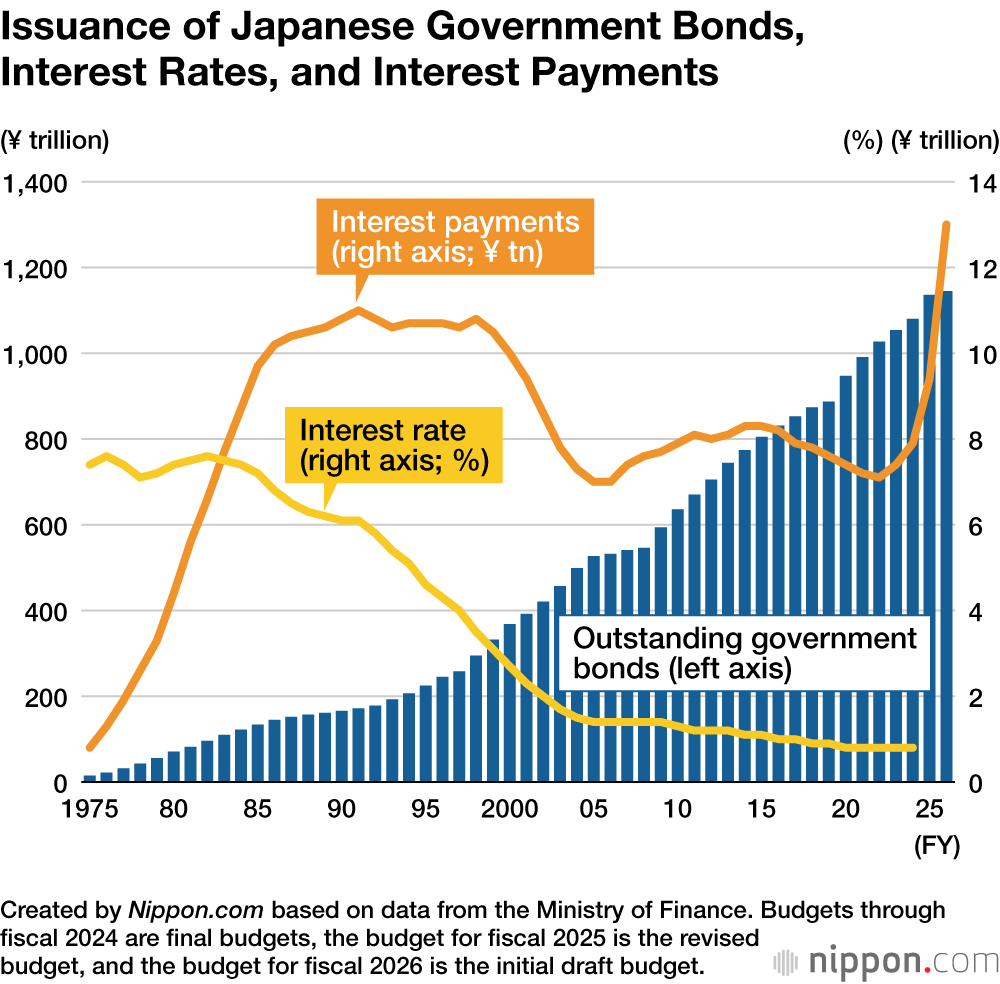

The outstanding amount of issued government bonds increases each year and is predicted to reach ¥1.15 quadrillion by the end of fiscal 2026. This includes ¥13 trillion in interest payments. Interest has become a factor again after the Bank of Japan switched from its policy of negative interest rates, and if long-term rates rise they will put further pressure on public finances.

Data Sources

- Data on the key points and framework of the fiscal 2026 budget, and the fiscal situation in Japan (Japanese) from the Ministry of Finance.

(Translated from Japanese. Banner photo: Prime Minister Takaichi Sanae (left) listens to questions alongside Finance Minister Katayama Satsuki at a House of Councillors Budget Committee session. Photo taken on November 12, 2025. © Jiji.)