Japan’s Share Buybacks on Track for Record High in Fiscal 2025

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Management Focused on Boosting Share Prices

Corporate share buybacks in Japan, where listed companies repurchase their own stock, are set to reach an all-time high in fiscal 2025. While buybacks enhance shareholder benefits by lifting stock prices, some argue that companies should allocate available funds to capital investment or increased wages for employees instead.

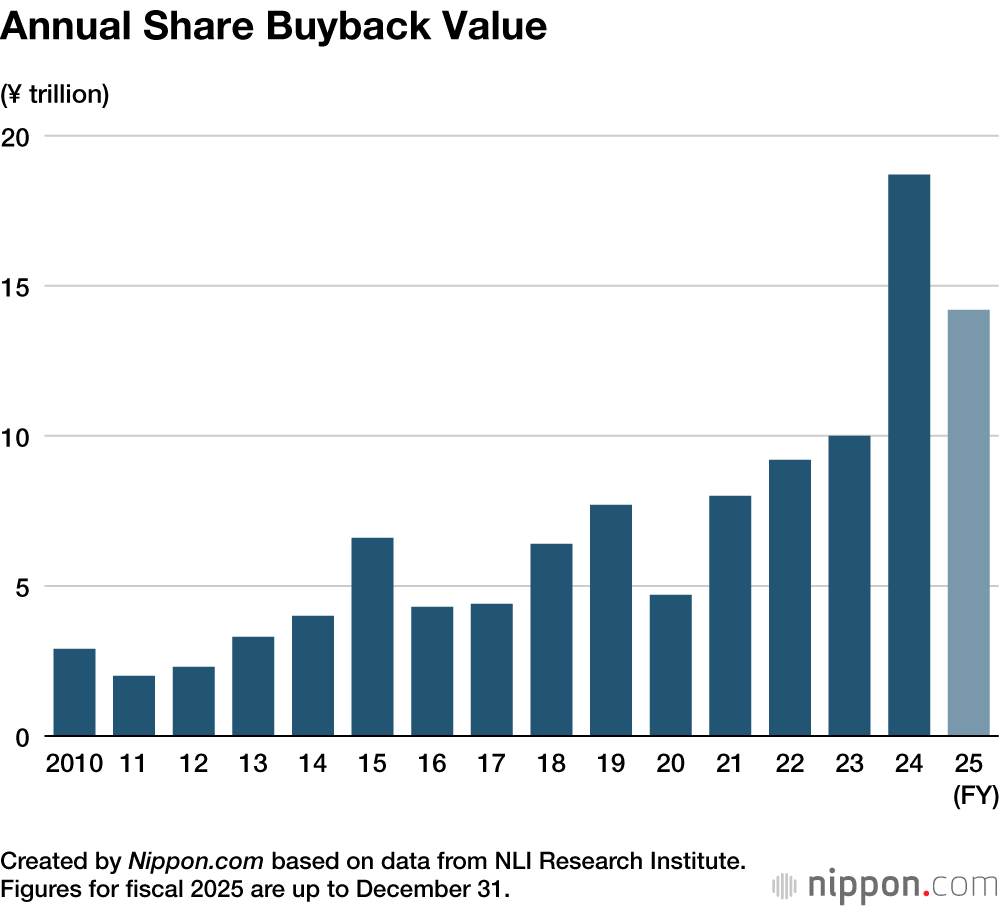

For share buybacks, companies set an upper limit on the number of shares to purchase and then buy them back over a fixed period of time. The amount of funds authorized for buybacks between April and December 2025 totaled ¥14.2 trillion, according to calculations made by the Tokyo Stock Price Index (TOPIX). The largest share buyback was announced by Mitsubishi Corporation in April, capped at ¥1 trillion.

Morishita Chizuru, a researcher at the NLI Research Institute, stated that if the current momentum continues, “fiscal 2025 could match the previous year’s ¥18.7 trillion in buybacks or even surpass that amount to set a new record for the fifth straight year.”

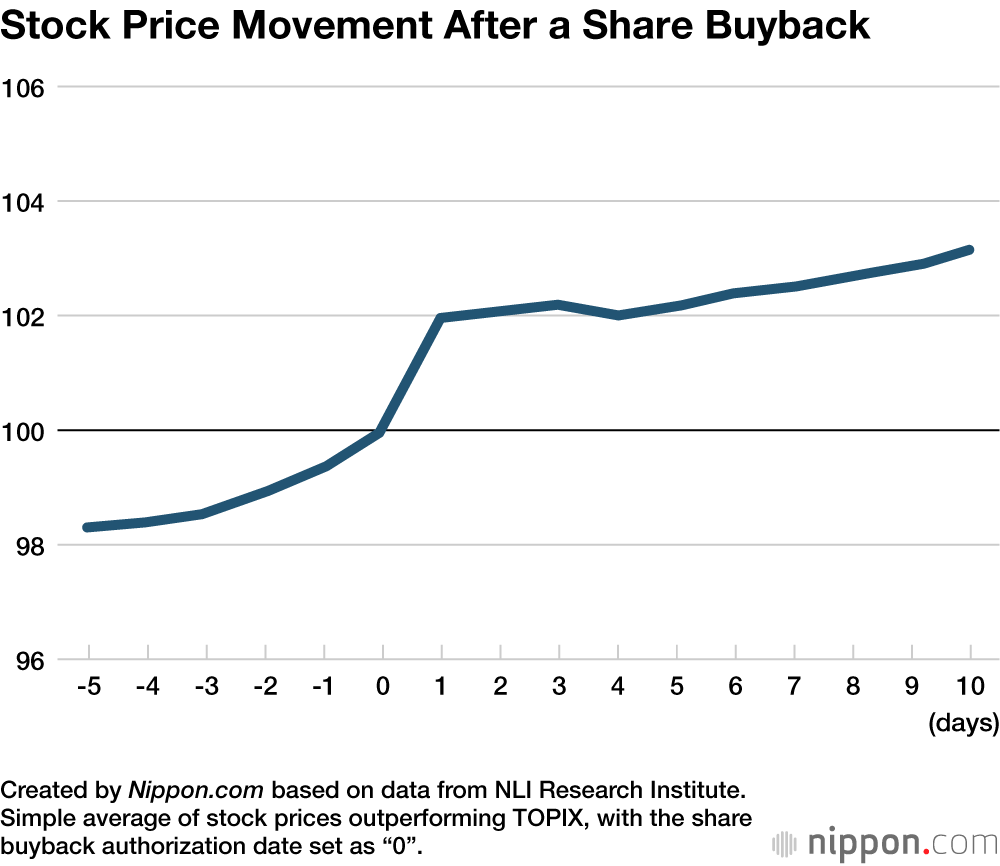

Share buybacks by companies reduce the number of shares available on the market, thereby raising earnings per share, as calculated by dividing profit by the number of shares outstanding. In this way, buybacks help lift stock prices. According to the NLI Research Institute, on the day following a company’s announcement of a share buyback, the price of its stock outperforms TOPIX by around 2% on average. The practice of buybacks is also a factor that has lifted overall stock prices, including the Nikkei Average.

Following the formulation of the Corporate Governance Code in 2015, as a guideline for improving corporate value, the Financial Services Agency and the Tokyo Stock Exchange began encouraging companies to implement “management that is conscious of stock prices.” Another factor behind the surge in share buybacks in recent years is demand among foreign investors for greater shareholder returns.

Revisions to the CGC are expected this year. Within the business community, some concerns are being voiced about the way management resources are being allocated. Kobayashi Mitsuyoshi, an executive advisor at NTT West, offered the following comments: “While returns for shareholders have expanded significantly, the growth in wages and capital investment have remained limited. It is crucial for companies to reassess whether they are adequately achieving sustainable growth and enhancing their corporate value over the medium- to long-term.”

Data Sources

- Analysis of corporate share buybacks in FY 2025 (Japanese) by NLI Research Institute.

- Proposal for revision of corporate governance code (Japanese) by Financial Services Agency.

(Translated from Japanese. Banner image © Pixta.)