Hometown Tax Showdown: Interview with Izumisano Mayor Chiyomatsu Hiroyasu

Politics- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Neither Cute nor Cuddly

Most Japanese local governments have fluffy promotional mascots—–known colloquially as yuru kyara—that incorporate something famous about the locality.

Izumisano, a city in the south of Osaka Prefecture bordering the Kansai International Airport, has Inunakin. The character is neither cute nor cuddly, but a canine superhero wrestler bursting with brawn. Named after nearby Mount Inunaki and designed by the author of the popular Kinnikuman (Muscle Man) manga series, Inunakin’s motto is “to make utmost effort.”

It’s an apt mascot for Izumisano. For over a year, the city that has been single-handedly wrestling the central government over a controversial donation scheme for local government.

Inunakin (left) shows off his second-place medal alongside other winning mascots at the 2019 Yuru Kyara Grand Prix in Nagano. (© Jiji)

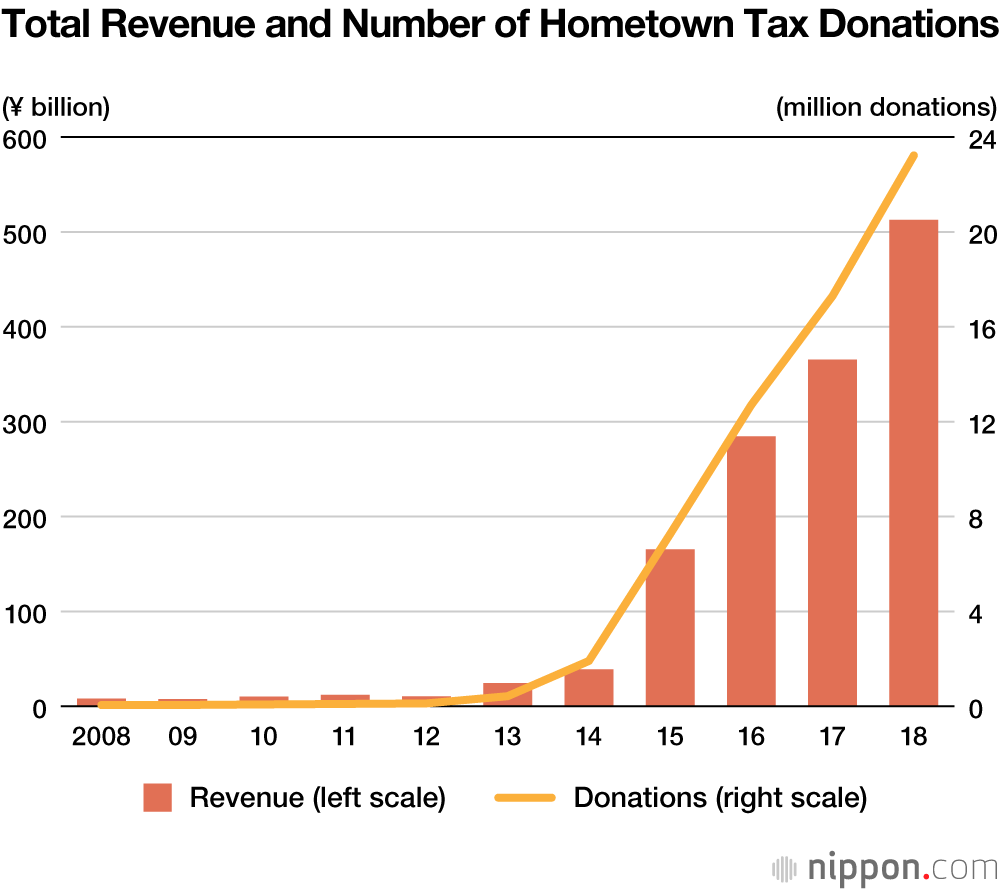

The program in question, the furusato nōzei (hometown tax payment) system, allows taxpayers to donate a portion of their local taxes to a local government of their choice. In return, local governments send gifts—oftentimes local produce, processed foods, or crafts—to thank donors. First introduced in 2008, the scheme exploded in popularity in 2015 after the maximum amount that could be deducted doubled to 20%. Efforts to attract donations have triggered fierce competition among local governments offering ever more lavish gifts, often unrelated to their locality, through easy-to-use portal sites.

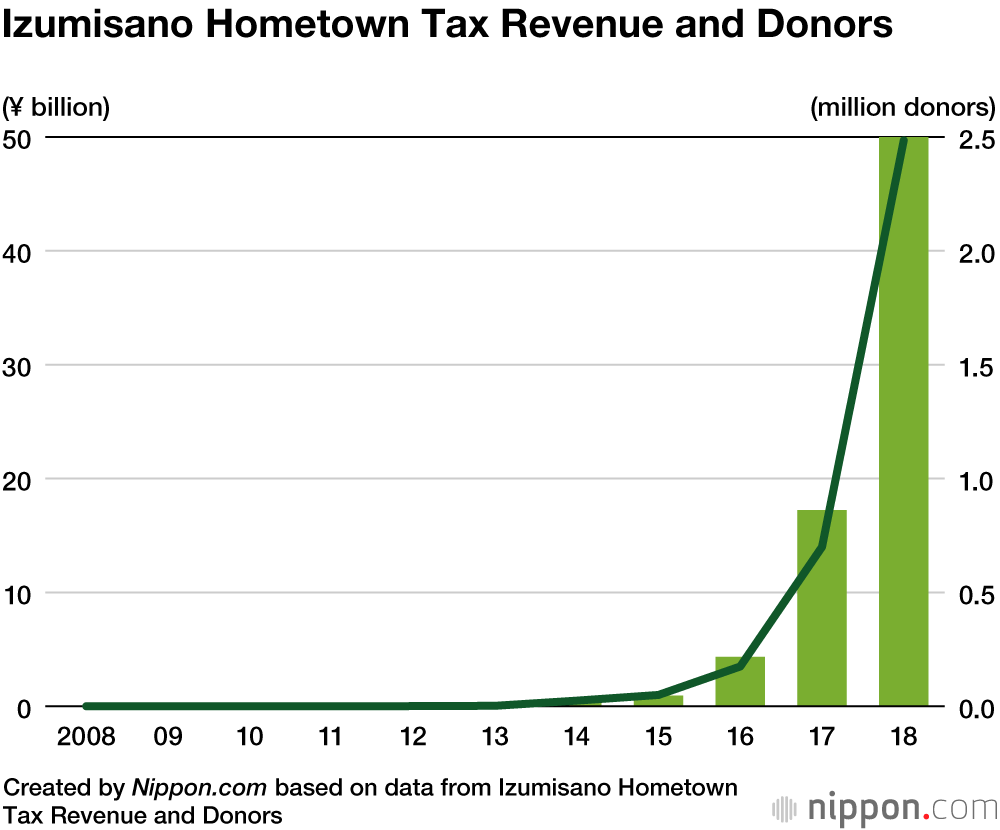

Izumisano became Japan’s top donor recipient in 2019, raking in ¥50 billion through aggressive campaigns featuring high-value goods and Amazon gift cards. The sum represents nearly a tenth of all donations nationwide and more than double the city’s average annual local tax revenues (around ¥20 billion).

Facing mounting criticism that the donation system was getting out of hand, the central government clamped down, issuing guidelines advising localities to limit the value of return gifts to no more than 30% of the donation and restrict gifts to locally sourced goods. When the law was finally changed to reflect these guidelines in June of 2019, the internal affairs ministry excluded Izumisano and three other municipalities from the scheme, claiming the local governments were abusing the system.

Izumisano alone fought back.

The city first took the issue for dispute arbitration and then sued the ministry in the Osaka High Court. Although the court ruled against Izumisano in January, the city appealed to the Supreme Court. Izumisano Mayor Chiyomatsu Hiroyasu, a black belt in Judo and former American football player, is promising “to fight to the end.”

On March 13, I sat down with Mayor Chiyomatsu to talk about the city’s ongoing spat with the central government and what it says about local autonomy in Japan. The peculiar hometown donation tax system reveals much about challenges facing local governments, the limits to decentralization, and the risks of half-baked schemes counting on market competition to vitalize regions.

Izumisano Mayor Chiyomatsu Hiroyasu (left) speaks at a press conference in Osaka on January 30, 2020, regarding the Osaka High Court’s ruling.

Whack-a-Mole

“The government envisioned the hometown tax as a clever way of encouraging local communities to come up with ideas to attract extra funding,” says Chiyomatsu. “But when competition over-heated and brash local governments like ours appeared, the ministry of internal affairs feared things were getting out of control and in a panic changed the law.”

Inaugurated under the leadership of current Chief Cabinet Secretary Suga Yoshihide, then minister of internal affairs, the system was designed so citizens could give back to their “hometowns” and other local communities that were dear to them. The scheme was also part of a broader effort to combat over-centralization, with donations redistributing a measure of the large tax revenues from big cities to rural regions facing depopulation, aging, and outflow of workers to urban areas.

Even as central government subsidies and funding to local governments were reduced, municipalities and prefectures were encouraged to compete for donations that they could use to revive their communities. For the fiscal year ending in March 2019, four million taxpayers had donated a total of ¥510 billion, jumping thirteen-fold from 2015. Since total local residence tax revenues are around ¥13 trillion, this still represents a fraction of tax revenues that theoretically could be deducted if all Japanese citizens donated the maximum deductible amount.

Izumisano and a handful of aggressive local governments bought the ire of other cities less successful in attracting donations. In its judgement, the Osaka High Court stated that the city had “greatly impacted other municipalities by collecting donations in ways that go against the scheme's original purposes.”

Complaints from other localities and a desire to keep things in check led the ministry to publish ever stringent regulations and eventually revise the law.

“The government’s handling of the hometown donation tax system has revealed how decentralization is not progressing, but is being reversed,” says Chiyomatsu. “The independence and autonomy of regions promoted by the central government in recent years basically meant ‘don’t depend on us.’ But when our city took the initiative, they whacked us down like a whack-a-mole. Decentralization in Japan, we learned, is just empty rhetoric.”

Ex Post Facto

When Izumisano appealed to the Supreme Court earlier this year, it noted that the ministry of internal affair’s decision was “an arbitrary and unconstitutional act that undermined local autonomy.”

The city is arguing that the ministry was, by excluding Izumisano and other municipalities, applying ex post facto law. Until the revisions to the hometown tax donation law, there were no legal restrictions on what kind or value of gifts local governments could send donors. In fact, the scheme originally did not envision such “return gifts” at all.

Moreover, the series of ministry guidelines on gifts, such as keeping their value under 30% of the donation, were nonbinding “technical advice.” Since Japan passed a series of decentralization laws in 2000, central and local governments are theoretically on equal footing; central ministries may advise local governments, but they may not punish them for not following such advice.

“So now we are fighting till the end so as to not leave a source of problems for the future of local autonomy in Japan,” Chiyomatsu says.

Marketing Savvy

There is no question that Mayor Chiyomatsu has made utmost effort to generate revenue for his city of 100,000. In 2009, the central government designated Izumisano as a local government needing to improve its finances, stemming largely from debts of over ¥90 billion incurred to build facilities related to Kansai International Airports (partly in the city’s territory, shared with two neighboring municipalities, with the bridge being solely within Izumisano).

Chiyomatsu, who studied economics at Dōshisha University and Lincoln University in the United States and later worked for Kyoto-based Horiba Engineering, has marketing savvy in spades. Under his leadership, the city pursued innovative revenue-raising schemes like selling naming rights of the city, taxing dog owners, and applying taxes on use of the bridge to Kansai International.

But it was the hometown donation system in which Izumisano struck gold. In 2014, the city signed a comprehensive deal with Trustbank Inc., a company running a popular internet platform for hometown tax donations. Izumisano promised the company bonus remuneration if the city became number one in donation revenues nationally. Since then, it has offered a range of popular gifts, such as locally manufactured towels and mileage points for Peach Aviation (a locally based budget airline), eventually adding Amazon gift cards on top of such offerings.

Chiyomatsu explains that some ¥17 billion of the ¥50 billion raised in donations in 2019 remained even after deducting the costs of return gifts and administration. “For a city whose annual revenues are about twenty billion yen, this is huge,” he notes.

Fighting to the End

Although saddled with debt, Izumisano has relatively large local tax revenues, in part from the airport facilities, and only receives 6.7% from local allocation tax, a relatively low figure.

“Izumisano fought to the end because we aren’t easily controlled by tax allocations,” explains Chiyomatsu. Referring to a town in Shizuoka that was also excluded last year and quickly went cap in hand to Tokyo to apologize to the ministry, he adds, “If we’d been in their situation, we may have had to back down, too.”

In any case, during the showdown, the ministry of internal affairs threatened to reduce the city’s subsidies, and in fact cut its special revenue-sharing grants twice last year. The mayor says the city is considering a separate lawsuit if it decides to cut allocations again.

Chiyomatsu enjoyed backing from different quarters in the ongoing struggle: the governor of Osaka who is from the Japan Innovation Party and champions local autonomy; sympathetic Diet members; as well as local voters. In 2019, the mayor sailed to a third consecutive term, despite the Osaka branch of the ruling Liberal Democratic Party pulling its support over his antagonistic position to the central government. “During the campaign, supporters frequently shouted out to me to keep up the fight,” says Chiyomatsu.

Insidious Competition

Looking beyond Izumisano’s experience, the hometown donation tax scheme is riddled with systemic problems, much of it undealt with in last year’s legal changes.

Foremost is the question of loss of revenue for individual municipalities and the state as a whole. The bulk of donors are in larger cities in populous regions—Kanagawa, Aichi, Tokyo, Osaka—and some municipalities, such as Yokohama, Nagoya, Minato, and Setagaya have seen drastic outflows of residence tax revenues due to donations. The central government compensates three-quarters of these losses of revenue with extra tax allocations, further weighing on already dire national finances.

More problematic is how net revenue to the state is lost by maintaining this gift-giving scheme in order to pay commissions to internet platform services and advertisers as well as purchase and ship return gifts. Under the new legislation, all costs must be kept under half of the received donations. At that rate, Japan last fiscal year lost ¥250 billion in taxes that could have been used for public services and initiatives to revive local economies. Worryingly, these losses could expand if more taxpayers decide to participate in the racket.

There is also the regressive nature of the tax deduction scheme to consider. The wealthier you are, the more you can donate and deduct from your local taxes, amassing ever more “gifts” from across Japan. In effect, this is, as critics have called it, a system of “catalogue shopping” and “government-legitimated tax avoidance.” Such actions privatize the benefits of what should be a public resource. More worryingly it erodes trust in the fairness of the taxation system.

Nor is it clear that short-term surges of donations will help revitalize local economies sustainably. Kinoshita Hitoshi, an expert on reviving regional communities, has called the hometown tax donation system “bad competition leading to bad results” encouraging “first-come, first-served” behavior that disregards the public good.

Kinoshita writes: “The central government shouldn’t be fanning this nonsensical competition for short-lived resources, but rather decentralize fiscal resources and design incentives which encourage localities to invest in their economies for the long term.”

The scheme also undermines support for decentralization and local self-determination by rewarding beggar-thy-neighbor competition. Though the current administration, as have past ones, called for localities to take initiative and be more independent, the overall results from their institutional tweaks, such as the donation scheme, to the local government system have been dismal: overconcentration of wealth and population in Tokyo continues, regional inequalities have expanded, and most rural areas continue to atrophy.

For it is in Giving that We Receive

Chiyomatsu, a sportsman, says that “leaders must make the effort, rather than waiting idly by and looking on enviously.” This is certainly true. But even if we accept the need for greater innovative efforts among local governments and residents, it is not clear whether a level playing field can be achieved.

The new scheme is not fair for all regions. Return gifts must basically be locally sourced and all costs, including shipping, must be within 50% of the donation received. “Municipalities with popular local produce have an unfair advantage,” points out Chiyomatsu. Not all regions, including Izumisano, can offer brand rice, beef, or crabs—the so-called three sacred items of hometown tax donations—or similar attractive goods. Additionally, regions far from the major cities where most wealthy donors live will need to pay higher freight costs, forcing them to offer less valuable return gifts.

“The central government should ideally let local governments decide what rules should apply to the hometown tax donation system as they know what’s best for themselves,” says Chiyomatsu.

That is also largely true, but whether a more equitable and less restrictive system would emerge from agreements among Japan’s 1,800 or so local governments is less clear.

In the meantime, as the sovereign referee and guardian of all local communities in Japan, the central government must think long and hard about the viability of this donation scheme. So far, it seems, Tokyo has focused its energy on punishing those who step out of line while papering over the cracks of a poorly thought-out system.

The central government, and more importantly Japanese taxpayers, should remember that it is not the gift, but the thought that counts.

(Originally published in English. Banner photo: Izumisano Mayor Chiyomatsu Hiroyasu (center) on January 30, 2020, with municipal officials and legal team outside the Osaka High Court prior to hearing the ruling in the city’s case against the central government. © Jiji.)