Path to Zero Emissions: Honda Latest Automaker Focusing on Hydrogen Technology

Economy Technology Environment Culture- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Hydrogen Horizons

Japanese automaker Honda is boosting its hydrogen business initiatives. At a press briefing in Tokyo in February of this year, company executives unveiled plans to launch a new fuel cell electric vehicle in Japan and North America in 2024. The FCEV will be equipped with a next-generation fuel cell system codeveloped with US carmaker General Motors. If realized, the vehicle will place Honda among the ranks of Toyota and Hyundai in having a hydrogen-fueled car model commercially available.

An early proponent of hydrogen power in the car industry, Honda has been researching the potential of hydrogen technologies and fuel cell vehicles for more than three decades. It developed its first prototype in 1998, and since 2013 it has teamed up with GM to build a next-generation fuel cell system. Honda has built three models of FCEVs to date, but all have had limited production runs, serving either for research and development purposes or leased in select markets.

With its new FCEV, though, Honda is looking to make a passenger vehicle that can stand shoulder to shoulder with the two other commercially available fuel-cell vehicles in Japan, Toyota’s Mirai and Hyundai’s Nexo. (Mercedes-Benz released its GLC F-Cell in 2019, but it is currently only available for lease.)

The second-generation Toyota Mirai. The 2020 model starts from around ¥7.1 million, slightly less than the ¥7.8 million price tag for a 2022 Hyundai Nexo, and travels up to 850 kilometers on a single tank. (© Toyota)

In simple terms, a fuel cell relies on the chemical reaction between hydrogen and oxygen to generate power, with the only emission being water. The energy to propel the vehicle comes from hydrogen electrons traveling along a dedicated circuit.

In the case of FCEVs, the hydrogen fuel is stored in high-pressure tanks inside the vehicle, with oxygen coming from the air. Fuel cell vehicles have been touted as environmentally friendly, and many experts argue that they are crucial for achieving a sustainable, carbon-neutral society.

The fuel cell on the Toyota Mirai powers the 134 kW (182 HP) rear-drive motor. (© Toyota)

BEV Dominance

While FCEVs are garnering attention, they continue to be overshadowed by fully electric vehicles with rechargeable batteries, or BEVs, which have surged in popularity worldwide. From 2021 to 2022, BEV sales as a portion of the car market rose three points to 12.1% in Europe, climbed by over two and a half points to 5.9% in North America, and nearly doubled to 20% in China. By comparison, the pace of sales in Japan has been anemic, increasing by a little over one point to 1.7%.

BEVs have taken center stage as zero-emission vehicles, with demand rising as Japan and other nations work toward achieving broad commitments to decarbonize society. Although a lack of charging stations and other basic infrastructure has presented a hurdle to the uptake of BEVs, momentum is clearly in their favor. This leaves one to wonder what role, if any, FCEVs have to play.

In answering this question, it is important to consider the advantages FCEVs have over their battery-powered counterparts. Prominent among these is their short refueling times, typically around 3 to 5 minutes compared to the hours needed to fully charge a BEV. The high energy storage capacity of hydrogen also gives FCEVs significantly longer driving ranges than BEVs powered by even the most advanced lithium-ion batteries. Fuel cells are beneficial from a sustainability standpoint, too, as they utilize one-fiftieth the lithium and cobalt that go into manufacturing EV batteries, an appealing point considering the heavy burden on the environment from mining these minerals.

FCEVs also have their downsides, though. For one, fuel cells are less energy efficient than BEVs. A 2001 paper by Max Ahman of Sweden’s Lund University found that the powertrain of FCEVs had a maximum efficiency of 34%, barely double the 14% of gasoline engines and far behind the 61% of BEVs. Another drawback is the need for large, pressurized fuel tanks to store hydrogen, which make fuel cells less suited to smaller passenger vehicles.

The growing consensus among experts assessing the pros and cons of the different technologies is that fuel cells are more practical for large, long-haul vehicles, whereas BEVs are better for city commutes and driving around town. Seen in this light, BEVs are not in competition with FCEVs, but rather the two complement each other by fulfilling distinct transportation needs.

There is also growing evidence that developing both side by side would be beneficial from the perspective of infrastructure. BMW, for instance, has suggested that building infrastructure solely with BEVs in mind would be more costly in the long run than a broader approach that included other types of zero-emission vehicles.

BMW recently unveiled its new fuel-cell vehicle, the iX5 Hydrogen. The German automaker began limited production of the FCEV in December 2022. (© BMW)

BMW bases its argument on the domestic forecast of over 20 million BEVs on German roads compared to a few million FCEVs, with the automaker saying that supporting such a concentration will require extensive upgrades to the power grid at considerable cost. It notes that BEV charging stations would be relatively easy to install in urban areas with well-developed power grids, whereas hydrogen refueling stations would be a more cost-effective option in rural areas where drivers typically travel greater distances.

Although BMW’s focus is on Germany, the scenario can be just as readily applied to Japan. Here, though, the hurdles in installing recharging stations at housing complexes in cities have hampered the uptake of BEVs, a situation that could bolster the appeal of FCEVs for urban residents. Currently, many BEV drivers must go out of their way or face long waits to recharge their batteries. Installing hydrogen refueling ports at existing gas stations would make FCEVs more attractive to city dwellers by enabling owners to quickly fill their tanks in much the same way as drivers of gasoline vehicles.

Having easily accessible fueling stations would also help in the development of other types of hydrogen vehicles. For instance, Toyota is currently working on a hydrogen engine-equipped car that burns the element in a similar way to a conventional gasoline motor. While hydrogen engines are appealing for such reasons as carmakers can rely on existing combustion engine technology, Toyota is currently the only company developing a model.

Most firms with hydrogen-fueled vehicles, including the likes of Toyota, Honda, GM, and Hyundai, are focusing on FCEVs. The Stellantis Group, the world’s fourth largest automaker boasting a sizable portfolio that includes brands like Jeep and Peugeot, is also looking to expand its FCEV offerings, as illustrated by the recent announcement that it is looking to bolster its share in a collaboration with French fuel-cell system maker Symbio.

Toyota’s hydrogen engine-equipped Corolla competes at the Fuji Super TEC 24 Hours Race at the Fuji Speedway in Shizuoka Prefecture in 2021. (© Toyota)

Industrial Applications

Hydrogen lends itself to numerous industrial applications beyond passenger vehicles. Notably, the Japanese government is looking to expand its reliance on hydrogen in the energy-related sector, placing it alongside offshore wind and fuel ammonia as a core component of its “green growth strategy” for achieving net zero emissions by 2050.

Along with power generation, the government’s roadmap points to hydrogen as a key carbon-neutral technology in areas like transportation and industry while stressing the need to involve a wide range of players to boost industrial competitiveness as countries in Europe and East Asia step up their hydrogen efforts. Such a high-level commitment guarantees that hydrogen will play a greater role than just powering passenger vehicles.

Core to the Japanese government embrace of hydrogen is its potential as a renewable energy source that can compete with fossil fuels. Unlike electricity, which must be produced regionally due to the tendency of long transmission lines to suffer power loss, it can be made in areas where there are plentiful raw materials and transported over vast distances. It is also easier and less costly to store than constructing large, expensive battery arrays.

These factors are driving interest in developing hydrogen’s potential to bridge the gap in wind and solar energy, which are hampered in their ability to meet base power needs due to fluctuations in output and land constraints that affect the construction of large-scale installations. Utilizing renewable power generated during off-peak hours, so-called green hydrogen (which has no carbon emissions) can be produced and stored, allowing utilities to cover shortfalls in demand.

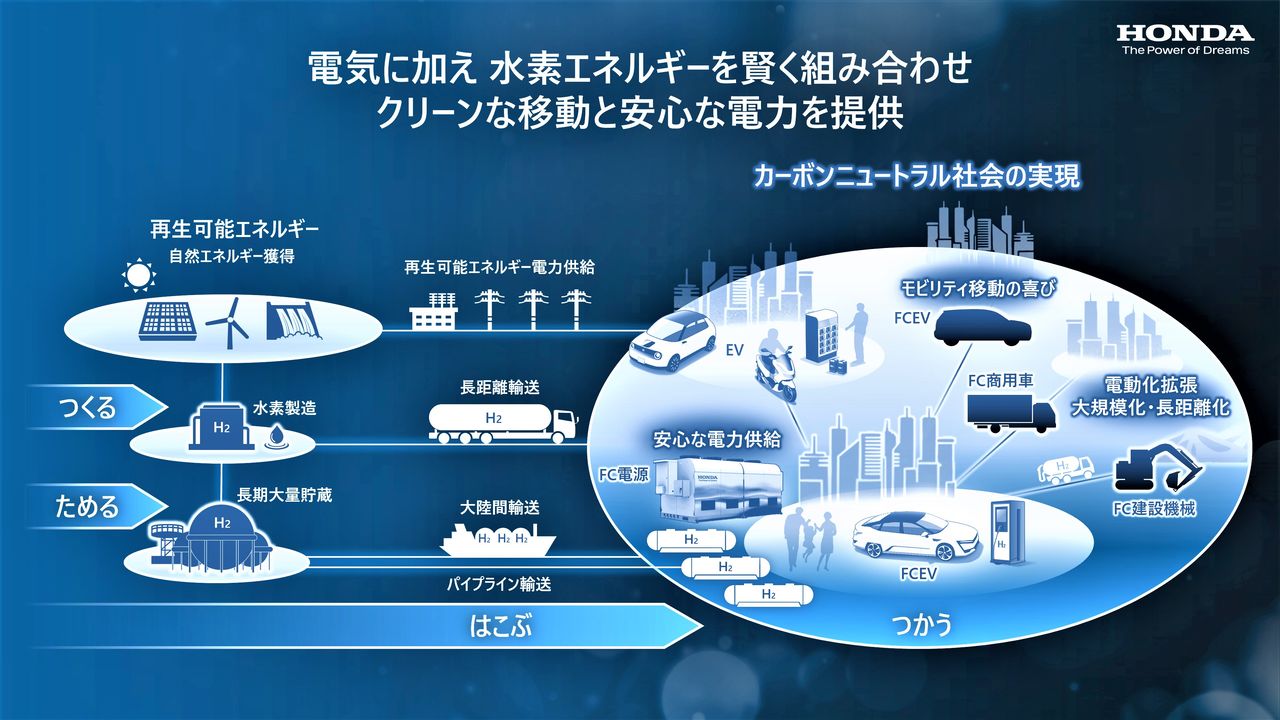

Honda plans to expand the use of hydrogen to all sectors of its business by 2050. (© Honda)

Japan has a limited hydrogen producing capacity and is working to create an international value chain, with a focus on developing technology and infrastructure for transporting hydrogen in liquid form that include several ongoing projects in Australia. While much of the hydrogen from Australia is derived from carbon-emitting sources like coal or natural gas, efforts are being made to increase the share of green hydrogen.

Honda’s announcement that it was expanding its hydrogen business comes amid this growing interest in hydrogen as a low-cost energy carrier. Along with its planned new FCEV, Honda is looking to apply the next-generation fuel cell system it codeveloped with GM in a range of areas, including grouped in arrays to power large cars, trucks, and construction equipment as well as in stationary power units. Honda is confident that its new system, which is one-third the cost and twice as powerful as its predecessor, will win over customers.

Following step, Toyota and BMW are also planning new applications for their fuel cell systems, such as in large trucks.

While BEVs look to become the main zero-emission vehicle going forward, fuel cells undoubtably have a role to play as society moves to decarbonize. The best approach for achieving carbon neutrality would be to utilize both technologies to their fullest.

(Originally published in Japanese. Banner photo: Honda’s senior managing executive officer Aoyama Shinji (center) and others pose with the automaker’s next-generation fuel system during a press conference announcing the firm’s new hydrogen business initiatives. © Jiji.)