BOJ won't use operation to defend yield target 'frequently', says Gov Kuroda

Newsfrom Japan

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

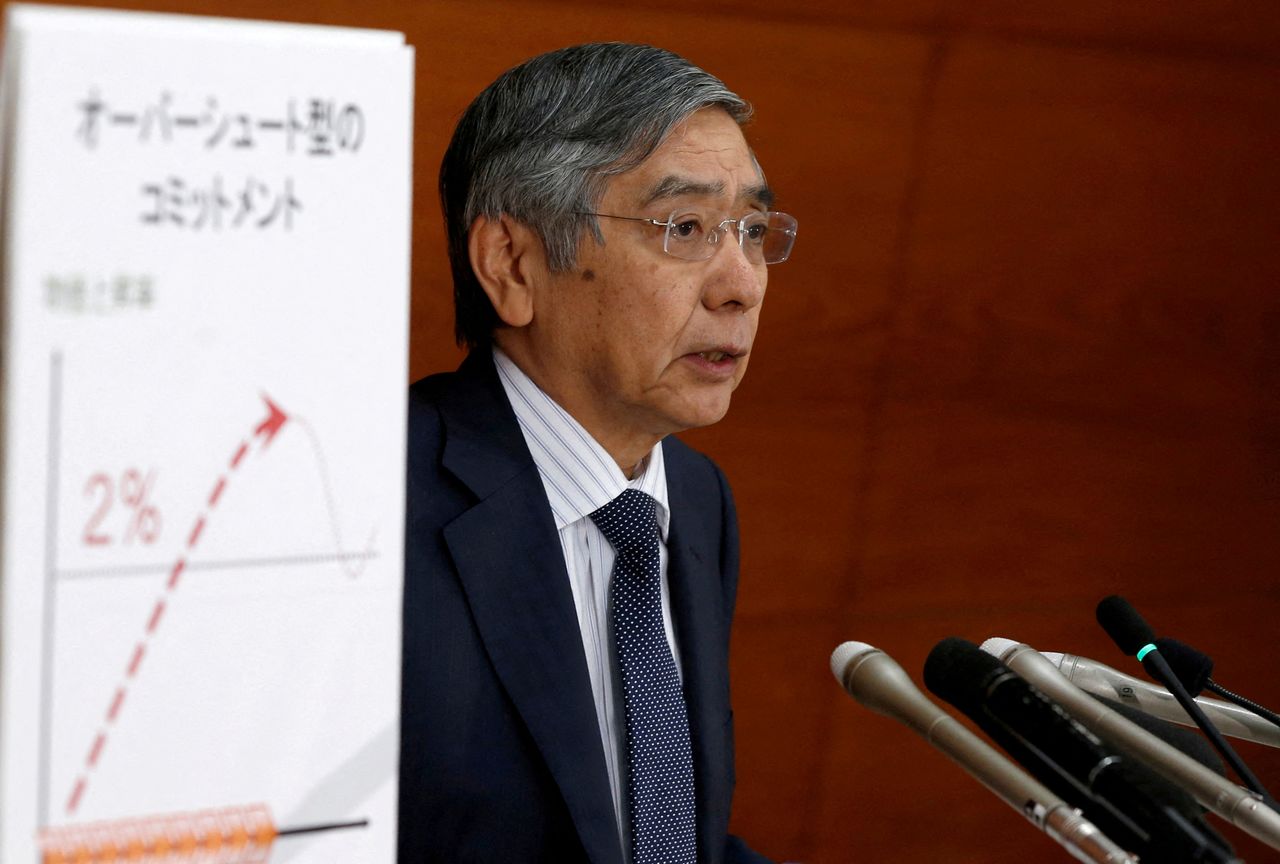

FILE PHOTO: Bank of Japan (BOJ) Governor Haruhiko Kuroda attends a news conference at the BOJ headquarters in Tokyo, Japan, September 21, 2016. REUTERS/Toru Hanai/

By Leika Kihara

TOKYO (Reuters) -The Bank of Japan's offer to buy an unlimited amount of government bonds to defend its yield target was a tool of "last resort" that won't be deployed frequently, its Governor Haruhiko Kuroda said on Tuesday.

Kuroda said the central bank will balance the need to support the economy with ultra-loose monetary policy, and mitigate the rising cost of prolonged easing such as the hit to bank profits from years of low interest rates.

The benchmark 10-year Japanese government bond (JGB) yield slid to as low as 0.2% on Monday after the BOJ offered to buy an unlimited amount of bonds of that maturity to defend an implicit 0.25% cap set for its key yield target.

Kuroda said the BOJ stepped into the market because the recent rise in JGB yields was driven by factors unrelated to Japan's economy, such as rising overseas interest rates.

"It's a last resort ... and a powerful means not used explicitly by other central banks," he said of the BOJ's offer to buy unlimited bonds at a set level.

"We don't expect to conduct such operation frequently. We'll do this as needed," Kuroda added.

Prospects of accelerated U.S. policy tightening and bets the BOJ would need to taper its ultra-loose policy sent the 10-year yield to 0.230% last week, the highest since 2016.

The market move tested the BOJ's resolve to defend its key yield target, without tightening its control too much in a market made dormant by its huge presence.

Kuroda repeated the BOJ's pledge to keep monetary policy ultra-loose with Japan's inflation distant from its 2% goal.

"Japan's economic and price conditions warrant maintaining our easy monetary policy," he said.

Under yield curve control, the BOJ guides short-term rates at -0.1% and the 10-year JGB yield around 0%.

The policy aims to keep borrowing costs low to stimulate the economy and fire up inflation to the BOJ's 2% target, while preventing excessive falls in super-long yields that would crush financial institutions' margin.

As part of efforts to breathe life back to a dormant JGB market, the BOJ clarified in March last year that it will allow the 10-year yield to move up and down 25 basis point each from the 0% target.

(Reporting by Leika Kihara; Editing by Kim Coghill and Tom Hogue)

(c) Copyright Thomson Reuters 2022. Click For Restrictions -

https://agency.reuters.com/en/copyright.html