Japan's service sector activity contracts at fastest pace in 21 months - PMI

Newsfrom Japan

- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

TOKYO (Reuters) -Japan's services sector activity shrank in February at the quickest pace in nearly two years, a survey showed on Thursday, as business took a hit from struggling consumer sentiment after a record spike in infections of the Omicron coronavirus variant.

The activity contraction highlights the challenge Japanese policymakers face in stimulating consumer spending to keep a fragile recovery on track as the Ukraine crisis and supply disruptions worsen uncertainty in the economic outlook.

The final au Jibun Bank Japan Services Purchasing Managers' Index (PMI) fell to a seasonally adjusted 44.2 from the prior month's final of 47.6, marking the fastest rate of contraction since May 2020.

While activity stayed well below the 50-mark that separates contraction from expansion on a monthly basis, that was better than a seasonally adjusted 42.7 flash reading.

"Activity and new business declined at the sharpest pace since last August," said Usamah Bhatti, economist at IHS Markit, which compiles the survey.

Business in the sector saw overall input prices rise for the 15th straight month, citing increased fuel and raw material costs, but that did not lead them to charge more for services as the surge in coronavirus cases hit consumer demand.

"Firms made attempts to stimulate demand by engaging in price discounting measures for the first time in six months, despite a renewed acceleration in average cost burdens," said Bhatti.

The composite PMI, which is calculated using both manufacturing and services, fell to 45.8 from January's final of 49.9, contracting at the fastest speed in 18 months.

A separate government data showed Japan's consumer confidence index fell for a third month in February, hitting the lowest in nine months.

"Higher COVID-19 infections...and a continuous rise in everyday goods prices influenced the consumer sentiment," a government official told a press briefing on Thursday, adding record-high 91.7% of consumers surveyed for the data said they expected prices to rise in one year.

The world's third-largest economy is expected to see growth grind to a near halt this quarter, likely growing an annualised 0.4%, as coronavirus curbs and supply bottlenecks weigh on overall activity, a Reuters poll showed this week.

(Reporting by Daniel Leussink; Additional reporting by Kantaro Komiya; Editing by Sam Holmes and Lincoln Feast.)

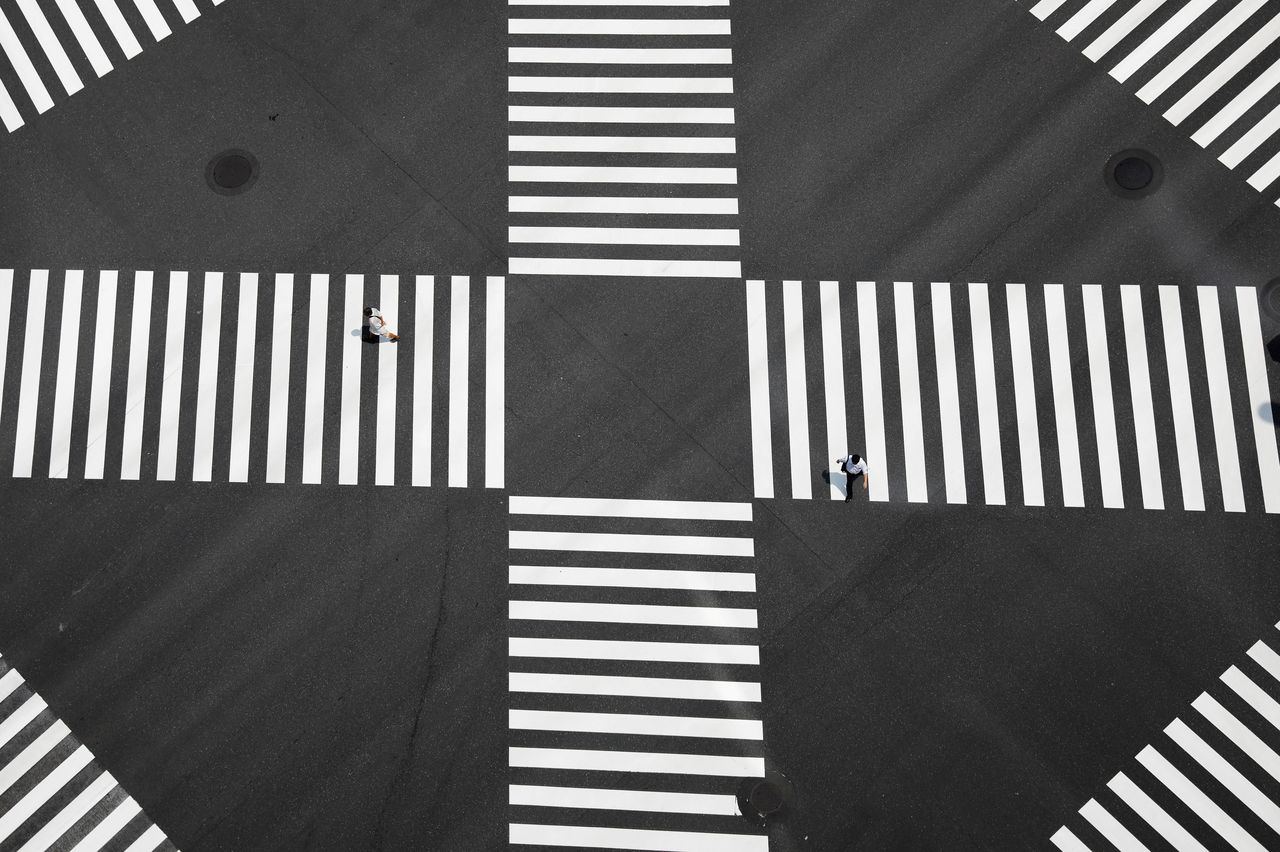

People wearing protective face masks walk past a cross road at a shopping district in Tokyo, amid the coronavirus disease (COVID-19) outbreak, Japan August 17, 2020. REUTERS/Kim Kyung-Hoon

Workers repair a facility of a chemical factory at the Keihin Industrial Zone in Kawasaki, Japan September 12, 2018. REUTERS/Kim Kyung-Hoon

(c) Copyright Thomson Reuters 2022. Click For Restrictions -

https://agency.reuters.com/en/copyright.html