Climbing Compensation: Wages See Fifth Straight Year of Growth

Economy- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

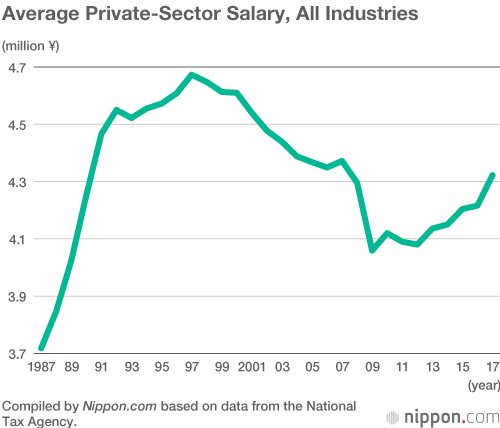

According to a report on salaries by the National Tax Agency, the average salary of employees in private companies grew from the previous year by 2.5% to ¥4.32 million in 2017. Wages have increased for five consecutive years, and have almost recovered to the same level as the ¥4.37 million reached in 2007, the year before the global financial crisis touched off by the collapse of the US subprime mortgage market. Male workers’ average wages increased year on year by 2.0% to ¥5.32 million, and female workers’ by 2.6% to ¥2.87 million—the highest recorded level for women.

The number of salaried employees increased by 1.6% to 49.45 million, of which 32.88 million were direct hires of companies (a 3.3% increase), and 11.33 million were part-time or contract workers (a 1.8% decrease). The full-time average salary of ¥4.93 million was nearly triple that of irregular workers, who pulled in just ¥1.75 million.

Salaries differed significantly by enterprise size. Companies with fewer than 10 employees paid workers an average of ¥3.52 million (¥4.37 million for men and ¥2.52 million for women), while those with 5,000 employees or more splashed out an average of ¥5.07 million (¥6.72 million for men and ¥2.72 million for women).

By industry, the highest paying sector was electric, gas, heat supply, and water utilities (¥7.47 million), followed by finance and insurance (¥6.15 million) and information and telecommunications (¥5.99 million). At the low end, employees in the accommodation and food and beverage industries took home an average of just ¥2.53 million.

In 1997, salaries hit a record-high level of ¥4,673,000, but Japanese wages began to fall that same year.

In April 1997, the consumption tax was hiked from 3% to 5% causing public consumer demand to drop sharply after the hike due to a reactionary splurge prior to it. This in turn drove San’yō Securities, Yamaichi Securities, and Hokkaidō Takushoku Bank into bankruptcy in November, touching off a crisis in the domestic financial sector. Companies asked middle-aged and older employees to take voluntary retirement packages to reduce costs, while also suppressing new hires and reducing the ratio of direct hires in favor of contract employees. To compensate for the labor shortages, meanwhile, employers turned increasingly to nondirect hires like part-time and contracted workers. These changes in employment structure were reflected in average salary trends, as was the impact of global economic trends—in 2009, wages fell by 5.5% from the previous year as a result of the global financial crisis.

Workers may cheer the fifth consecutive year since 2012 of average salary growth, but Japan has only recovered half of what it has lost in the last decade of deflated wages.

(Translated from Japanese. Banner photo © Pixta.)