Japan’s Consumption Tax Hike Raises Potential Gains for Gold Smugglers

Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

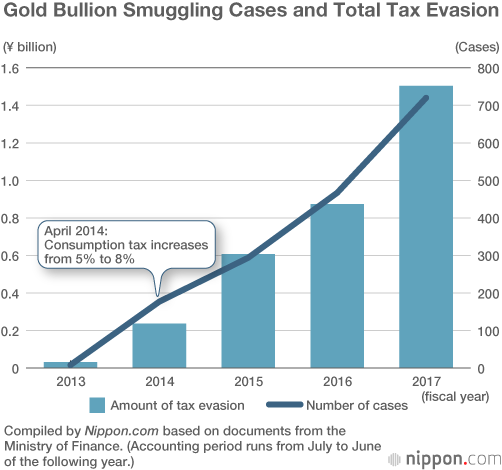

Gold smuggling is increasingly common in Japan. Criminal cases related to avoidance of import duties and consumption tax rose by almost 50% in the accounting year from July 2017 to June 2018, to 720. In the same period, the total amount of tax evasion hit a new record high, with a 70% increase to ¥1.54 billion.

The 2014 consumption tax hike from 5% to 8% sparked the recent increase. In Japan, gold is subject to taxation, so consumption tax has to be paid on it at customs. Smugglers who buy gold bullion in places like Hong Kong that do not have consumption tax and avoid the payment when entering the country can make 8% profit when selling the gold tax-inclusive within Japan.

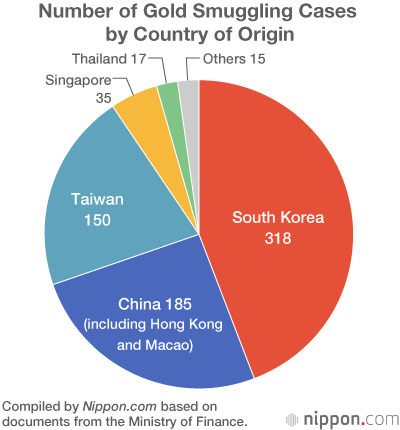

In 96% of cases, gold smugglers traveled as airline passengers, usually from elsewhere in East Asia. Ways to smuggle the gold ranged from simply wrapping it to the body using joint supports to more sophisticated techniques like wearing bras with gold-plate cup inserts and concealing gold in the battery sections of mobile phones.

Gold bra cup inserts that were worn to try and smuggle gold. Photograph courtesy of the Ministry of Finance. (© Jiji)

Gold bra cup inserts that were worn to try and smuggle gold. Photograph courtesy of the Ministry of Finance. (© Jiji)

In October 2019, consumption tax is set to rise to 10%, making gold smuggling even more enticing, so the Ministry of Finance is taking measures to strengthen borders, such as by increasing the number of metal detectors at airports. In April 2018, the Customs Act was revised to include stricter punishment for smuggling.

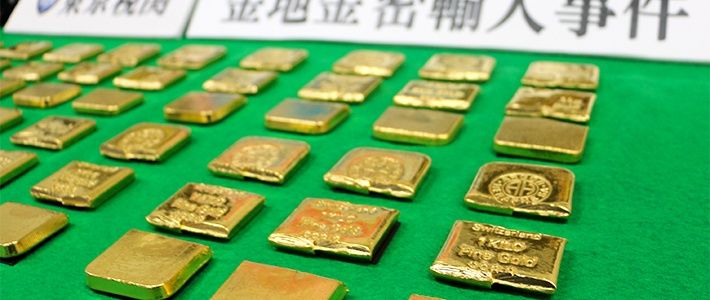

(Translated from Japanese. Banner photo: Gold bullion bars that had been split into three pieces and smuggled into the country. © Jiji.)