Falling Interest in the Far East? The Current State of Foreign Investment into China

World Economy Politics- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Figures in Free Fall

It was reported in February 2024 that foreign direct investments into China fell by more than 80% year on year in 2023, an annual drop on a scale unseen in 30 years. Reasons offered for this decline were economic uncertainties stemming from a sluggish real estate market, the unease caused by conflict between the United States and China, and the psychological shock of China strengthening its Counter-Espionage Law.

China’s Ministry of Commerce, however, has reported that realized (utilized) FDI was 1.13 trillion yuan (about $158 billion) in 2023, a decline of 8.0% year on year, a huge difference from the above-reported 80% decline.

This is because they are two different types of statistics. The 80% decrease is a net figure derived by offsetting inbound and outbound flows of the balance of payments reported by the State Administration of Foreign Exchange. This statistic includes fund transfers and other financial transactions. In contrast, the 8% decrease is a gross figure of newly approved and utilized foreign direct investment.

Tsukioka Naoki, the chief economist of Mizuho Research and Technologies and a specialist in the Chinese economy, analyzes the 80% decline of China’s balance of payments and states that this cannot be explained by a simple decrease in foreign corporate investment. In a report issued in February 2024, he offered other possible reasons.

First, there is a growing trend among the Chinese affiliates of foreign companies to prepay the foreign-currency-denominated loans they have received from foreign parent companies. Given the stagnation of the Chinese economy, the Chinese yuan depreciated by more than 5% against the US dollar from April to October 2023. Fearing a rising repayment burden, many Chinese affiliates are prepaying such loans. Tsukioka estimates that this factor alone can explain about 30% of the slump in FDI.

Another contributing factor is a decline in the number of Chinese companies listing their shares on foreign exchanges. In view of the recent decrease of Chinese startups opting to list overseas, it is possible that transfers of funds to head companies in China raised through share listings abroad have also fallen.

Decrease of Return Investments Through Hong Kong

Besides the two factors cited by Tsukioka, other factors are likely contributing to the decrease of FDI.

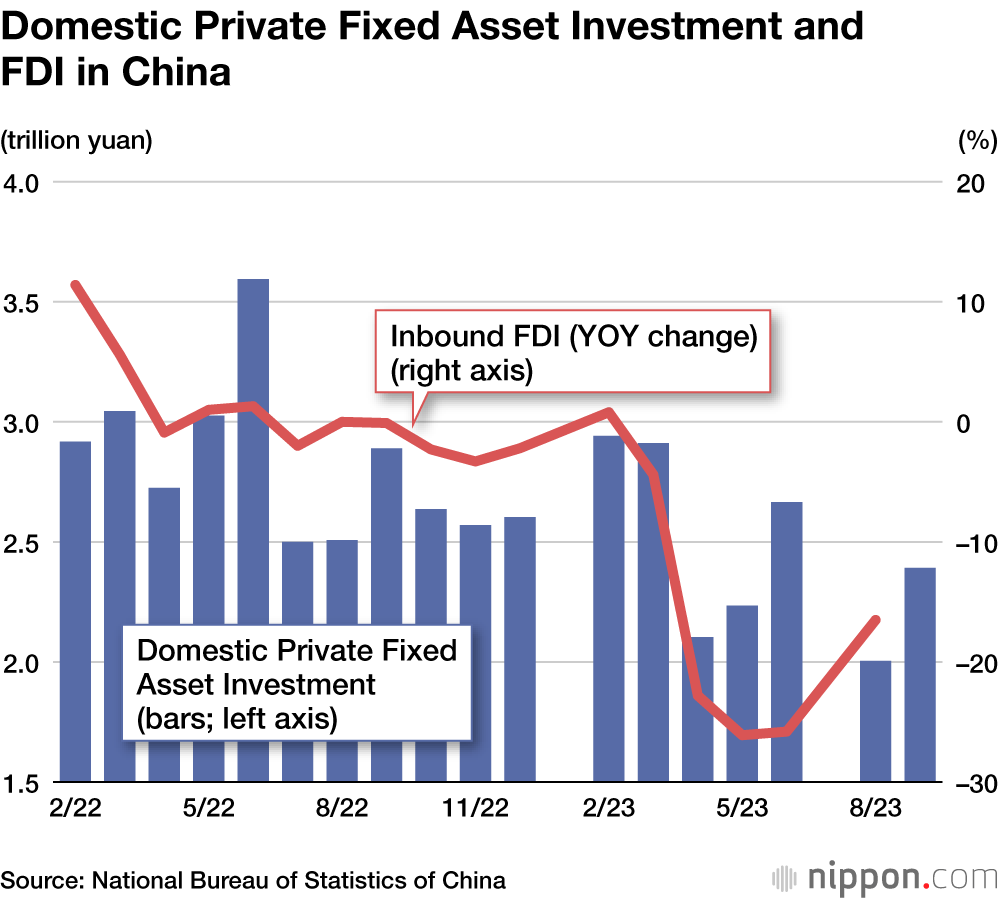

The first is a tendency seen among mainland China’s private enterprises. Since the second quarter of 2023, they held off from making investments due to concerns about the uncertain future of the Chinese economy. During this period, the rebound in consumption fell short of expectations even after the termination of zero-COVID-19 policies, and the real estate slump worsened as worries spread about large property developers.

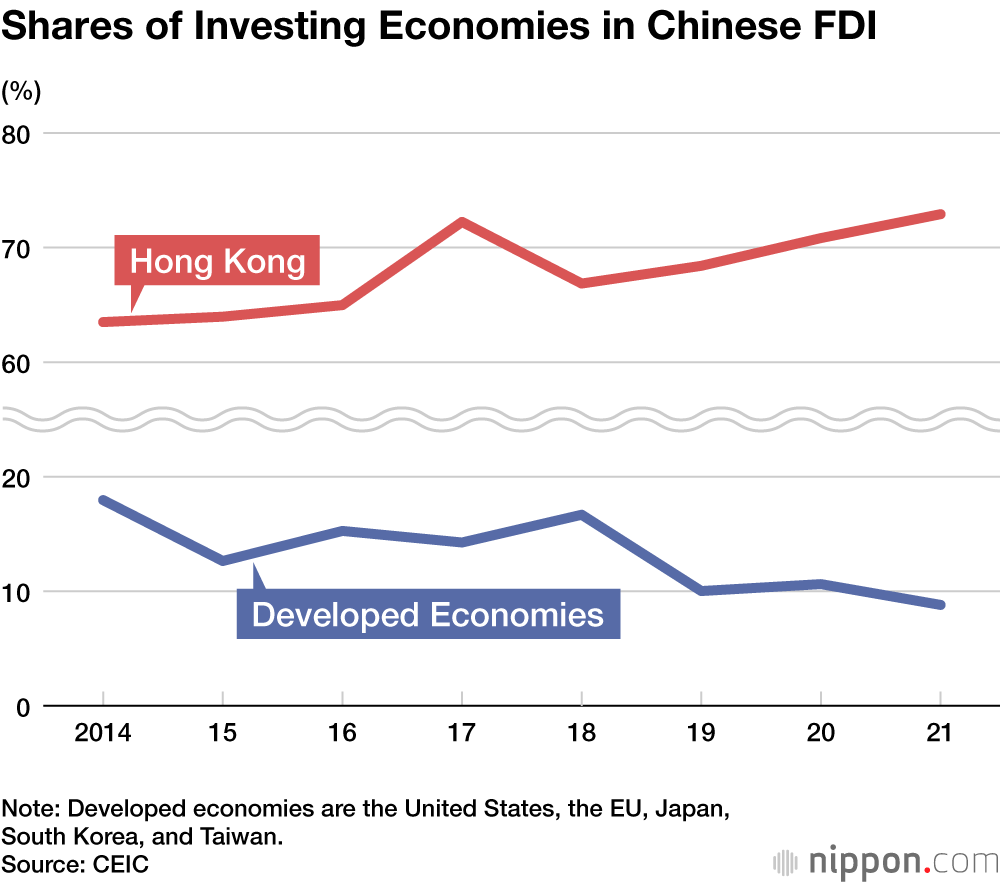

Why does domestic economic sentiment matter for FDI? It is because about three-fourths of FDI received by China is made from Hong Kong, a substantial portion of which is “return” investments made by mainland Chinese companies through the territory. They do so in order to benefit from preferential treatment given to FDI or to simplify mainland approval procedures for company sales.

A certain correlation is suggested when examining the graph comparing domestic private fixed asset investment and realized FDI. Whereas the main cause of the decrease in FDI from the balance of payments point of view is financial transactions, the “return investment” decrease is that of physical investments that appears in Ministry of Commerce statistics. It certainly reflects one aspect of the current change in FDI in China.

Friction Brings Changes to the Trade Structure

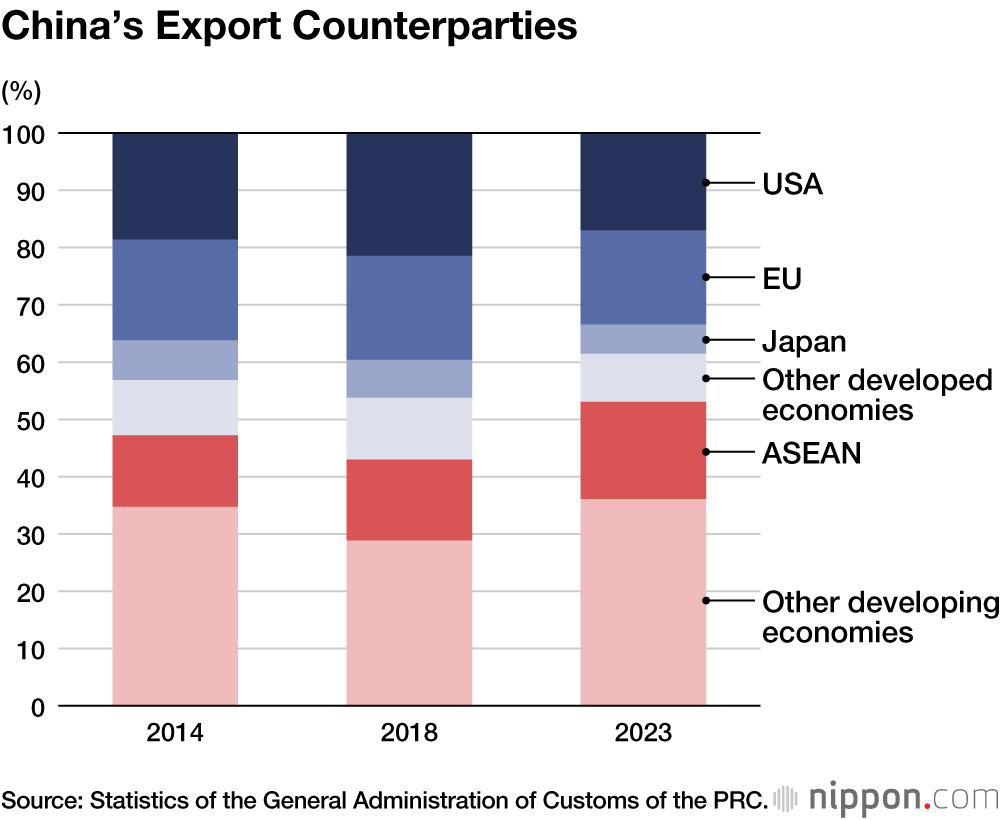

Another factor is related to the conflict between the United States and China. While not fully captured in statistics, in the last five years, both foreign affiliates and domestic companies have shifted their operations to either Southeast Asia or Mexico to avoid the US tariff hikes and tighter regulation on imports from China. If we only look at this aspect, it would appear that FDI has fallen, and China’s manufacturing industries are hollowing out. This kind of concern is also raised in China.

Such a limited view, however, misses the broader picture. The offshoring of operations mainly concerns the assembly of finished goods. These factories’ machinery, materials, and parts are all imported from China. In other words, adapting to the changing environment of US-China competition, the Chinese economy is extending its supply chain overseas.

China’s trade statistics already reflect these changes. ASEAN is replacing the developed economies of the West as the leading destination for Chinese exports. A breakdown of exports reveals that the share of finished goods such as PCs or smartphones, the assembly of which made in China is actually low-value-added, has diminished and the share of materials and machinery has risen. As a secondary effect of US-China conflict, we need to pay more attention in particular to the rapidly expanding and deepening trade and investment relations between China and ASEAN.

As China’s trade and industrial structure changes in this manner, it can be expected to have a longer-term impact on FDI into China and outbound investment by Chinese companies.

Polarization of Foreign Companies in China

In 2023, a representative of the European Union Chamber of Commerce in China created a stir by stating that not a single EU company had newly entered China since the start of the COVID-19 pandemic in 2020. It has also been reported that 90% of EU investments in China in 2018–21 were made by the top 10 companies, centering on Germany’s automotive industry.

This is not a phenomenon limited to EU companies. Two decades ago, the small and medium-sized enterprises of Japan, the United States, and the EU advanced into China in droves in order to reduce costs. This situation has now changed. Costs have risen in China, and local Chinese companies are becoming more competitive. Many foreign affiliates are no longer profitable in China, and many are considering pulling out of the country, or have already done so.

In Japan, the United States, and Europe, attitudes toward China are likely polarizing between global companies with annual sales of more than $100 billion and companies recording lesser sales (except small outfits highly competitive in specified areas).

In the United States, the US Chamber of Commerce publishes reports that favor maintaining and developing business relations with China. Here, too, companies central to such activities are a few large global corporations, such as semiconductor, pharmaceutical, or aircraft companies. It is reasonable to think that one reason the US Congress has increasingly taken a hard-line stance toward China is that the vast majority of US companies have come to distance themselves from China.

Despite the impression created by an 80% decrease of FDI, a survey of Chinese affiliates of Japanese companies shows that a considerable number reply that they intend to invest further in China. This result suggests that many foreign affiliates remaining in China are still making profits.

Three Champions

Automobiles, semiconductors, and finance can be named as three “champion industries” with influence and many successful companies. The automobile industry requires no explanation. For the West’s automakers, China, with 30 million vehicle sales in 2023, is the most important market in the world.

While less significant for Japan, China is also the largest semiconductor market, accounting for 30% of global demand. Large numbers of semiconductors are incorporated into such products as electronic devices, household electrical appliances, and automobiles and sold worldwide.

The financial industry’s situation deserves some explanation. While China has limited foreign financial institutions’ access to its domestic financial market, since 2018 it has gradually responded to strong demands for deregulation. Since this was a period when US President Donald Trump accelerated a trade war with China, Beijing’s aim was likely to win Wall Street over to its side.

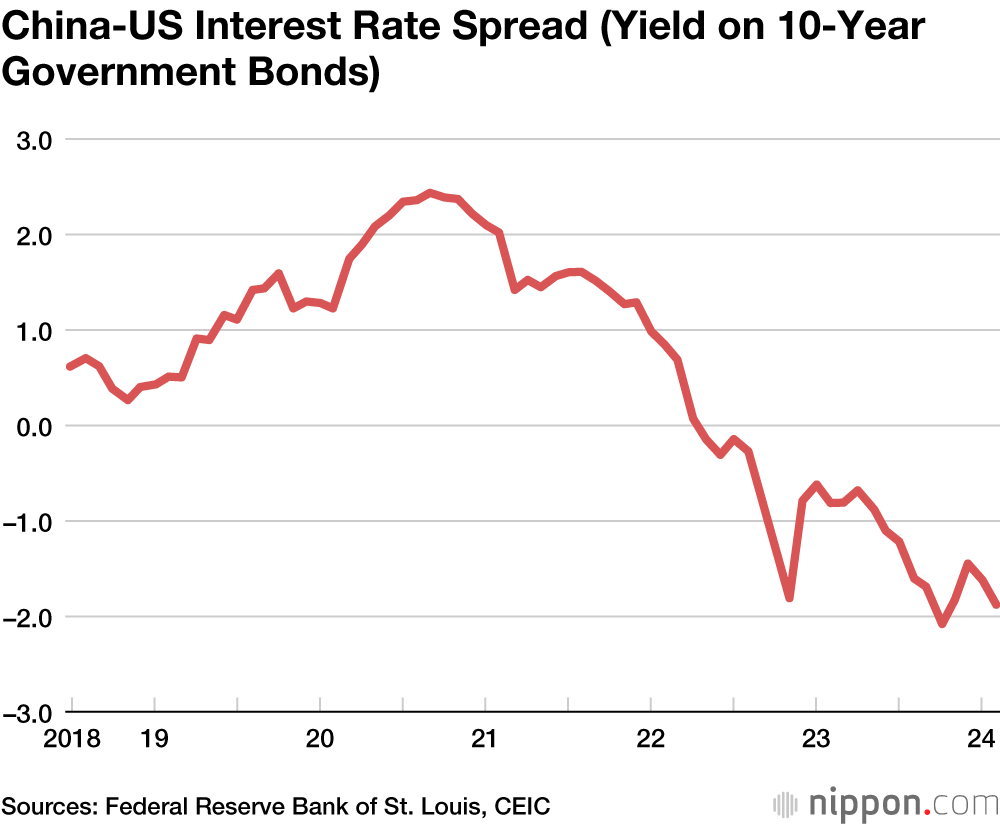

Until very recently, China was a very attractive place for Wall Street. Interest rates were high in the bond market, and in the stock market, there were many promising high-tech companies in the network, digital, and AI sectors. Wall Street players happily expanded their investments there, and they also desire to offer private banking services to wealthy Chinese.

Changes Seen in Successful Foreign Affiliates

Changes are now occurring in these three champion industries. The change seen in the automobile industry is the rapid emergence of Chinese electric vehicles. Foreign automobile makers lagging behind China in the transition to EVs and in network technology are losing market share in China and are beginning to cede market share to Chinese EVs in Southeast Asia and other developing economies.

Shares of Automobile Sales in China in 2023

- BYD (China): 2.71 million vehicle sales; up 50% YOY; 12.5% share

- FAW-Volkswagen (Germany): 1.85 million vehicle sales; up 3.8% YOY; 8.5% share

- Geely Automobile (China): 1.41 million vehicle sales; up 14.4% YOY; 6.5% share

- Changan Automobile (China): 1.37 million vehicle sales; up 7.7% YOY; 6.3% share

- SAIC Volkswagen (Germany): 1.23 million vehicle sales; down 1.0% YOY; 5.6% share

- GAC Toyota (Japan): 901,000 vehicle sales; down 7.3% YOY; 4.2% share

- SAIC-GM (USA): 870,000 vehicle sales; down 16.1% YOY; 4.0% share

- Chery Automobile (China): 811,000 vehicle sales; up 12.9% YOY; 3.7% share

- FAW Toyota (Japan): 802,000 vehicle sales; up 0.3% YOY; 3.7% share

- Great Wall Motor (China): 760,000 vehicle sales; up 0.2% YOY; 3.5% share

Source: AskCI Consulting

It goes without saying that the change occurring in the semiconductor industry is ensuing from the US-China conflict and growing concerns about economic security. Foreign chip makers want to sell and China wants to buy semiconductors, but the regulations of the governments of the West prevent such sales. The scope of prohibited sales that was initially meant to be narrowly limited (so-called “small yard”) is gradually widening, creating further difficulties for exports and investments.

Moreover, aiming to end its dependence on foreign semiconductors, the Chinese government is working to foster and strengthen its domestic semiconductor industry. It instructs domestic user industries, such as automotive or electronics, to use domestic semiconductors more and decrease dependence on foreign manufacturers. These foreign players may risk losing a substantial share in the world’s largest market.

The financial industry, meanwhile, has changed dramatically in a decade. When China eased regulations five years ago, the yield of 10-year Chinese government bonds was two percentage points higher than US Treasuries, making them an attractive investment target. In contrast, the yield of US Treasuries is two percentage points higher nowadays. Once home to many attractive picks, China’s stock market has cooled due to the Xi administration’s crackdown on private companies such as Alibaba and the high-tech Sino-American conflict.

The fate of foreign affiliates in the three champion industries has great significance given their position at the top of FDI ecosystems. Taking the automobile industry as an example, under the top-tier foreign assemblers, there are not only parts suppliers but also affiliates of foreign banks, trading houses, and consulting firms in the lower tiers. If the top-tier companies decline, those at the lower levels will find it difficult to survive independently. As a result, the entire ecosystem built by the Chinese affiliates of foreign companies will decline, raising concern that the economic ties between China and the West will wither further.

For now, China’s Counter-Espionage Law has become another obstacle for foreign affiliates doing business in China. However, the direction of the three champion industries in China will likely have greater structural and profound influence in the medium to long term.

(Originally published in Japanese. Banner photo: BYD, China’s leading EV company, displays its new models at the Beijing International Automotive Exhibition. Foreign companies that have lagged in the electric transition are losing market share in China. © Jiji.)