The Next BOJ Governor Will Face Major Challenges

Economy Politics Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

The Continuing Harms of the “Different Dimension”

We have recently seen a dramatic fall in the value of the yen versus the dollar. In November last year, when I spent time in New York City, the prices I saw in restaurants and supermarkets all appeared exorbitant, making me painfully aware of the decline of the Japanese currency. While the yen has strengthened somewhat after depreciating past 150 to the dollar on October 20, 2022, dipping once more below 130 to the dollar in January 2023, it remains weakened to the level of a half century ago in terms of purchasing power parity or the real effective exchange rate.

In simplified terms, applying purchasing power parity to the yen-dollar rate gives us an exchange rate equalizing price levels in the two economies. According to International Monetary Fund estimates, today that rate is around 88 yen to the dollar. The actual rate, at 130 yen, represents a 48% cheapening of the Japanese currency. In October 1982, when the exchange rate was 277 yen to the dollar, the discount relative to PPP was just 28%, meaning that then yen today is in a far weaker state than it was then.

Japan imports much of its food and other resources from abroad. Supply chain disruptions ensuing from the COVID-19 pandemic and the effect of Russia’s war on Ukraine, combined with the yen’s depreciation, caused the consumer price index to rise to 4% in December 2022 on a year-on-year basis. This is a painful number for Japan, where wages do not increase readily. Prices actually surged 7.8% for items purchased more than once a month, making them things directly related to living costs. The pass-through of the effects of a weaker yen to retail prices has only just begun, and price hikes can be expected to continue for the time being.

These developments are all harms resulting from the BOJ’s monetary easing of a “different dimension,” which was launched in April 2013 as the central pillar of Abenomics. This policy was based on the following assumptions.

- Deflation (the sustained decline of prices) is the main reason for the stagnation of Japan’s economy.

- Deflation arose from the BOJ’s inadequate monetary easing.

- Thus, if the BOJ implements bold monetary easing without hesitation and inflation reaches a target of 2%, the yen will depreciate, and Japan’s economy will recover.

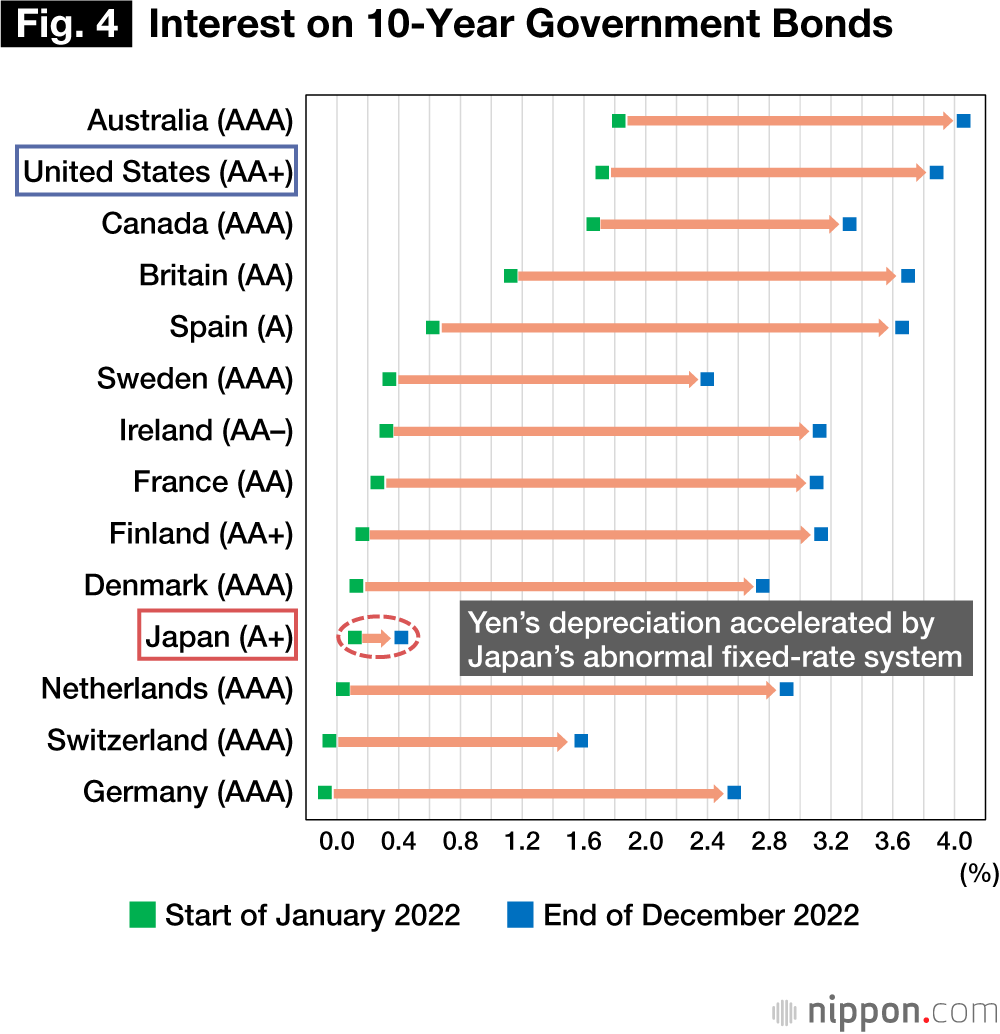

Since then, the BOJ has purchased massive quantities of Japanese government bonds and exchange-traded funds. Starting in 2016, it has also maintained a negative short-term interest rate and has held the interest of 10-year JGBs near zero. While the BOJ has not publicly said so, these monetary policies clearly intend to induce the depreciation of the yen.

In December last year, the BOJ, fearing that this extraordinarily low yield on 10-year paper was seriously distorting finance market functions, widened the allowance band on long-term yields from plus or minus 0.25% to plus or minus 0.5%. This was a sudden move by the bank, perhaps because it had to be: If the BOJ authorities gave any advance hint that they were considering such a move, market participants fearing a drop in the value of their holdings would begin to unload their JGBs en masse. For this reason, though, the market is now filled with warnings that the bank’s next policy change will also come unexpectedly.

All this aside, though, nearly all market players still believe that the upper limit on 10-year JGBs, that is to say, 0.5%, is still too low. Attention focused on the January 18 Monetary Policy Meeting, with mounting expectations, especially among foreign investors, that further policy changes were forthcoming; ahead of the meeting, the market saw strong upward pressure on JGB interest rates. In defense of the upper limit, the BOJ implemented its largest-ever bond purchase. Compared to the rest of the world, the government of Japan is far and away the top issuer of bond debt as a percentage of GDP, and frighteningly, today the BOJ is effectively the only willing purchaser in the market for JGBs—despite the fact that Article 5 of the Public Finance Act prohibits the Bank from directly purchasing bonds from the government of Japan.

At its January 18 meeting, the bank in the end announced a set of stopgap policies, along with a statement that the long-term interest rate would remain at its present ultralow level. Bank Governor Kuroda Haruhiko’s term comes to an end on April 8 this year; this meeting served as a signal that he has no intent of altering this policy while he remains in office. But the back-and-forth between the bank and market forces will continue.

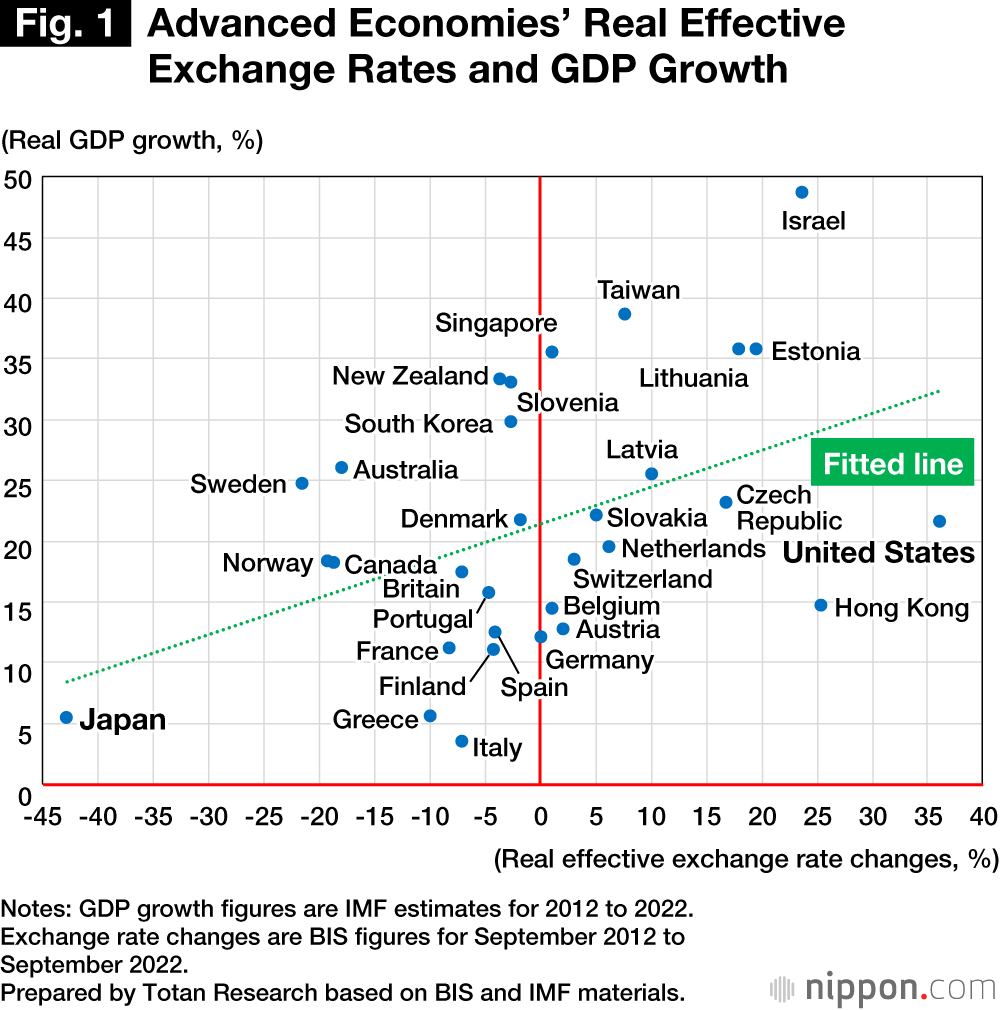

The BOJ’s ultralow interest policy has been maintained for nearly 10 years, producing both lower rates across the market and a cheaper yen. Nevertheless, Japan’s economy is mired in deep gloom. Figure 1 depicts the rates of change of the real effective exchange rate of the main advanced economies for the last 10 years (horizontal axis) and real economic growth rates for the 10 years to 2022 (vertical axis).

We can see in the chart that the exchange rate has fallen the most for Japan. (Moreover, government debt has increased the most for Japan relative to economic size for the same period.) Japan’s economic growth rate is also one of the lowest.

The green dotted line is the fitted line expressing the overall trend, which rises from left to right. Setting aside the question of causality, countries where the exchange rate is rising are also those whose economies are generally growing.

No Prosperity from a Weaker Yen

Robert Rubin, US Treasury Secretary in the mid-1990s, frequently asserted that a strong dollar is in the US national interest. According to Rubin, managing the economy such that the domestic currency appreciates will create a virtuous circle and will enable the nation’s citizens to prosper.

A stronger currency will increase the purchasing power of citizens relative to other nations and will reduce inflation. Nations whose economies are growing and whose exchange rates are rising will attract quality investment funds from abroad. This will boost employment and lift the wages of workers. Should consumption rise as a result, this will attract further foreign investment and create a virtuous circle. Should such a cycle materialize, the earnings of manufacturing industries will increase, as will investment in research and development, and productivity will rise.

Rubin warned that implementing policies to deliberately weaken the exchange rate would give rise to a vicious circle. This is exactly Japan’s situation in recent years.

Supported by the yen’s depreciation, the number of foreign visitors to Japan is beginning to increase. We must not forget, however, that foreign visitors are enjoying bargain prices in Japan at the expense of Japanese citizens experiencing surging living costs. It would be better to sell the appeal of Japan to foreigners without depending on a weak yen. After all, compared to the size of domestic consumption (¥294 trillion in fiscal 2021), inbound consumption is small, less than ¥5 trillion at its highest, and its economic benefits are limited.

There are some commentators who expect that a weak yen would attract foreign investments. However, investment funds that flow into a nation because of its weak currency are attracted by that nation’s low costs. Such funds will only generate “cheap” work and will not create the virtuous circle that Ruben referred to. It would be safe to say that Japanese citizens will never prosper by inducing a weaker yen.

Based on the above, it should be evident that the prescription for the BOJ’s monetary easing of a different dimension was fundamentally wrong. We should have directly addressed the structural problems of Japan’s economy, that is to say, the declining competitiveness of Japanese companies and an aging and diminishing population. These are issues that a central bank cannot solve. However, the assertion that bold monetary easing by the BOJ would enable Japan’s economy to recover resonated so well. If that was sufficient to solve Japan’s problems, there would be no need for painful reforms.

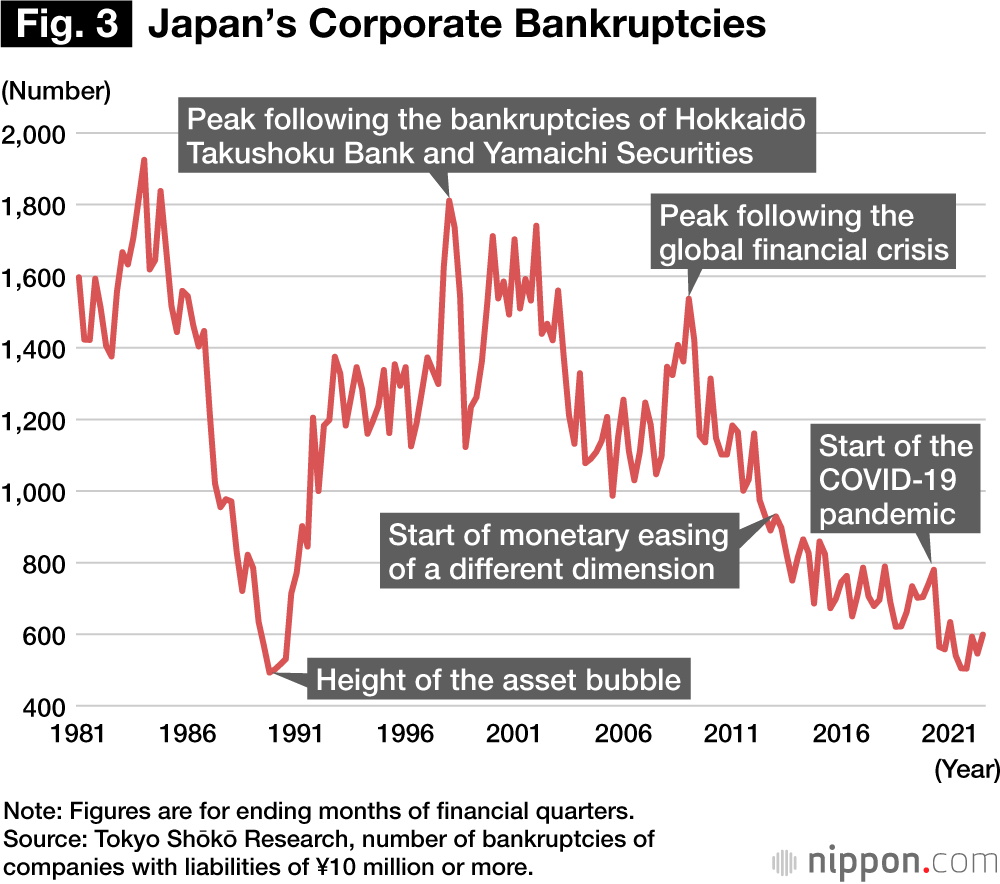

Monetary easing provides the economy with temporary pain relief. Should a lower interest rate reduce the interest payments of companies, the number of bankruptcies will be reduced. It will also become easier for the government to issue bonds to stimulate the economy. The resulting expenditures will be meaningful if they contribute to the future growth of productivity. However, when the interest on newly issued JGBs is close to zero due to BOJ policies, many politicians will experience sensory paralysis and will resort to pork-barrel spending on a massive scale as a pain relief measure.

Stalling for Time Promotes Zombification

William White, formerly the chief economist of the Bank for International Settlements, accurately foresaw in 2012 what the BOJ’s monetary easing would lead to, the year before this policy was launched. He stated then that it would simply be a waste of time for governments and legislatures to use the effects of easing to delay making structural reforms while central banks stall for time through the pain relief of monetary easing.

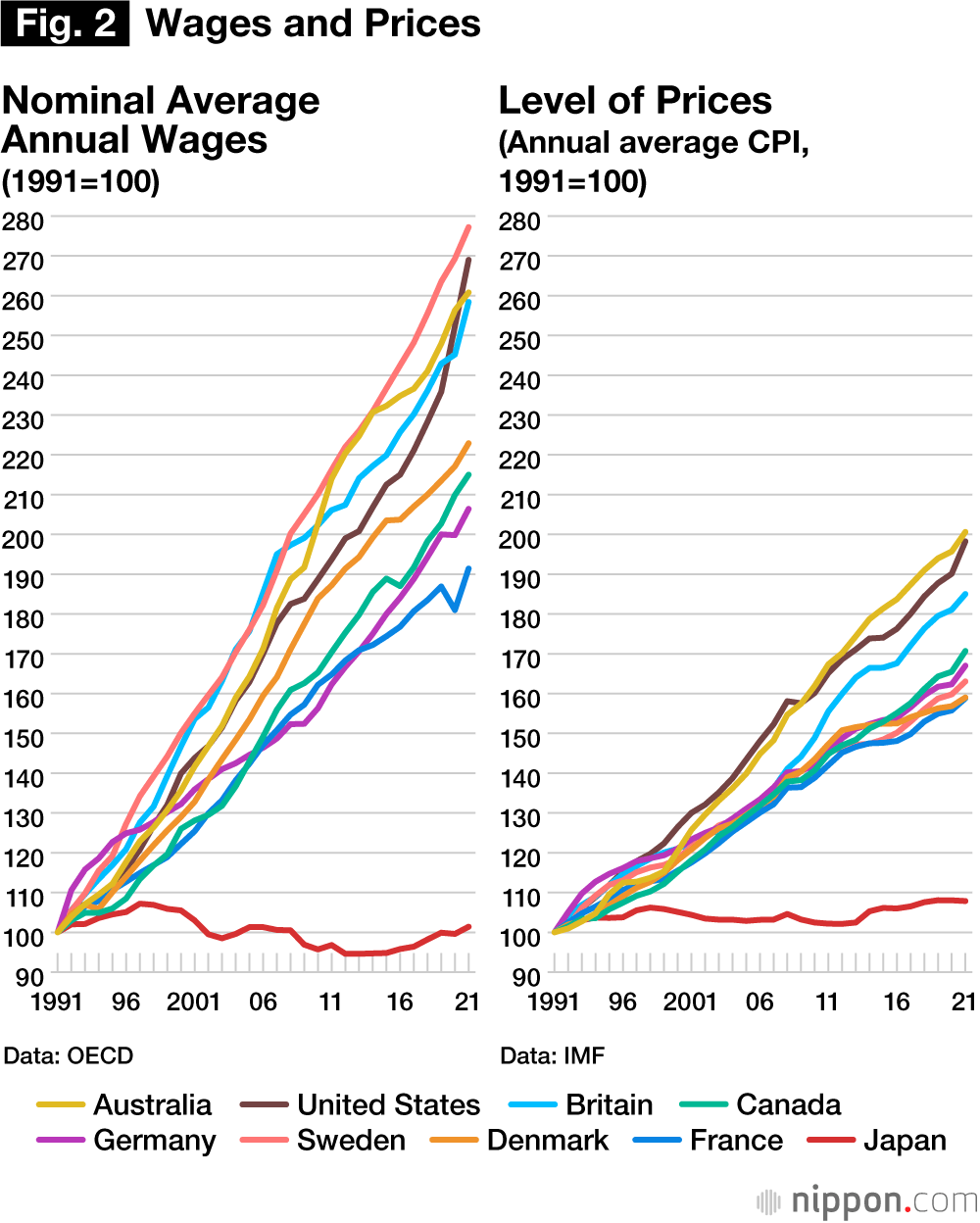

Figure 2 illustrates the trends for nominal average annual wages and the level of prices since 1991. The BOJ has stated that it will forcefully maintain its monetary easing of a different dimension until higher wages and higher prices create a virtuous circle. It cannot be said, however, that such an outcome is within view. Rather, there is the risk that, through pain relief being maintained for the long term, the trend toward zombification will strengthen, a process where monetary policies enable an increasing number of zombie companies to avoid bankruptcy.

David Malpass, president of the World Bank, stated in a speech delivered in September 2022, “‘Low for long’ [interest rates] reduced the incentives of business to clean up their balance sheets and of governments to push for structural reforms. Evidence shows that large-scale purchase programs have promoted the presence of zombie banks and businesses, which means that creative destruction is not occurring, damaging the economy’s growth potential.”

Figure 3 depicts the nationwide trend for corporate bankruptcies. The number of bankruptcies has declined in recent years to about its level at the height of Japan’s asset-price bubble around 1990. Bankruptcies are being suppressed and zombification is progressing through the BOJ’s extreme monetary easing and through government measures to support the cash positions of companies.

In recent years, Japan’s unemployment rate has been either the lowest or the second lowest among advanced economies. When the unemployment rate is so low, usually labor shortages develop and companies compete to raise wages to secure needed workers. However, when a low unemployment rate ensues from the growth of zombie companies, the sustained increase of wages is extremely unlikely.

The Next BOJ Governor Will Be Tested

The current rate of inflation has greatly exceeded the 2% target. BOJ Governor Kuroda, however, stubbornly refuses to shift from his ultraloose approach to monetary policy. The next BOJ governor, to be appointed in the spring of 2023, will face many difficult challenges. Remarks frequently heard these days from former BOJ and Ministry of Finance officers is that the person after Kuroda will assume an unenviable position. Is there anyone really interested in becoming the next BOJ governor?

Changing direction is not easy when unconventional monetary policies are maintained for a long time because of the debt trap they create.

William White, mentioned above, stated the following in 2021. Monetary easing aims to reduce market interest rates, expand the debt held by such economic actors as households, companies, and government, and boost the economy through the attendant growth of expenditures. Such easing, however, gives rise to difficulties when the trend toward zombification is strengthened, when the intended economic recovery does not take place, and when an extremely low interest rate is maintained over the long term. Since many economic actors will have increased their debt holdings, a central bank seeking to raise the interest rate will provoke complaints and strong opposition from many quarters.

It is precisely this debt trap that Japan has fallen into. The BOJ’s policy of holding the interest of 10-year JGBs to near zero is making it more difficult to escape from this trap. All other advanced economies use a floating rate system where the interest of government bonds is determined by market supply and demand. With the global rise of prices in 2022, the spread between the interest of 10-year JGBs and global interest rates has become unnaturally wide (figure 4). There is good reason to worry about the chances of a soft landing.

Given this predicament, the BOJ will only accelerate zombification and the debt trap by prolonging its current policies, making it more difficult to develop an exit strategy. The BOJ should make the minimally needed changes to its policies before the global economy slows in earnest. It should at the very least end its fixing of the interest of 10-year JGBs and return to a situation where the market can warn against their excessive issuance. Moreover, the BOJ should abandon its negative interest rate policy (a policy adopted by no other central bank) and return to a zero-rate policy.

Will a Renewal-Averse Japan Continue to Sink?

The current depreciation of the yen is resulting from the decline of long-term confidence due to the decent of Japan’s economy combined with the rapid widening of the spread between domestic and foreign interest rates due to the BOJ’s refusal to act. Accordingly, should the Federal Reserve and other central banks pause their increase of interest rates in 2023 and should the BOJ raise the interest rate somewhat, the yen can be expected to appreciate. This appreciation, however, will be limited since the debt trap will restrict how far the BOJ can raise rates. Many domestic and foreign investors are likely thinking that the next cycle of yen appreciation will be the perfect time to sell yen for foreign currencies.

If the next BOJ governor also avoids raising the interest rate, fearing the difficulty of changing monetary policy, we will see further increases of investors who think that Japan does not want renewal and that it will continue to sink as government debt multiplies.

In such a situation, the deprecation of the yen over the long term will become more probable, which will risk normalizing a “bad” increase of prices ensuing from a weak yen. The BOJ will be compelled at some point to substantially increase the interest rate, which would prompt a major increase in the interest expense of the government and other borrowers. A debt trap is not sustainable in the long term. It should be understood that it only puts off the addressing of issues to the future.

(Originally published in Japanese. Banner photo © Pixta.)

Bank of Japan monetary policy finance Kuroda Haruhiko quantitative easing