The Once Feared Strong Yen Is Now in Japan’s National Interest: A 50 Year History of the Floating Exchange Rate Regime

Economy Society Work- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Visitors to Japan Enjoy Bargain Prices

Foreigners visiting Japan are increasing at a pace exceeding the period before the COVID-19 pandemic. These visitors are praising Japan on social media for having lots of places to see, for being safe, and for having delicious food. Some are also promoting Japan as great value, with everything from the meals to the desserts found at convenience stores being unbelievably cheap and tasty.

Booming inbound tourism, however, is not something that can be welcomed unreservedly. The International Monetary Fund forecasts that Japan’s nominal GDP will be surpassed by Germany’s in 2023 and that Japan will sink to fourth place behind the United States, China, and Germany. If Japan’s economy is overtaken by a German counterpart that is expected to record negative growth, this will be none other than the consequence of the yen’s weakness against the euro and the dollar.

After maintaining the position of second place in GDP rankings for 40 years, Japan then yielded that spot to China in 2010. That may have been inevitable, given a Chinese population more than 10 times the size of Japan’s. To be surpassed by Germany, with a population a third smaller, however, is harder to accept.

At this point, it will be worthwhile to review the history of the yen.

Only a few Japanese will remember a time when the yen’s exchange rate was fixed and when the yen was neither weak nor strong. From soon after the end of World War II, in 1949, to 1971, the yen’s exchange rate was fixed at 360 to the US dollar. The value of the dollar was backed by gold, and the currencies of other nations were pegged to the dollar at a fixed rate (par value).

This fixed rate regime was known as the Bretton Woods system since it was agreed to by allied nations gathered toward the end of World War II at the New Hampshire resort town of that name. This system was then dismantled by the United States, its original promoter.

A Strong Yen Phobia Takes Root

In August 1971, President Richard Nixon suddenly announced that he would end the dollar’s convertibility to gold and place a 10% tariff on imports. These developments came to be known as the “Nixon shock” in Japan.

As the costs of the Vietnam War mounted, and facing an export offensive by Japan and Germany, the United States was burdened by fiscal and balance of payment deficits and suffered from inflation and a high unemployment rate. The solution was the blunt instrument of forcing a higher par value on the currencies of surplus nations.

I was just getting started as an economic reporter when Nixon closed the gold window. This caused an uproar in Japan. Fearing a national crisis, exporting companies and localities where export goods were made howled that the upward revaluation of the yen was a matter of life or death.

Some took a more composed view of the situation, though. Several days after Nixon’s declaration, Emperor Hirohito, who was briefed by Minister of Finance Mizuta Mikio, is said to have stated that the appreciation of the yen was a good thing since it meant that the work performed by the Japanese people was being highly rated.

The emperor’s response to this briefing was treated as a confidential matter, and his statement was kept secret for a while. It was only some time later that I heard it leaked by several Ministry of Finance officials.

In December 1971, four months after Nixon’s declaration, finance ministers of 10 major nations gathered at the Smithsonian Institution in Washington DC, and new par values of currencies were decided. The Japanese yen was pegged at 308 to the US dollar, an upward revaluation of 16.88%, the largest increase among participating nations.

However, the Smithsonian system, a revised fixed rate regime, lasted for just over one year. As foreign exchange markets became exposed to speculative trading, in February and March 1973 major nations gradually transitioned to a floating rate regime, where exchange rates fluctuate in accordance with market supply and demand. This floating rate regime has now continued to the present day.

Naturally, under a floating rate regime, the yen’s exchange rate will fluctuate upward and downward. In my view, the upward revaluation of the yen may have been a traumatic event, and a strong yen phobia may have taken root in Japan, where the appreciation of the yen is feared excessively and where its depreciation is tolerated.

The Asset Bubble and Its Collapse

The asset bubble, whose collapse was the starting point of the lost 30 years, was a product of this strong yen phobia.

In September 1985, the ministers of finance and the governors of the central banks of five major nations gathered at the Plaza Hotel in New York and, agreeing to the demand of the United States, decided to depreciate the excessively strong dollar through coordinated intervention. This became known as the Plaza Accord.

The yen, which at that time traded at around 240 to the dollar, appreciated sharply, and the dollar depreciated by half in about three years’ time. Responding to the pleas of exporting companies, the Japanese government instituted measures to counter the recessionary effects of the strong yen. It intervened massively in the foreign exchange market to buy dollars with yen, and the domestic economy became flooded with such yen.

The Bank of Japan cut interest rates five times in succession, reducing the basic discount rate of policy interest to an all-time low of 2.5%, where it stayed for two years and three months. The government also resorted to fiscal measures and repeatedly instituted lavish public works spending.

While consumer prices were steady, stock and land prices soared. In Capital in the Twenty-First Century, the French economist Thomas Piketty states that Japan’s asset bubble was the largest bubble that occurred between 1970 and 2010.

This bubble collapsed at the start of the 1990s. The party was over, replaced by a financial crisis. Many financial institutions failed, including major ones. In this process, Japan’s banking sector wrote off more than ¥100 trillion in bad debt.

Back to ¥120 to the Dollar in 2024?

The yen momentarily depreciated past 150 to the dollar in 2023. The current increase of prices is influenced by the ascent of the import prices of energy and foods due to the weakening of the yen. There are likely people finally traveling overseas after the COVID-19 pandemic who are shocked by the prices being asked at designer brand stores and restaurants. Even so, there are few calls to do something about the weak yen. Does this signify excessive Japanese tolerance of a weak currency?

The yen’s real effective exchange rate, which expresses its purchasing power, is at an all time low since moving to a floating rate regime. It is at a similar level to the exchange rate of 360 to the dollar of the fixed rate regime of some 50 years ago. One wants to cover one’s eyes over the fall of the yen.

Sakakibara Eisuke, former vice minister of finance for international affairs (currently president of the Institute for Indian Economic Studies), who was known as “Mr. Yen” when he led Japan’s currency policies in the latter half of the 1990s, has reflected at a press conference on the 50 years of a floating rate regime.

He stated that a weak yen was better for Japan during the period when exports powered Japan’s economy. However, now that Japanese companies have advanced overseas and have responded to globalization, a strong yen is better. Borrowing the assertion by US Treasury Secretary Robert Rubin that a strong dollar is in the US national interest, Japan can say that a strong yen is in its own best interest.

Sakakibara also recognized that it is difficult to correct a weak yen through market intervention. The appreciation of the currency can be stopped by aggressively buying dollars, and there are plenty of funds to do so. However, stopping the depreciation of the yen will mean selling dollars. He stated that he had tried this using about one-tenth of Japan’s foreign currency reserves, but thought he could go no further.

Regarding the future direction of the yen, Sakakibara remarked that it will depend on the Japanese and US economies. The US economy may be heading toward a downturn. Japan’s economy is growing at an annual rate approaching 2%, so the yen should gradually appreciate. It is likely to trade at around 130 to the dollar from the summer toward the end of 2024. It may even strengthen to the 120 level.

Will the sentiment that a strong yen is in the nation’s interest take hold in Japan?

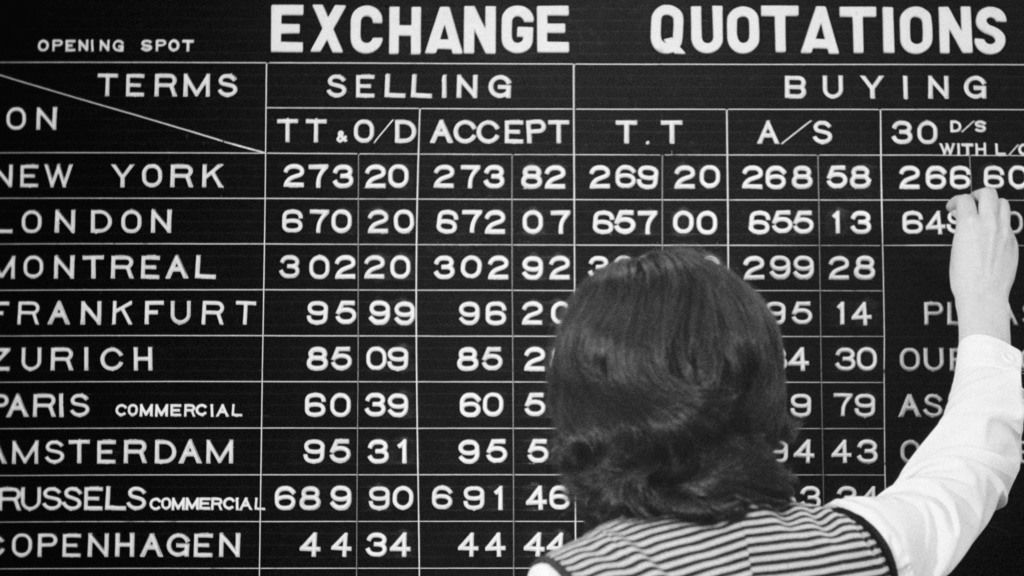

(Originally published in Japanese. Banner photo: On February 14, 1973, a sign at the Tokyo Foreign Exchange Market shows changes as the yen switches to a floating exchange rate regime. © Kyōdō.)