Japan’s Pension Woes

Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

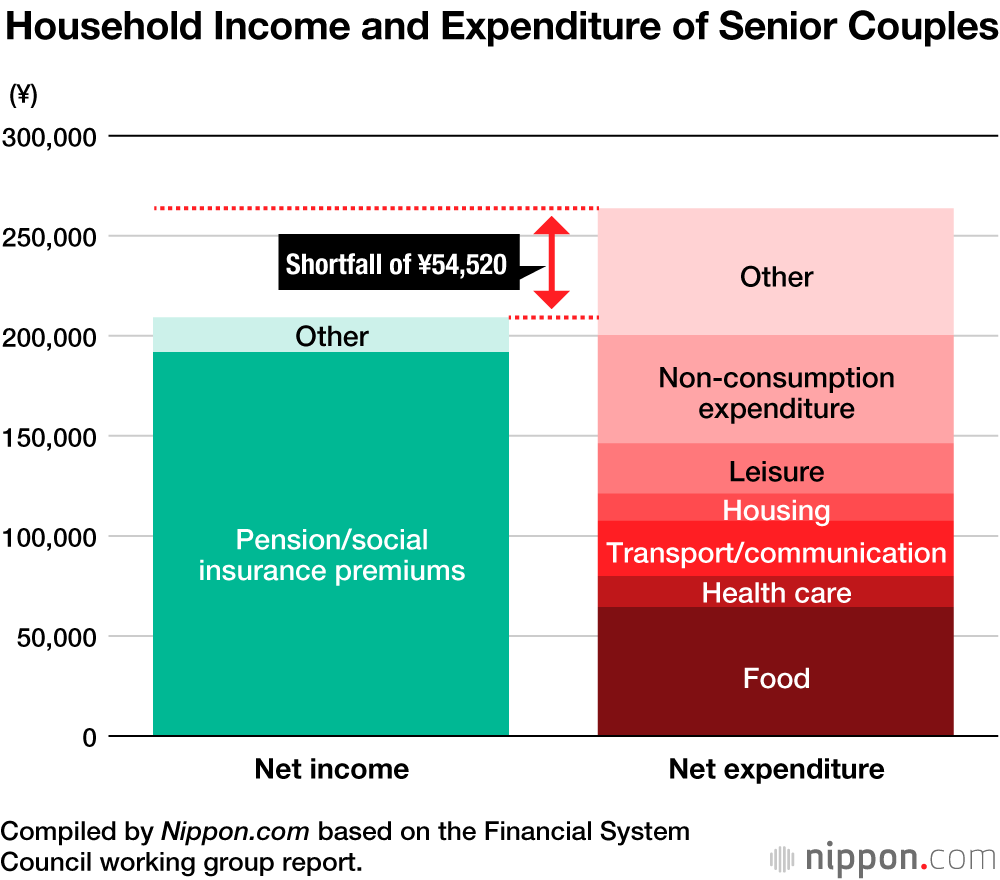

A report released by the Financial System Council (part of the Financial Services Agency) states that in a one month period, the average senior couple (defined as a married couple in which the male partner is 65 or over and the female partner is 60 or over) receives an income of ¥209,198 but spends ¥263,718, leaving it ¥54,520 in deficit. The amount of financial assets, such as private pension payouts, that the average couple will need to dip into in order to make up for this shortfall will total ¥13 million over 20 years and ¥20 million over 30 years.

According to the report, couples in the “senior couple” demographic have average net savings (gross savings minus debt) of ¥24.8 million, which might seem a lot, but one should remember that this is only an average. Some couples have less, and extraordinary expenses such as nursing care would lead them to struggle.

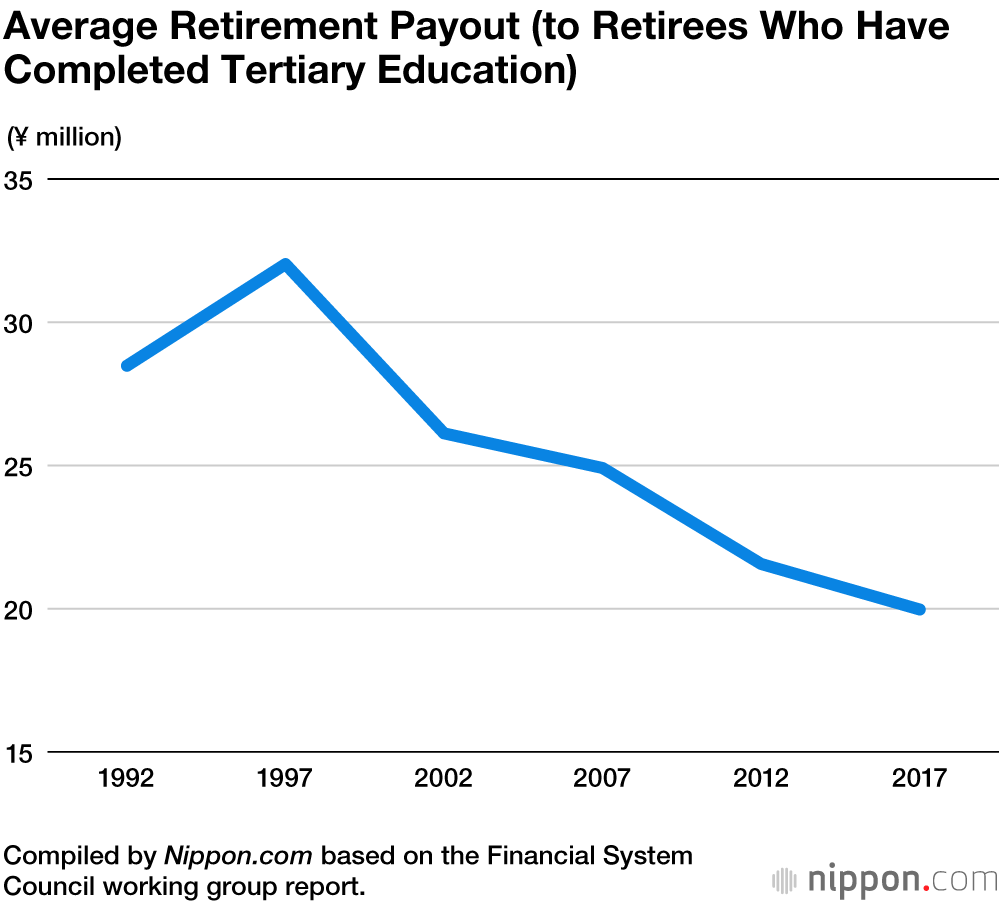

The problem is that the assets and pension checks that retirees depend on for a living are under pressure, and worse may be yet to come. With wages in decline ever since Japan’s economic bubble burst, workers are finding it even harder to save. As of 2017, retirement payouts to retirees who had completed tertiary education averaged ¥20.0 million, a decrease of 38% on 20 years before. This was due partly to increased employee mobility as more workers switch jobs mid-career.

Japan’s declining birth rate has skewed the balance between pension scheme contributors and recipients, meaning that further cuts now seem inevitable. The Financial System Council’s report reveals that the replacement rate, which expresses income at age 65 as a percentage of income before retirement, was 59.7% in 2019, but is predicted to decrease to 50.6% by 2049 when those born in 1984 turn 65.

When asked what they would do to ensure they had enough to retire on, respondents were most likely to say that they would retire later or cut back on living expenses. However, the 8.8-year gap between average life expectancy (81.0) and healthy life expectancy (72.1) for men shows that senior citizens have limited earning potential.

(Translated from Japanese. Banner photo © Pixta.)