Many Japanese Seniors Comfortable Financially

Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

A government white paper on aging society released in June 2019 notes that many senior citizens do not face serious financial worries, thanks to having amassed substantial retirement savings.

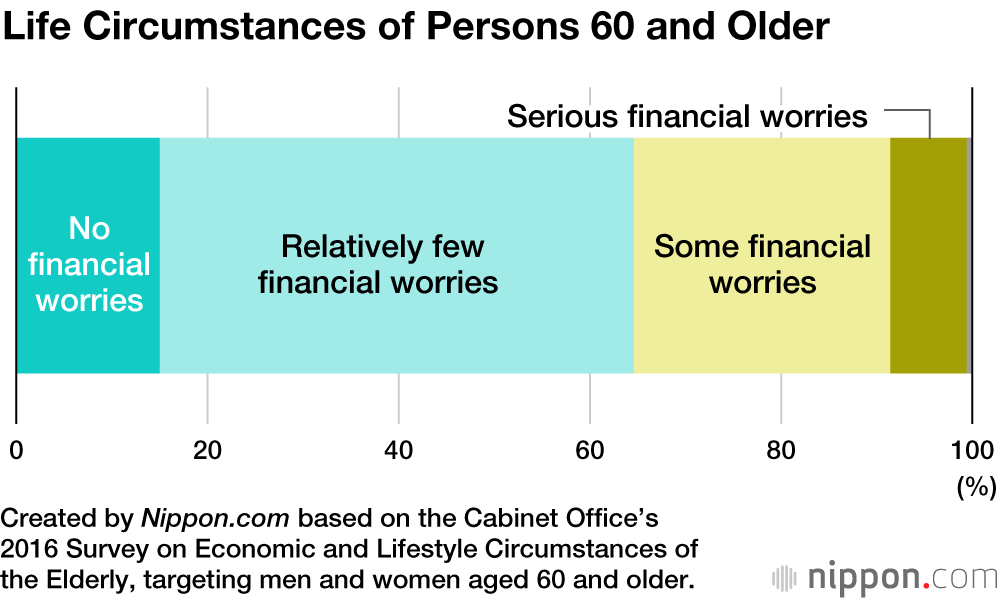

A Cabinet Office survey of persons 60 and older found that a combined 64.6% had either “plenty of leeway and no financial worries” or “relatively few financial worries.” The older the respondents, the more likely they were to fall under the category of not having financial concerns, which included 71.5% of those 80 or older.

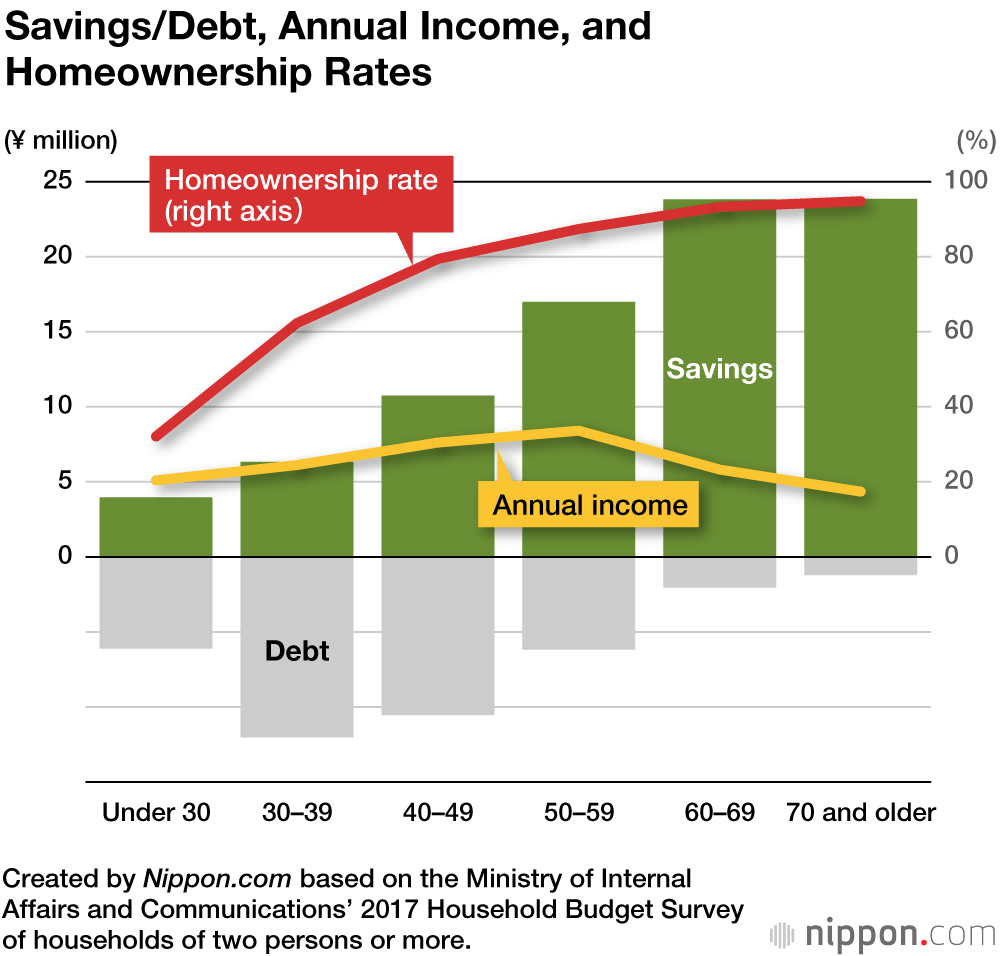

A look at the family assets for households of two or more persons reveals that net savings per household (savings minus debt) tend to increase the higher the age of the head of the household. Those heads of households in their sixties or seventies have much greater net savings than other age groups.

Incomes tend to peak when people are in their fifties and then decline thereafter, but around that same time they usually are no longer burdened by mortgage payments and are also freed from educational expenses for their children, leaving them more economic leeway.

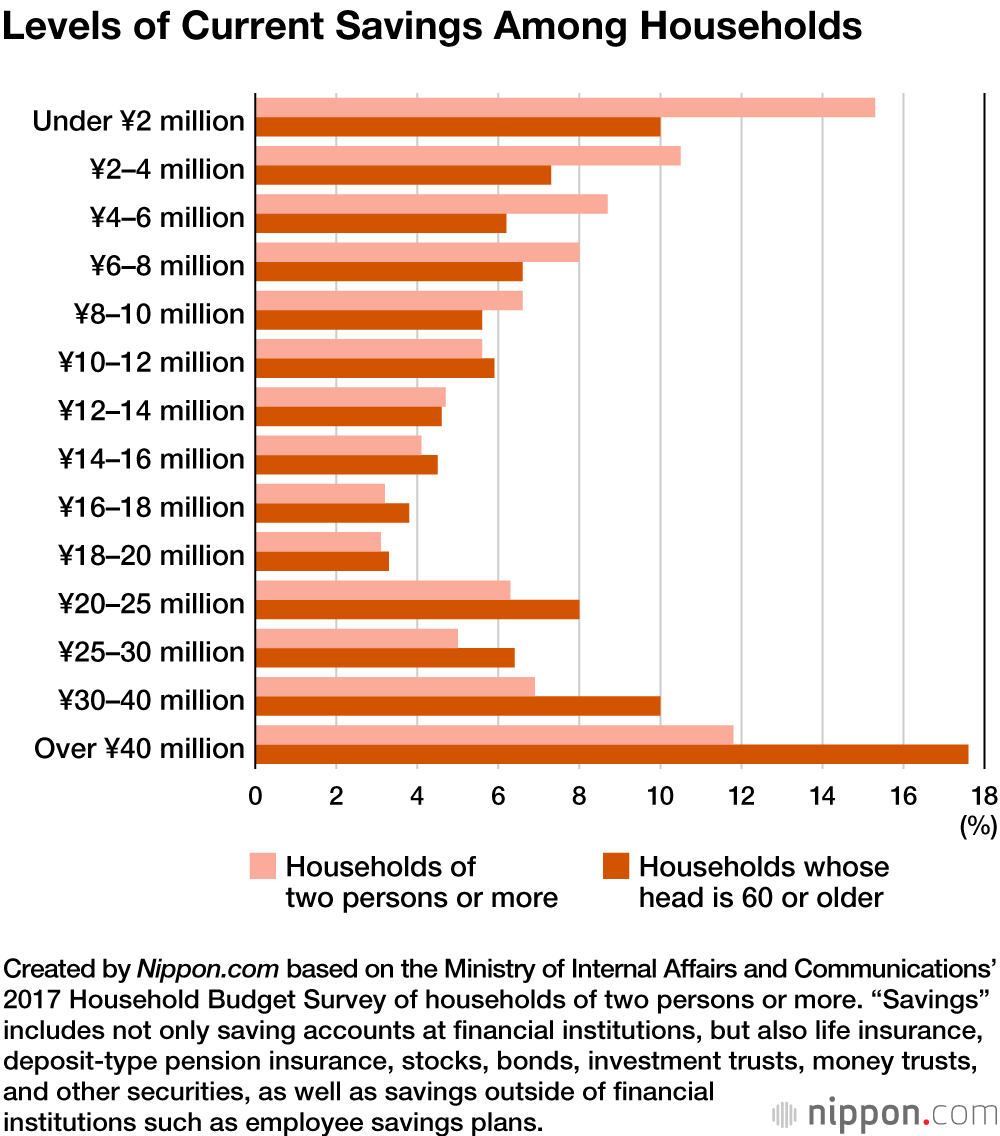

Average savings among all households of two or more persons surveyed was ¥10.7 million, but the average was 1.5 times higher, or ¥16.4 million, for households whose head was 60 or older. The percentage of those whose current savings are ¥40 million or more was also quite high, at 17.6% among those 60 or older and 11.8% among all households surveyed.

(Translated from Japanese. Banner photo © Pixta.)