Japan’s Bond Dependency Ratio Rises to 45.4%

Economy Politics Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

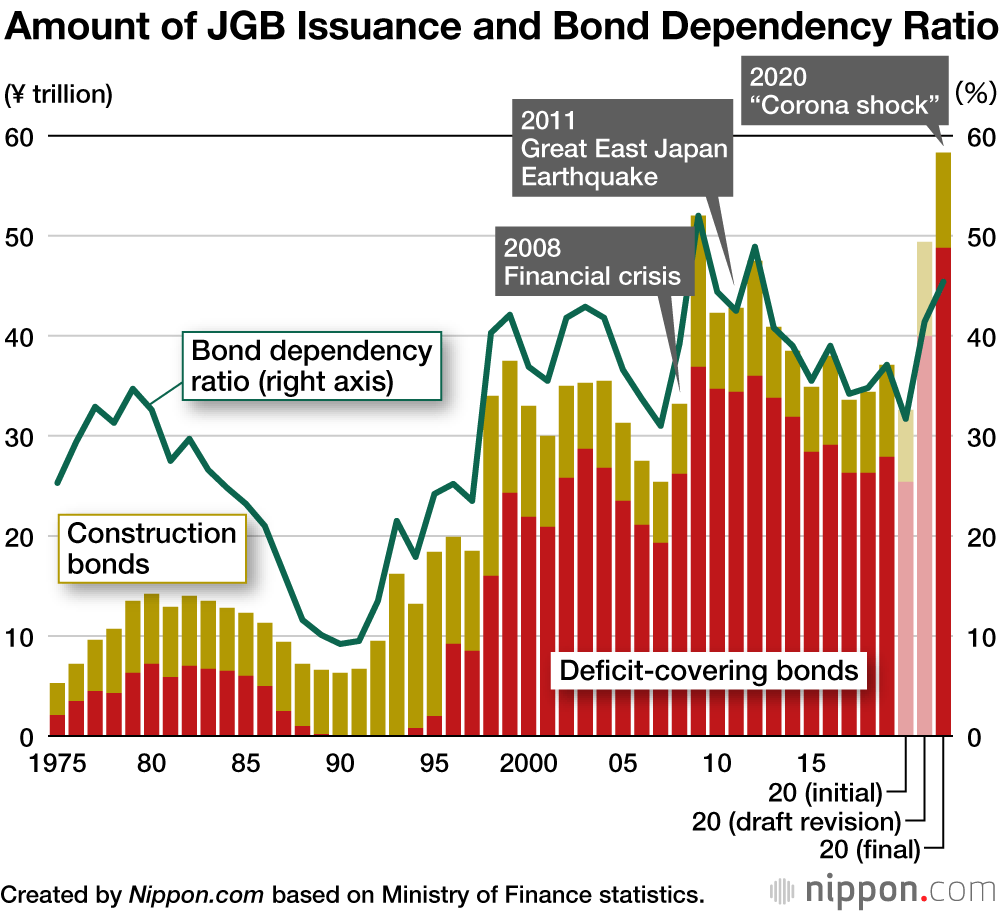

A supplementary budget for fiscal 2020 including ¥100,000 payments to all residents was approved in the Diet on April 30. It amounts to ¥25.7 trillion, of which ¥12.9 trillion is earmarked for the payments and will be covered by the additional issuing of deficit-covering bonds. The revised figure for these bonds to be issued in fiscal 2020 will be ¥23.4 trillion, the highest amount ever for a supplementary budget.

This brings Japanese government bond issuance to a record ¥58.2 trillion in fiscal 2020. The bond dependency ratio—31.7% in the initial budget plan and 41.3% in the draft revision—is now 45.4%.

This revised budget plan does not factor in loss of revenue due to economic stagnation though, so if further adjustments are needed to cover that loss, JGB dependency will increase. Finance Minister Asō Tarō acknowledged at a House of Representatives’ Budget Committee meeting on April 28 that the ratio will certainly exceed 50%. That will be the first time it has been that high since 2009, when the ratio hit 51.5% due to the global financial crisis.

(Translated from Japanese. Banner Photo © Pakutaso)