Smaller Companies In Japan Face Excessive Debt Amid the Pandemic

Economy Work Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

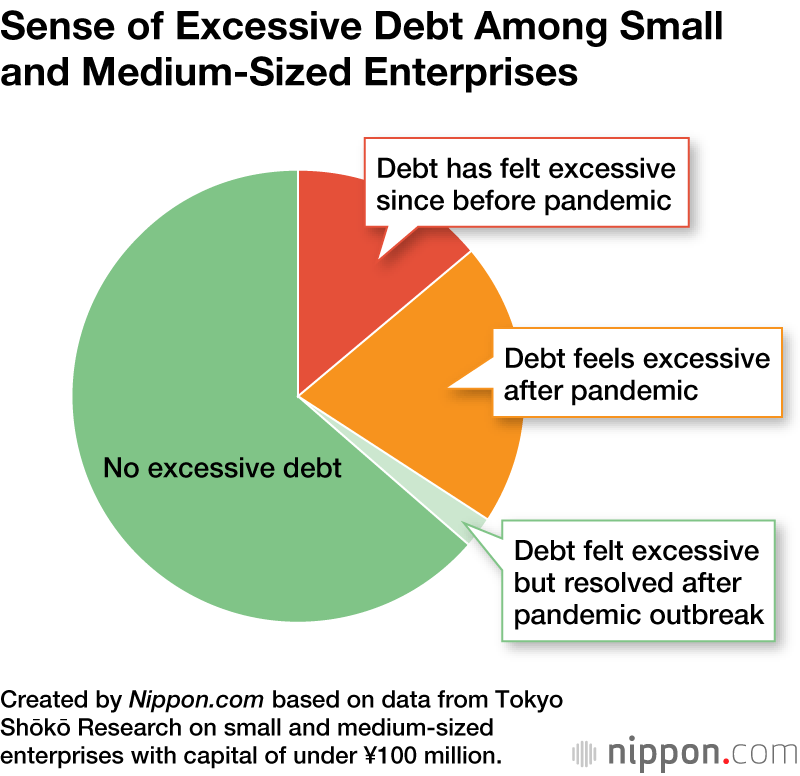

According to a survey conducted by the credit-research firm Tokyo Shōkō Research, 34.2% of small and medium-sized enterprises with capital under ¥100 million reported that they had excessive debt, much higher than the 15.4% among large enterprises. Among those SMEs, 60% said that they had fallen into excessive debt after the outbreak of the pandemic. The survey was conducted between June 1 and 9, with 9,492 valid responses.

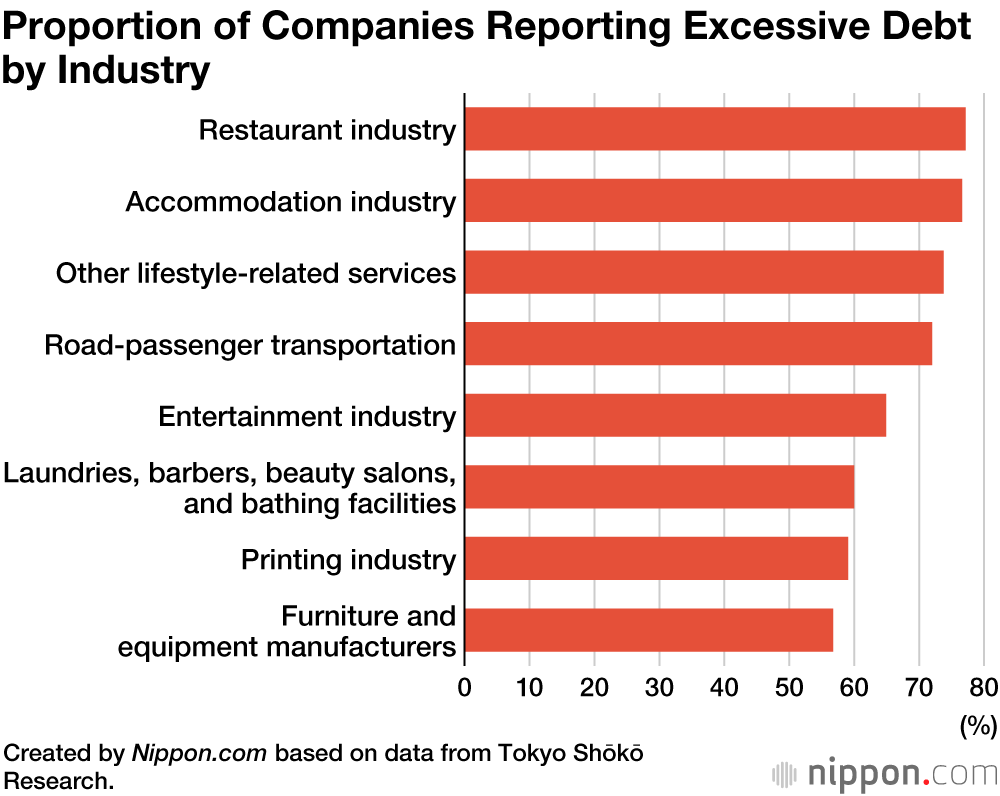

Excessive debt was most prevalent in the food and beverage industry, followed by the accommodation industry, other lifestyle-related services industries, and the road-passenger transportation industry, which were all directly affected by the stagnation in travel and movement due to the COVID-19 pandemic.

Although sales among SMEs have declined significantly, the number of corporate bankruptcies (for debts of ¥10 million or more) fell year on year by 22.2% for the January–May period of 2021, to 2,503 bankruptcies in total. However, business performance has yet to recover, especially in the restaurant industry, resulting in excessive debt.

The Bank of Japan’s Financial System Report for April 2021 points out that measures to provide financial support, such as virtually interest-free loans with interest subsidies, will be very effective in reducing overall corporate defaults until around fiscal 2022. However, the BOJ urges caution for customer-related service industries, such as the food and beverage industry, based on the belief that the recovery in demand will be gradual, thus pushing up the default rate.

(Translated from Japanese. Banner photo: A street lined with restaurants near Kanda Station with few pedestrians. © Kyōdō.)