Personal Bankruptcies in Japan Reach Nearly 70,000 in 2021

Economy Society Family- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

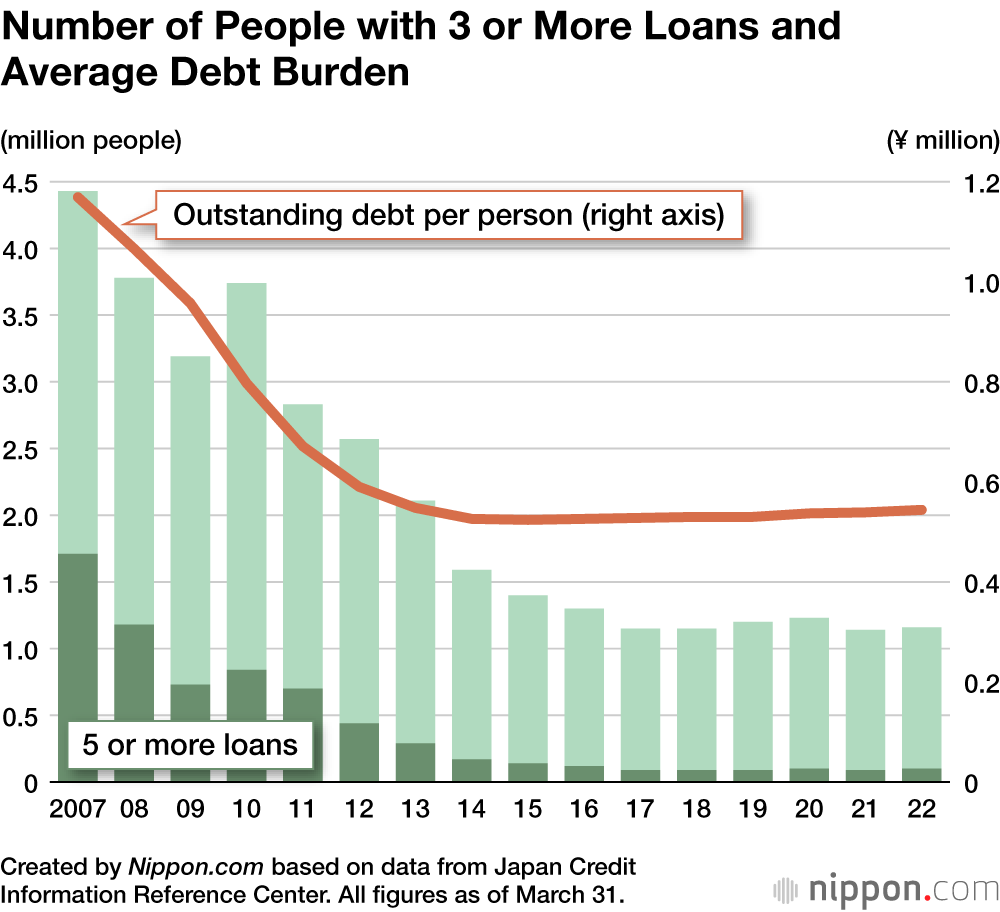

The number of people in Japan unable to pay back multiple loans obtained from consumer finance companies and other firms has decreased since the passing of an amendment to the Money Lending Business Act in December 2006 and its full enforcement in June 2010, remaining around 1.2 million since 2017. As of the end of March 2022, there were 1.16 million people with multiple unpayable loans, with an average combined debt of ¥544,000.

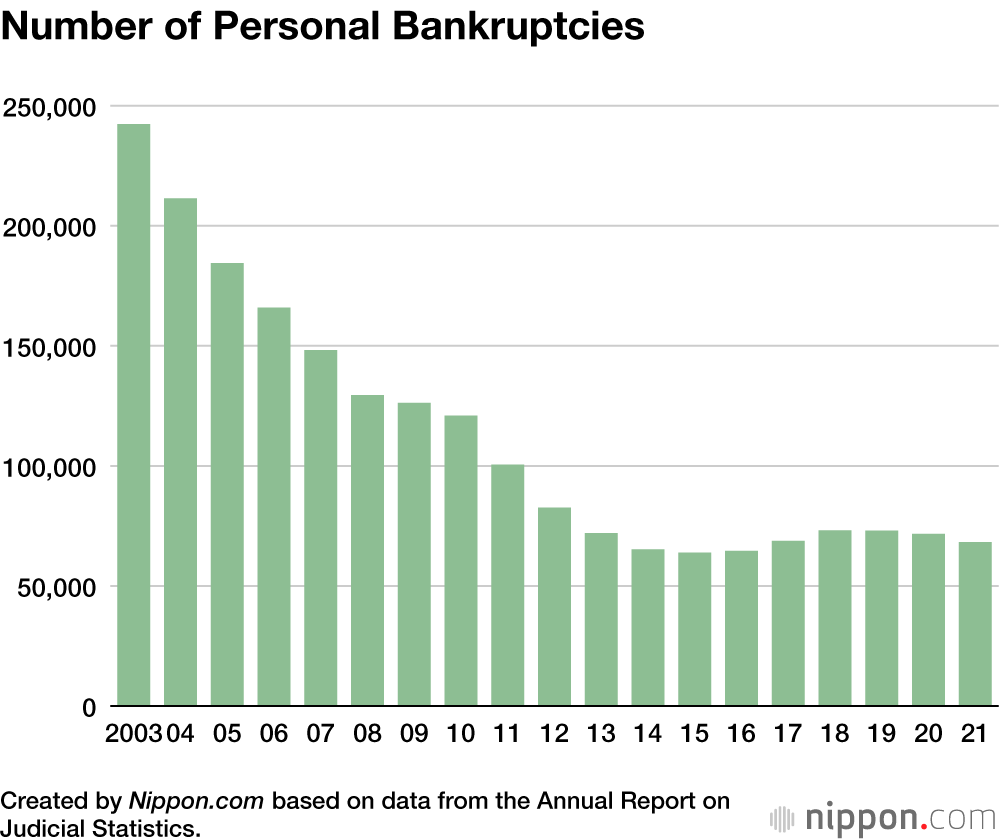

The number of personal bankruptcies was 68,420 in 2021, down 3,438 year on year. This number has remained stable in the years following the revision of the Money Lending Business Act, hovering around the 60,000 to 70,000 range. The ratio of personal bankruptcies to the total population is 0.0541% nationwide. The highest ratio by prefecture is 0.0760% in Hokkaidō, followed by 0.0742% in Osaka and 0.0678% in Miyazaki, while the lowest rate is 0.0309% in Toyama.

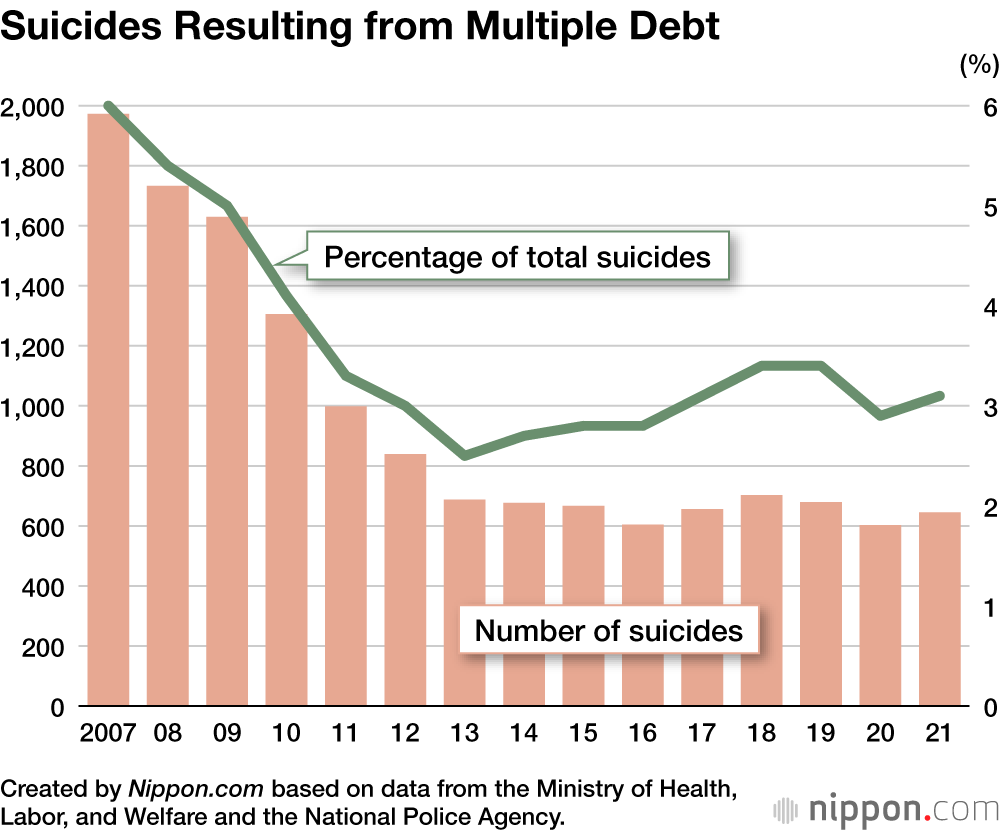

The number of suicides believed to be caused by multiple debts numbered 645 in 2021, accounting for around 3% of the total suicides for that year.

(Translated from Japanese. Banner photo © Pixta.)