Nearly Half of Tax Return Filers in Japan Use Commercial Software

Economy Society Work- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

Filing tax returns can be a hassle given the revisions in the system every year. The Japanese tax accounting firm Bengo4.com conducted a survey on tax returns, asking 348 sole proprietors.

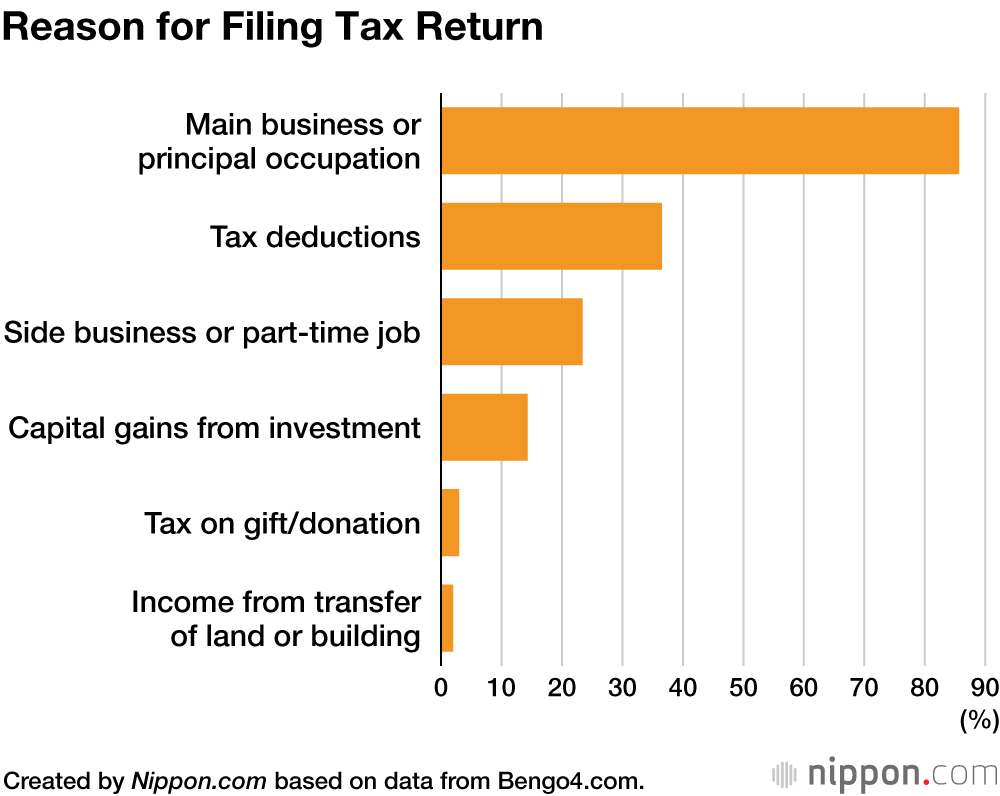

The vast majority of the survey respondents, at 85.7%, reported that their tax returns were related to their main business or principal occupation, while 36.5% filed taxes to obtain tax deductions (due to medical payments, life insurance, hometown tax payments, etc.) and 23.4% for their side business or part-time job.

Among those filing taxes, 41.8% used commercially available accounting software as their method of preparation. Only 15.2% of the filers used the government’s e-Tax electronic system via a smartphone app. Combined with the 19.9% who made use of the National Tax Agency’s online “tax return preparation corner,” a total of 35.1% in total made use of services offered by the agency, which was less than the percentage of persons using commercially available software.

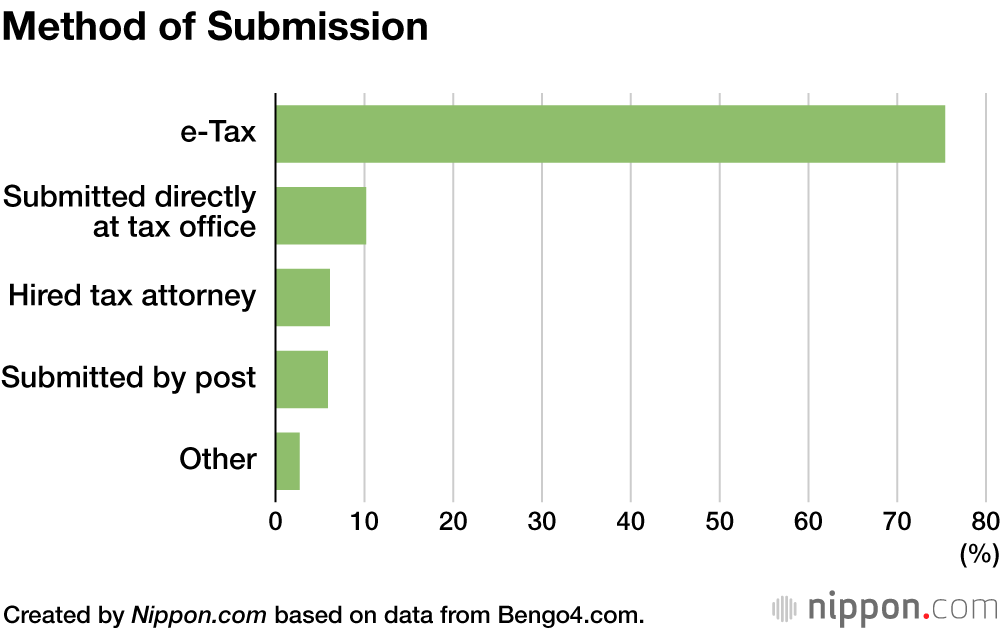

While e-Tax was used by only about 15% of the respondents to prepare their tax forms, 75.4% used it to submit their files. Meanwhile, only 10.2% directly submitted their tax forms at the tax office.

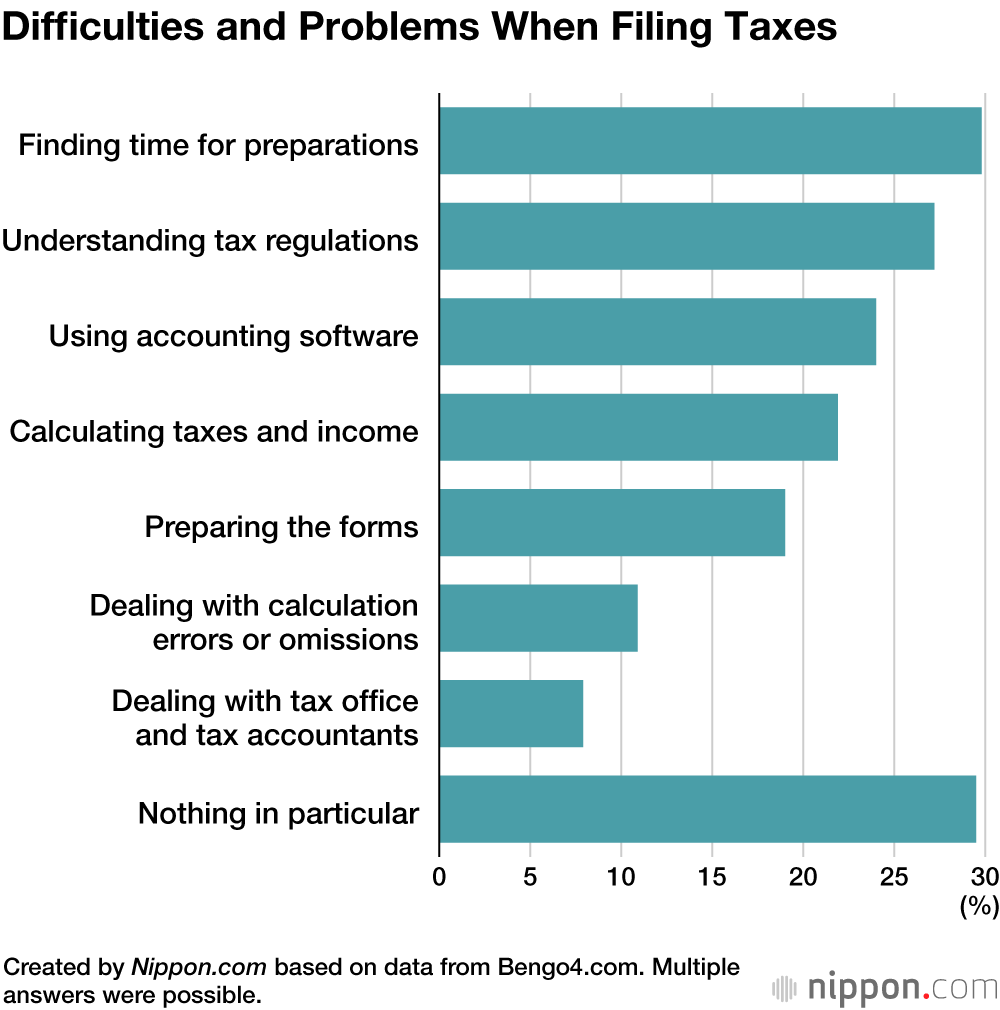

The most commonly cited problem or difficulty for filing taxes, mentioned by 29.8% of the respondents, was finding time for preparation, while 27.2% found it hard to understand the tax regulations and 24% had difficulty using accounting software.

(Translated from Japanese. Banner photo © Pixta.)