Financial Losses from Specialized Fraud in Japan Rise for First Time in Eight Years

Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

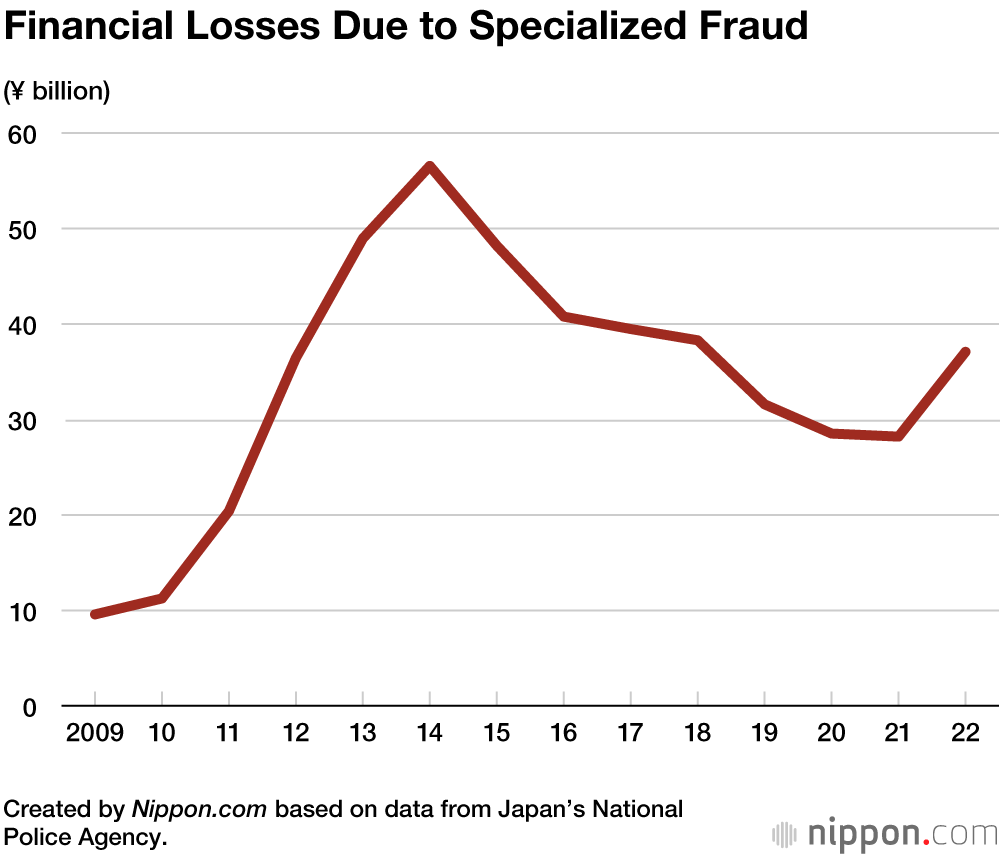

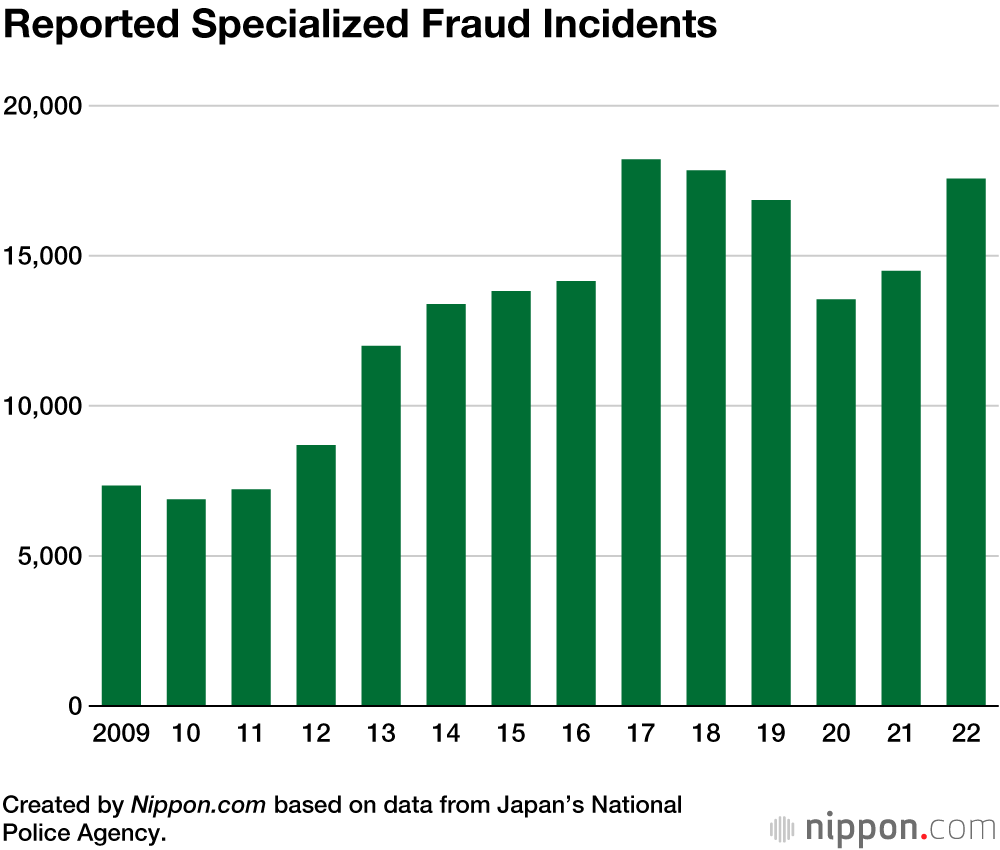

The National Police Agency’s recently released finalized statistics on specialized fraud for 2022 show that the nationwide losses from fraud rose year on year for the first time in eight years, increasing by ¥8.9 billion, or 31.5%, to a total of ¥37.1 billion. The number of reported cases of fraud rose by 3,072, or 21.2%, to 17,570.

The police handled 6,640 cases of fraud in 2022, which is 40 more than in the previous year, involving 2,458 fraudsters, up 84 year on year. Among the fraudsters, 473 were under the age of 20, of whom around 70% were involved in the ukeko role of receiving money from the targeted victim. In some cases, the young accomplices were recruited online through websites for so-called “dark part-time jobs” (yami baito).

“Specialized fraud” is a general term for crimes in which fraudsters win the trust of a victim via the telephone or some other means, without any face-to-face interaction, and swindle them out of their money by convincing them to wire money to a specified bank account.

The fraud cases are concentrated in major metropolitan areas. In 2022, there were 3,218 cases in Tokyo (down 101), 2090 in Kanagawa Prefecture (up 629), 2,064 in Osaka Prefecture (up 526), 1,457 in Chiba Prefecture (up 354), 1,387 in Saitama Prefecture (up 305), 1,074 in Hyōgo Prefecture (up 215), and 980 in Aichi Prefecture (up 106). These seven prefectures accounted for roughly 70% of all cases in Japan.

The amount of losses on a daily basis from specialized fraud in 2022 was ¥101.6 million, a year-on-year increase of ¥24.3 million, while the amount per case increased by ¥166,000 to ¥2.2 million.

The breakdown of the main types of fraud shows that “refund fraud,” which is an attempt to defraud people by claiming they will be reimbursed for medical bills or insurance premiums, was the most common, at 4,679 cases. This was followed by 4,287 cases of ore ore sagi (it’s me, it’s me scams), in which fraudsters impersonated family members, and 3,074 cases of “cash card scams” in which fraudsters obtain a cash card from an elderly person and replace it with a fake card. The ore ore sagi cases brought in the most money at ¥12.9 billion or 35% of the take from all scams combined.

(Translated from Japanese. Banner photo © Pixta.)