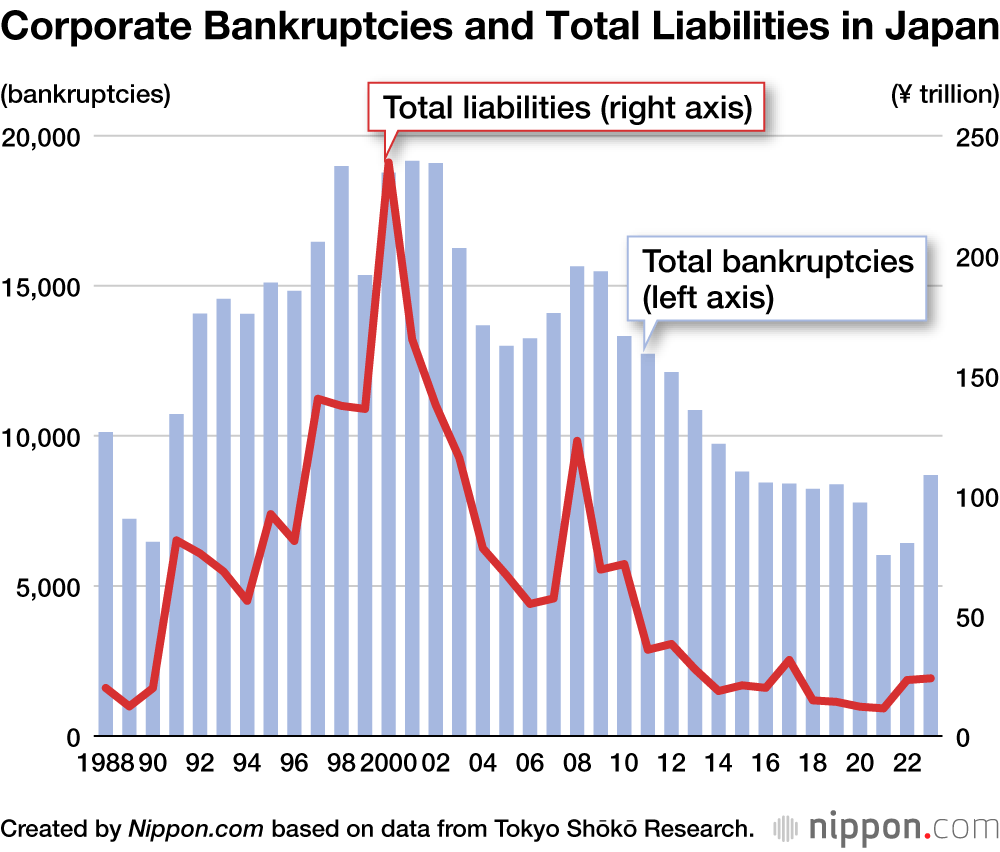

Corporate Bankruptcies in Japan Exceed 8,000 for First Time in Four Years

Economy Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

According to a report issued by Tokyo Shōkō Research, the number of corporate bankruptcies in Japan involving a total liability of ¥10 million or more increased year on year by 35.2% in 2023 to 8,690, marking the first time in four years for the total to exceed 8,000 companies. Total liabilities for the bankruptcies increased 3.1% to ¥2.40 trillion.

By industry, the largest number of bankruptcies was in the service industry, with 2,940 cases, a year-on-year increase of 41.6%. The construction industry, which is facing a labor shortage and soaring material prices, had 1,693 bankruptcies in 2023, a year-on-year increase of 41.7%. The third largest number of bankruptcies, at 977 cases or a year-on-year increase of 35.3%, was in the manufacturing industry, which is suffering from increased costs for raw materials and energy.

Rising prices were a contributing factor in the case of 645 bankruptcies, which is 2.2 times more than bankruptcies due to prices in the previous year. As economic activity rebounded after the stagnation of the pandemic years, corporate profits have been seriously impacted by rising prices, including the prices of raw materials and crude oil, against the backdrop of a weak yen and the Russian invasion of Ukraine.

The number of bankruptcies due to labor shortages jumped 2.5 times year on year, to 158 cases, the highest number since the survey was first conducted in 2013. The number of bankruptcies due to rising labor costs increased year on year by 8.4 times, while the number of bankruptcies due to difficulties in recruiting workers was 2.1 times greater than the previous year. Raising wages to secure human resources and maintaining a healthy working environment are emerging as major management challenges.

Bankruptcies related to the COVID-19 pandemic totaled 3,127 cases, for a year-on-year increase of 36.3%. Bankruptcies that occurred after the end of the program granting virtually interest-free unsecured “zero-zero loans” as a measure to deal with the pandemic increased by 1.4 times over the previous year, for a total of 631 cases. According to Tokyo Shōkō Research, “repayment of the zero-interest loans will reach a peak around April 2024, so that even more companies will struggle to finance themselves, raising the possibility that the number of corporate bankruptcies will exceed 10,000 this year.”

(Translated from Japanese. Banner photo © Pixta.)