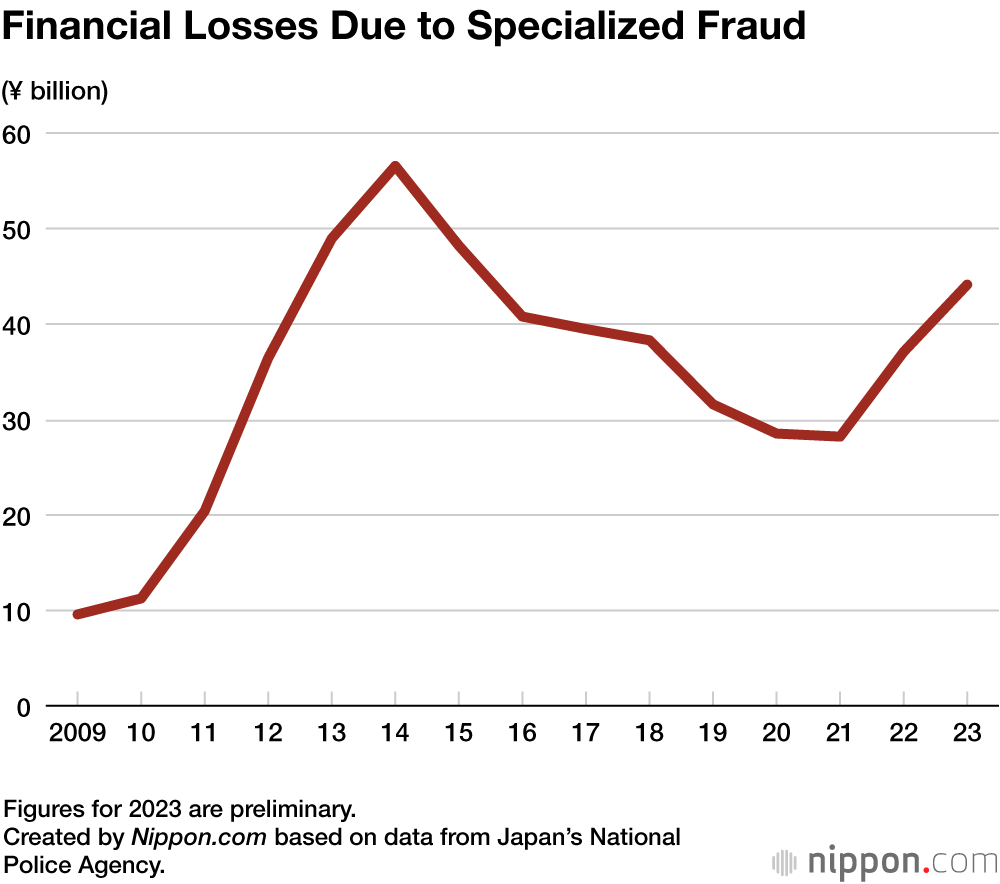

Financial Losses from Specialized Fraud Rise to ¥44 Billion in 2023

Society- English

- 日本語

- 简体字

- 繁體字

- Français

- Español

- العربية

- Русский

The National Police Agency’s recently released preliminary statistics on specialized fraud in 2023 showed that nationwide losses from fraud rose from the previous year by ¥7 billion, or 19.0%, to a total of ¥44.1 billion. Meanwhile, the number of reported cases of fraud rose by 1,463, or 8.3%, to 19,033.

The amount of losses on a daily basis from specialized fraud was ¥120.9 million, a year-on-year increase of ¥19.3 million, while the average amount per case increased by ¥193,000 to ¥2.4 million.

There were 14,878 reported cases involving people aged 65 or older. With the exception of cases of corporate financial losses, these incidents accounted for 78.3% of all reported fraud cases.

The police handled 7,219 cases, 579 more than in the previous year, involving 2,499 fraudsters, up 41 year-on-year. Among the fraudsters, 446 were under the age of 20, with around 70% of who acted in the ukeko role, the person who receives money from the targeted victim. In addition, of the 1,594 fraudsters who were the ukeko, 319, or 20%, of them were young men under 20.

A total of 69 fraudsters in 12 cases were transferred to Japan in 2023 after authorities in the Philippines, Cambodia, Thailand, and Vietnam discovered the overseas bases of specialized fraud groups.

“Specialized fraud” is a general term for crimes in which fraudsters win the trust of a victim via the telephone or some other means, without any face-to-face interaction, and swindle them out of their money by convincing them to wire money to a specified bank account. The National Police Agency stated that criminal groups, including both organized and quasi-organized crime groups, were systematically carrying out the frauds by dividing labor and creating anonymity.

Looking at the different types of fraud in 2023, there were more than 5,000 reported cases of “false billing fraud” in which victims are tricked into paying false usage fees for services they have never used. Accounting for 27.0% overall, this was the most common type of fraud, and the financial losses from it increased year-on-year by 35.7% to ¥13.8 billion. According to the agency, in 43.8% of cases, the method used to initially trick victims was a pop-up display on a website they were browsing.

In the case of other types of crime, such as “refund fraud,” an attempt to defraud people by claiming they will be reimbursed for medical bills or insurance premiums, and ore ore sagi (“it’s me” scams) in which fraudsters impersonate family members, the majority of victims were elderly women, and more than half of the financial losses originated from receiving phone calls from fraudsters.

(Translated from Japanese. Banner photo © Pixta.)